This version of the form is not currently in use and is provided for reference only. Download this version of

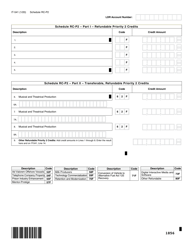

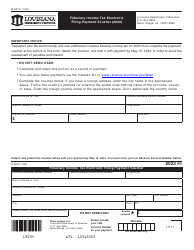

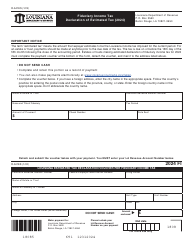

Form IT-541

for the current year.

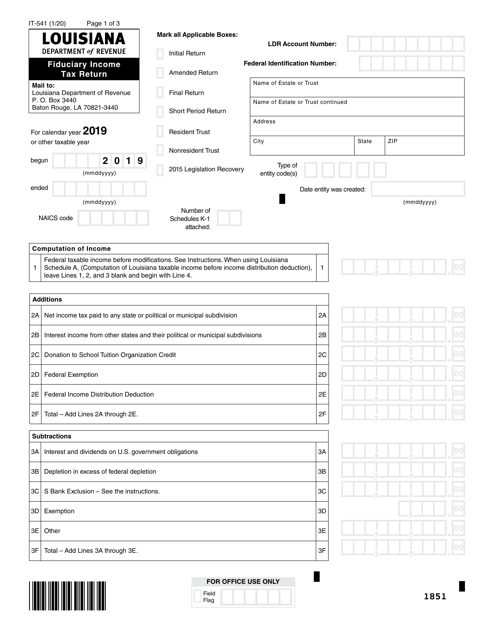

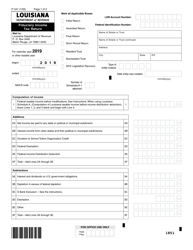

