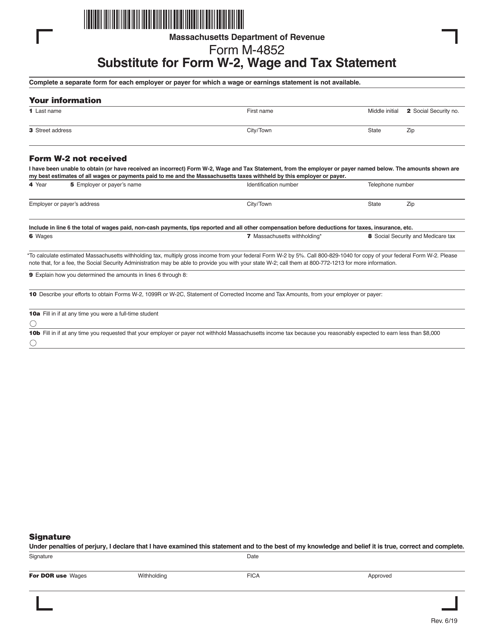

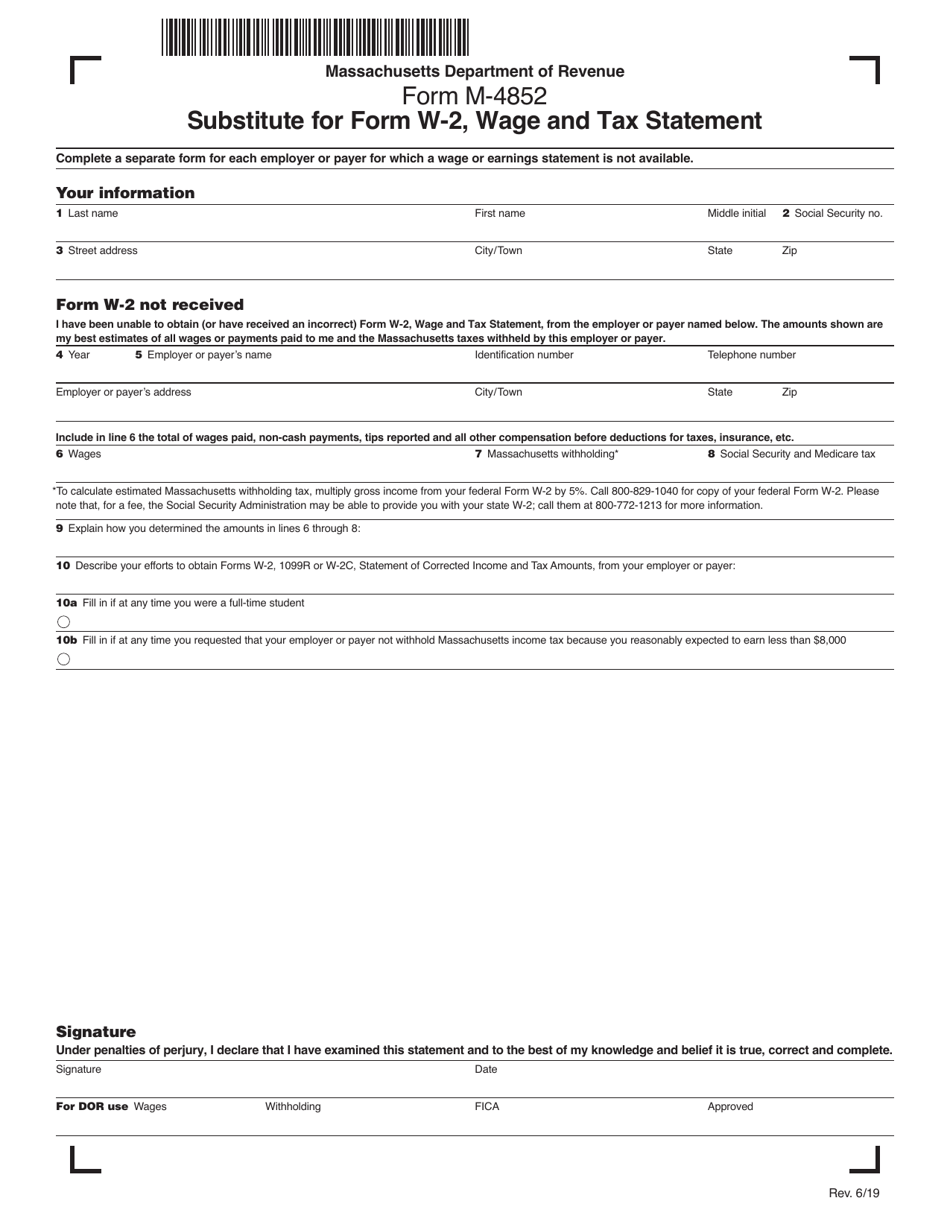

Form M-4852 Substitute for Form W-2, Wage and Tax Statement - Massachusetts

What Is Form M-4852?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-4852?

A: Form M-4852 is a substitute for Form W-2, Wage and Tax Statement specifically for Massachusetts.

Q: When is Form M-4852 used?

A: Form M-4852 is used when an individual does not receive their Form W-2 from their employer.

Q: How do I fill out Form M-4852?

A: You need to provide your personal information, including your name, address, and social security number, as well as details about your wages and taxes withheld.

Q: Why would I need to use Form M-4852?

A: You may need to use Form M-4852 if you have not received your Form W-2 from your employer and need to file your taxes.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-4852 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.