This version of the form is not currently in use and is provided for reference only. Download this version of

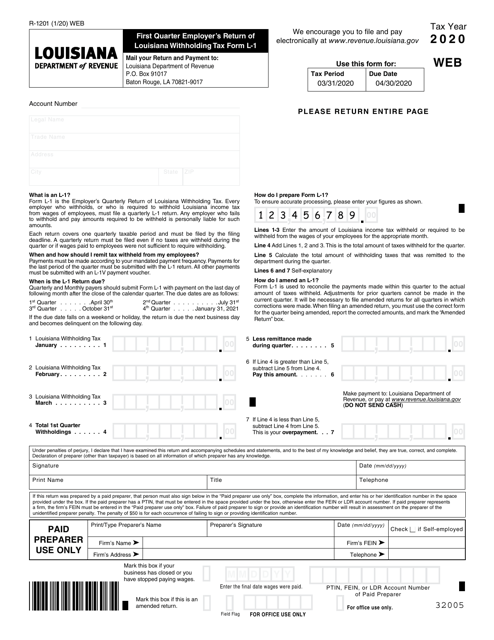

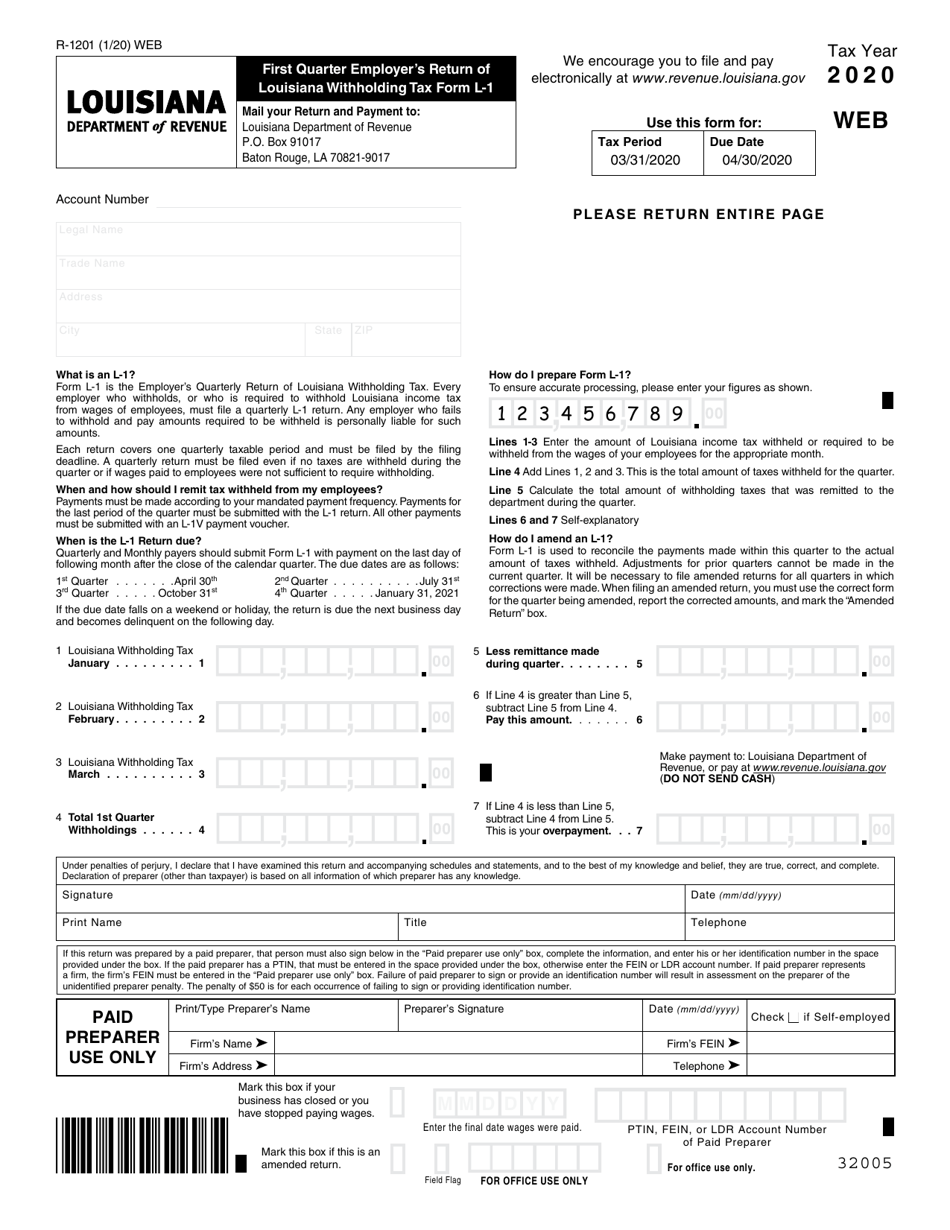

Form L-1 (R-1201)

for the current year.

Form L-1 (R-1201) First Quarter Employer's Return of Louisiana Withholding Tax Form - Louisiana

What Is Form L-1 (R-1201)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-1?

A: Form L-1 is the First Quarter Employer's Return of Louisiana Withholding Tax form.

Q: When should Form L-1 be filed?

A: Form L-1 should be filed quarterly.

Q: What is the purpose of Form L-1?

A: The purpose of Form L-1 is to report Louisiana withholding tax.

Q: Who should file Form L-1?

A: Employers in Louisiana who have employees subject to withholding tax should file Form L-1.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-1 (R-1201) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.