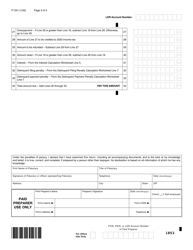

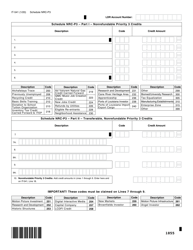

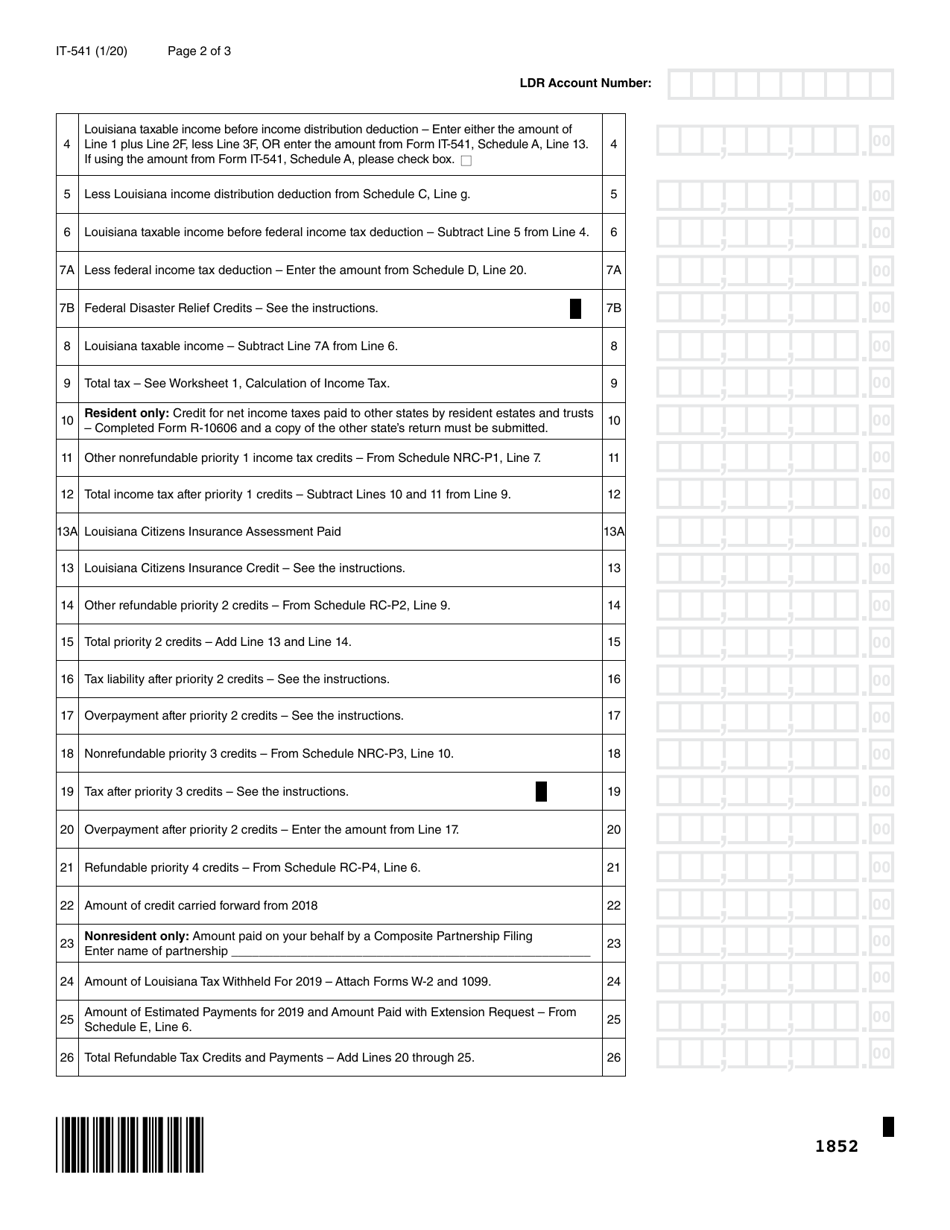

