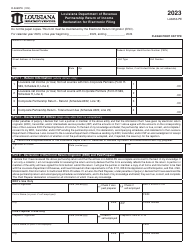

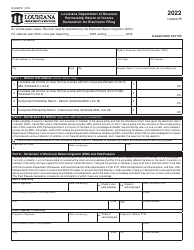

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-565

for the current year.

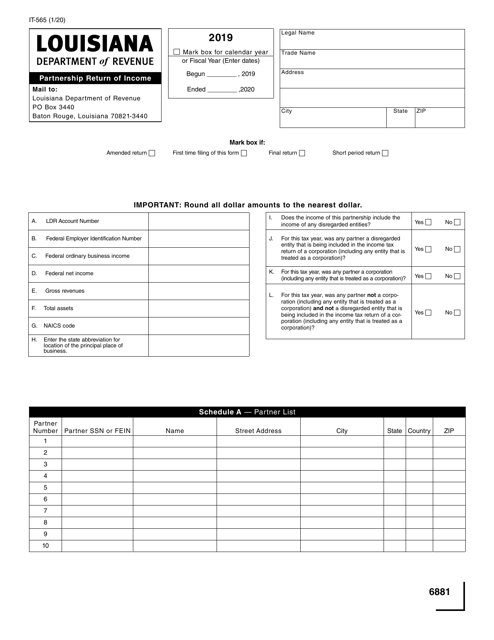

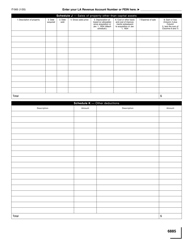

