This version of the form is not currently in use and is provided for reference only. Download this version of

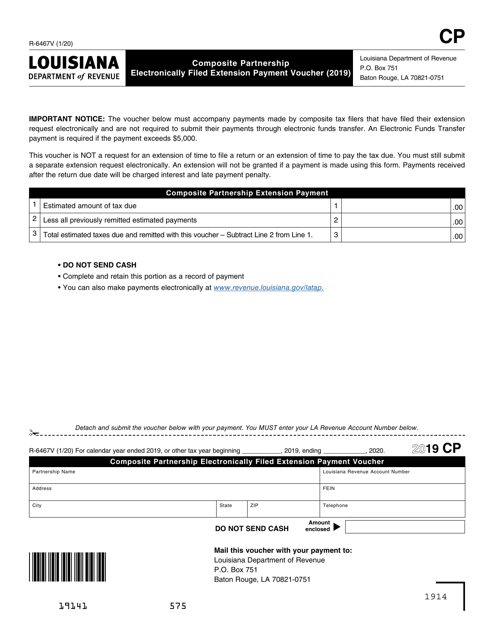

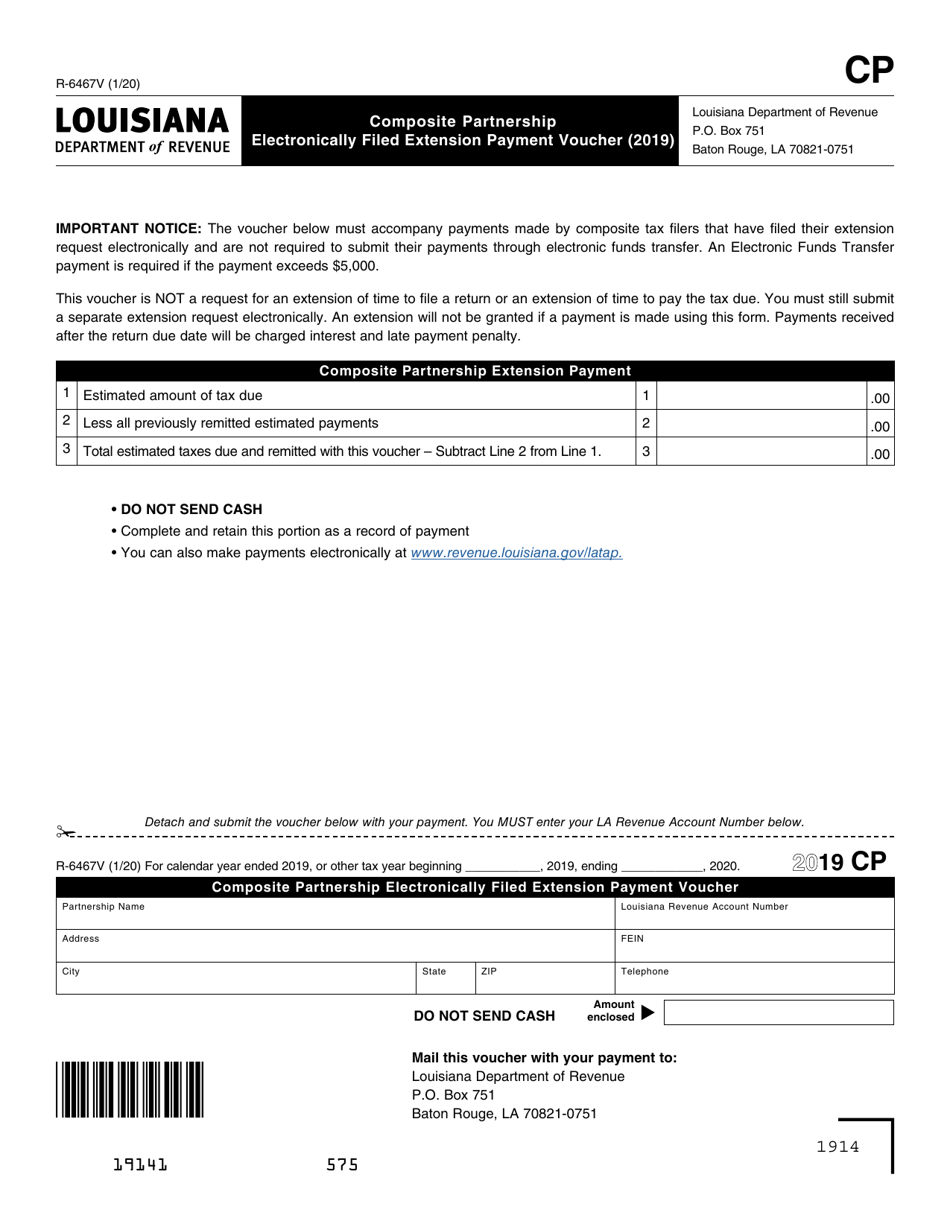

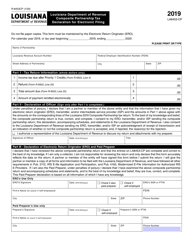

Form R-6467V

for the current year.

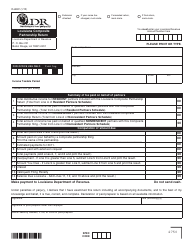

Form R-6467V Composite Partnership Electronically Filed Extension Payment Voucher - Louisiana

What Is Form R-6467V?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6467V?

A: Form R-6467V is a Composite Partnership Electronically Filed Extension Payment Voucher specifically for the state of Louisiana.

Q: What is a composite partnership?

A: A composite partnership is a type of partnership where the partnership itself pays the income tax on behalf of its nonresident partners.

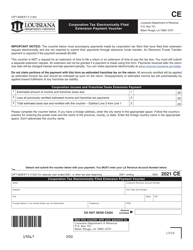

Q: What is an electronically filed extension?

A: An electronically filed extension is a request for additional time to file a tax return, which is submitted electronically.

Q: What is an extension payment voucher?

A: An extension payment voucher is a form used to submit a payment for the estimated tax owed when requesting an extension.

Q: Who needs to use Form R-6467V?

A: Form R-6467V is used by composite partnerships in Louisiana to submit a payment for the extension request.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6467V by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.