This version of the form is not currently in use and is provided for reference only. Download this version of

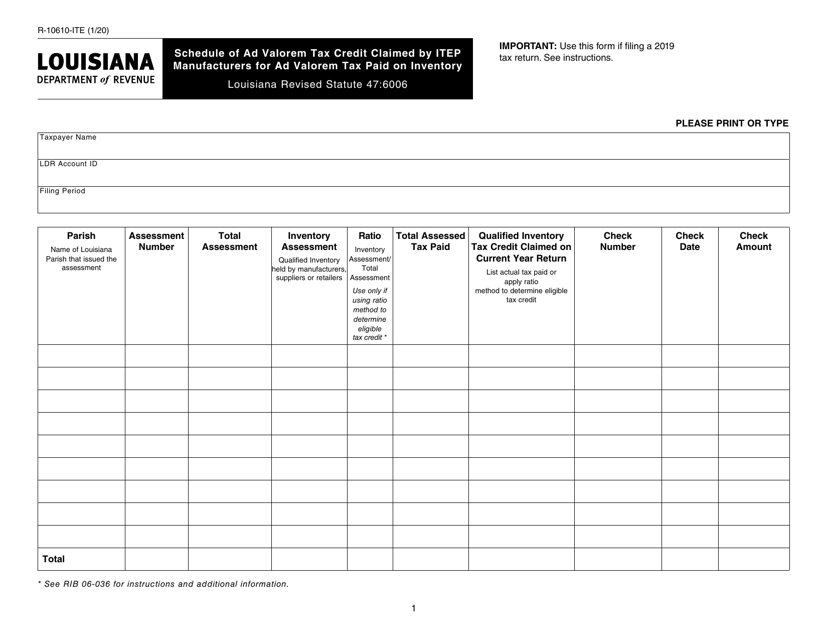

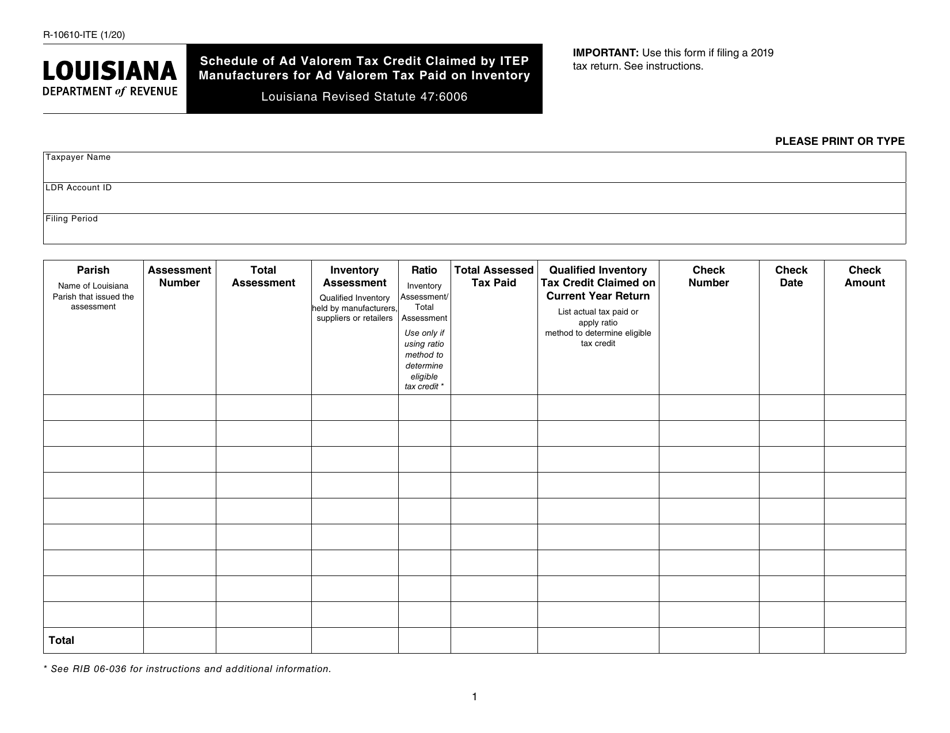

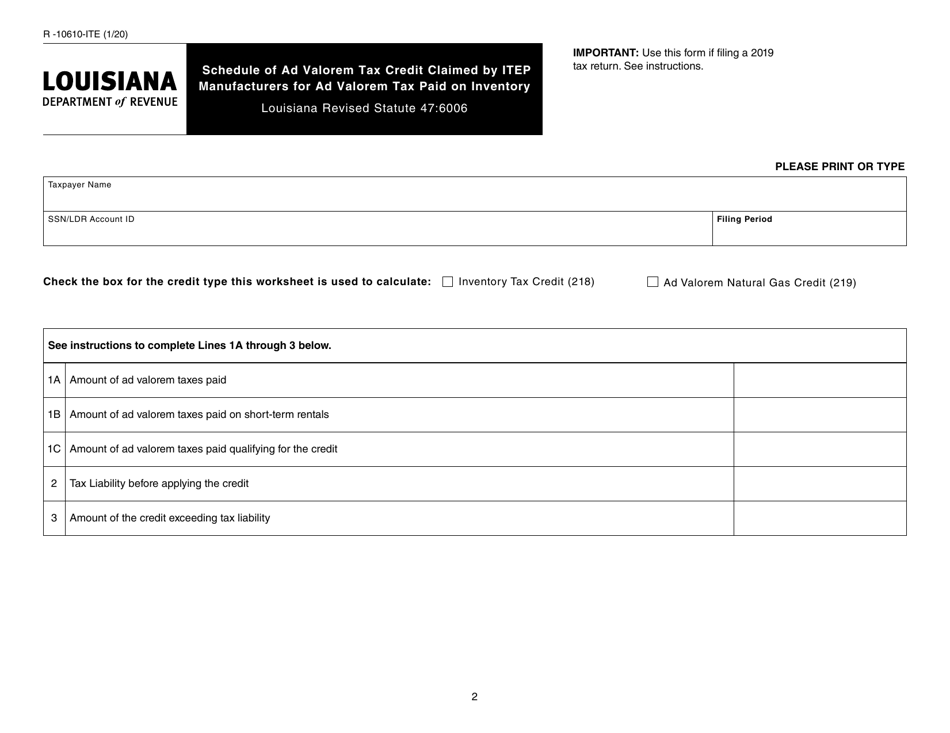

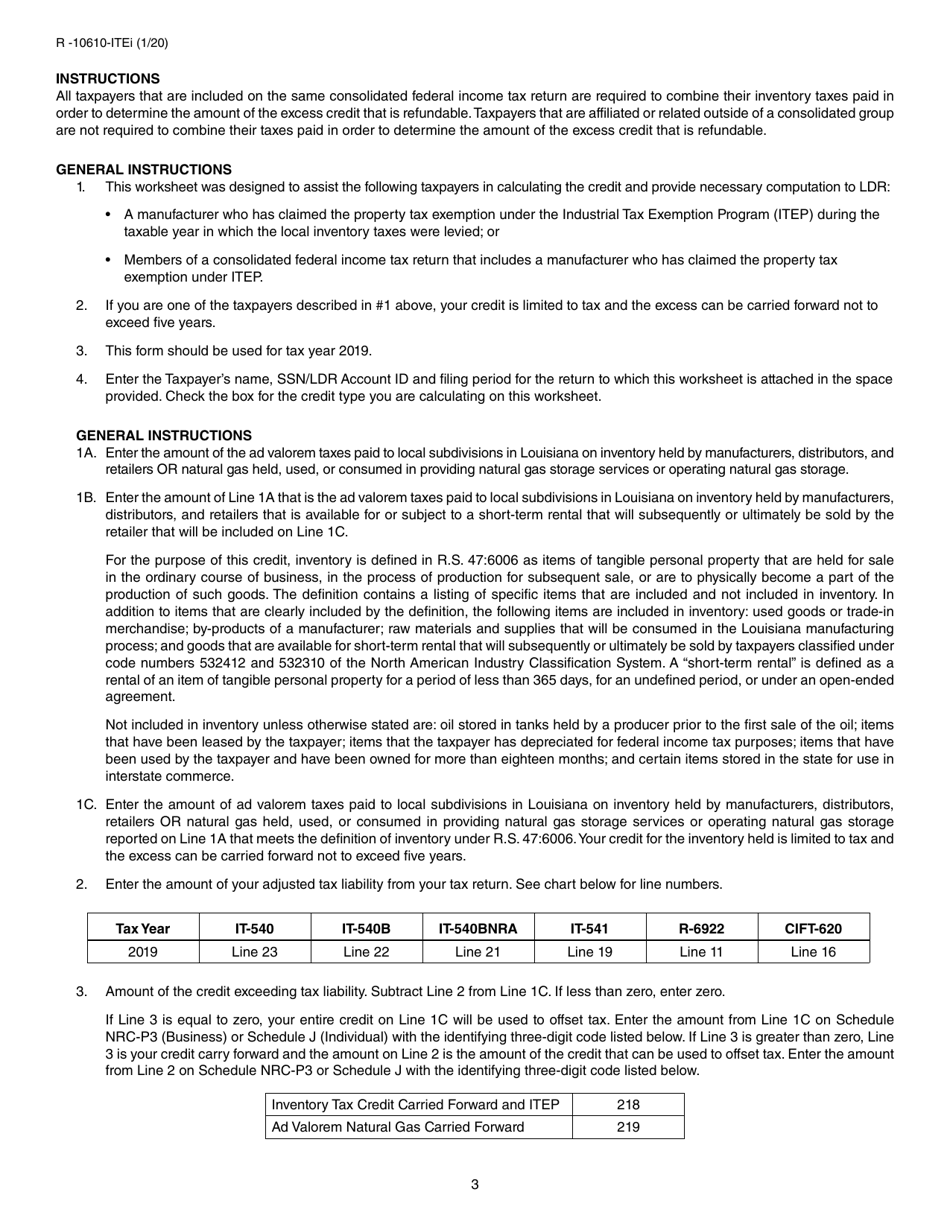

Form R-10610-ITE

for the current year.

Form R-10610-ITE Schedule of Ad Valorem Tax Credit Claimed by Itep Manufacturers for Ad Valorem Tax Paid on Inventory - Louisiana

What Is Form R-10610-ITE?

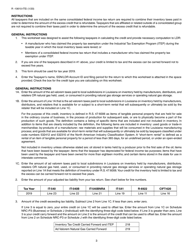

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10610-ITE?

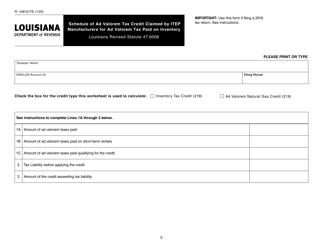