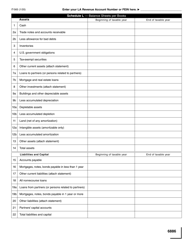

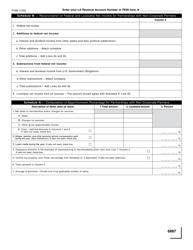

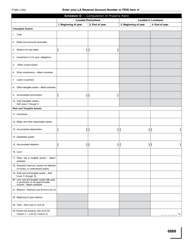

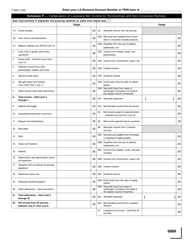

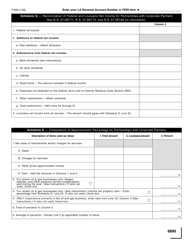

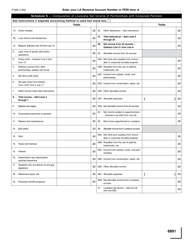

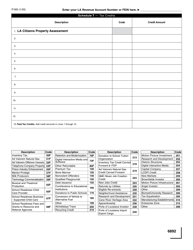

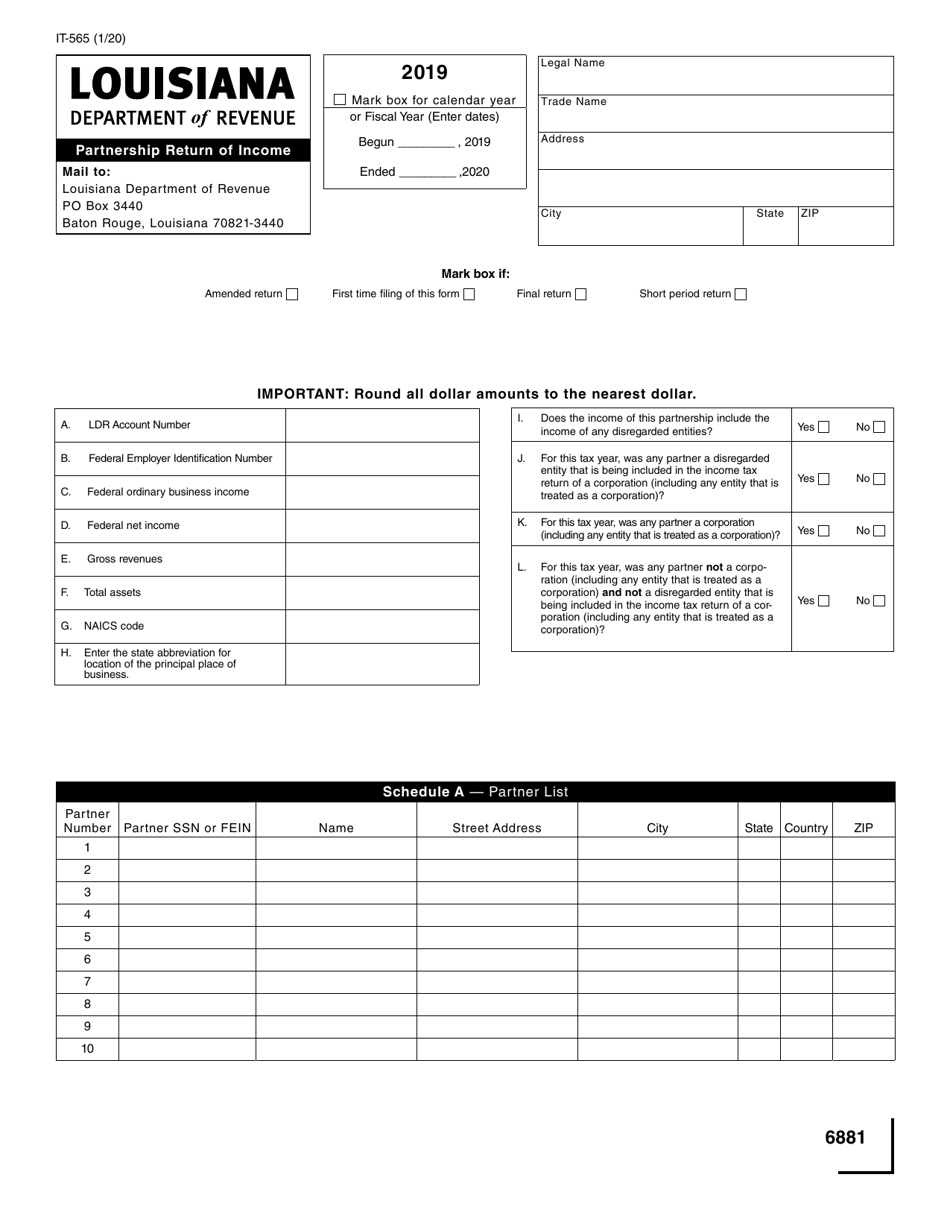

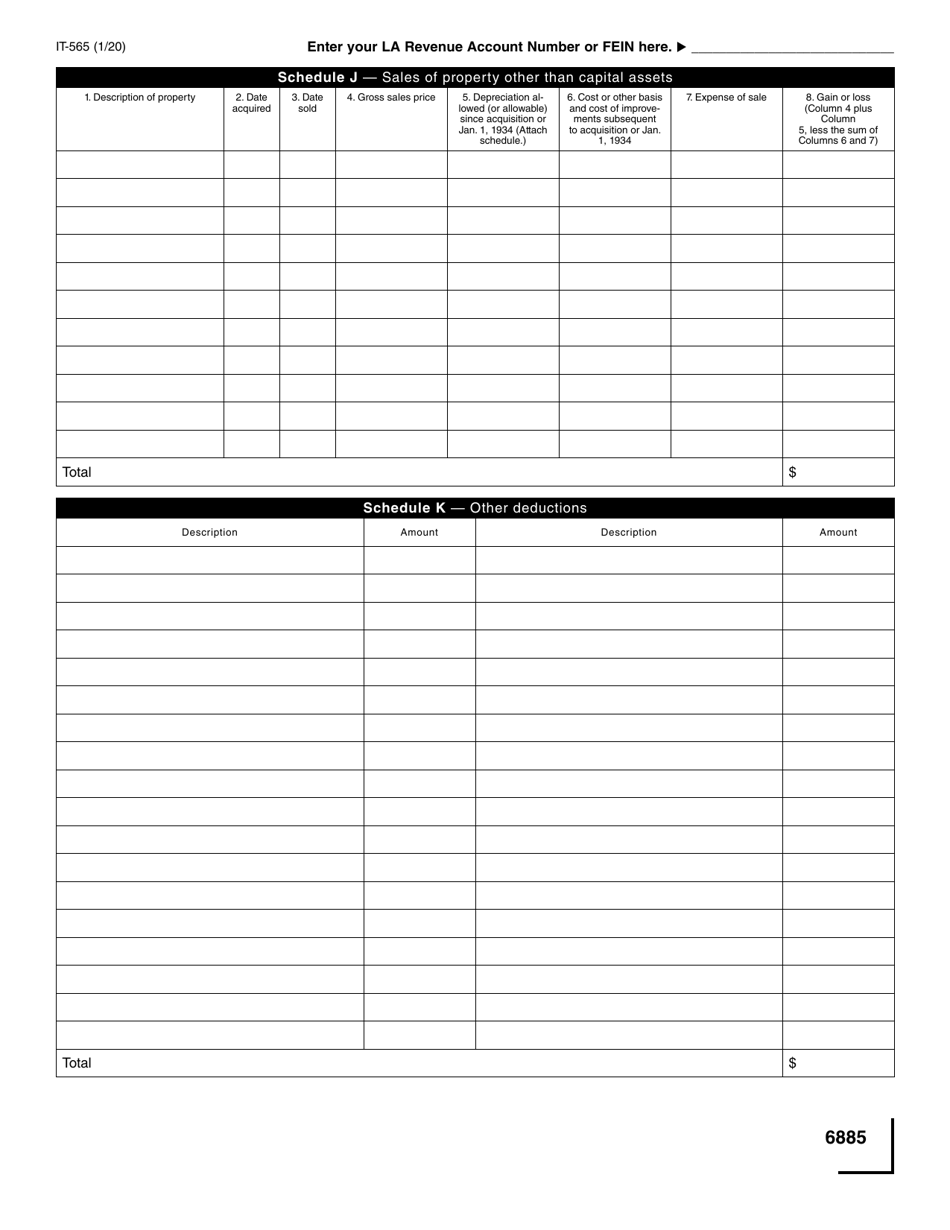

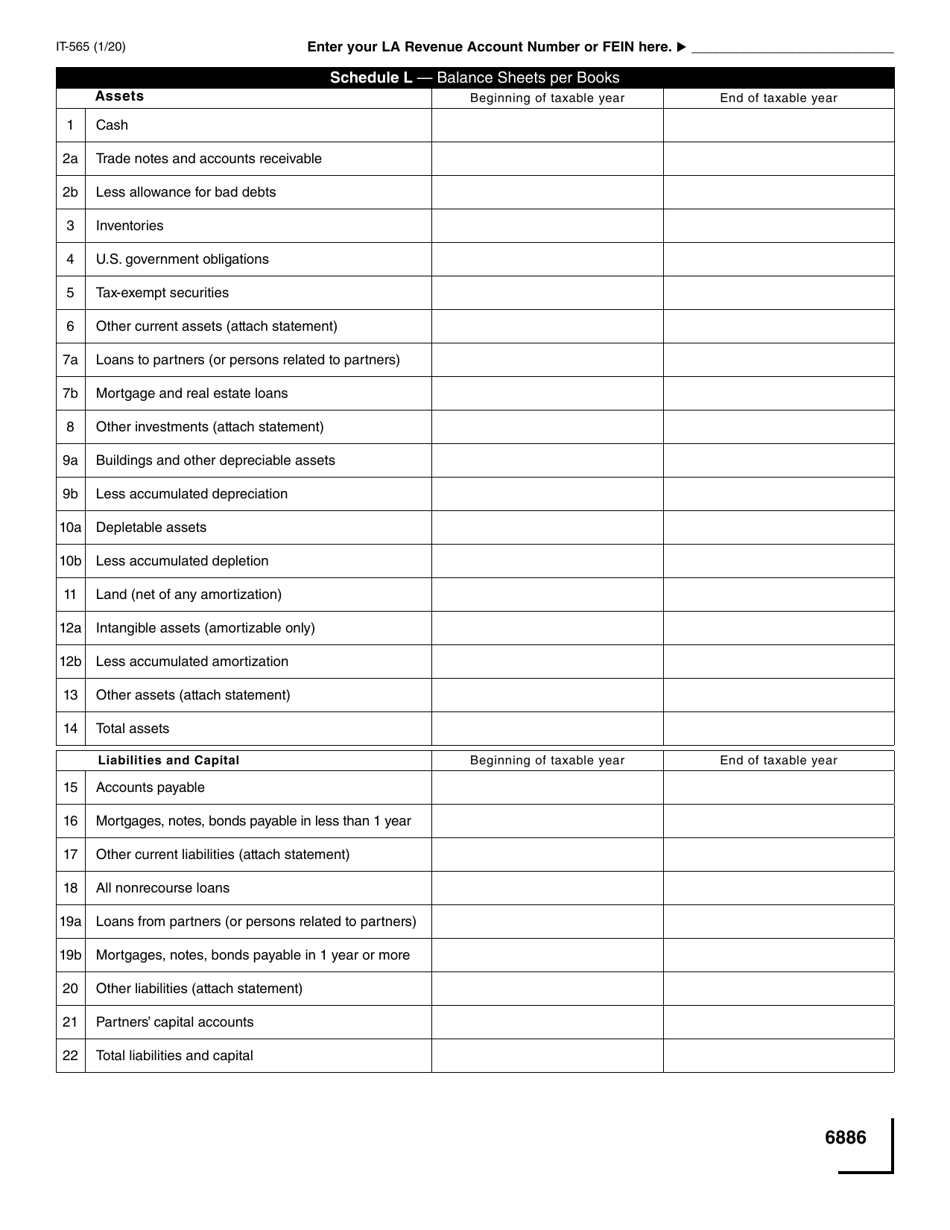

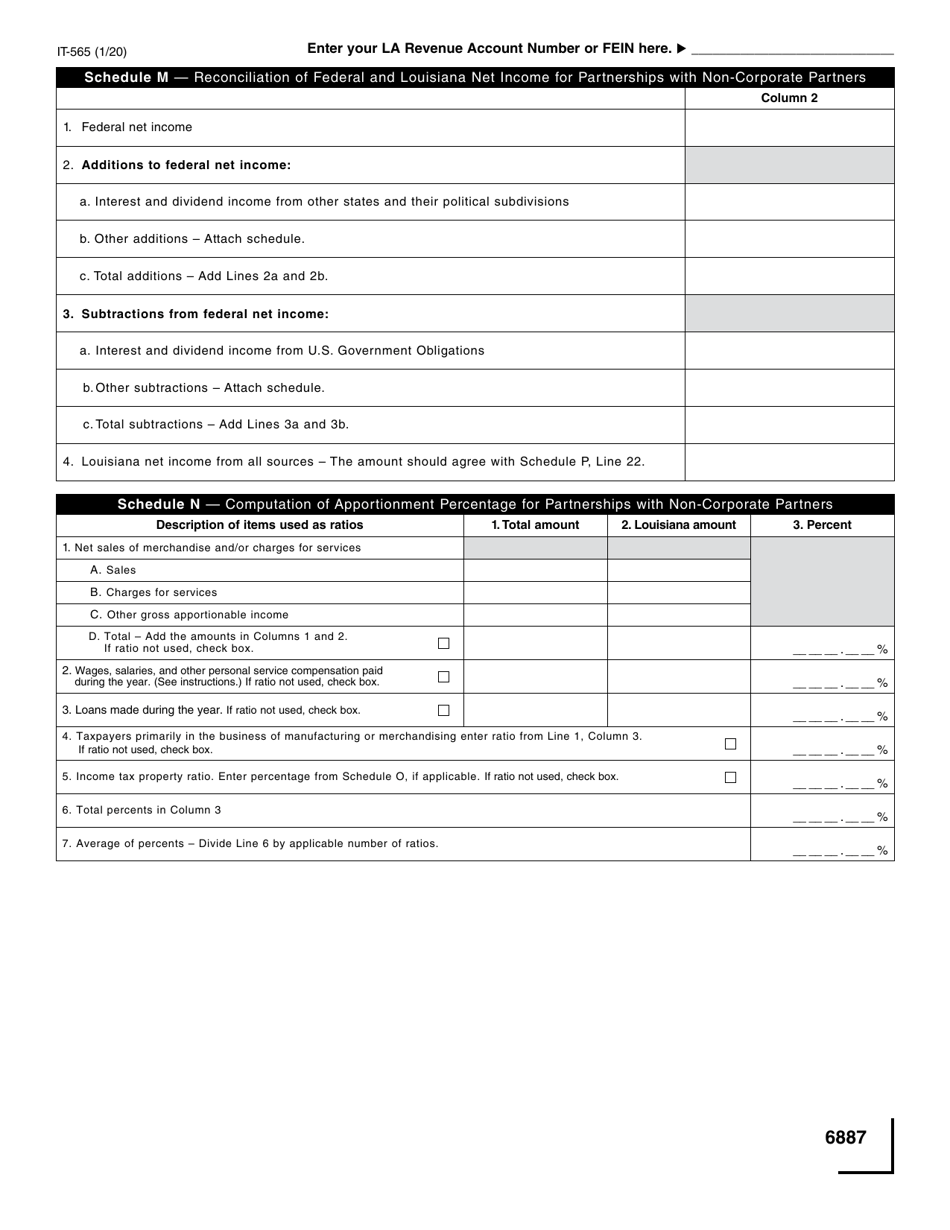

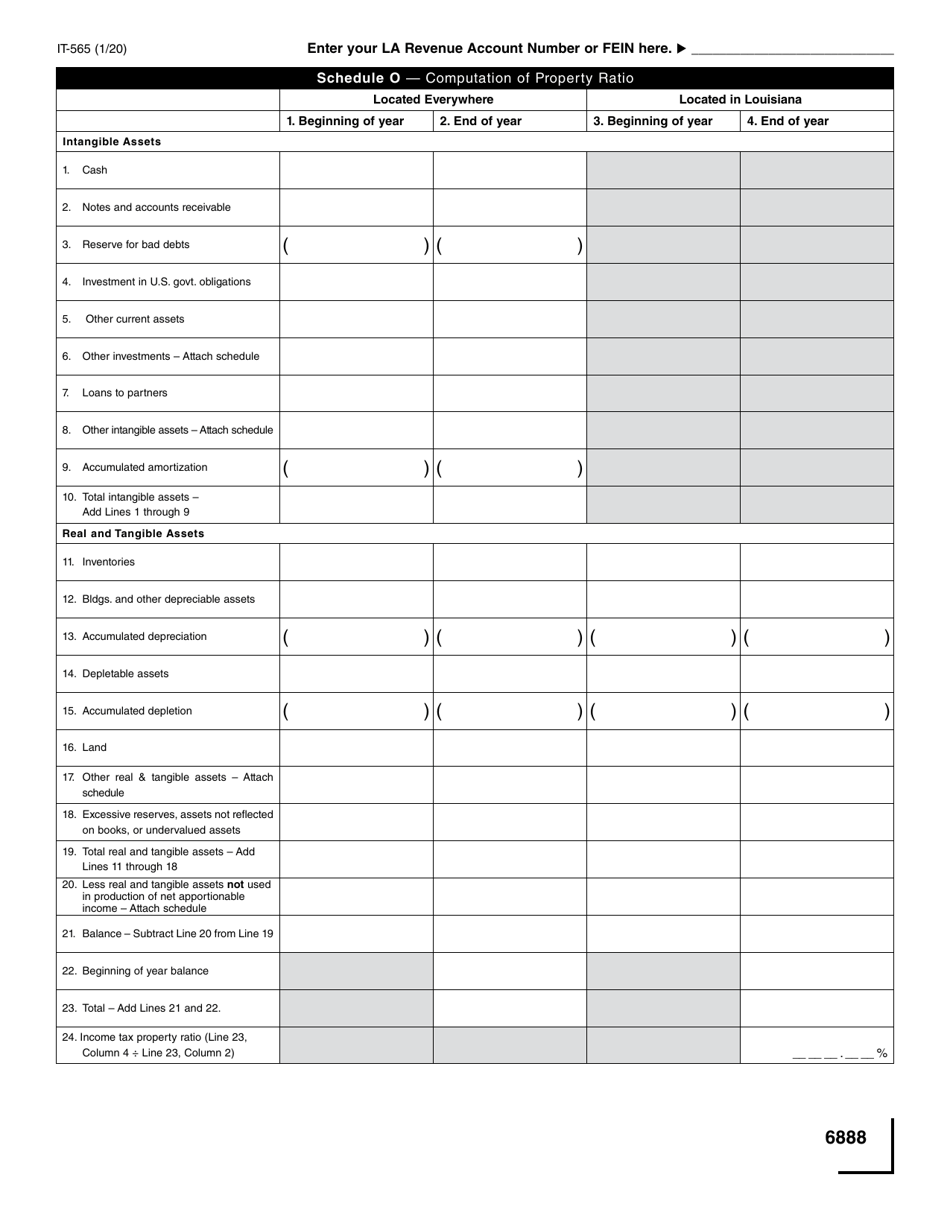

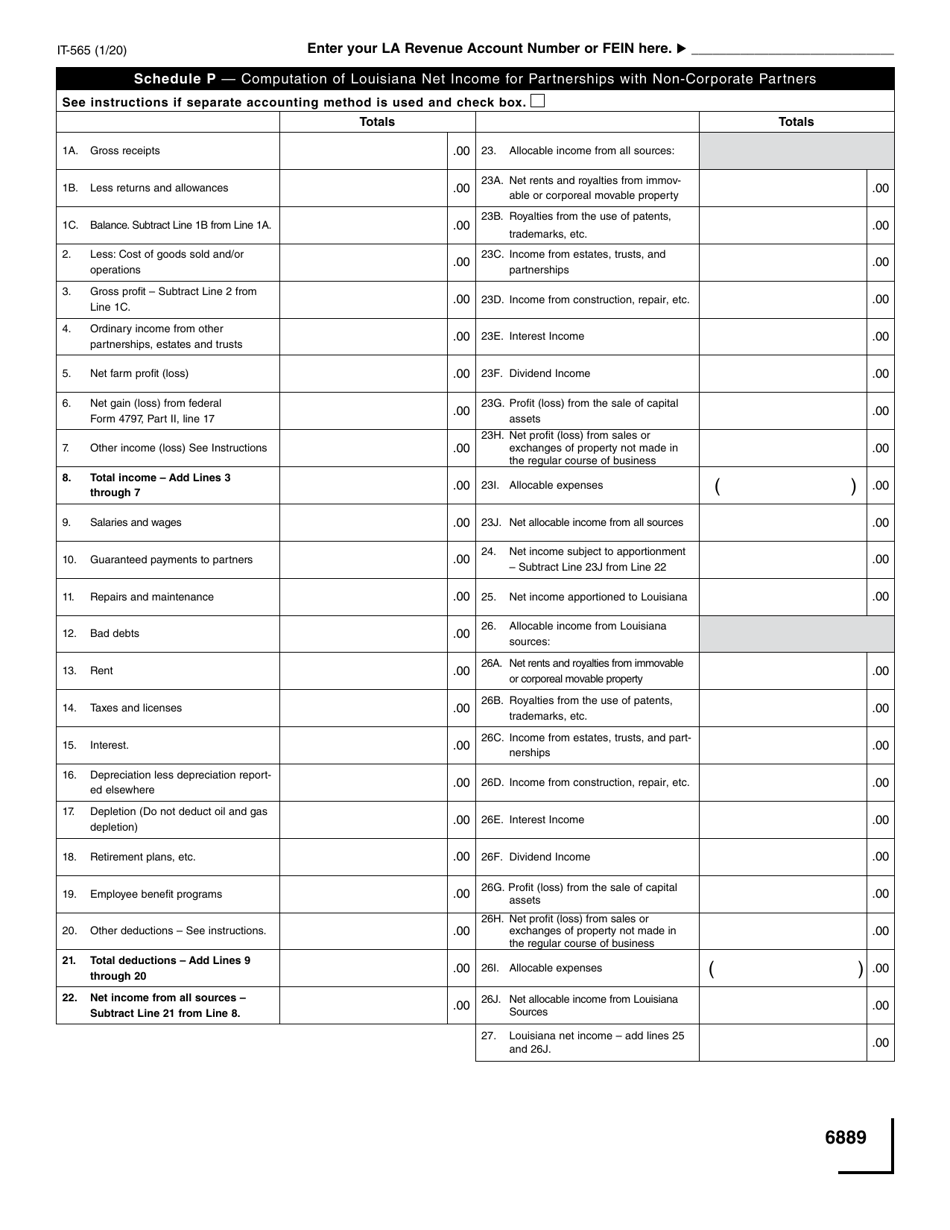

