This version of the form is not currently in use and is provided for reference only. Download this version of

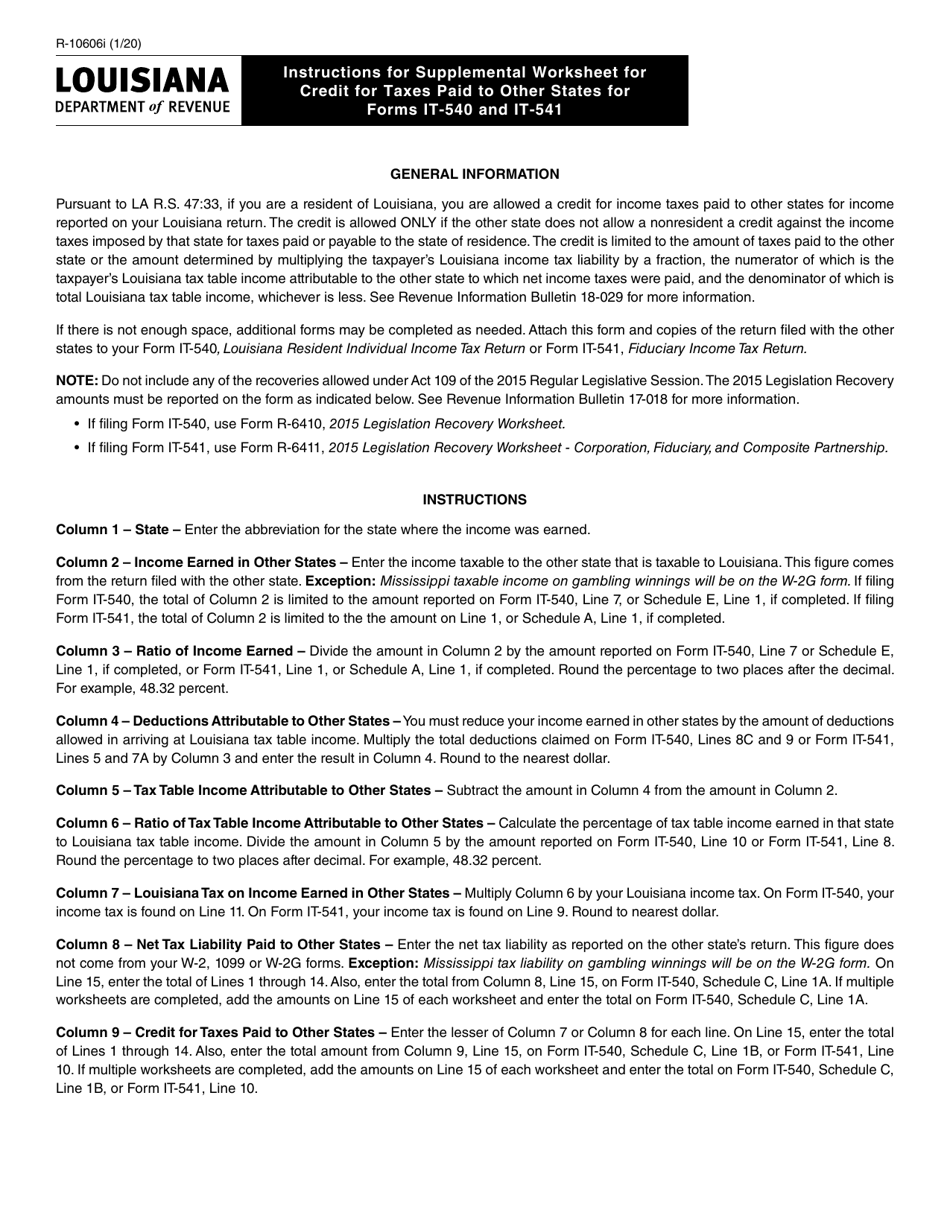

Form R-10606

for the current year.