A: Form R-10610-ITE is a schedule used by Itep manufacturers in Louisiana to claim ad valorem tax credit for ad valorem tax paid on inventory.

Q: Who uses Form R-10610-ITE?

A: Itep manufacturers in Louisiana use Form R-10610-ITE.

Q: What is the purpose of Form R-10610-ITE?

A: The purpose of Form R-10610-ITE is to claim a tax credit for ad valorem tax paid on inventory.

Q: What is an Itep manufacturer?

A: An Itep manufacturer is a manufacturer that is eligible for the Industrial Tax Exemption Program in Louisiana.

Q: What is ad valorem tax?

A: Ad valorem tax is a tax based on the assessed value of property.

Q: What is the Industrial Tax Exemption Program?

A: The Industrial Tax Exemption Program (ITEP) is a program in Louisiana that provides a property tax incentive to eligible manufacturing companies.

Q: How do I claim the tax credit on Form R-10610-ITE?

A: You can claim the tax credit by completing Form R-10610-ITE and providing the required information.

Q: Is Form R-10610-ITE for businesses located only in Louisiana?

A: Yes, Form R-10610-ITE is specifically for businesses located in Louisiana.

Q: Is there a deadline for filing Form R-10610-ITE?

A: Yes, the deadline for filing Form R-10610-ITE is typically the same as the deadline for filing the Louisiana state tax return.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10610-ITE by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.