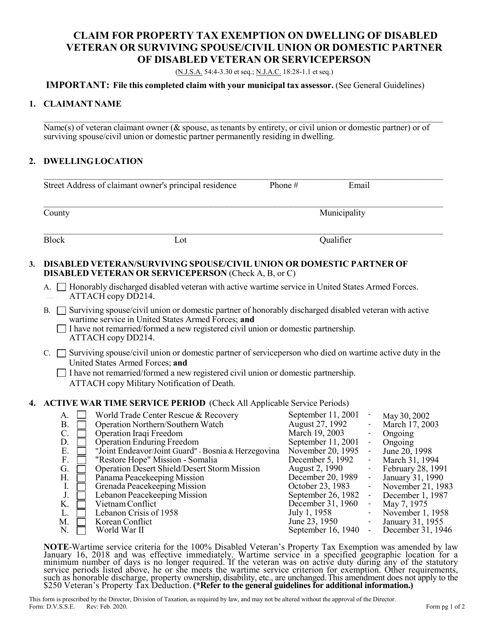

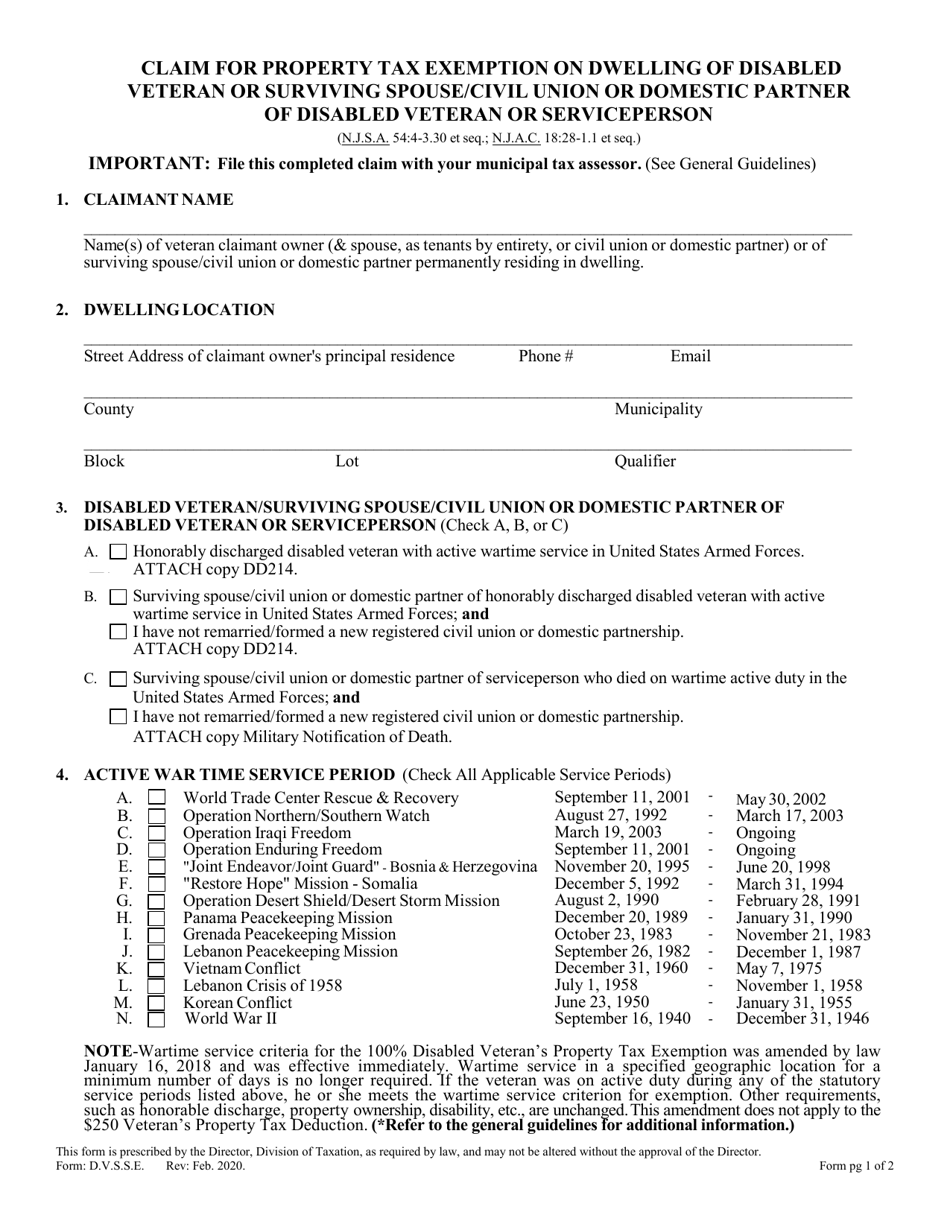

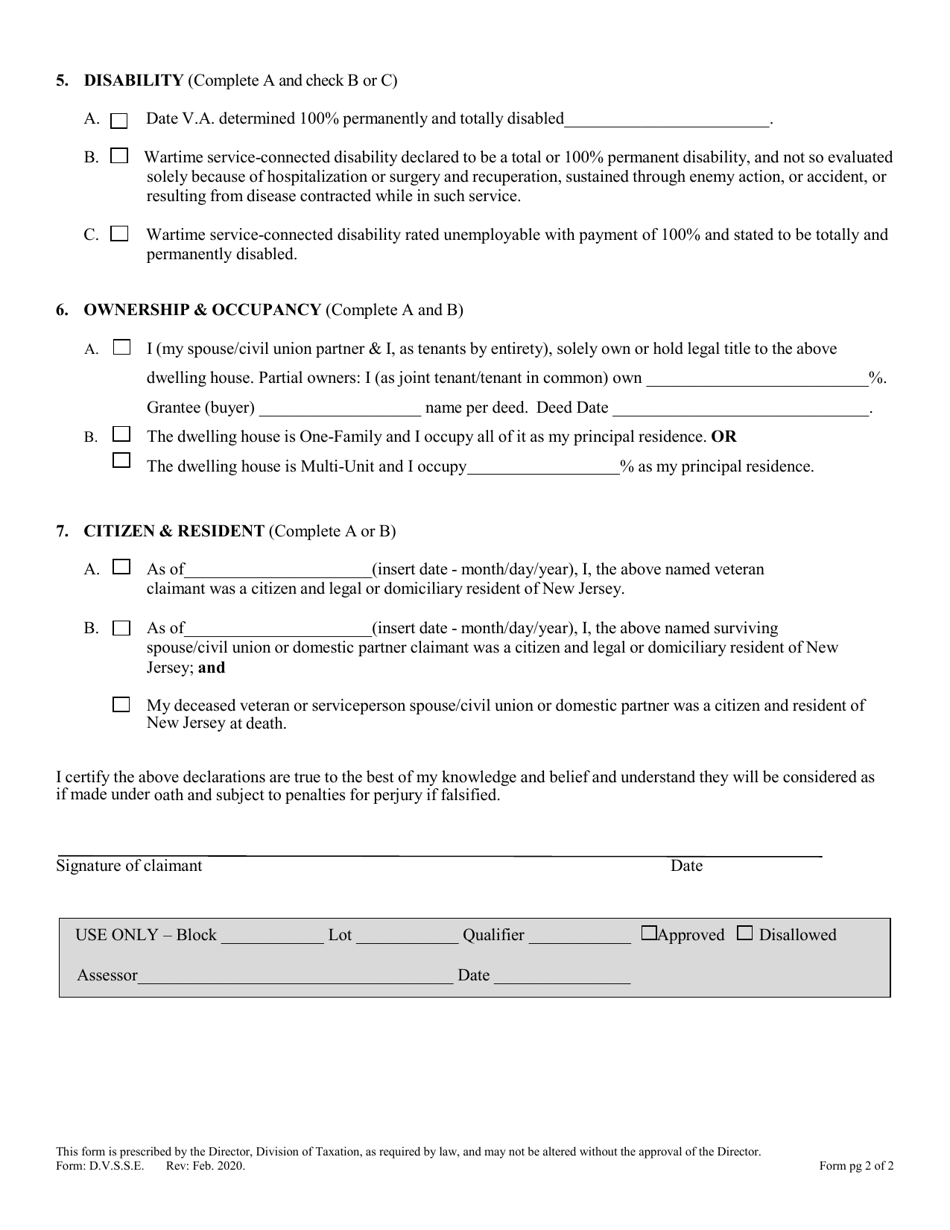

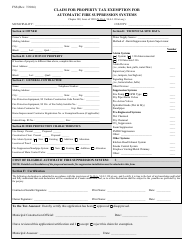

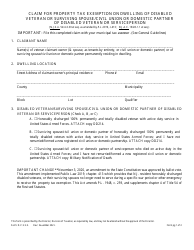

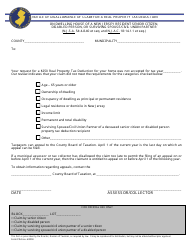

Claim for Property Tax Exemption on Dwelling of Disabled Veteran or Surviving Spouse / Civil Union or Domestic Partner of Disabled Veteran or Serviceperson - New Jersey