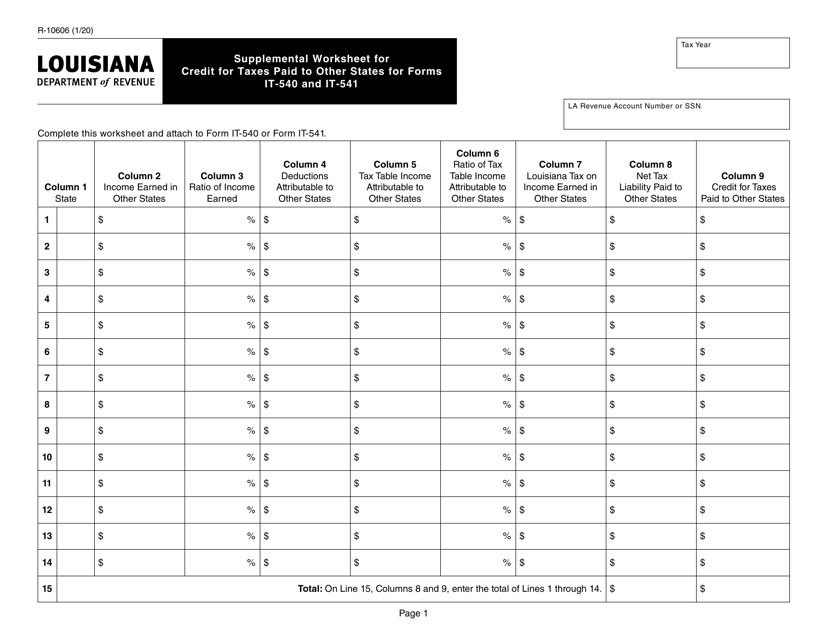

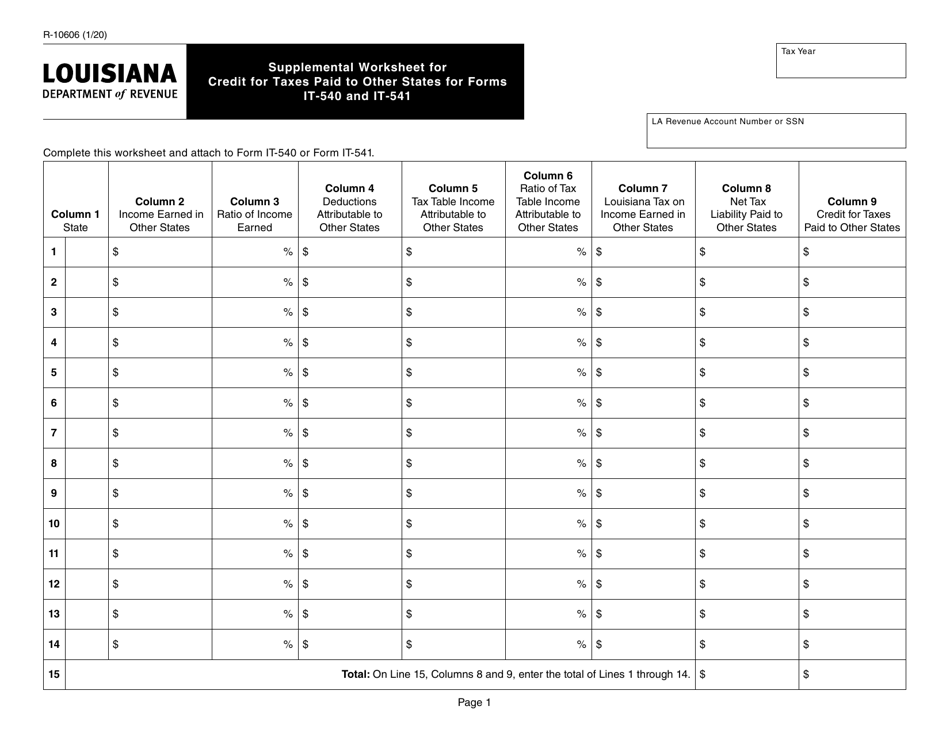

Form R-10606 Supplemental Worksheet for Credit for Taxes Paid to Other States for Forms It-540 and It-541 - Louisiana

What Is Form R-10606?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10606?

A: Form R-10606 is the Supplemental Worksheet for Credit for Taxes Paid to Other States for Forms IT-540 and IT-541 in Louisiana.

Q: What is the purpose of Form R-10606?

A: Form R-10606 is used to calculate and claim a credit for taxes paid to other states on your Louisiana individual income tax return.

Q: Which forms in Louisiana require Form R-10606?

A: Forms IT-540 and IT-541 in Louisiana require the use of Form R-10606 if you have paid taxes to other states.

Q: Do I need to include Form R-10606 with my tax return?

A: Yes, if you are claiming a credit for taxes paid to other states on your Louisiana tax return, you must include the completed Form R-10606.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10606 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.