This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

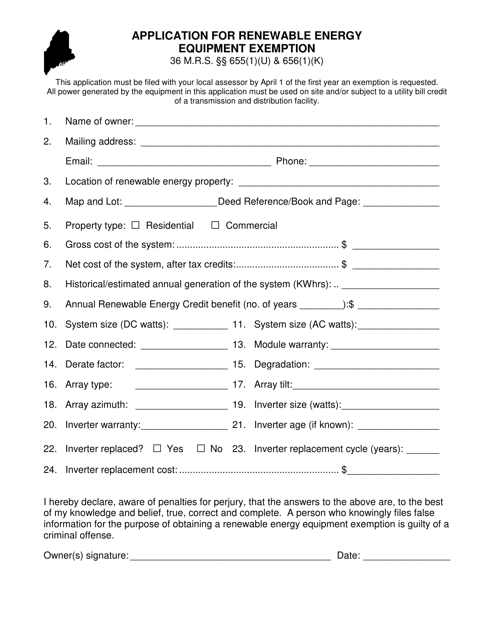

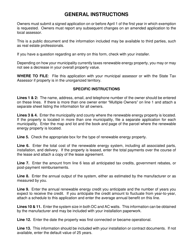

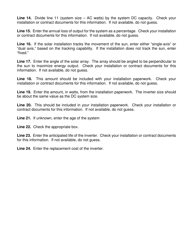

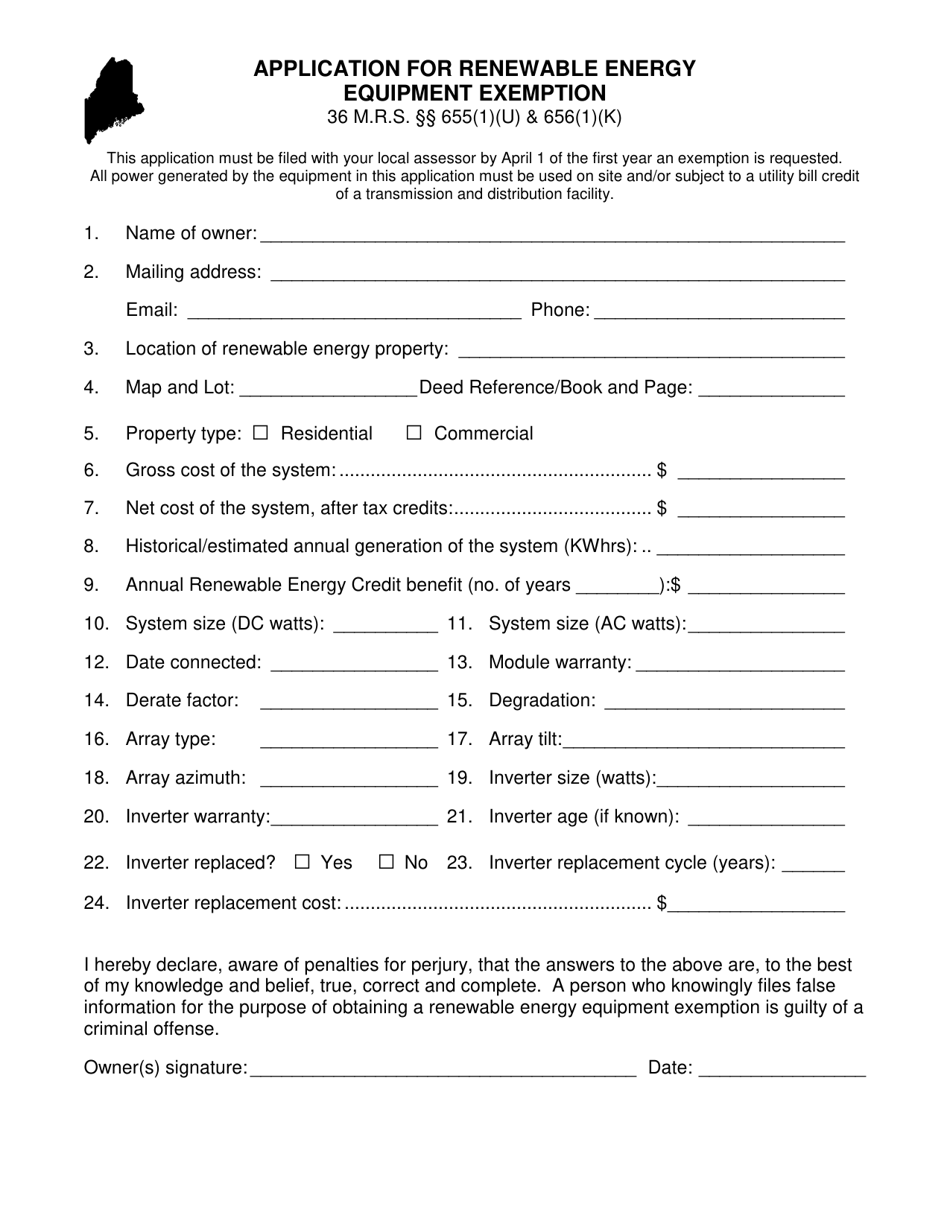

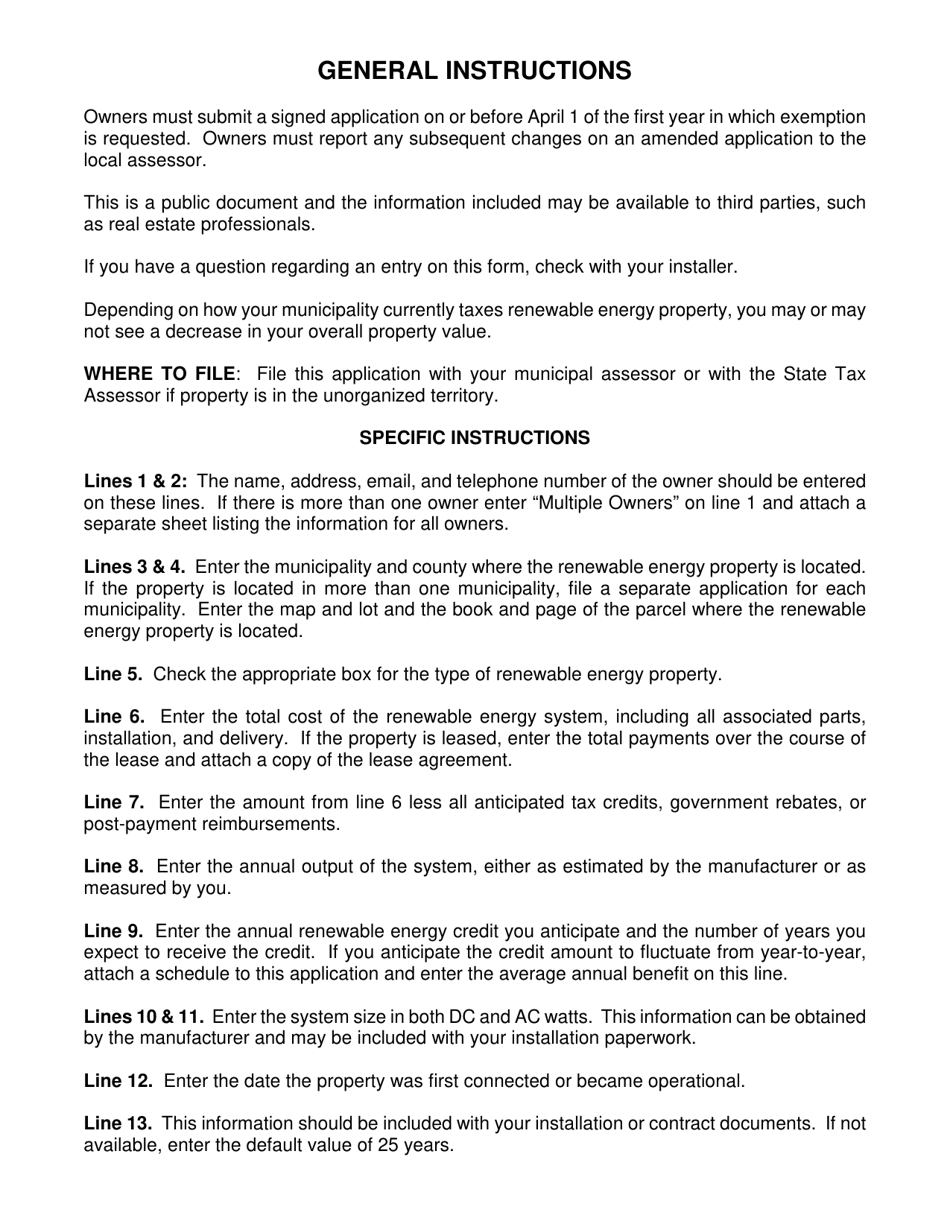

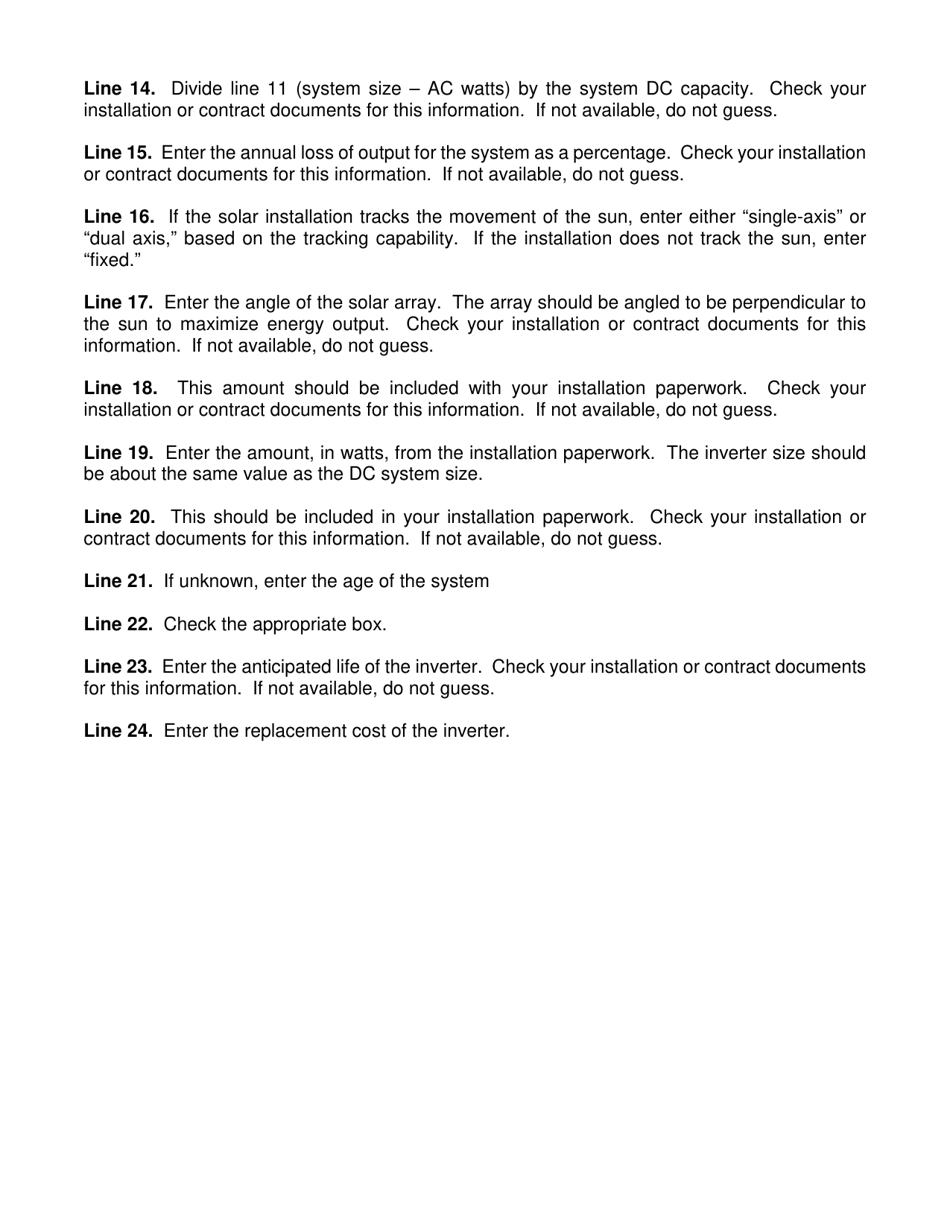

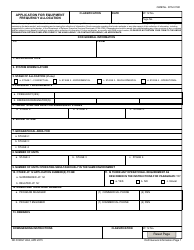

Application for Renewable Energy Equipment Exemption - Maine

Application for Renewable Energy Equipment Exemption is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is the Renewable Energy Equipment Exemption in Maine?

A: The Renewable Energy Equipment Exemption in Maine is a program that provides exemption from property taxes for renewable energy equipment installed on residential or commercial properties.

Q: Who is eligible for the Renewable Energy Equipment Exemption?

A: Both residential and commercial property owners who have installed eligible renewable energy equipment in Maine are eligible for this exemption.

Q: What types of renewable energy equipment are eligible for the exemption?

A: Solar panels, wind turbines, geothermal heat pumps, and solar water heaters are some examples of eligible renewable energy equipment.

Q: How can I apply for the Renewable Energy Equipment Exemption?

A: You can apply for the exemption by submitting an Application for Renewable Energy Equipment Exemption to your local assessor's office.

Q: What are the benefits of the Renewable Energy Equipment Exemption?

A: The exemption allows you to reduce your property taxes by exempting the value of the eligible renewable energy equipment from assessment.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.