Claim for Property Tax Exemption on Dwelling of Disabled Veteran or Surviving Spouse/Civil Union or Domestic Partner of Disabled Veteran or Serviceperson is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

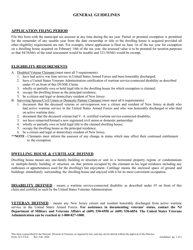

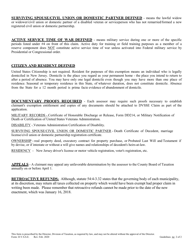

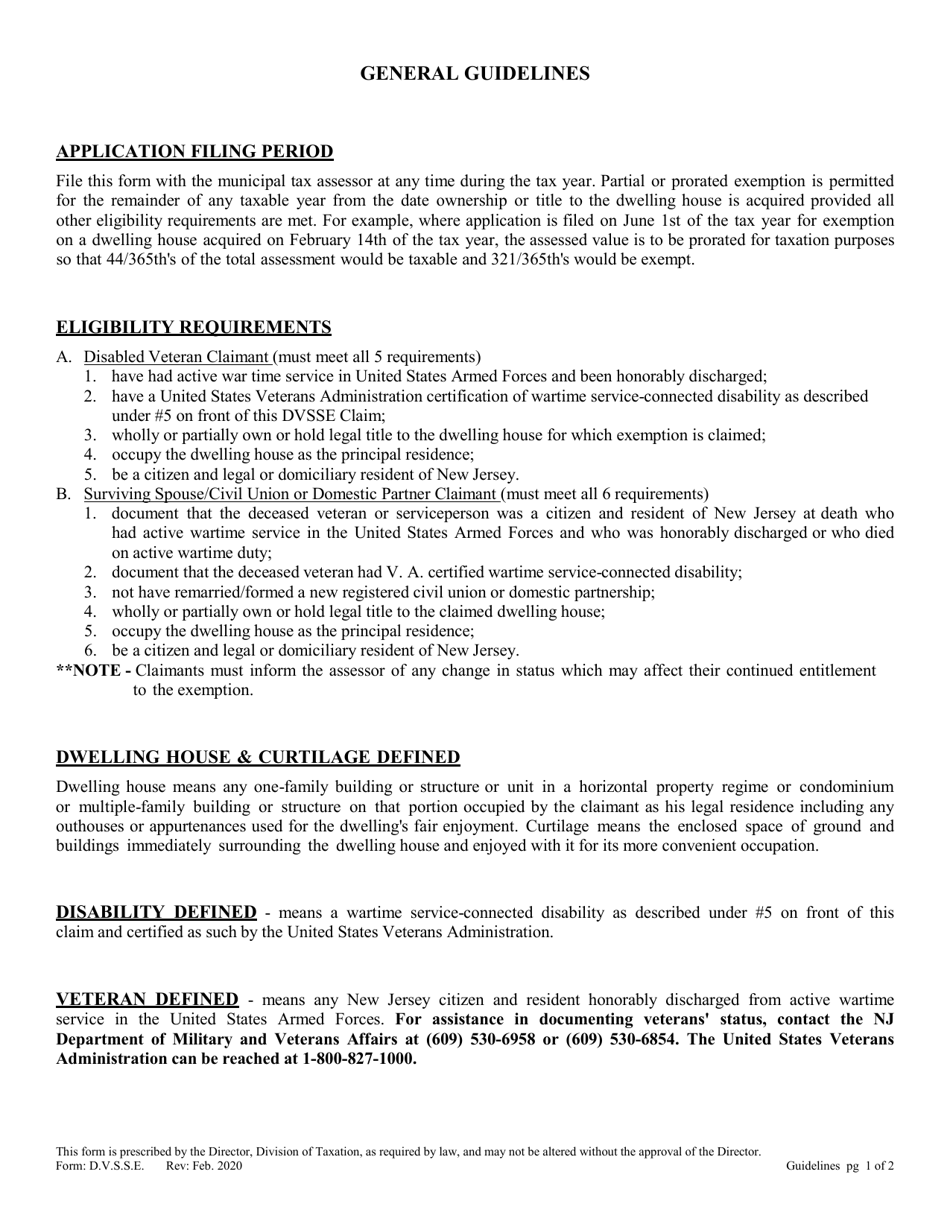

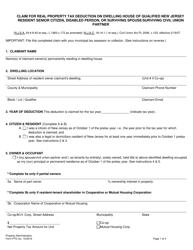

Q: Who is eligible for property tax exemption on dwelling in New Jersey?

A: Disabled veterans, surviving spouses/civil union or domestic partners of disabled veterans or servicepersons.