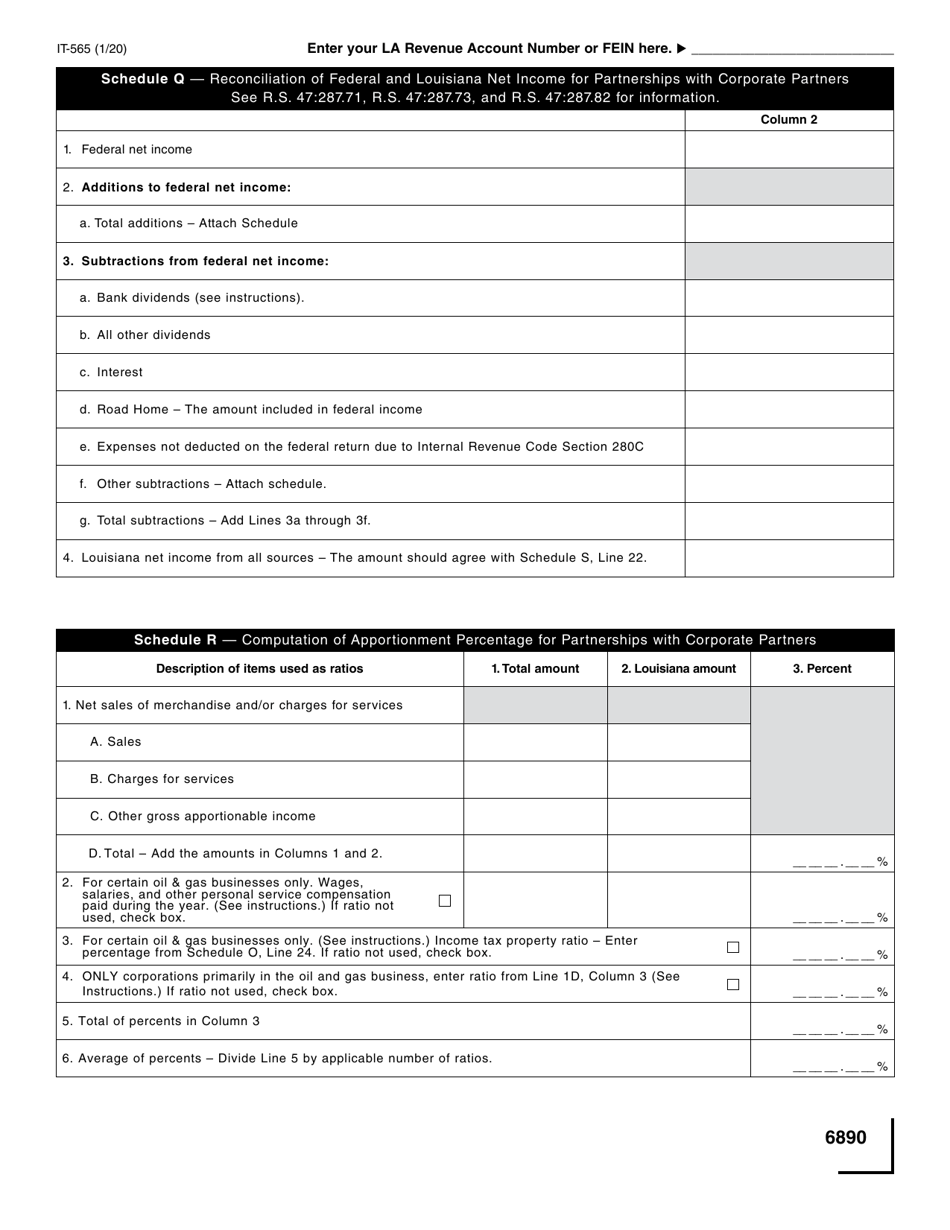

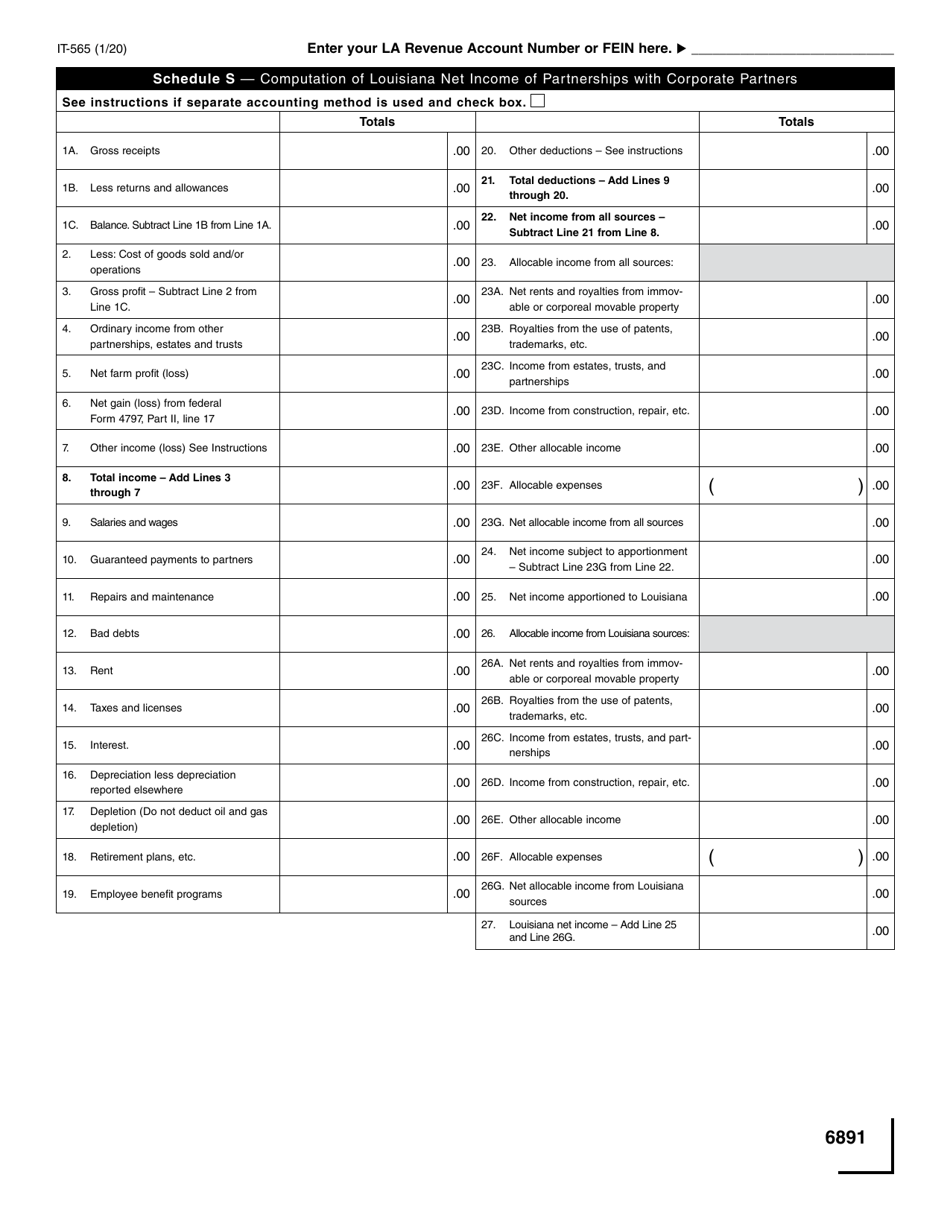

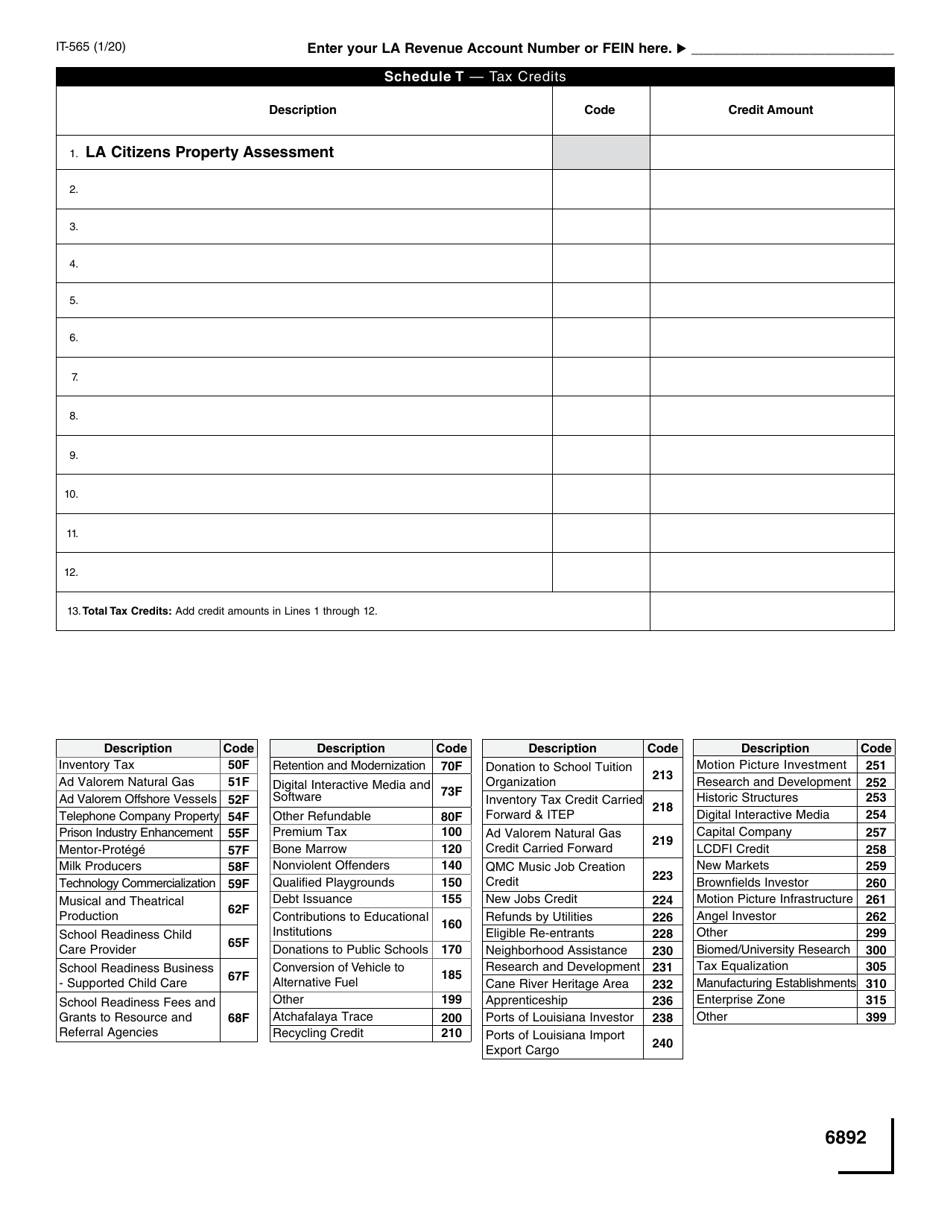

Form IT-565 Partnership Return of Income - Louisiana

What Is Form IT-565?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-565?

