This version of the form is not currently in use and is provided for reference only. Download this version of

Form R-10610

for the current year.

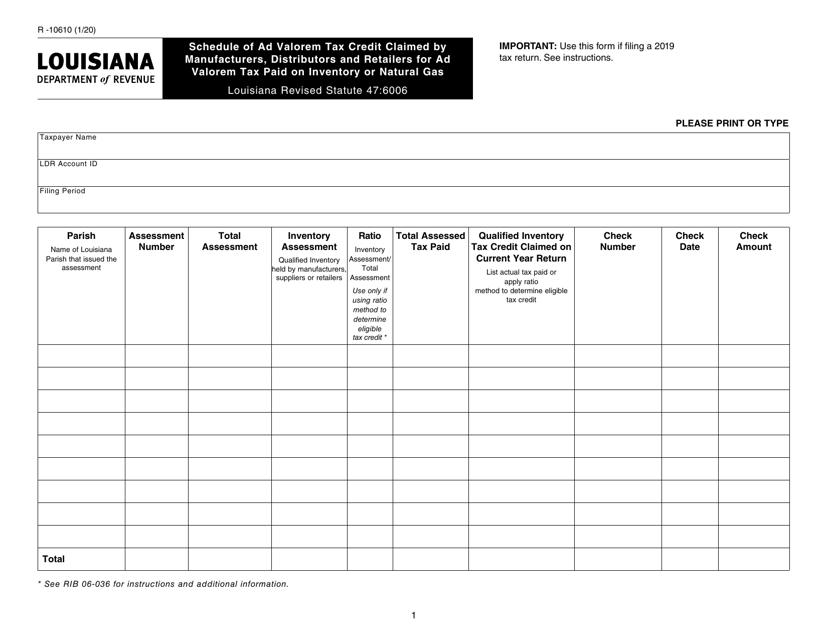

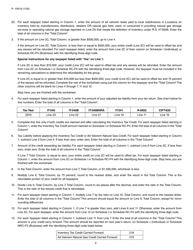

Form R-10610 Schedule of Ad Valorem Tax Credit Claimed by Manufacturers, Distributors and Retailers for Ad Valorem Tax Paid on Inventory or Natural Gas - Louisiana

What Is Form R-10610?

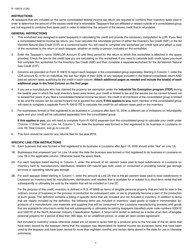

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-10610?

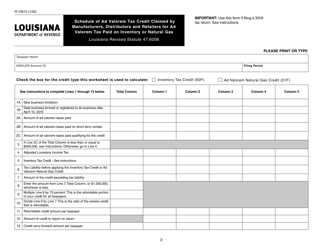

A: Form R-10610 is a schedule used by manufacturers, distributors, and retailers in Louisiana to claim a credit for ad valorem tax paid on inventory or natural gas.

Q: Who can use Form R-10610?

A: Manufacturers, distributors, and retailers in Louisiana can use Form R-10610 to claim a credit for ad valorem tax paid on inventory or natural gas.

Q: What is the purpose of Form R-10610?

A: The purpose of Form R-10610 is to allow manufacturers, distributors, and retailers in Louisiana to claim a credit for the ad valorem tax they have paid on their inventory or natural gas.

Q: What is ad valorem tax?

A: Ad valorem tax is a tax based on the value of property or goods.

Q: What can be claimed as a credit on Form R-10610?

A: On Form R-10610, manufacturers, distributors, and retailers can claim a credit for the ad valorem tax they have paid on their inventory or natural gas.