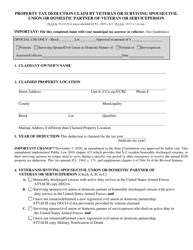

Q: What is the purpose of the property tax exemption?

A: To provide financial relief to disabled veterans and their families.

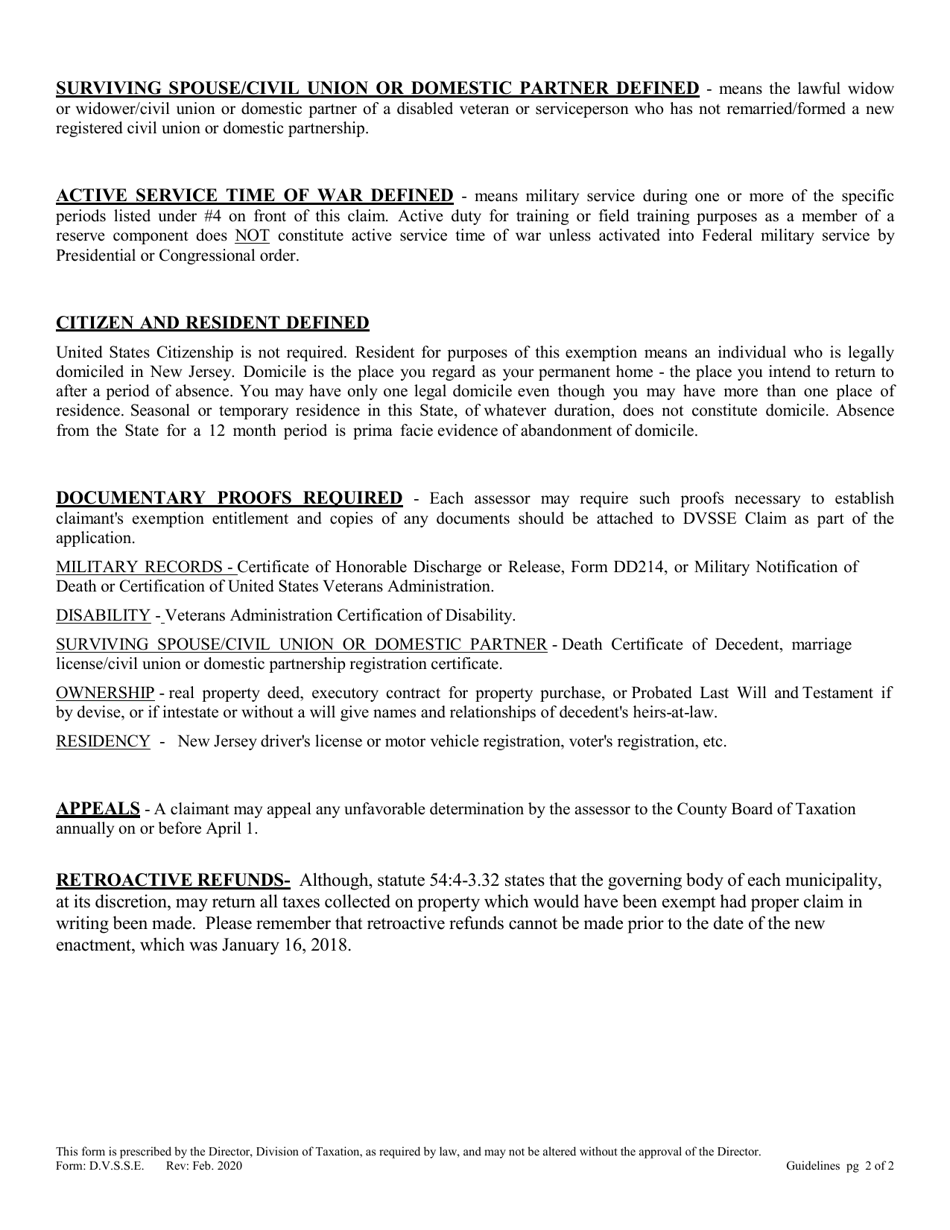

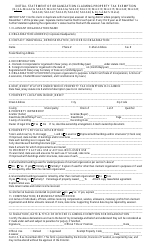

Q: What is required to claim the property tax exemption?

A: Submission of an application and supporting documentation.

Q: Do you need to reapply for the exemption each year?

A: No, the exemption continues as long as the eligibility criteria are met.

Q: How much is the property tax exemption?

A: The exemption amount varies based on the type of disability.

Form Details:

- Released on February 1, 2020;

- The latest edition currently provided by the New Jersey Department of the Treasury;

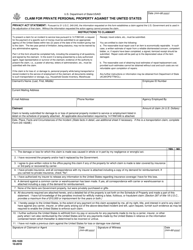

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.