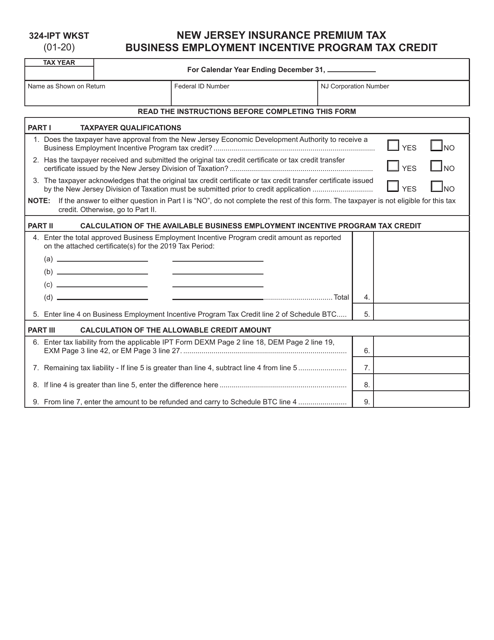

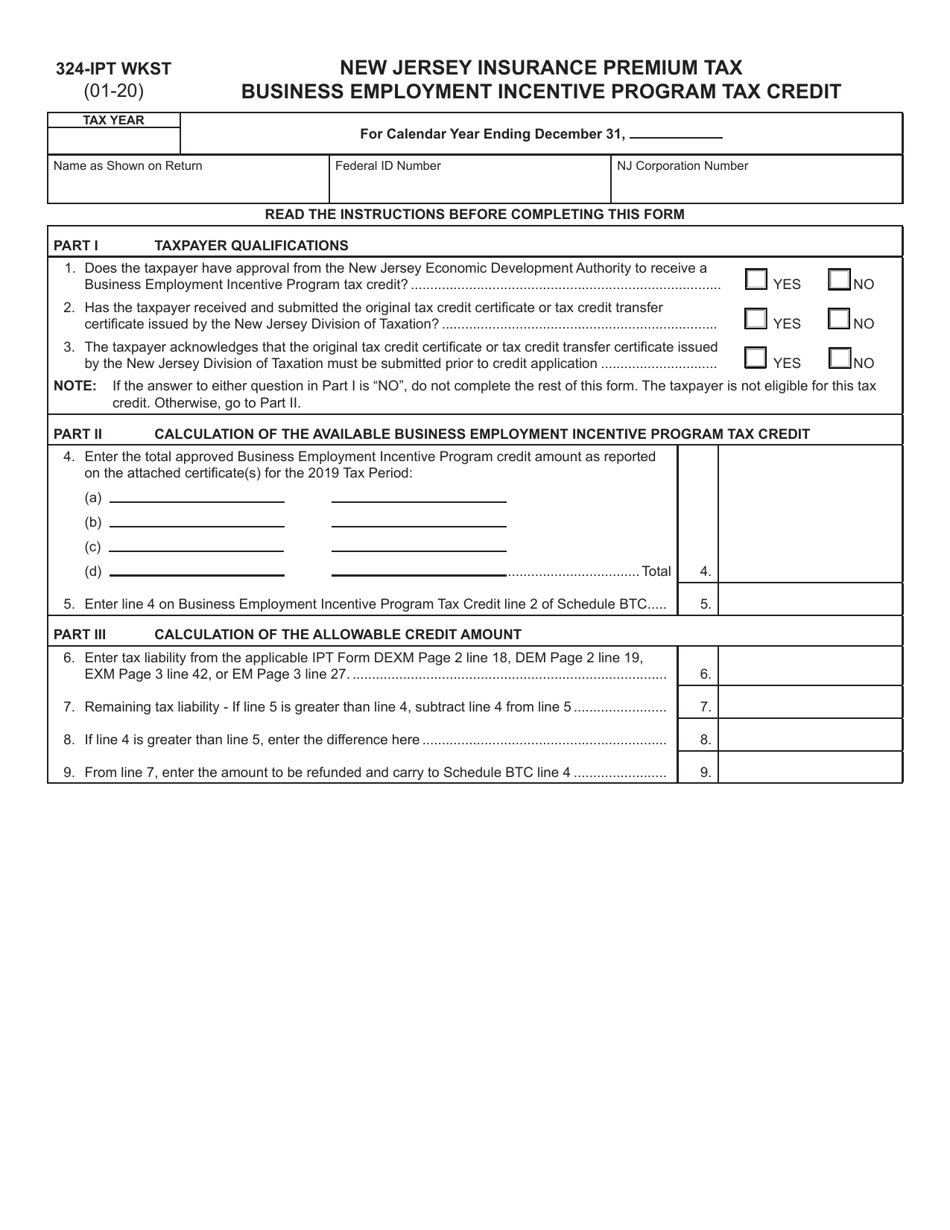

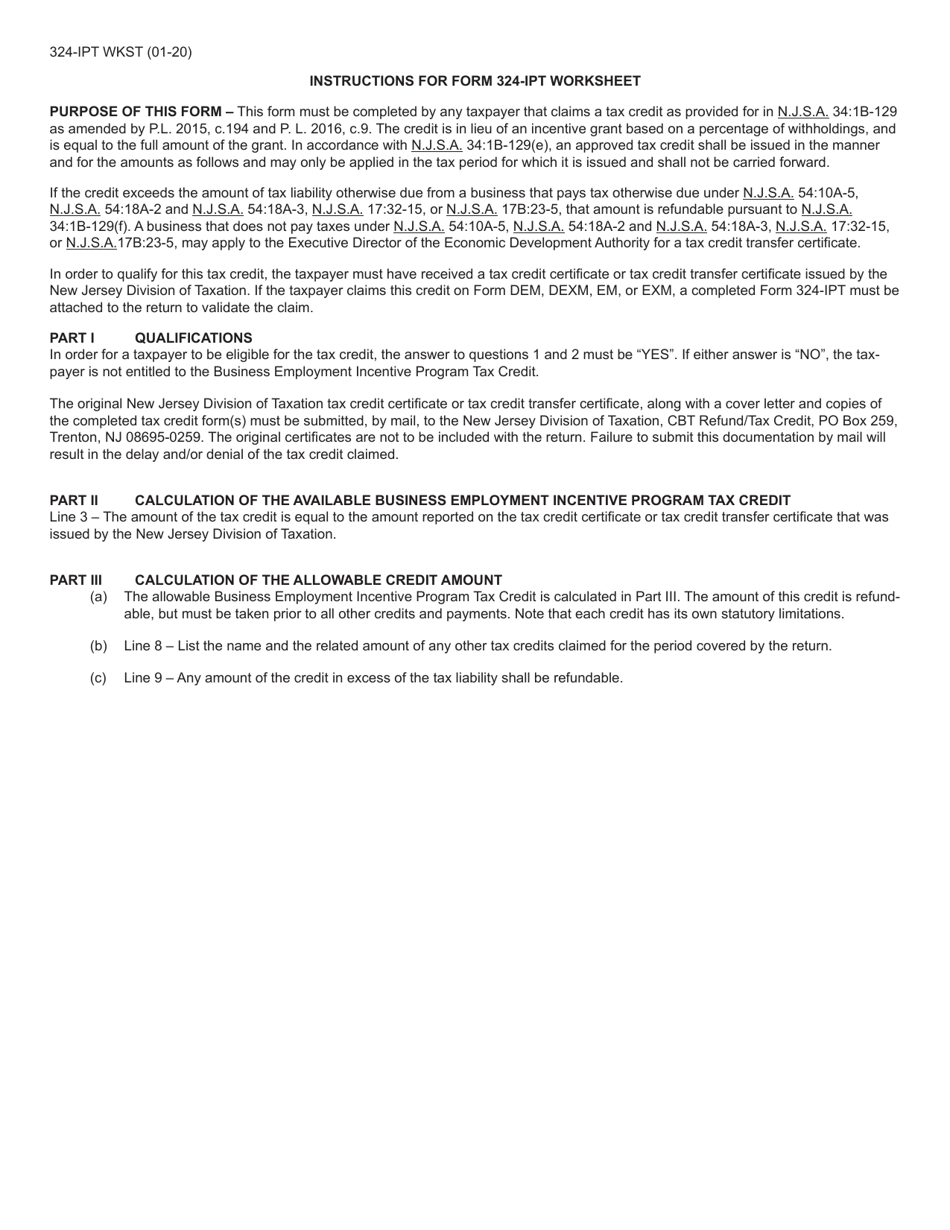

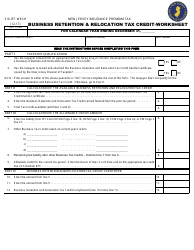

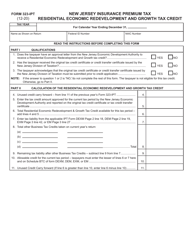

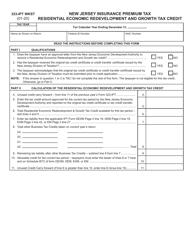

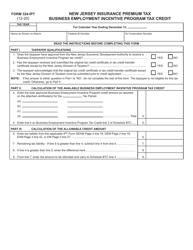

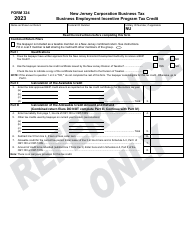

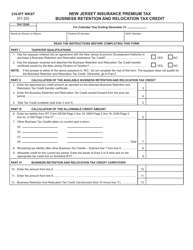

Form 324-IPT WKST Business Employment Incentive Program Tax Credit - New Jersey

What Is Form 324-IPT WKST?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 324-IPT WKST?

A: Form 324-IPT WKST is a tax form used in New Jersey for the Business Employment IncentiveProgram Tax Credit.

Q: What is the Business Employment Incentive Program?

A: The Business Employment Incentive Program (BEIP) is a program in New Jersey that provides tax incentives to businesses that create jobs and invest in the state.

Q: What is the purpose of Form 324-IPT WKST?