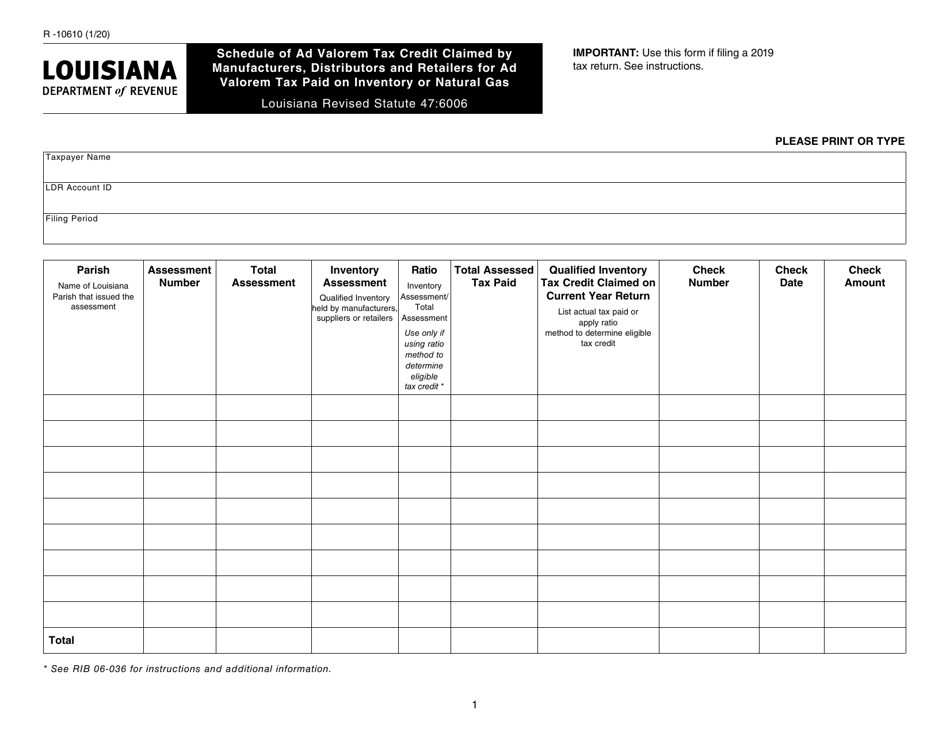

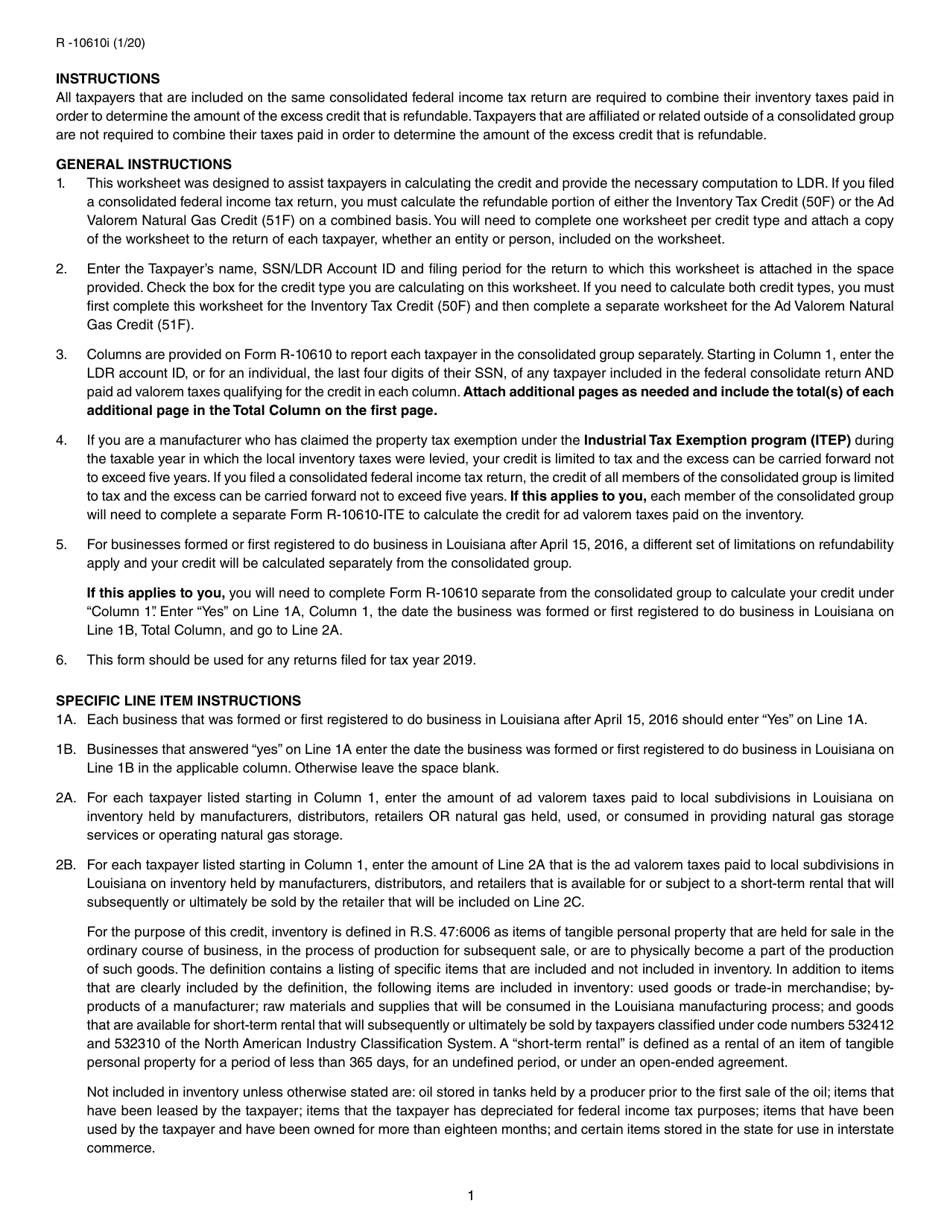

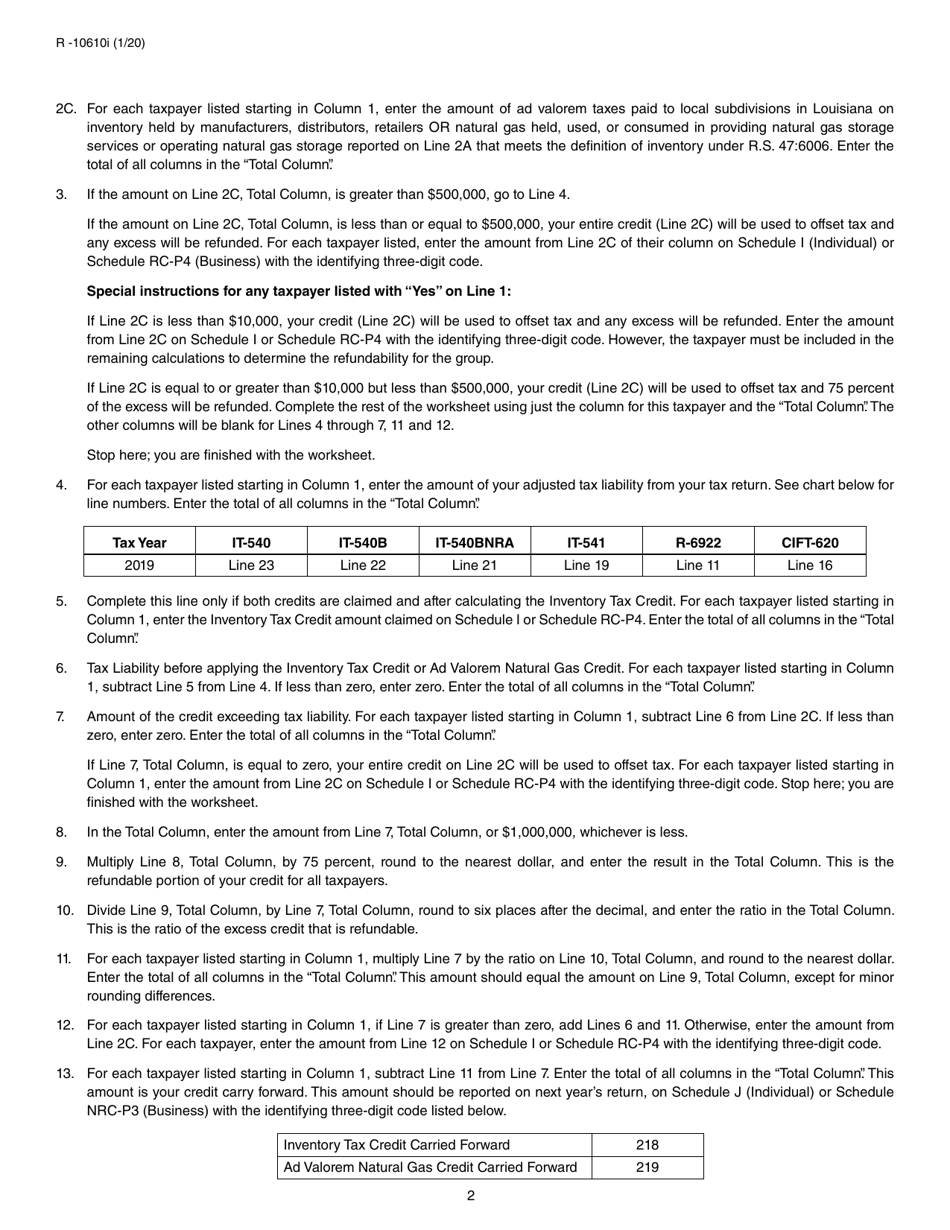

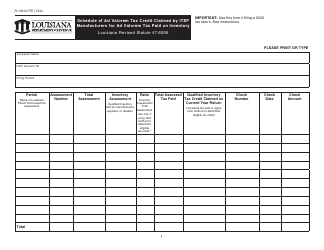

Q: How to fill out Form R-10610?

A: To fill out Form R-10610, manufacturers, distributors, and retailers need to provide their business information, details of the ad valorem tax paid, and calculate the credit amount.

Q: Is there a deadline for submitting Form R-10610?

A: Yes, there is a deadline for submitting Form R-10610. The specific deadline can be found on the form or by contacting the Louisiana Department of Revenue.

Q: Are there any additional requirements for claiming the credit on Form R-10610?

A: There may be additional requirements for claiming the credit on Form R-10610. It is recommended to consult the instructions and guidelines provided by the Louisiana Department of Revenue.

Q: Can the credit claimed on Form R-10610 be carried forward?

A: Yes, the credit claimed on Form R-10610 can be carried forward for a certain period of time, as specified by the Louisiana Department of Revenue.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-10610 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.