A: Form IT-565 is the Partnership Return of Income for the state of Louisiana.

Q: Who needs to file Form IT-565?

A: Partnerships that derive income in Louisiana or have members who are Louisiana residents need to file Form IT-565.

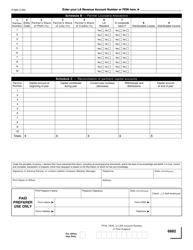

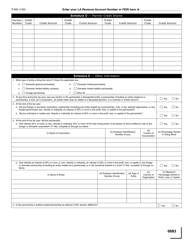

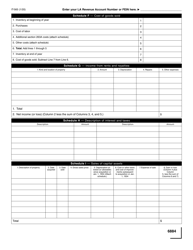

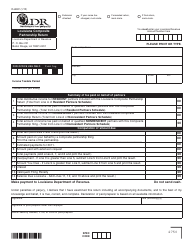

Q: What information is required on Form IT-565?

A: Form IT-565 requires information about the partnership's income, deductions, credits, and members.

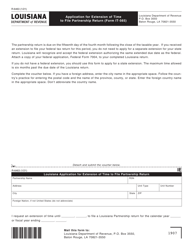

Q: When is the due date for Form IT-565?

A: Form IT-565 is due on the 15th day of the fourth month following the close of the partnership's taxable year.

Q: Are there any penalties for late filing of Form IT-565?

A: Yes, there are penalties for late filing, ranging from 2% to 10% of the tax due, depending on the length of the delay.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-565 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.