A: The purpose of Form 324-IPT WKST is to calculate and claim the Business Employment Incentive Program Tax Credit in New Jersey.

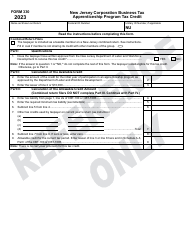

Q: Who is eligible for the Business Employment Incentive Program?

A: Most businesses in New Jersey are eligible for the Business Employment Incentive Program, including corporations, limited liability companies, partnerships, and sole proprietorships.

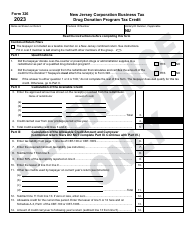

Q: What expenses can qualify for the Business Employment Incentive Program Tax Credit?

A: Expenses such as employee compensation, health benefits, pension contributions, and training expenses can qualify for the Business Employment Incentive Program Tax Credit.

Q: How is the Business Employment Incentive Program Tax Credit calculated?

A: The tax credit is calculated based on a percentage of eligible expenses paid by the business.

Q: Are there any deadlines for filing Form 324-IPT WKST?

A: Yes, the form must be filed within the prescribed time limits set by the New Jersey Division of Taxation.

Q: Can I claim the Business Employment Incentive Program Tax Credit if I have already claimed other tax incentives?

A: Yes, it is possible to claim the Business Employment Incentive Program Tax Credit along with other tax incentives, as long as the requirements for each program are met.

Q: Is there a limit on the amount of the Business Employment Incentive Program Tax Credit that can be claimed?

A: Yes, there is a cap on the amount of the tax credit that can be claimed, which is determined by the New Jersey Division of Taxation.

Q: What should I do if I have more questions about Form 324-IPT WKST and the Business Employment Incentive Program Tax Credit?

A: If you have more questions, you can contact the New Jersey Division of Taxation for assistance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 324-IPT WKST by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.