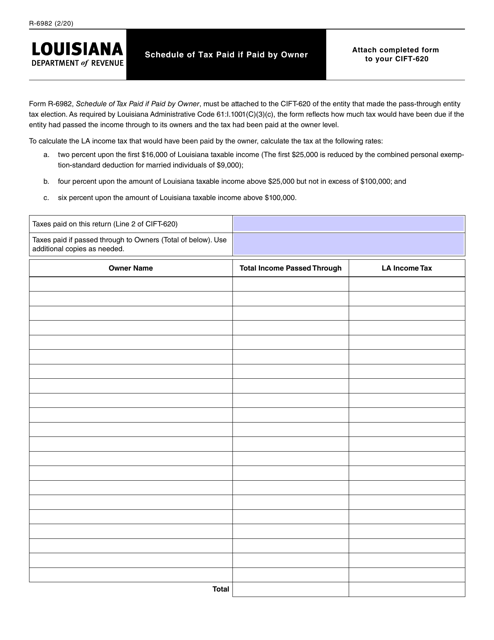

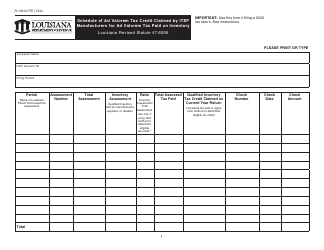

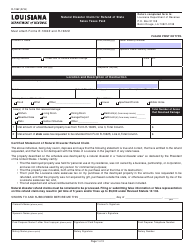

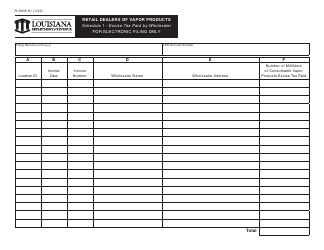

Form R-5982 Schedule of Tax Paid if Paid by Owner - Louisiana

What Is Form R-5982?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5982?

A: Form R-5982 is the Schedule of Tax Paid if Paid by Owner, which is used in Louisiana.

Q: What is the purpose of Form R-5982?

A: The purpose of Form R-5982 is to report and document tax payments made by the owner.

Q: Who needs to use Form R-5982?

A: Property owners in Louisiana who have made tax payments need to use Form R-5982.

Q: When is Form R-5982 due?

A: Form R-5982 is typically due by April 1st of each year.

Q: Are there any penalties for not filing Form R-5982?

A: Penalties may apply for not filing Form R-5982 or for filing it late, so it is important to submit it on time.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5982 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.