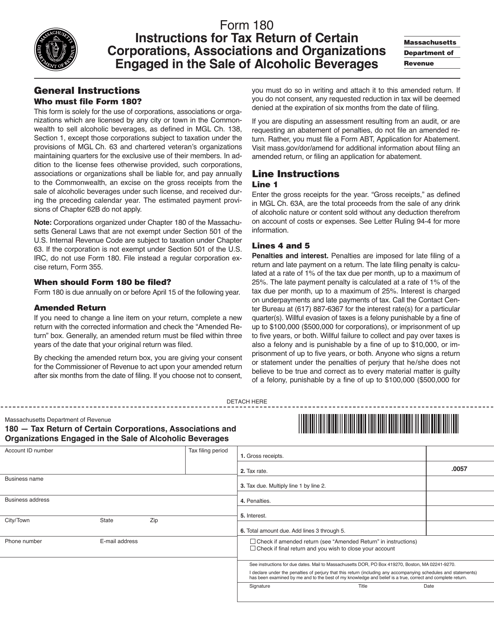

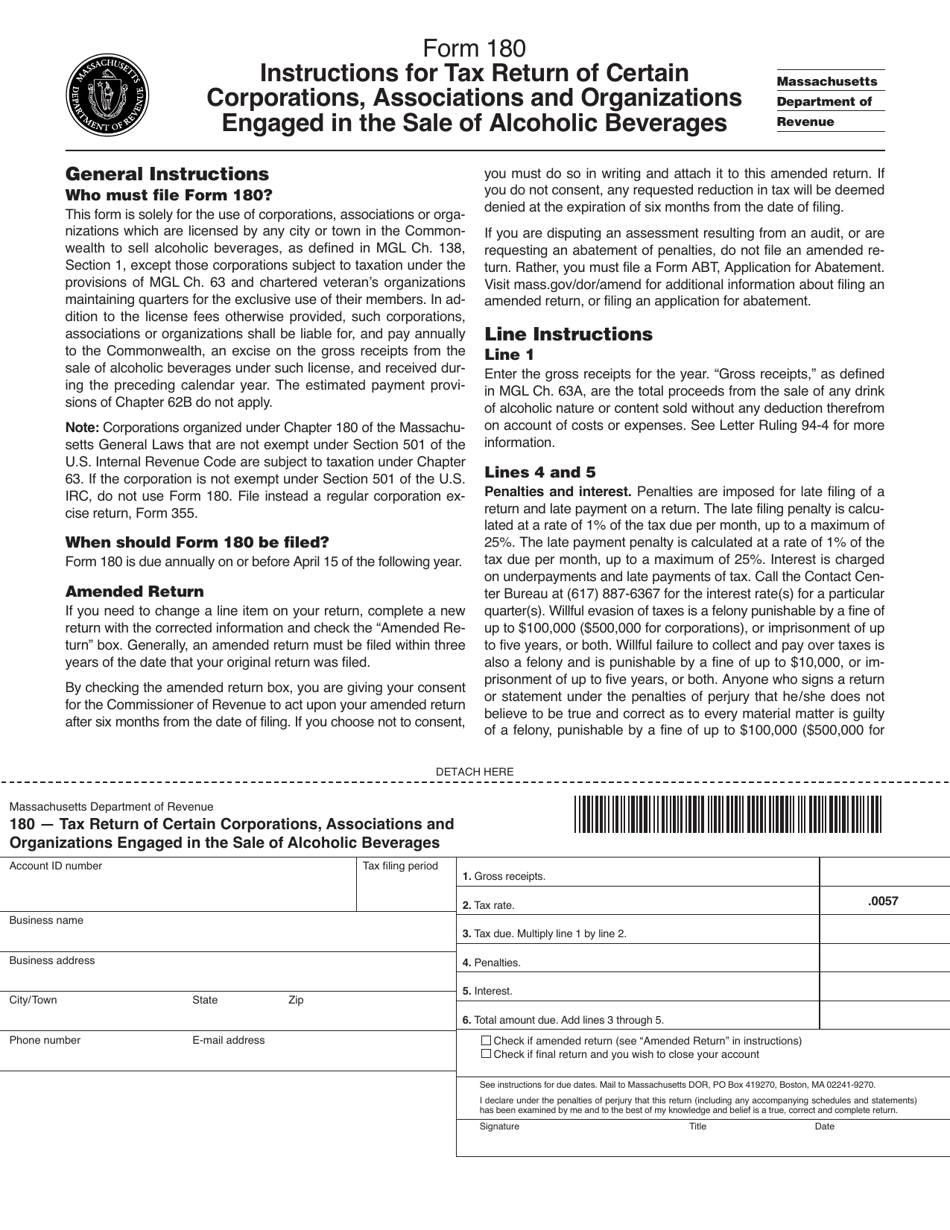

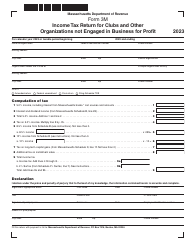

Form 180 Tax Return of Certain Corporations, Associations and Organizations Engaged in the Sale of Alcoholic Beverages - Massachusetts

What Is Form 180?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 180?

A: Form 180 is a tax return form.

Q: Who needs to file Form 180?

A: Corporations, associations, and organizations engaged in the sale of alcoholic beverages in Massachusetts need to file Form 180.

Q: What is the purpose of Form 180?

A: The purpose of Form 180 is to report and pay taxes on the sale of alcoholic beverages in Massachusetts.

Q: When is Form 180 due?

A: Form 180 is due on the 20th day of the month following the end of each calendar quarter.

Q: Are extensions available for filing Form 180?

A: No, extensions are not available for filing Form 180.

Q: What are the consequences of not filing Form 180?

A: Failure to file Form 180 may result in penalties and interest charges.

Q: Are there any exemptions or deductions available?

A: Yes, there are certain exemptions and deductions available. It is advisable to consult the instructions of Form 180 for more information.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

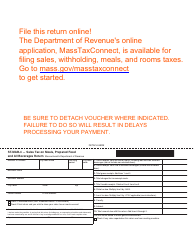

- Fill out the form in our online filing application.

Download a printable version of Form 180 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.