This version of the form is not currently in use and is provided for reference only. Download this version of

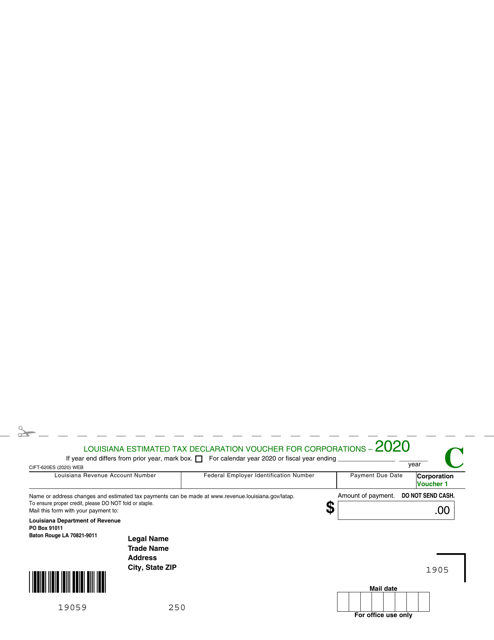

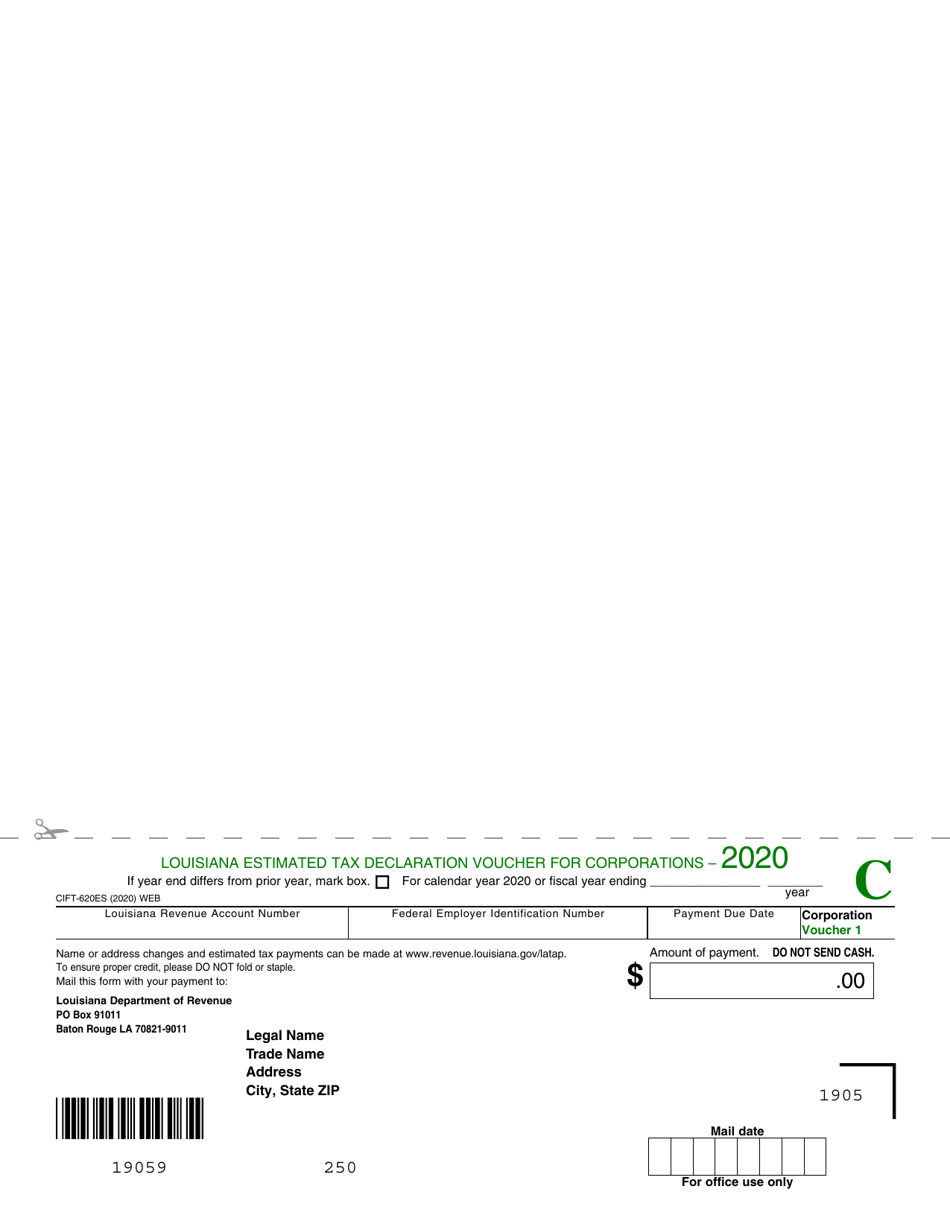

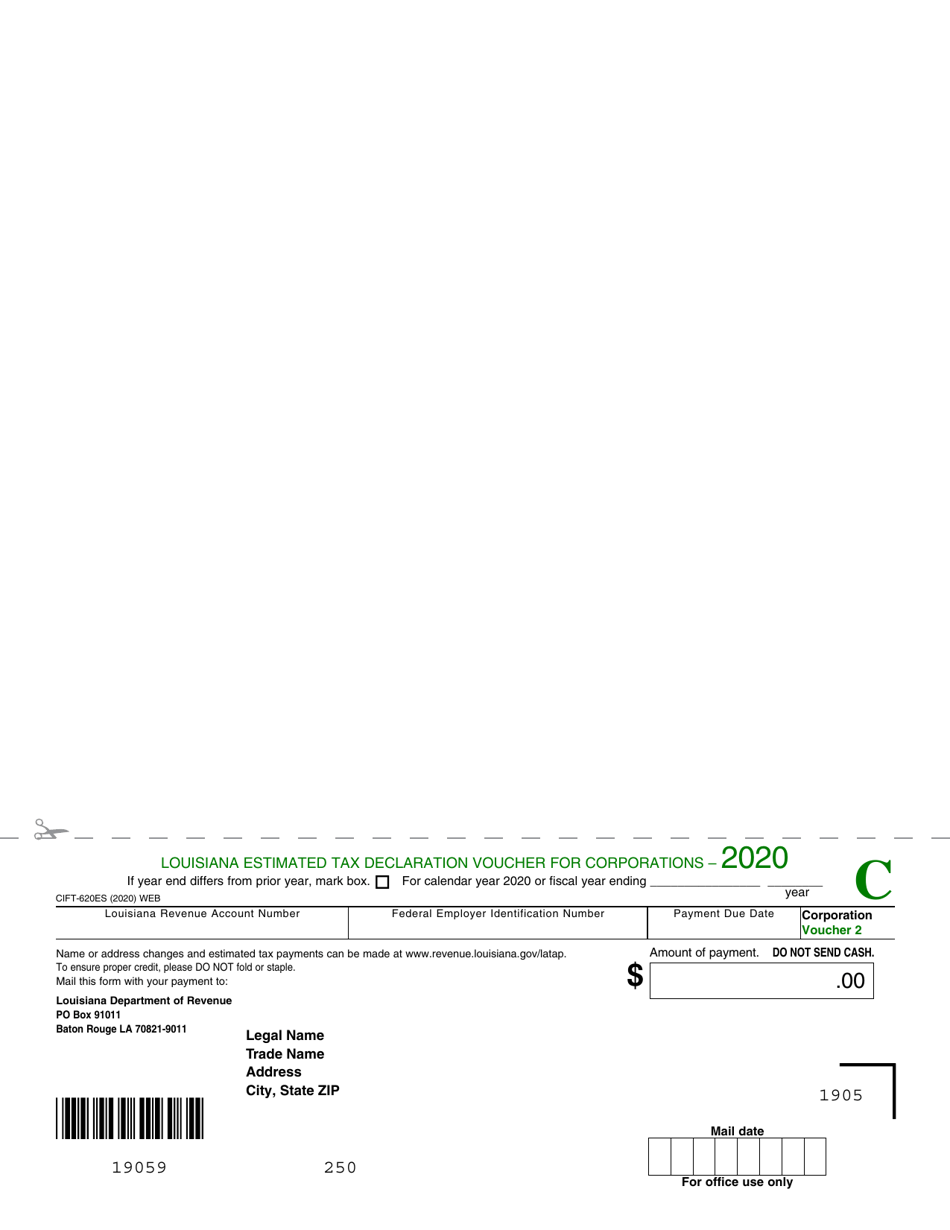

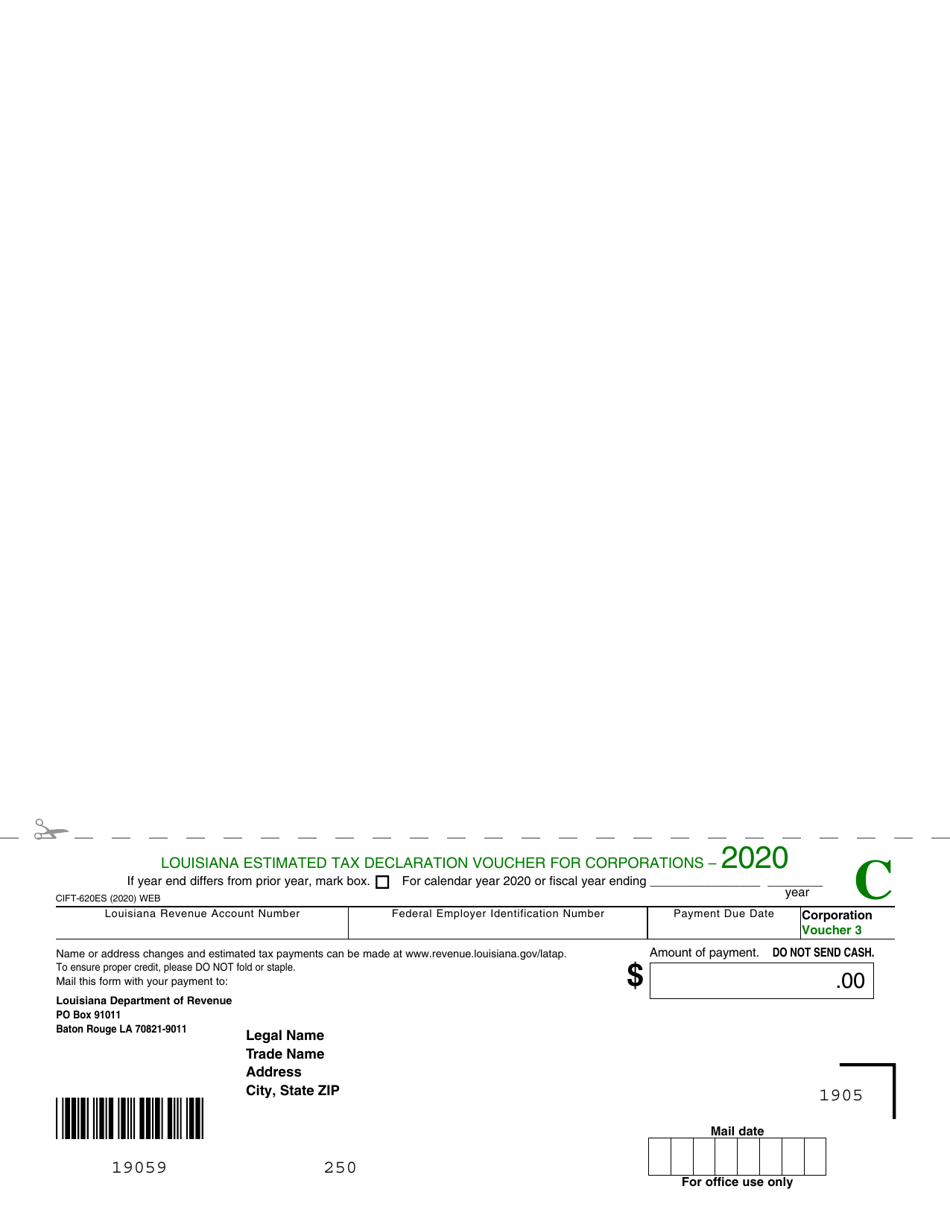

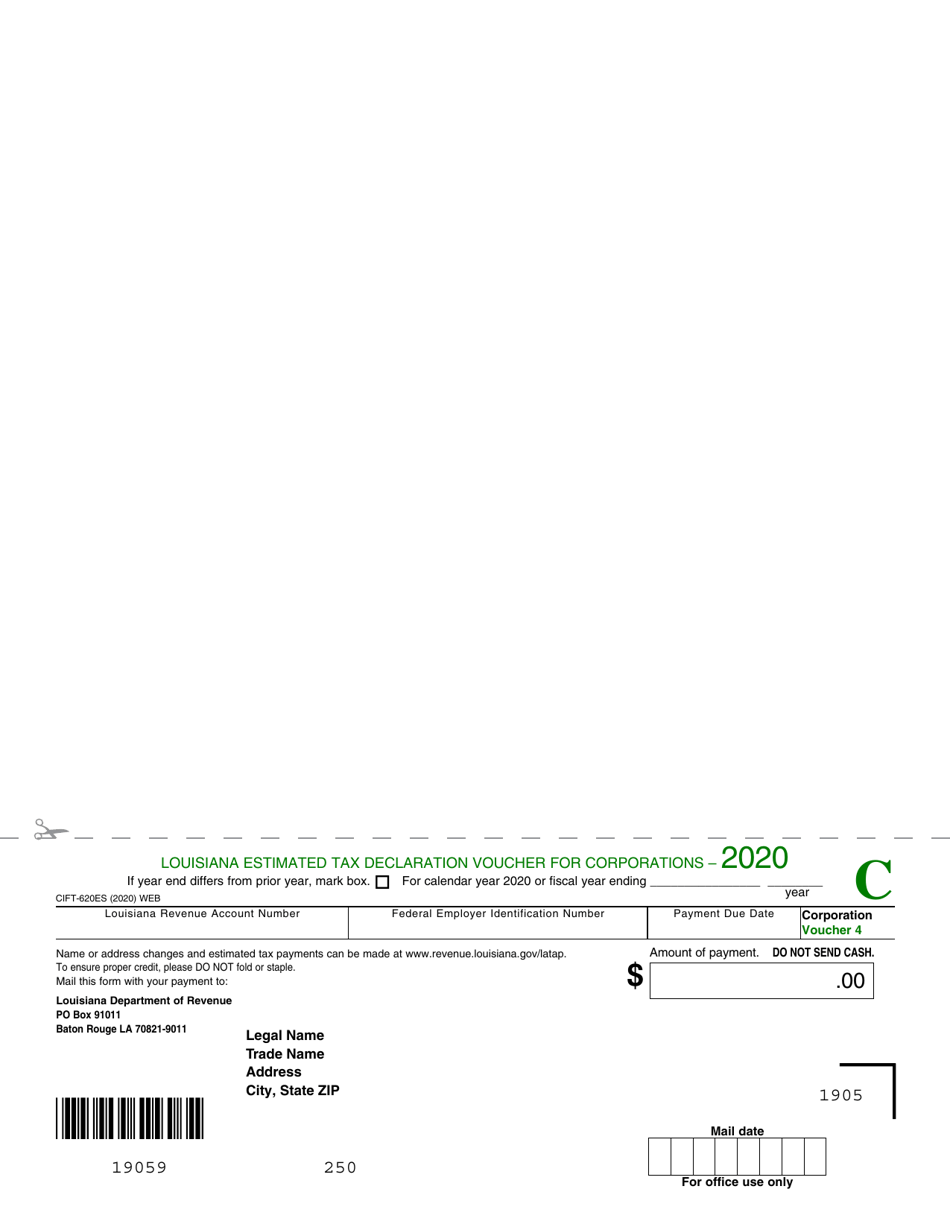

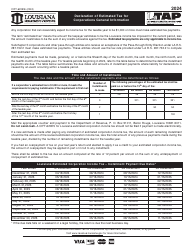

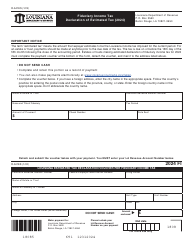

Form CIFT-620ES

for the current year.