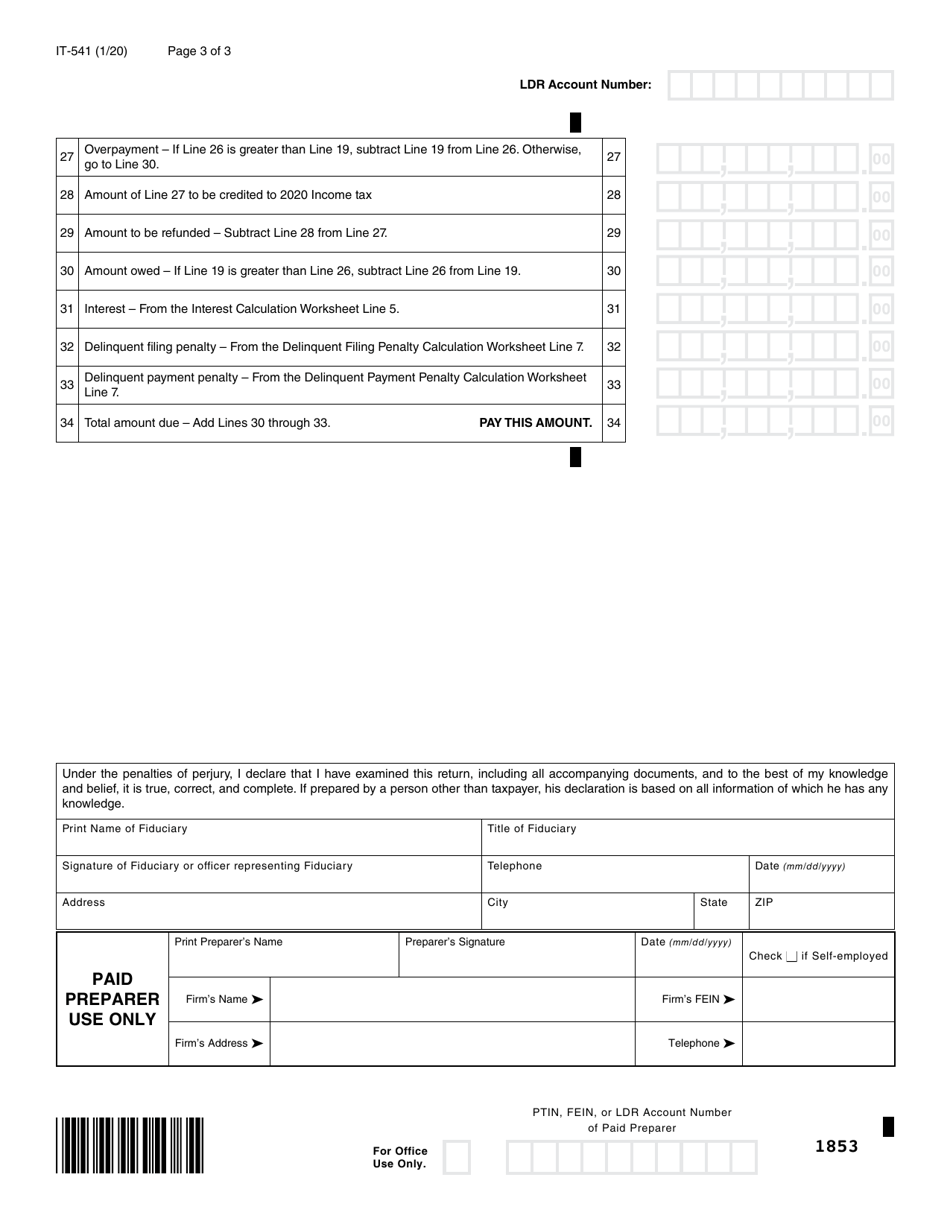

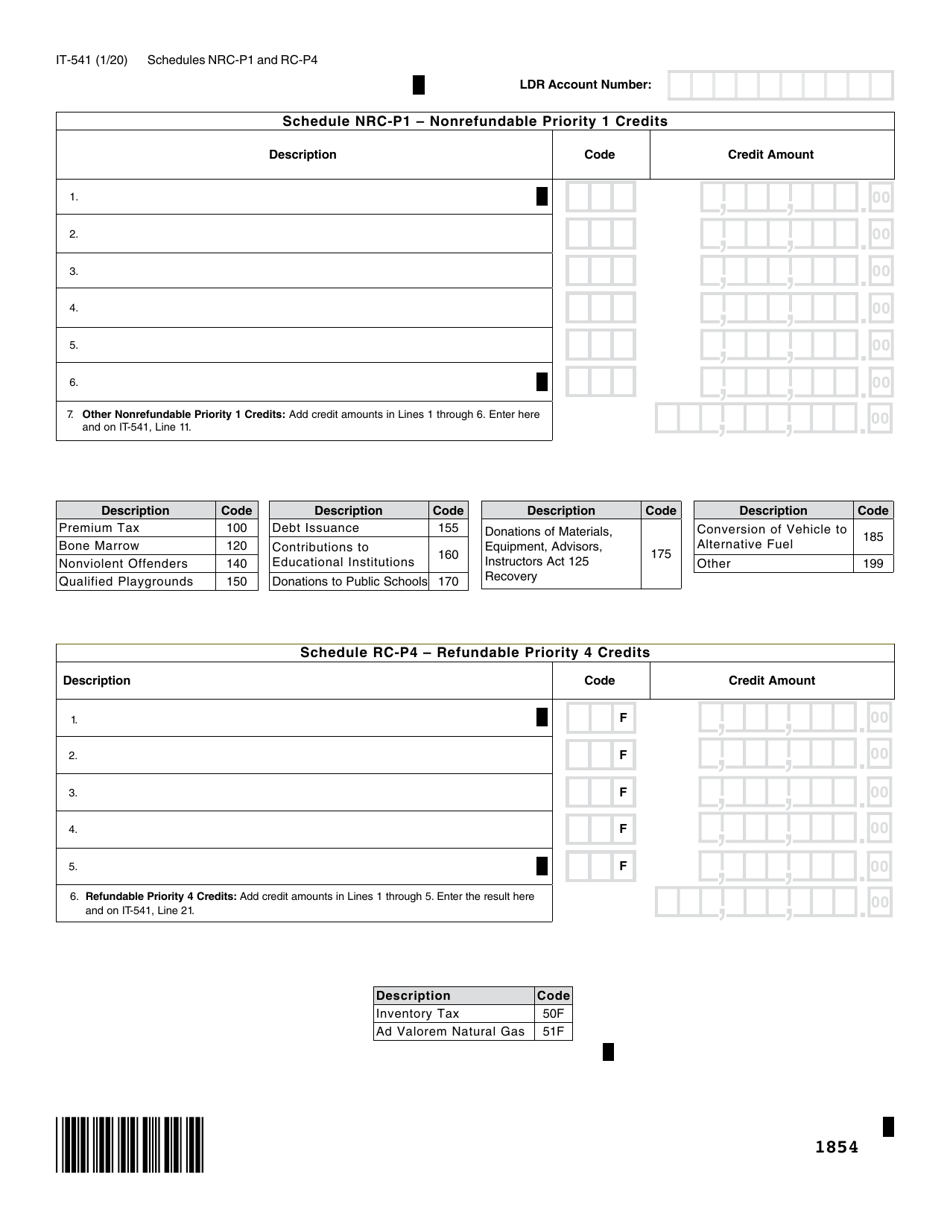

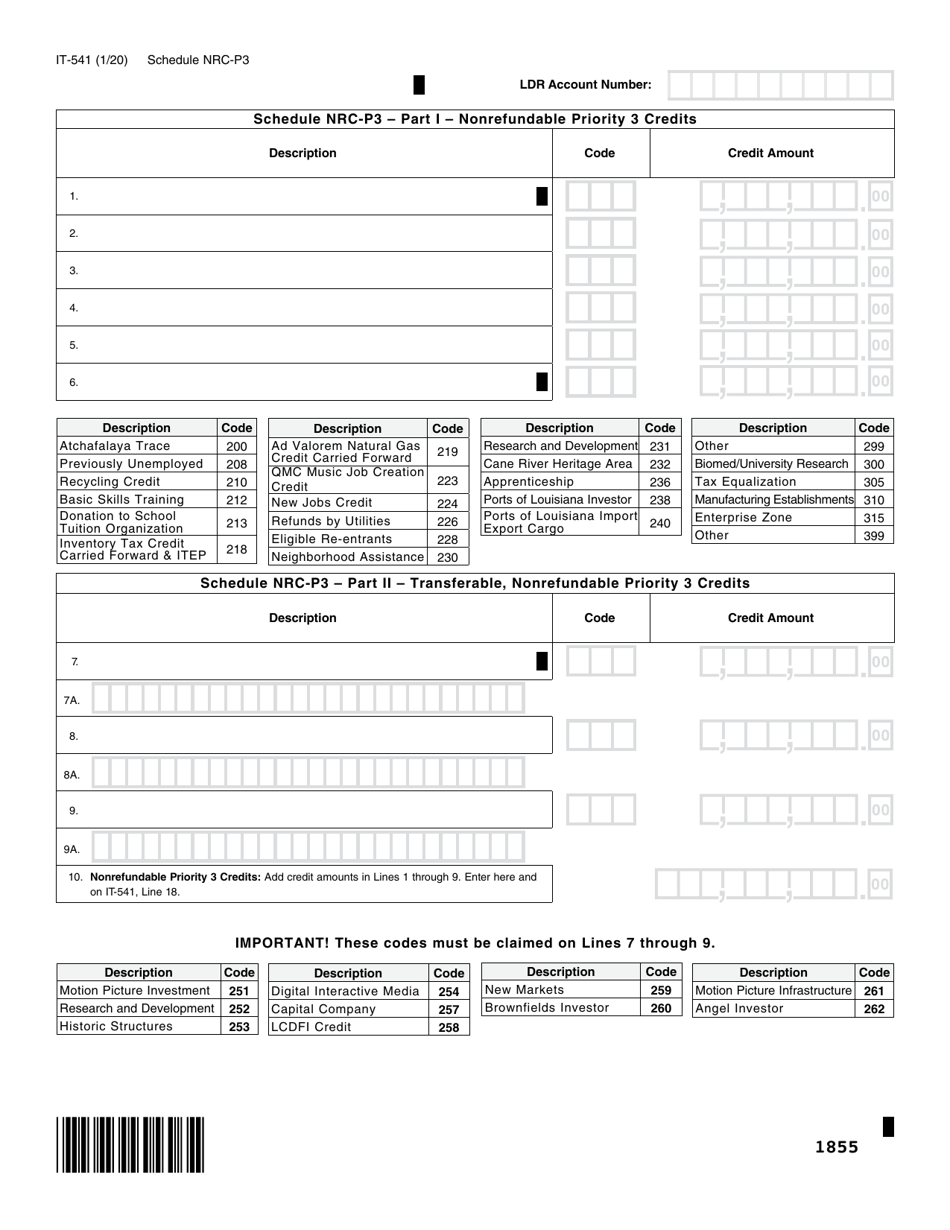

