This version of the form is not currently in use and is provided for reference only. Download this version of

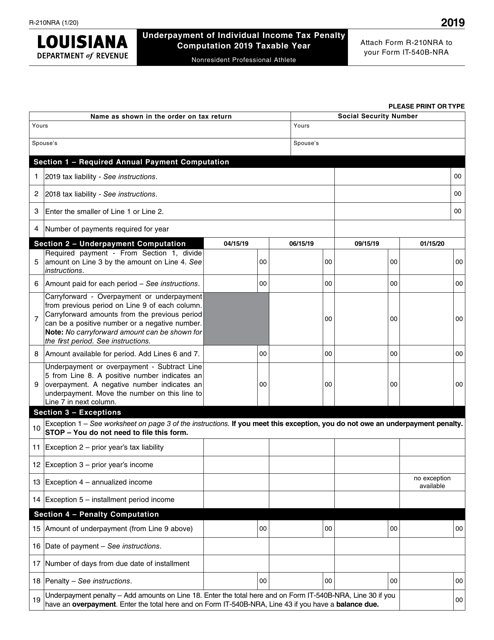

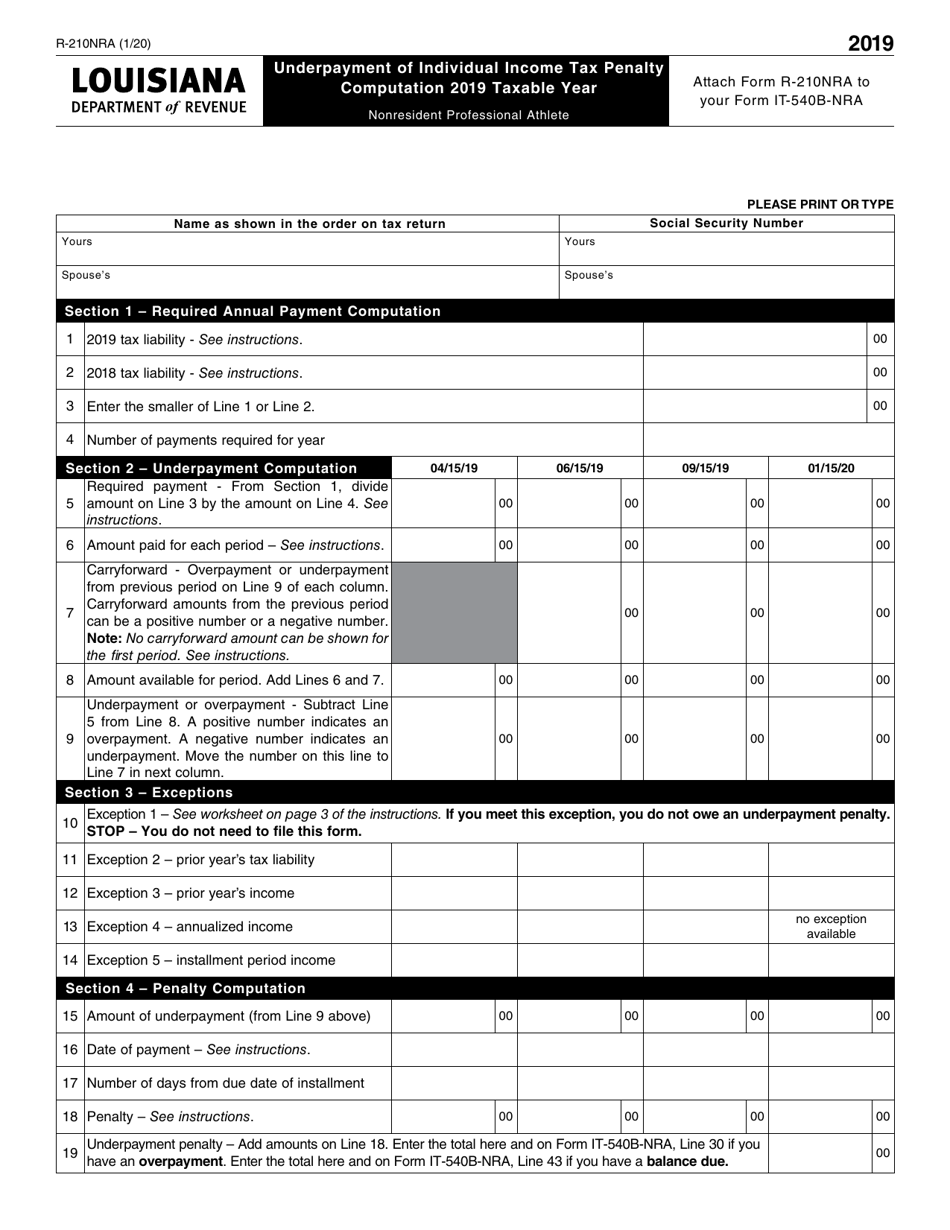

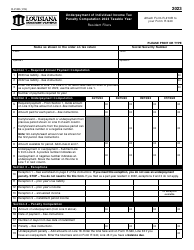

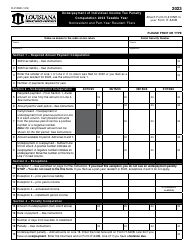

Form R-210NRA

for the current year.

Form R-210NRA Nonresident Professional Athlete Underpayment Penalty Computation Worksheet - Louisiana

What Is Form R-210NRA?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-210NRA?

A: Form R-210NRA is a underpayment penaltycomputation worksheet specific to nonresident professional athletes in Louisiana.

Q: Who needs to use Form R-210NRA?

A: Nonresident professional athletes in Louisiana need to use Form R-210NRA.

Q: What is the purpose of Form R-210NRA?

A: The purpose of Form R-210NRA is to compute the underpayment penalty for nonresident professional athletes in Louisiana.

Q: Is Form R-210NRA only applicable for professional athletes?

A: Yes, Form R-210NRA is specifically for nonresident professional athletes in Louisiana.

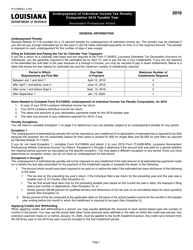

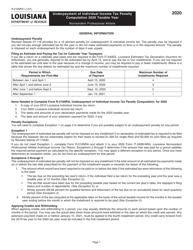

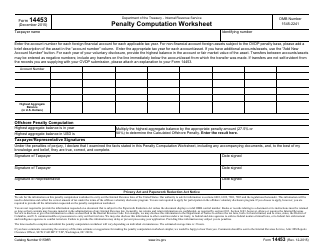

Q: What is the penalty for underpayment of taxes for nonresident professional athletes in Louisiana?

A: The penalty for underpayment of taxes for nonresident professional athletes in Louisiana can be computed using Form R-210NRA.

Q: Are there any specific requirements for completing Form R-210NRA?

A: Yes, Form R-210NRA requires specific information related to income, estimated tax payments, and other tax liabilities for nonresident professional athletes in Louisiana.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-210NRA by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.