This version of the form is not currently in use and is provided for reference only. Download this version of

Form 80-155

for the current year.

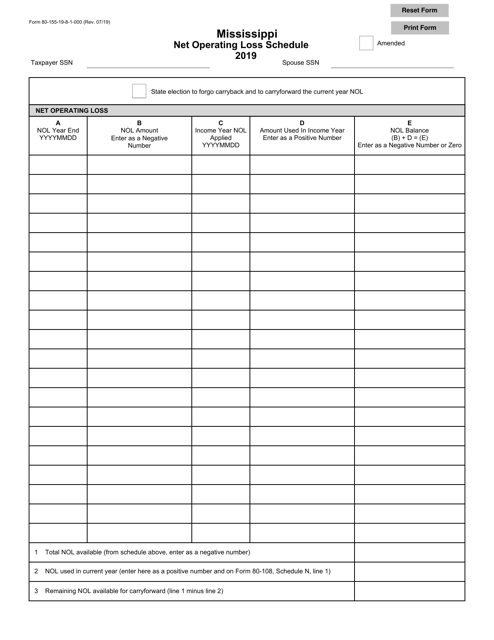

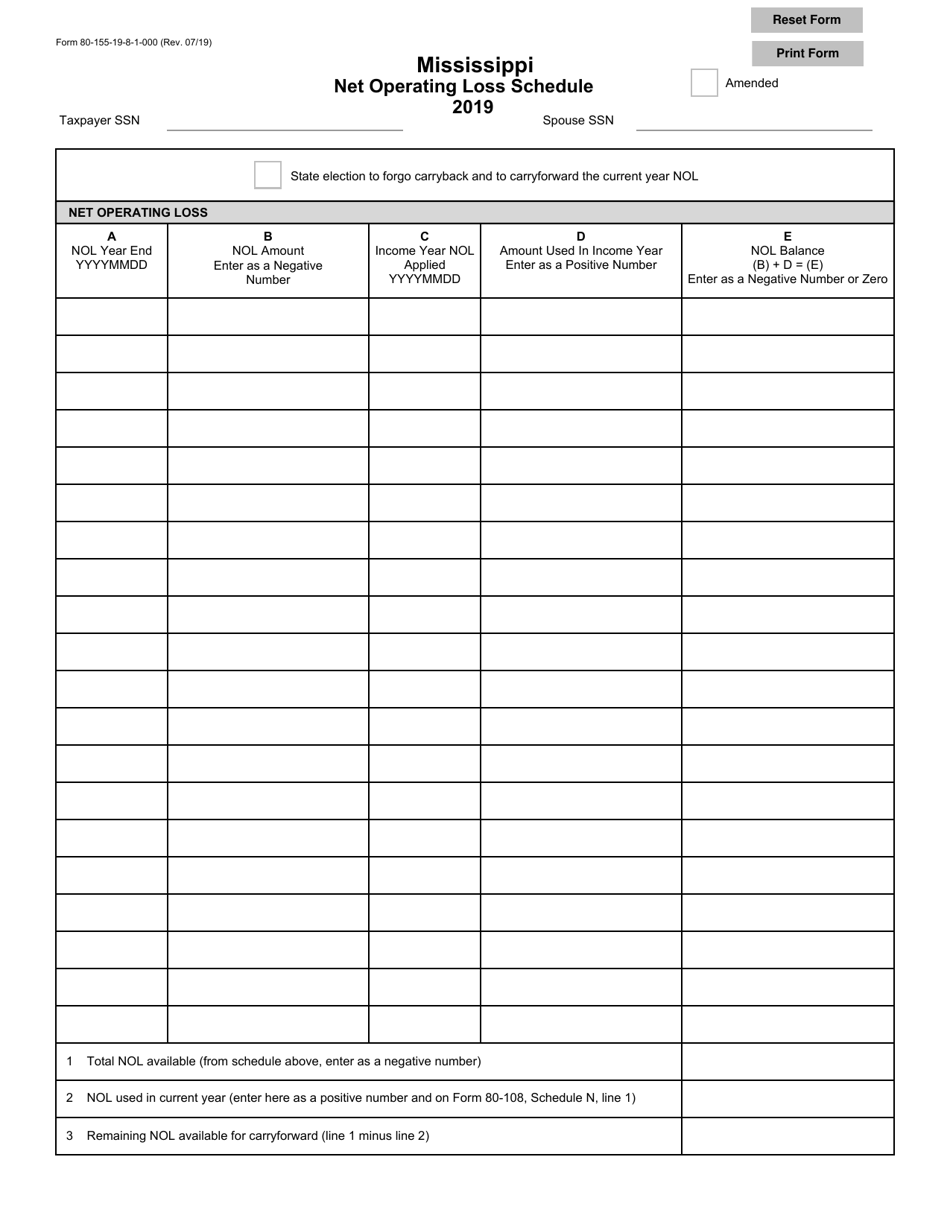

Form 80-155 Mississippi Net Operating Loss Schedule - Mississippi

What Is Form 80-155?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-155?

A: Form 80-155 is the Mississippi Net Operating Loss Schedule.

Q: What is a net operating loss?

A: A net operating loss occurs when a company's allowable deductions exceed its taxable income.

Q: Who needs to file Form 80-155?

A: Those who have a net operating loss in Mississippi need to file Form 80-155.

Q: What information do I need to complete Form 80-155?

A: You will need information about your net operating loss, including the amount and year it occurred.

Q: When is Form 80-155 due?

A: Form 80-155 is due on the same date as your Mississippi income tax return.

Q: Can I file Form 80-155 electronically?

A: Yes, you can file Form 80-155 electronically if you file your Mississippi income tax return electronically.

Q: What if I don't have a net operating loss in Mississippi?

A: If you don't have a net operating loss in Mississippi, you do not need to file Form 80-155.

Q: Is there a fee for filing Form 80-155?

A: There is no fee for filing Form 80-155.

Q: Can I amend my Form 80-155 if I made a mistake?

A: Yes, you can amend your Form 80-155 if you made a mistake. However, you must use Form 80-155X to do so.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-155 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.