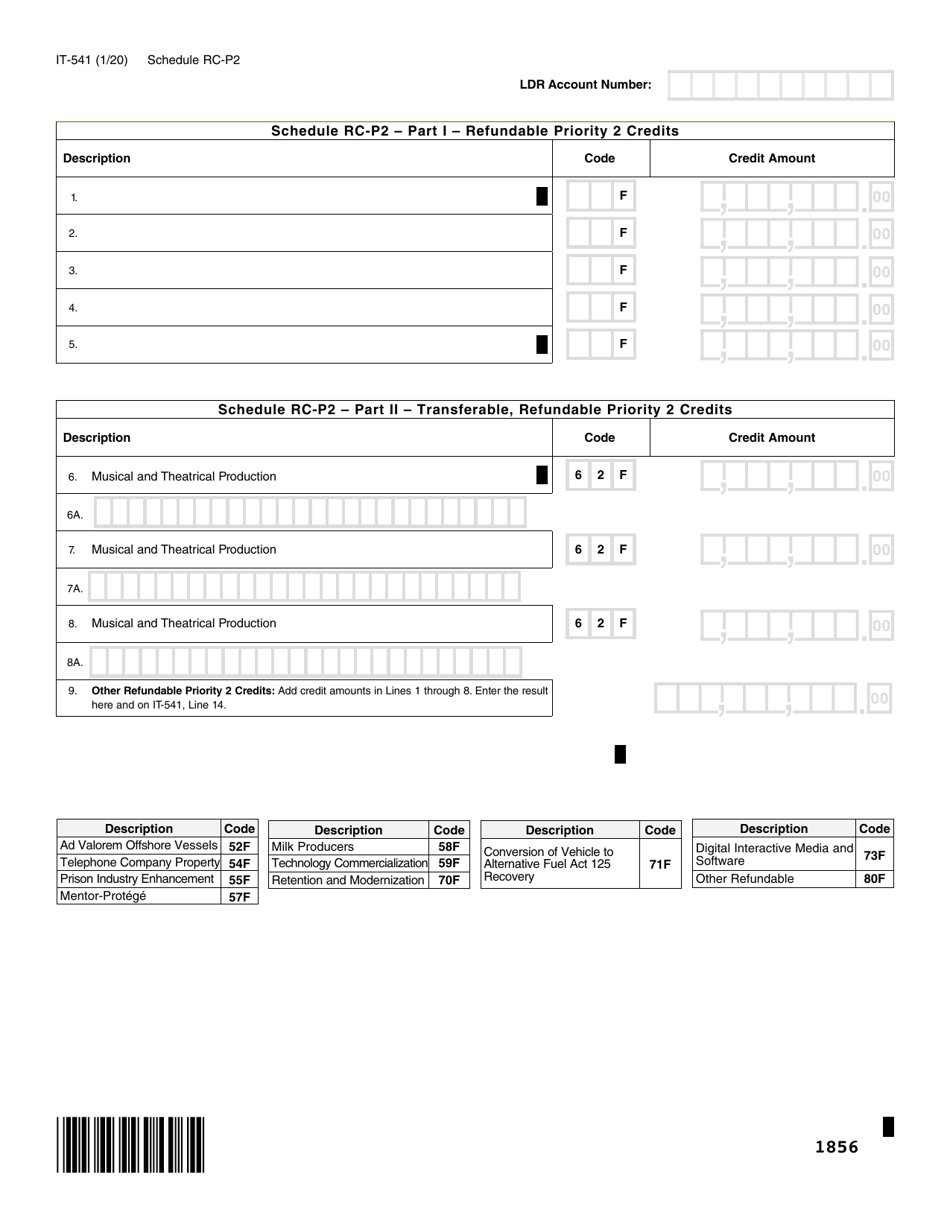

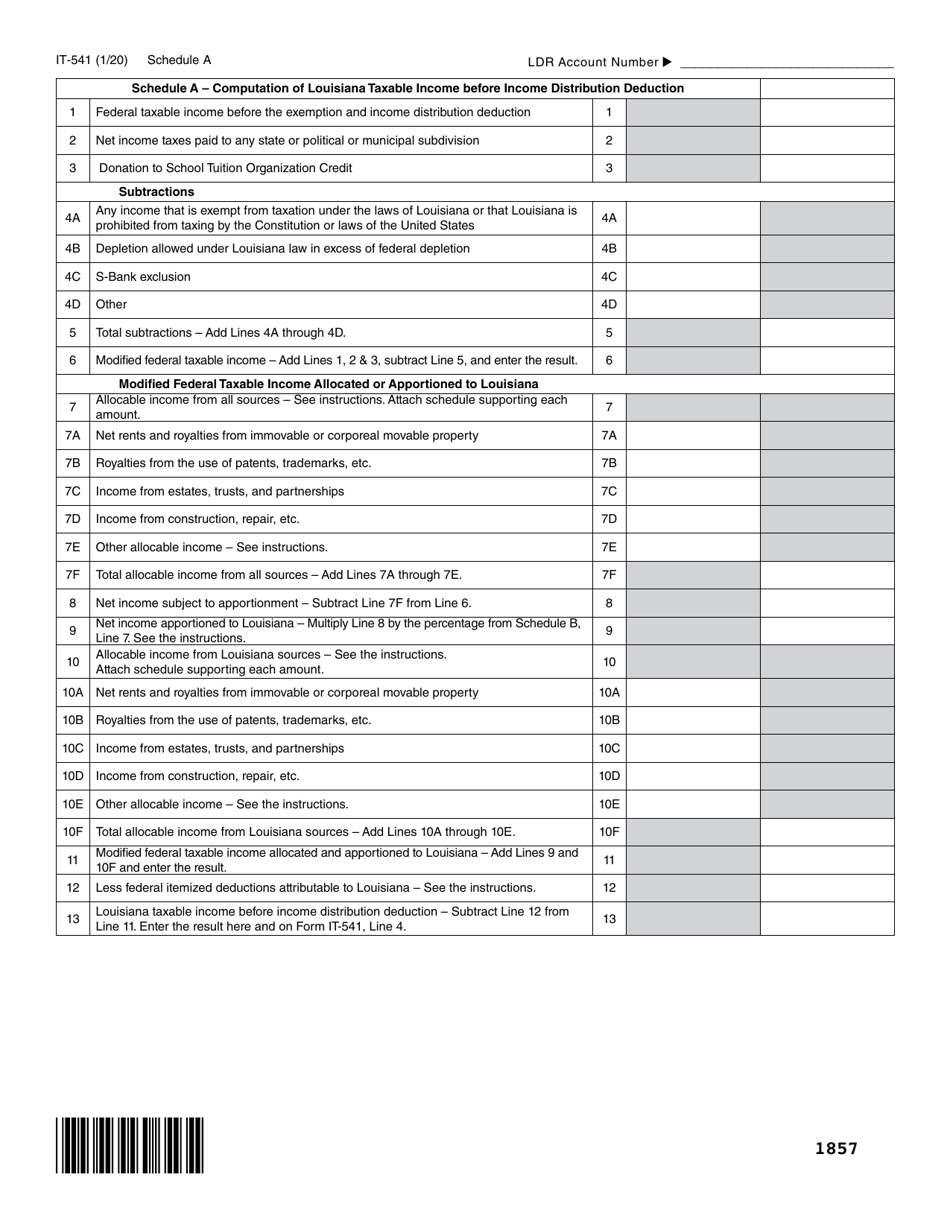

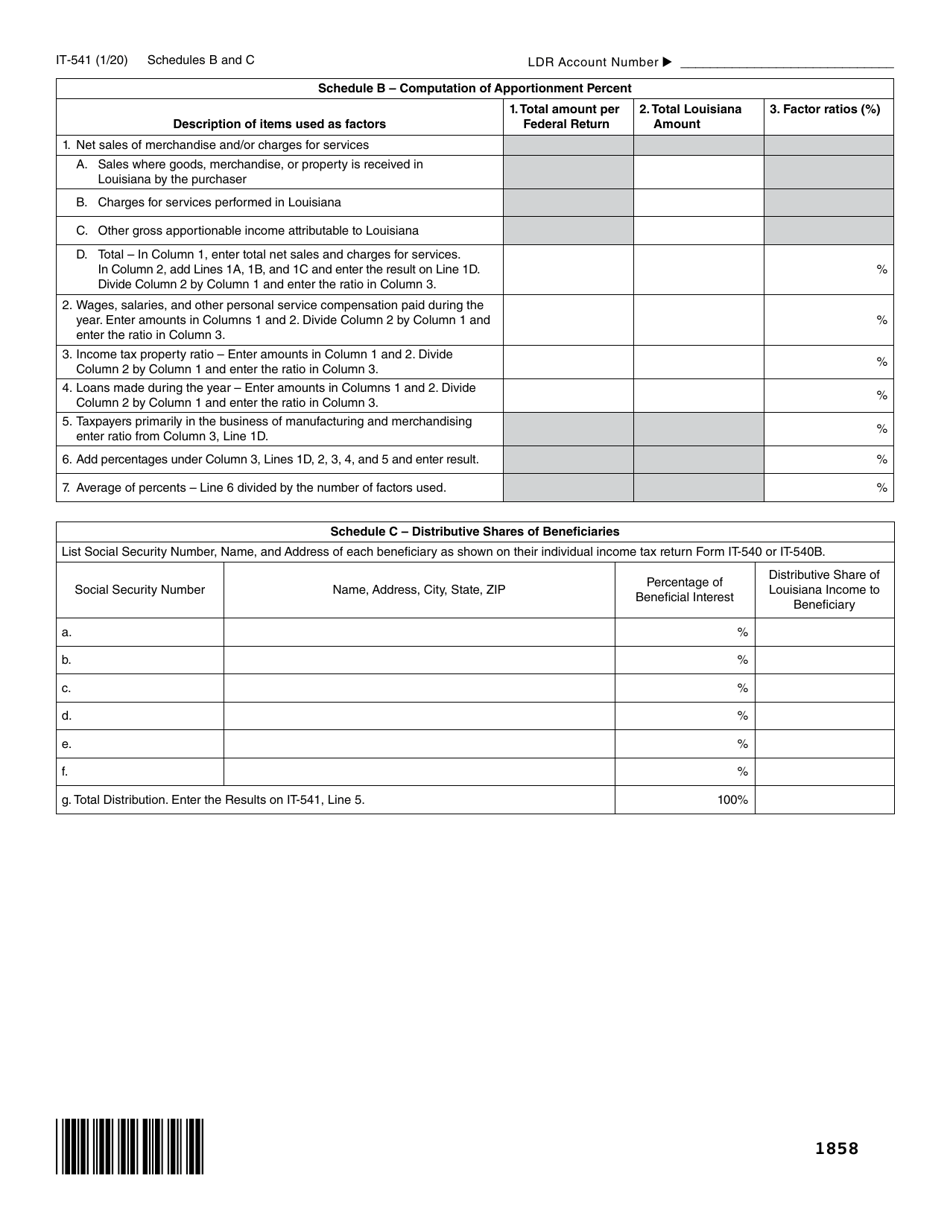

