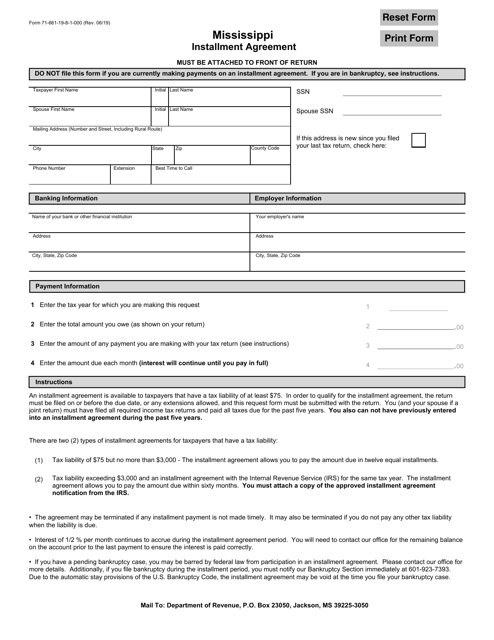

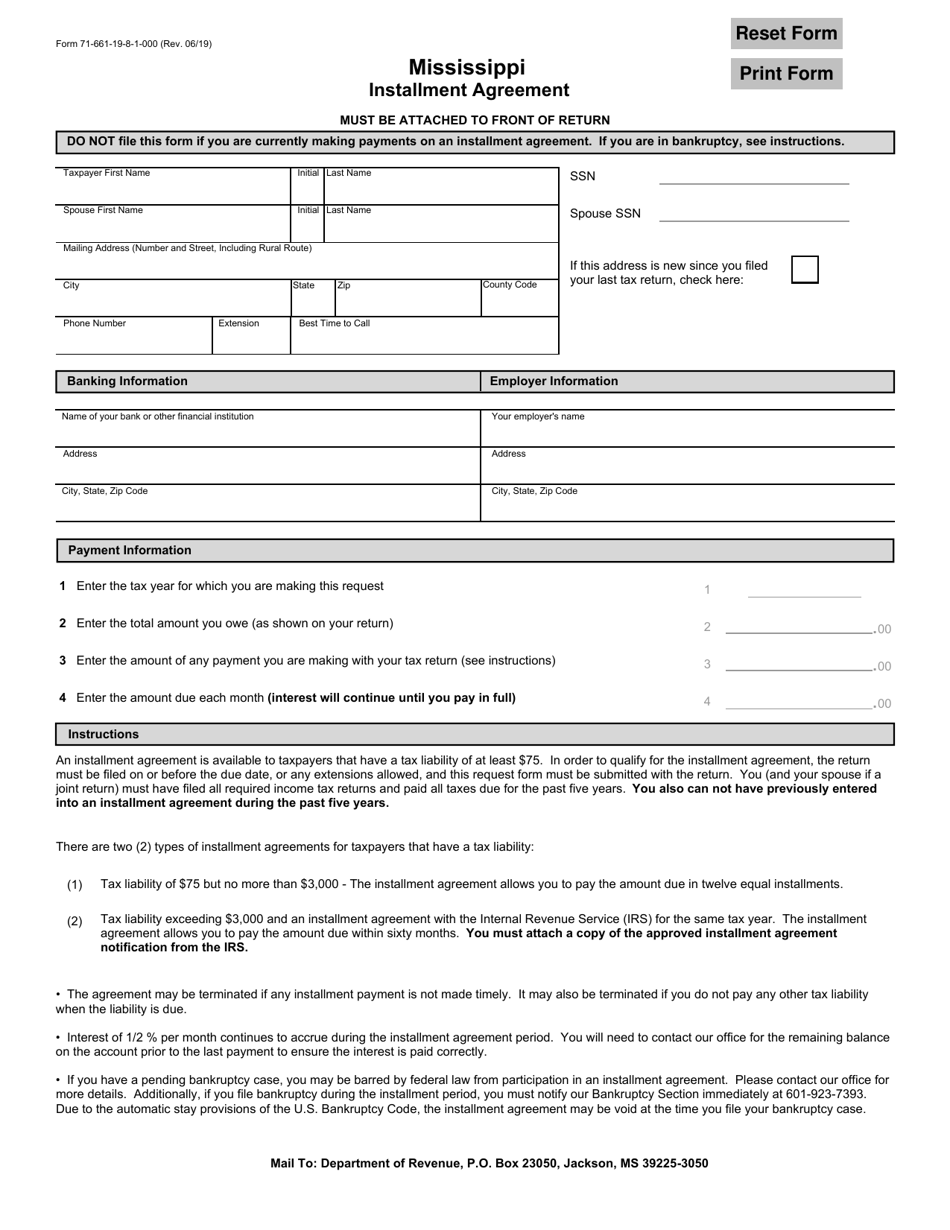

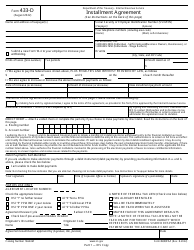

Form 71-661-19-8-1-000 Mississippi Installment Agreement - Mississippi

What Is Form 71-661-19-8-1-000?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 71-661-19-8-1-000?

A: Form 71-661-19-8-1-000 is the Mississippi Installment Agreement form.

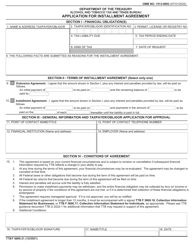

Q: What is the purpose of Form 71-661-19-8-1-000?

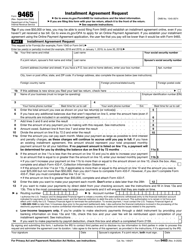

A: The purpose of Form 71-661-19-8-1-000 is to enter into an installment agreement with the state of Mississippi to pay off a tax debt.

Q: How do I fill out Form 71-661-19-8-1-000?

A: You need to provide your personal information, details of your tax debt, and propose an installment payment plan.

Q: Can I negotiate the terms of the installment agreement?

A: Yes, you can negotiate the terms of the installment agreement with the Mississippi Department of Revenue.

Q: What happens if I fail to make the installment payments?

A: If you fail to make the installment payments, the state may take collection actions against you, such as placing liens on your property or garnishing your wages.

Q: Is there a fee for setting up an installment agreement?

A: Yes, there may be a fee for setting up an installment agreement. You should check the instructions on Form 71-661-19-8-1-000 for details.

Q: Can I pay off my tax debt early?

A: Yes, you can pay off your tax debt early by making additional payments.

Q: Can I modify my installment agreement?

A: Yes, you can request modifications to your installment agreement if your financial situation changes.

Q: What if I can't afford the proposed installment payment?

A: If you can't afford the proposed installment payment, you can contact the Mississippi Department of Revenue to discuss alternative arrangements.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 71-661-19-8-1-000 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.