This version of the form is not currently in use and is provided for reference only. Download this version of

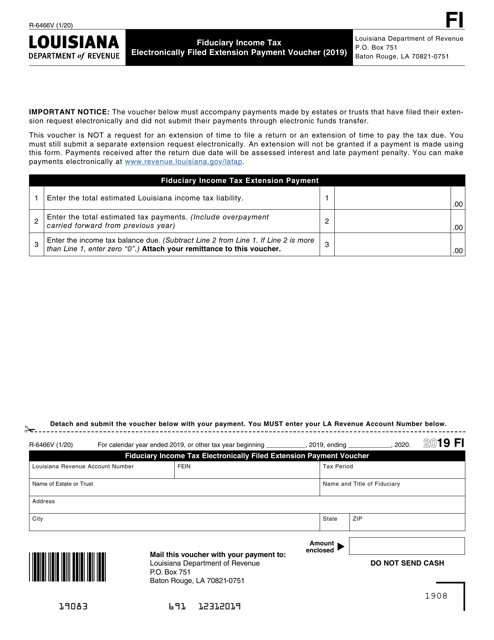

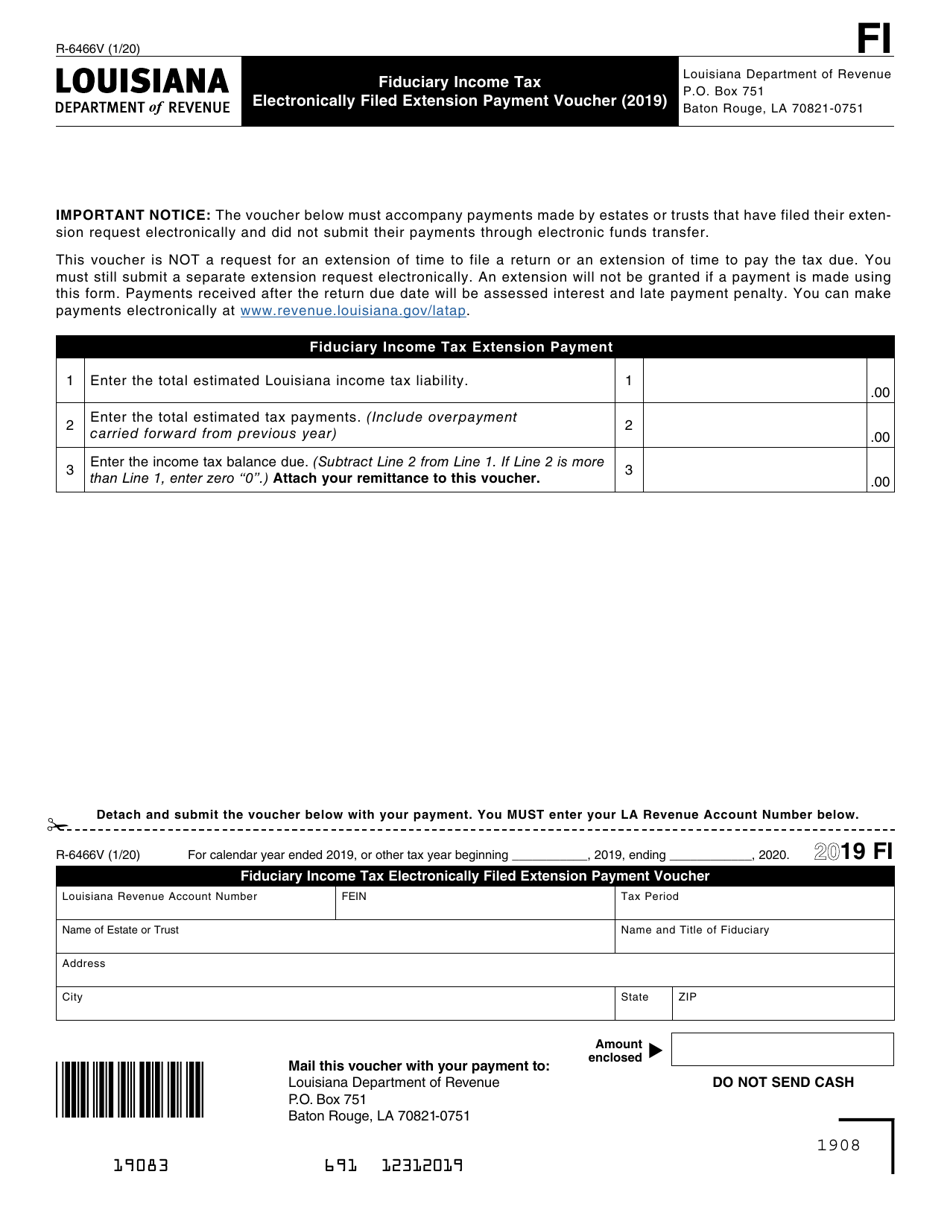

Form R-6466V

for the current year.

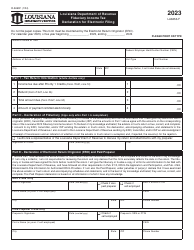

Form R-6466V Fiduciary Income Tax Electronically Filed Extension Payment Voucher - Louisiana

What Is Form R-6466V?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6466V?

A: Form R-6466V is a voucher used for making extension payments for fiduciary income taxes in Louisiana.

Q: What is a fiduciary income tax?

A: Fiduciary income tax is a type of tax that applies to income earned by estates or trusts.

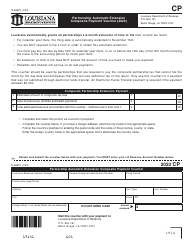

Q: How do I use Form R-6466V?

A: You can use Form R-6466V to make an electronic extension payment for fiduciary income taxes in Louisiana.

Q: What is an extension payment?

A: An extension payment is a payment made to request more time to file a tax return.

Q: Can I file Form R-6466V electronically?

A: Yes, Form R-6466V can be filed electronically in Louisiana.

Q: What is the deadline for filing Form R-6466V?

A: The deadline for filing Form R-6466V depends on the tax year. It is usually due on April 15th.

Q: Are there any penalties for late payment?

A: Yes, there may be penalties for late payment of fiduciary income taxes in Louisiana. It is best to file the extension and make the payment on time to avoid penalties.

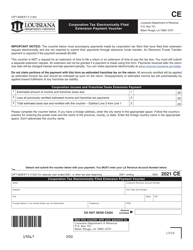

Q: Can I get a refund if I overpay?

A: Yes, if you overpay your fiduciary income taxes, you may be eligible for a refund.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6466V by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.