Form CIFT-620ES Louisiana Estimated Tax Declaration Voucher for Corporations - Louisiana

What Is Form CIFT-620ES?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CIFT-620ES?

A: Form CIFT-620ES is the Louisiana Estimated Tax Declaration Voucher for Corporations.

Q: Who should use Form CIFT-620ES?

A: Corporations in Louisiana who need to make estimated tax payments should use Form CIFT-620ES.

Q: What is the purpose of Form CIFT-620ES?

A: The purpose of Form CIFT-620ES is to declare and submit estimated tax payments for corporations in Louisiana.

Q: What information is required on Form CIFT-620ES?

A: Form CIFT-620ES requires information such as the corporation's name, address, federal employer identification number, estimated tax liability, and payment details.

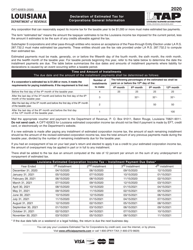

Q: When is Form CIFT-620ES due?

A: Form CIFT-620ES is due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's taxable year.

Q: Are there any penalties for not filing Form CIFT-620ES?

A: Yes, failure to file Form CIFT-620ES or pay the estimated tax on time may result in penalties and interest.

Q: Is Form CIFT-620ES specific to Louisiana?

A: Yes, Form CIFT-620ES is specific to corporations in Louisiana and is used for their estimated tax payments.

Form Details:

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIFT-620ES by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.