This version of the form is not currently in use and is provided for reference only. Download this version of

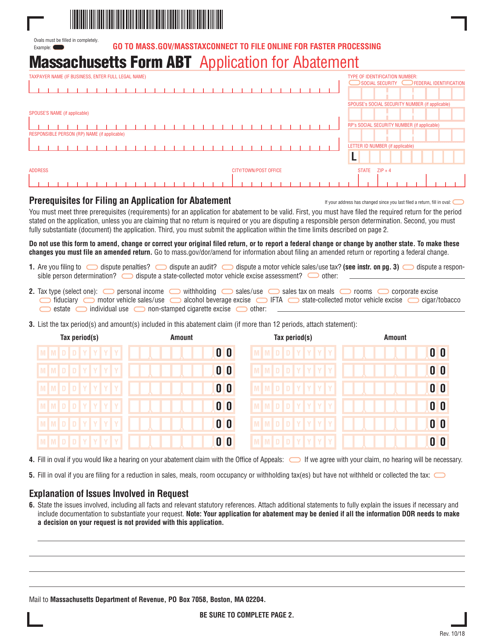

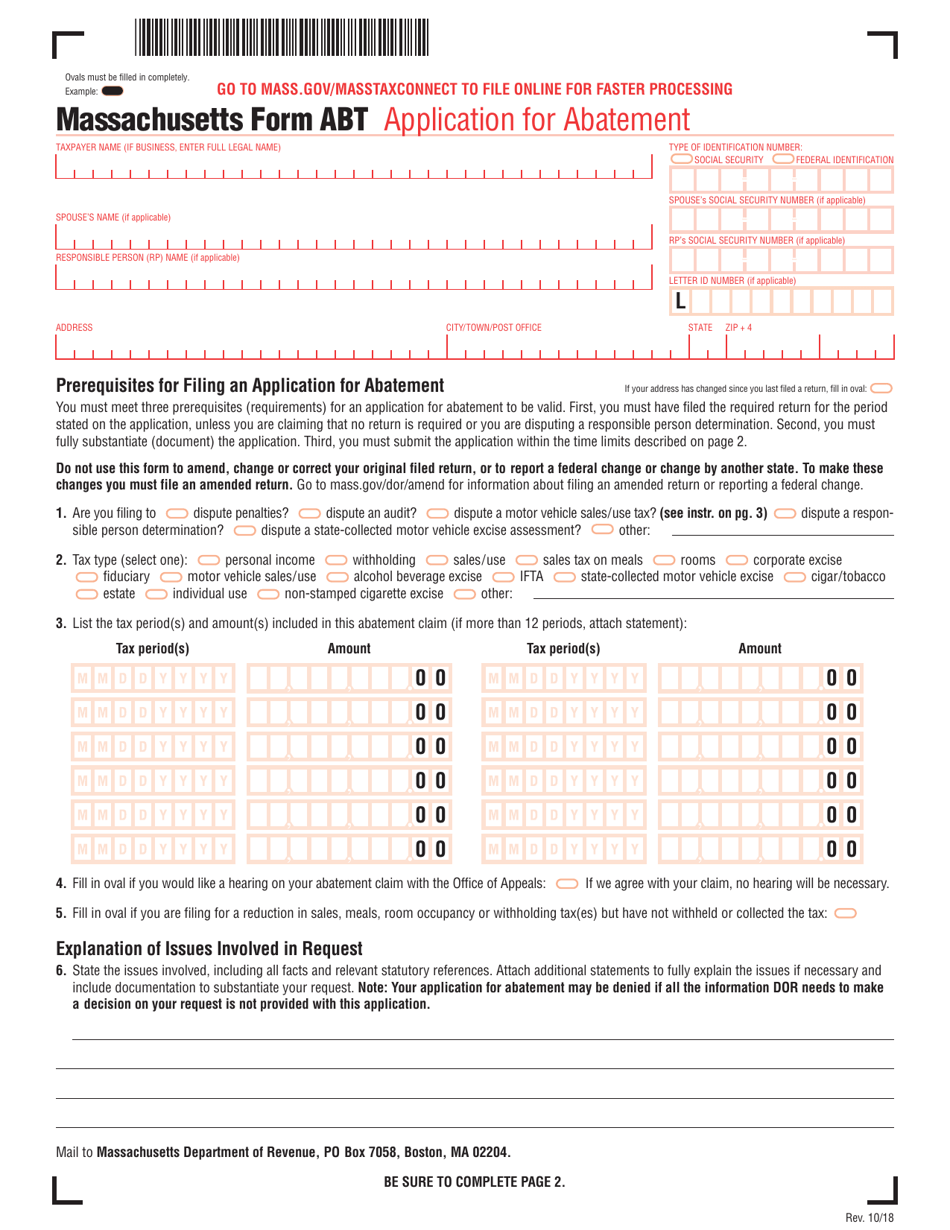

Form ABT

for the current year.

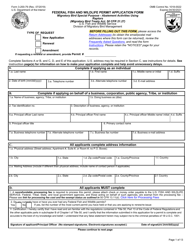

Form ABT Application for Abatement - Massachusetts

What Is Form ABT?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an ABT application for abatement?

A: An ABT application for abatement is a form used in Massachusetts to request a reduction or elimination of a tax assessment.

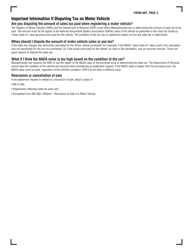

Q: What can I use an ABT application for abatement for?

A: You can use an ABT application for abatement to request a reduction or elimination of various types of taxes, including property taxes and personal income taxes.

Q: What information do I need to provide on an ABT application for abatement?

A: You will typically need to provide information about your property or tax assessment, supporting documentation, and a statement explaining why you believe an abatement is warranted.

Q: What is the deadline for submitting an ABT application for abatement?

A: The deadline for submitting an ABT application for abatement varies depending on the type of tax you are seeking an abatement for and the specific deadlines set by the Massachusetts Department of Revenue.

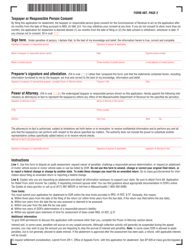

Q: What happens after I submit an ABT application for abatement?

A: After you submit an ABT application for abatement, it will be reviewed by the appropriate tax authority. They will evaluate the information provided and make a determination on whether to grant or deny the abatement.

Q: Can I appeal a denial of my ABT application for abatement?

A: Yes, if your ABT application for abatement is denied, you have the right to appeal the decision. The appeals process may vary depending on the specific tax and jurisdiction.

Q: Are there any fees associated with filing an ABT application for abatement?

A: There may be fees associated with filing an ABT application for abatement, such as an application fee or administrative fee. You should check the specific requirements and fee schedule provided by the Massachusetts Department of Revenue.

Q: What should I do if I need help with my ABT application for abatement?

A: If you need help with your ABT application for abatement, you can contact the Massachusetts Department of Revenue or seek assistance from a tax professional or attorney familiar with Massachusetts tax laws.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ABT by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.