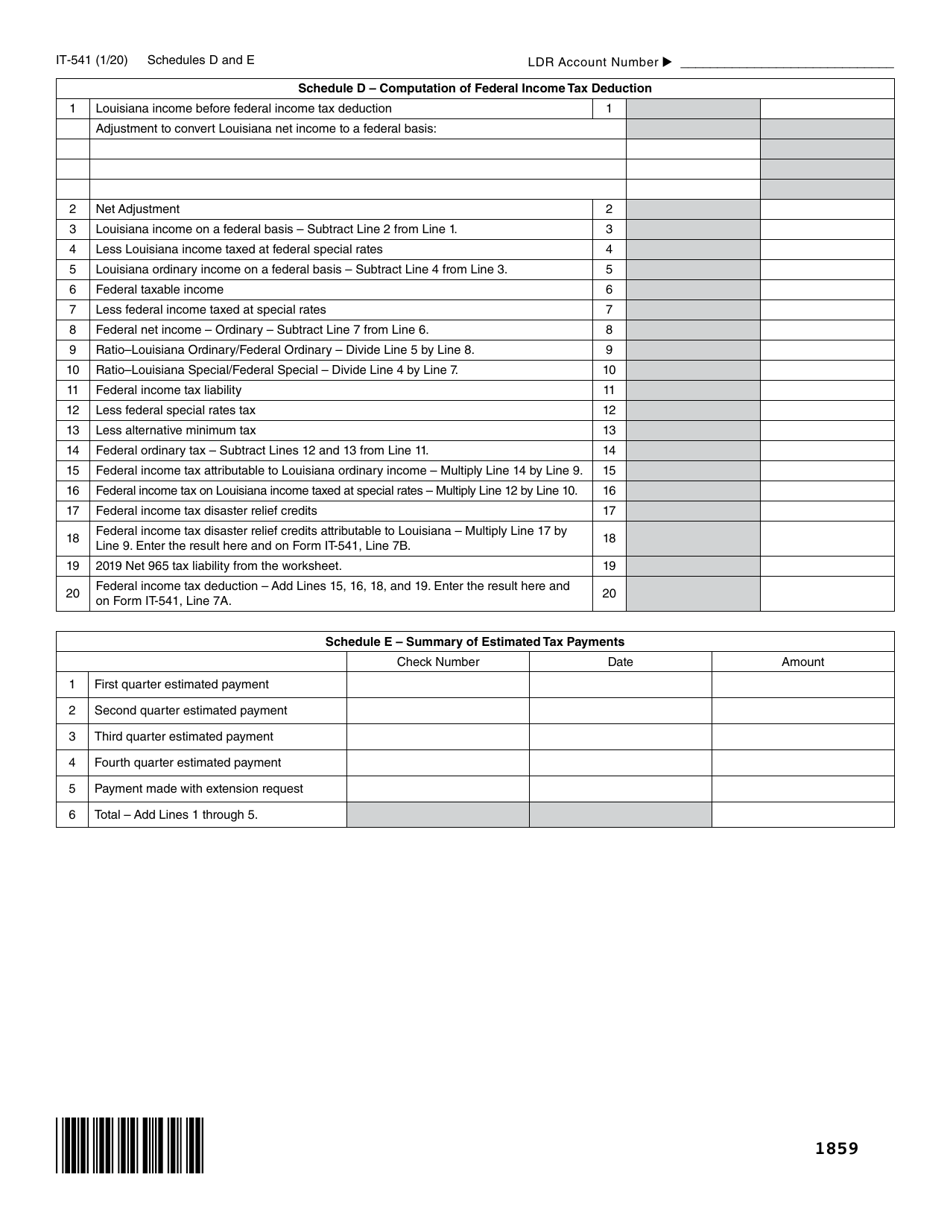

Form IT-541 Fiduciary Income Tax Return - Louisiana

What Is Form IT-541?

