This version of the form is not currently in use and is provided for reference only. Download this version of

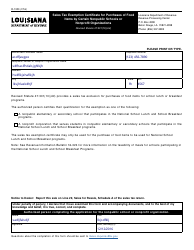

Form R-6981

for the current year.

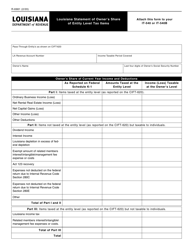

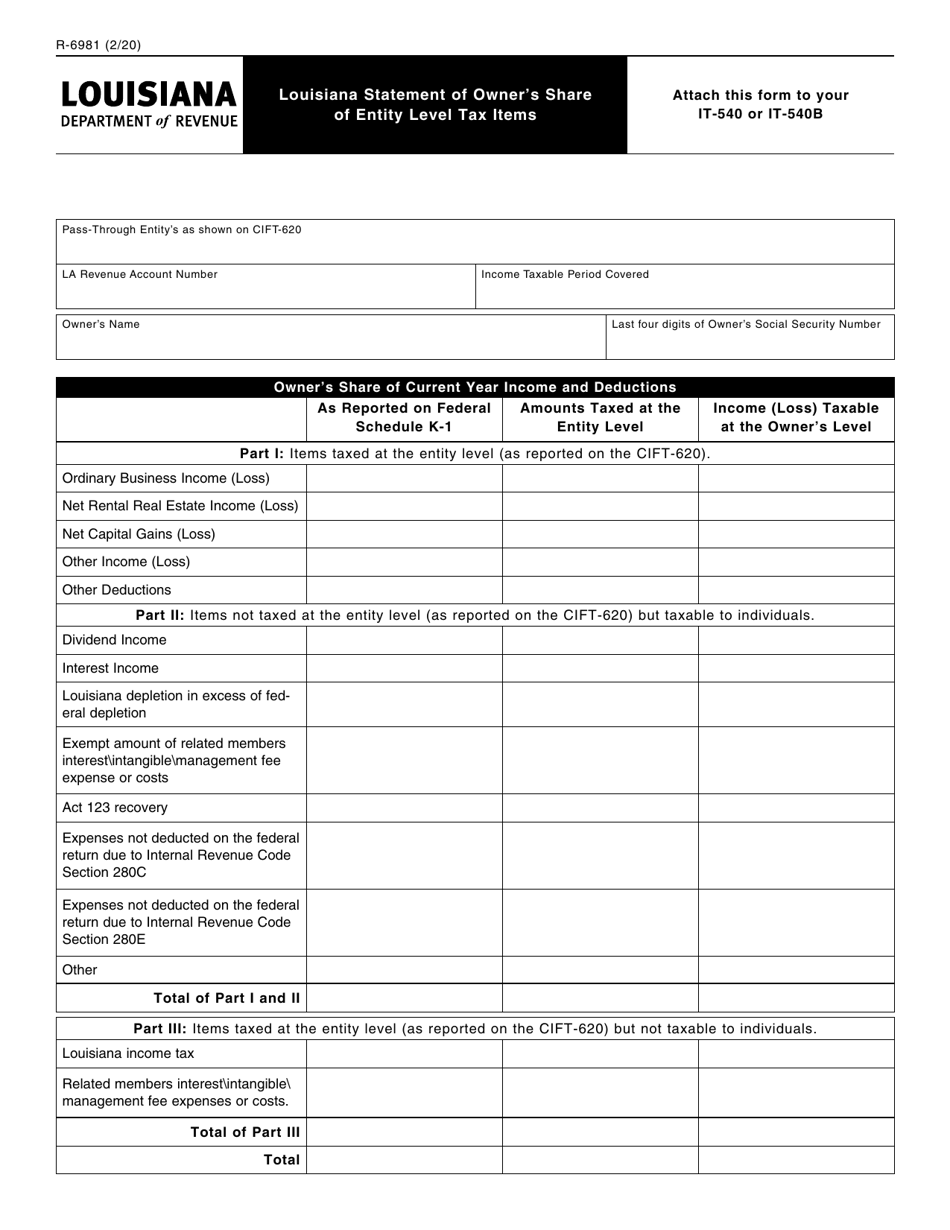

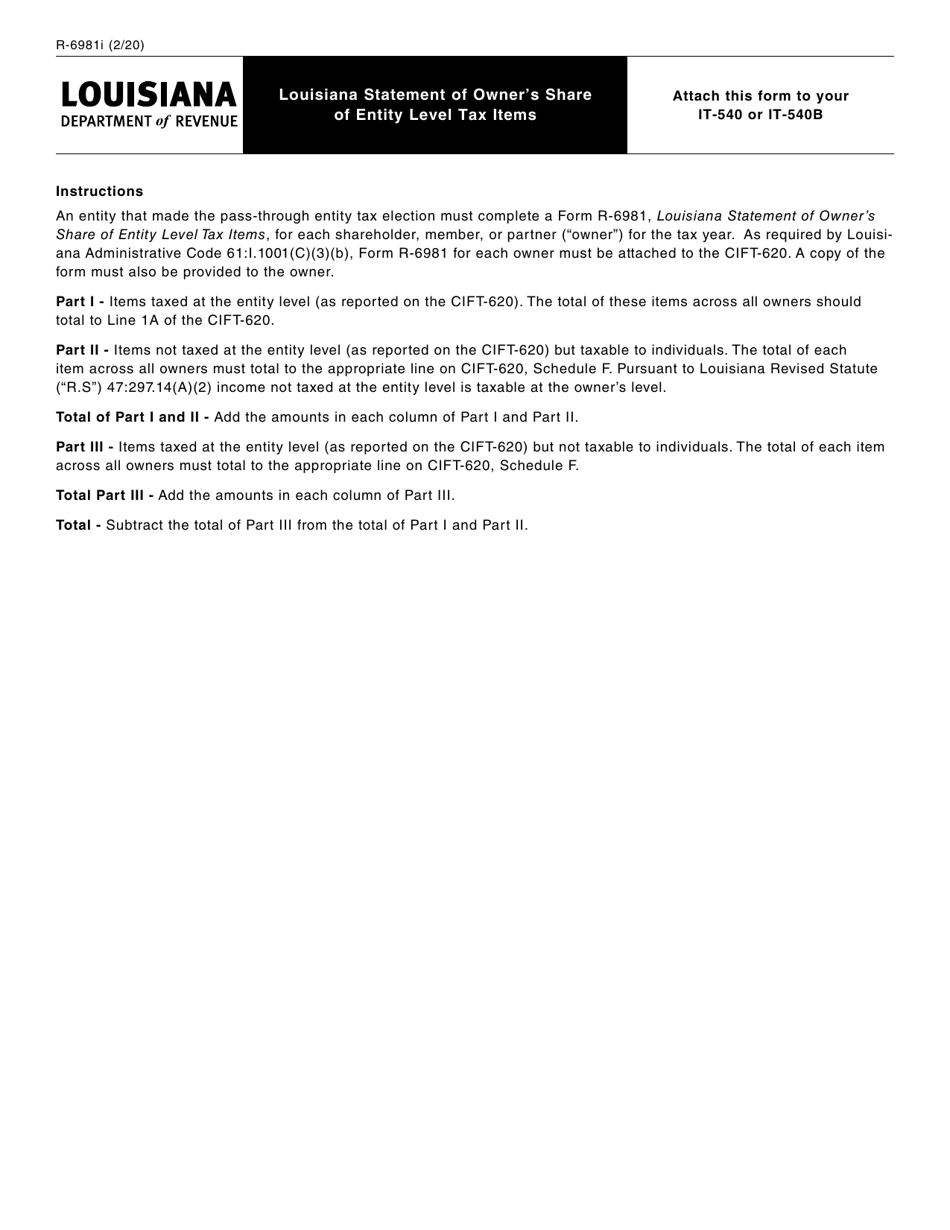

Form R-6981 Louisiana Statement of Owner's Share of Entity Level Tax Items - Louisiana

What Is Form R-6981?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6981?

A: Form R-6981 is the Louisiana Statement of Owner's Share of Entity Level Tax Items.

Q: Who needs to fill out Form R-6981?

A: Form R-6981 needs to be filled out by owners or members of an entity that is subject to Louisiana entity level tax.

Q: What is the purpose of Form R-6981?

A: The purpose of Form R-6981 is to report the owner's share of entity level tax items for Louisiana tax purposes.

Q: Is Form R-6981 specific to Louisiana?

A: Yes, Form R-6981 is specific to the state of Louisiana and is used for reporting taxes at the entity level.

Q: When is Form R-6981 due?

A: Form R-6981 is generally due on the same date as the entity's original tax return for Louisiana.

Q: Are there any penalties for not filing Form R-6981?

A: Yes, there may be penalties for not filing Form R-6981 or for filing it late, so it's important to submit it on time.

Q: What should I do with Form R-6981 once I fill it out?

A: Once you fill out Form R-6981, you should keep a copy for your records and submit the original to the Louisiana Department of Revenue.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6981 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.