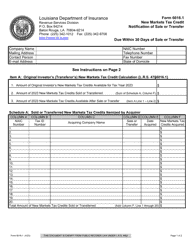

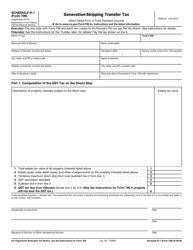

This version of the form is not currently in use and is provided for reference only. Download this version of

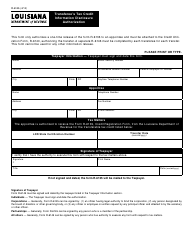

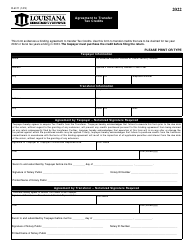

Form R-6111

for the current year.

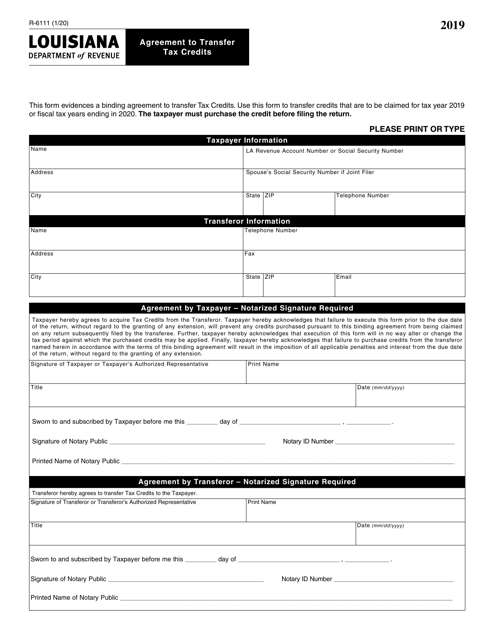

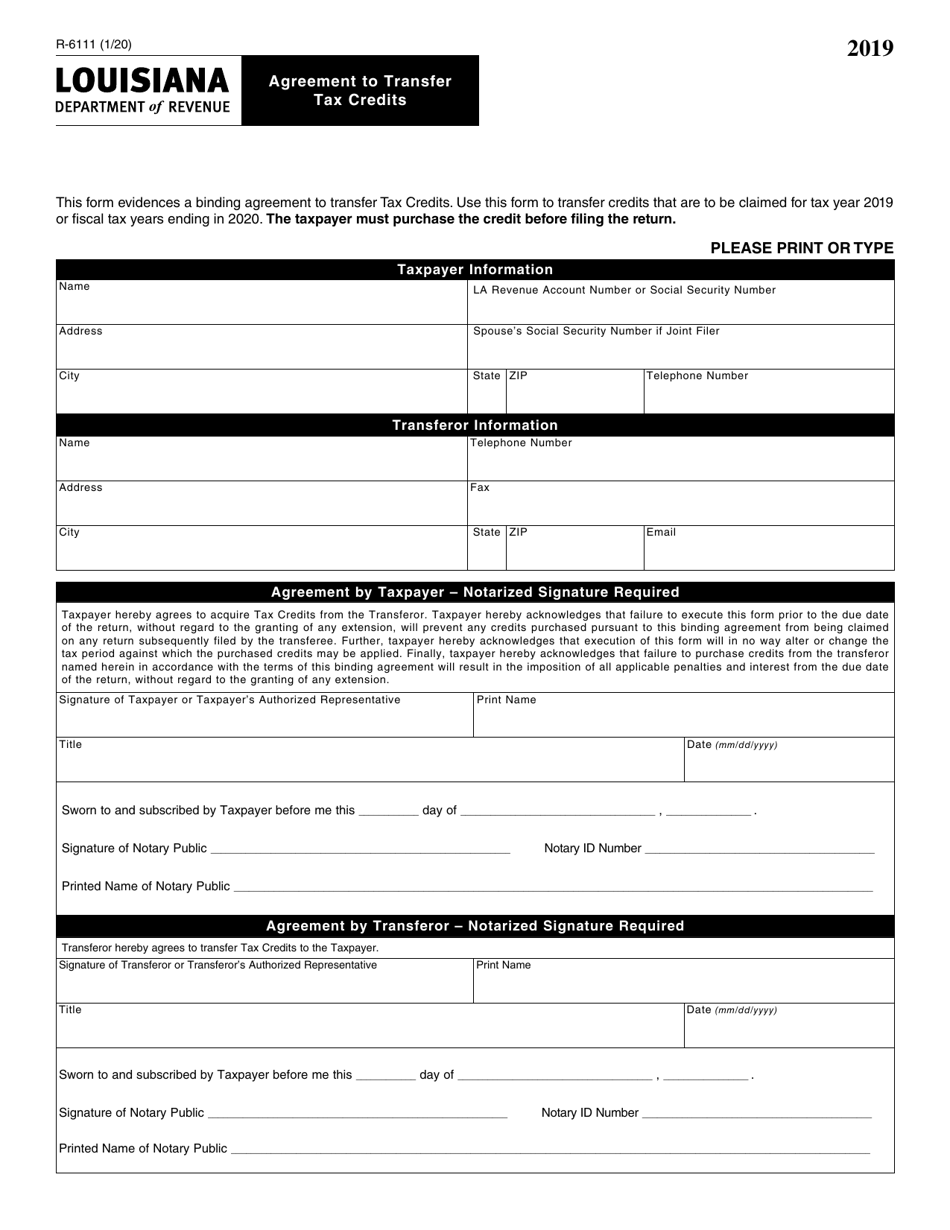

Form R-6111 Agreement to Transfer Tax Credits - Louisiana

What Is Form R-6111?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6111?

A: Form R-6111 is an Agreement to Transfer Tax Credits in Louisiana.

Q: What is the purpose of Form R-6111?

A: The purpose of Form R-6111 is to document the transfer of tax credits in Louisiana.

Q: Who needs to fill out Form R-6111?

A: Both the transferor and the transferee need to fill out Form R-6111.

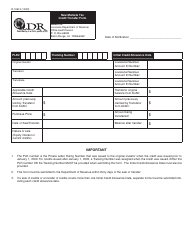

Q: What information is required on Form R-6111?

A: Form R-6111 requires information about the transferor, transferee, and the tax credits being transferred.

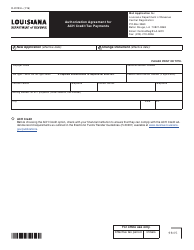

Q: Is there a deadline for filing Form R-6111?

A: Yes, Form R-6111 must be filed within 30 days after the transfer of tax credits.

Q: Are there any fees for filing Form R-6111?

A: Yes, there is a fee of $50 for filing Form R-6111.

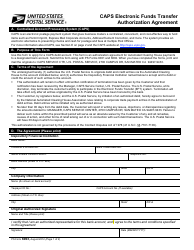

Q: Can Form R-6111 be filed electronically?

A: No, Form R-6111 cannot be filed electronically. It must be submitted by mail.

Q: What happens after filing Form R-6111?

A: The Louisiana Department of Revenue will review the form and process the transfer of tax credits.

Q: Are there any restrictions on transferring tax credits in Louisiana?

A: Yes, there are certain restrictions on transferring tax credits in Louisiana. It is recommended to consult with a tax professional or the Louisiana Department of Revenue for specific details.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6111 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.