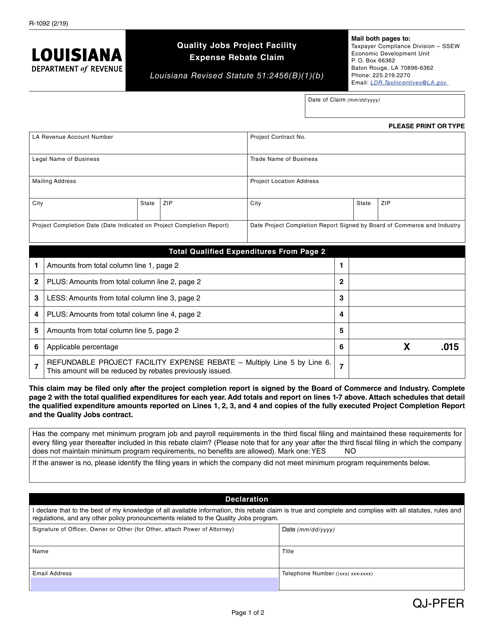

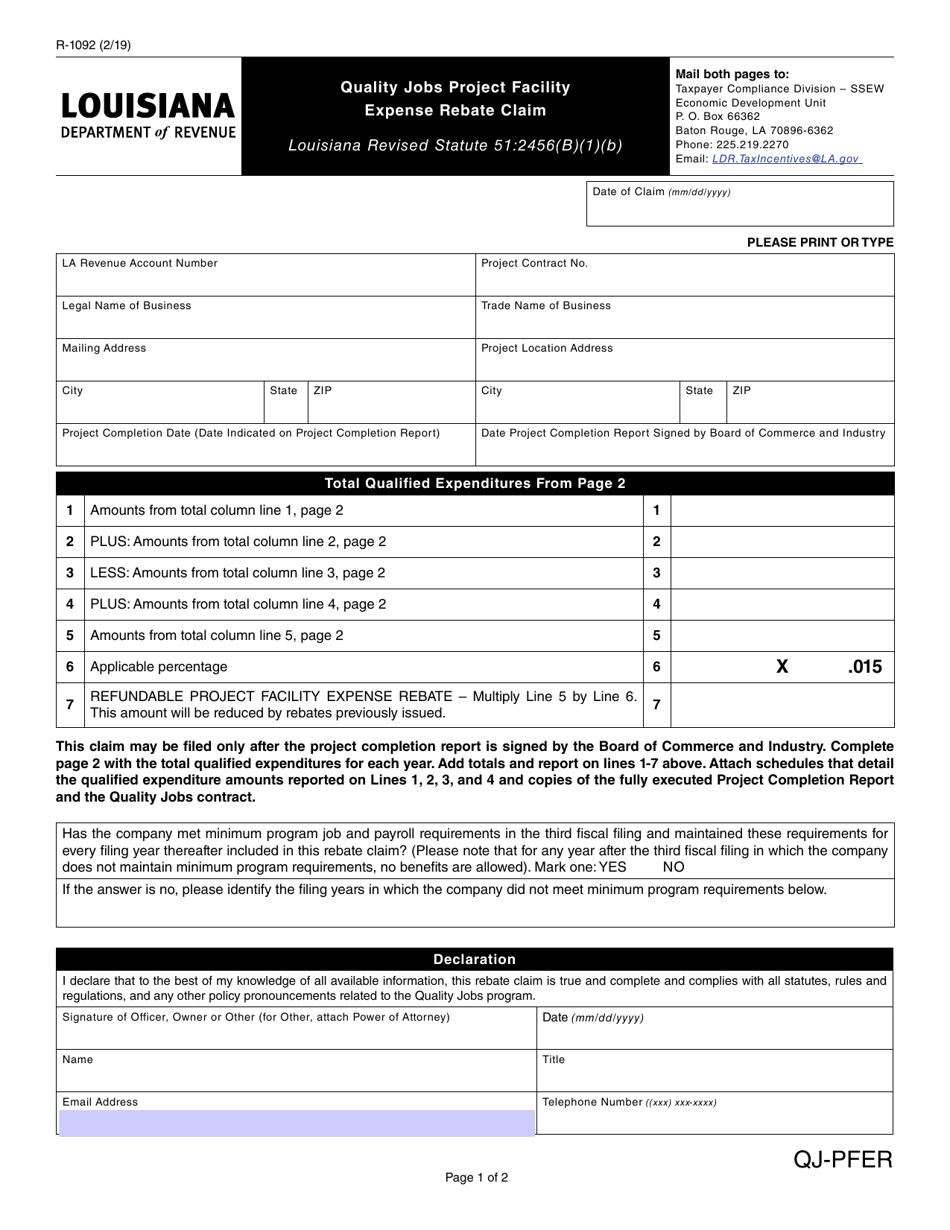

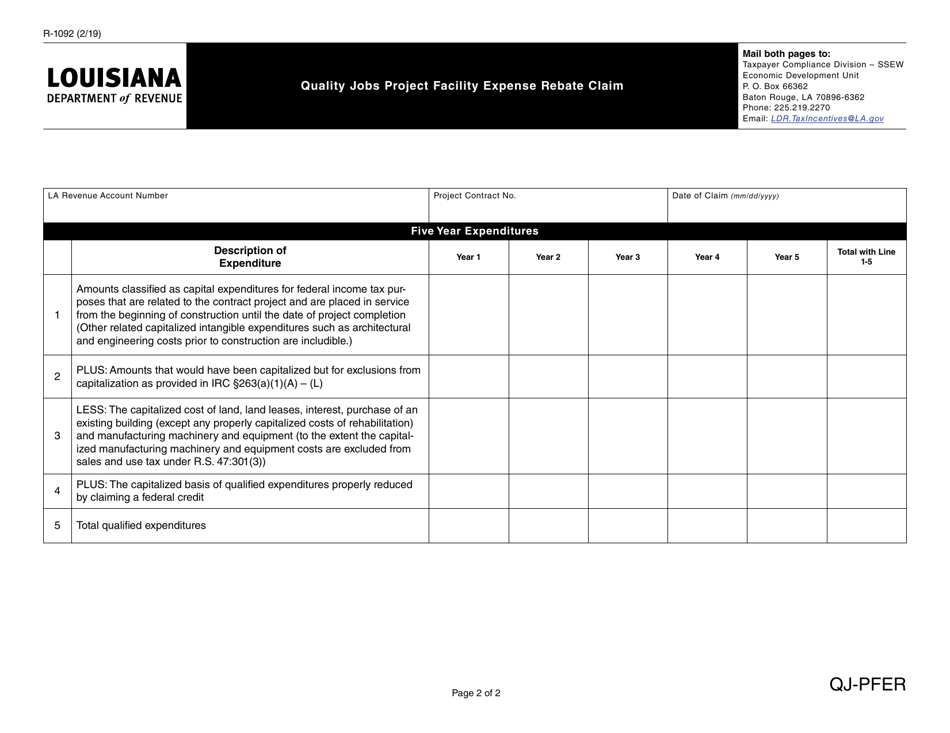

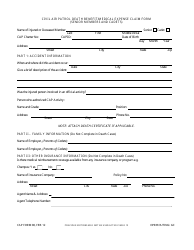

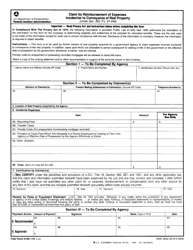

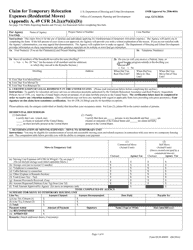

Form R-1092 Quality Jobs Project Facility Expense Rebate Claim - Louisiana

What Is Form R-1092?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

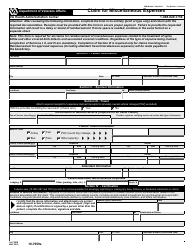

Q: What is Form R-1092?

A: Form R-1092 is the Quality Jobs Project Facility Expense Rebate Claim form in Louisiana.

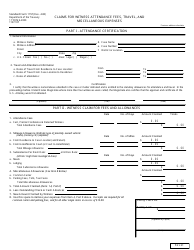

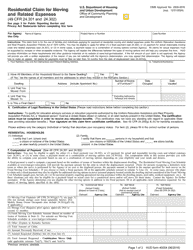

Q: What is the Quality Jobs Project?

A: The Quality Jobs Project is an economic development program in Louisiana aimed at creating high-quality jobs.

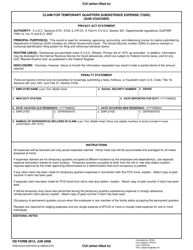

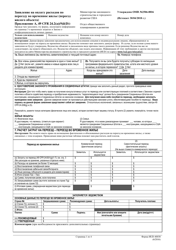

Q: What is the Facility Expense Rebate?

A: The Facility Expense Rebate is a financial incentive offered through the Quality Jobs Project to eligible businesses.

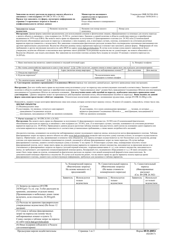

Q: Who is eligible to claim the rebate?

A: Businesses that have been certified as a Quality Jobs participant in Louisiana can claim the rebate.

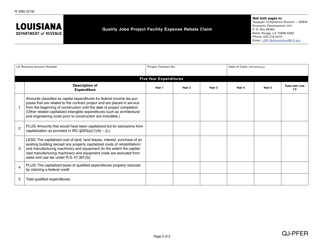

Q: What expenses can be claimed?

A: Businesses can claim certain facility expenses detailed in the form, such as construction costs or equipment purchases.

Q: How can the rebate be claimed?

A: The rebate can be claimed by submitting Form R-1092 to the Louisiana Department of Economic Development.

Q: Are there any deadlines for claiming the rebate?

A: Yes, the rebate claim must be filed within 120 days after the close of the calendar year in which the expenses were incurred.

Q: Is there a limit to the amount of rebate that can be claimed?

A: Yes, the total rebate claimed cannot exceed the amount specified in the facility expense rebate agreement.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1092 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.