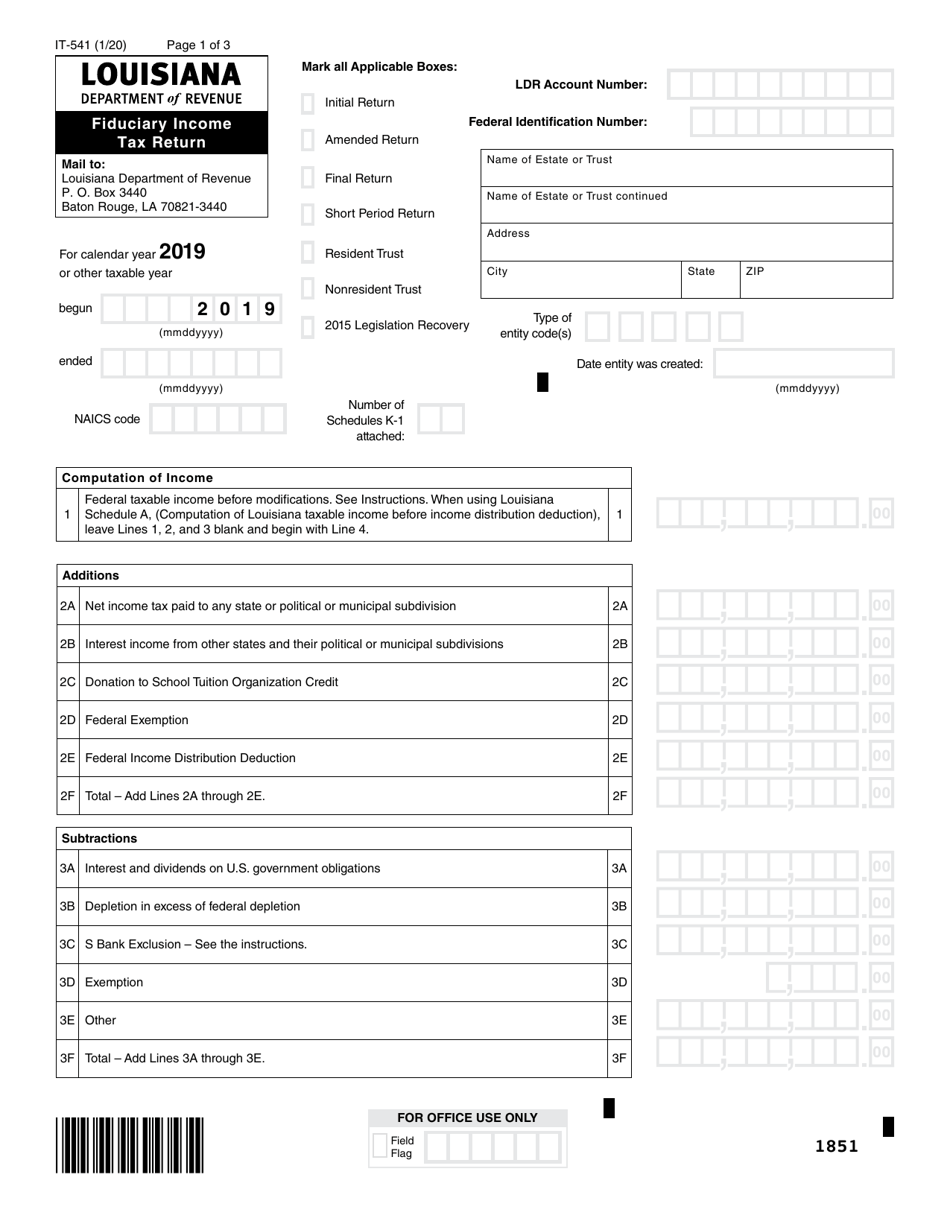

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-541?

A: Form IT-541 is the Fiduciary Income Tax Return for the state of Louisiana.

Q: Who needs to file Form IT-541?

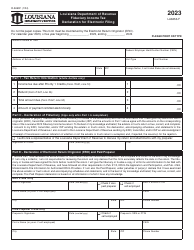

A: Any fiduciary, such as an executor or administrator of an estate, or a trustee of a trust, who has income that is taxable in Louisiana must file Form IT-541.

Q: What is the purpose of Form IT-541?

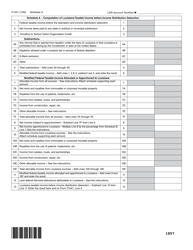

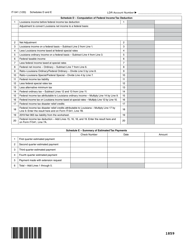

A: The purpose of Form IT-541 is to report the income, deductions, and tax liability of a fiduciary in Louisiana.

Q: When is Form IT-541 due?

A: For calendar year filers, Form IT-541 is due on or before May 15th of the following year.

Q: Are there any extensions available for filing Form IT-541?

A: Yes, an automatic extension of six months is granted if the fiduciary files Form R-6477 (Application for Extension of Time to File a Return) by the original due date of Form IT-541.

Q: What are the penalties for late filing or failure to file Form IT-541?

A: The penalties for late filing or failure to file Form IT-541 can include interest charges and penalties on the unpaid tax amount.

Q: Are there any specific instructions for completing Form IT-541?

A: Yes, the Louisiana Department of Revenue provides detailed instructions along with the form. It is important to carefully read and follow these instructions when completing Form IT-541.

Q: What supporting documents should I include with Form IT-541?

A: Supporting documents may include federal tax returns, Schedule K-1s, and other relevant financial statements or documents that are necessary to accurately report the income and deductions of the fiduciary.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-541 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.