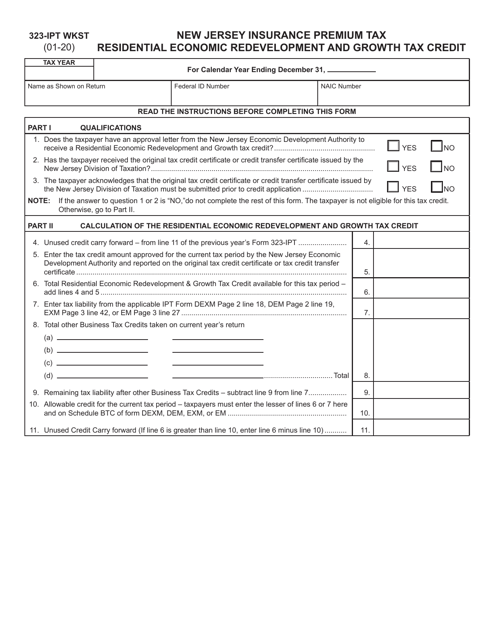

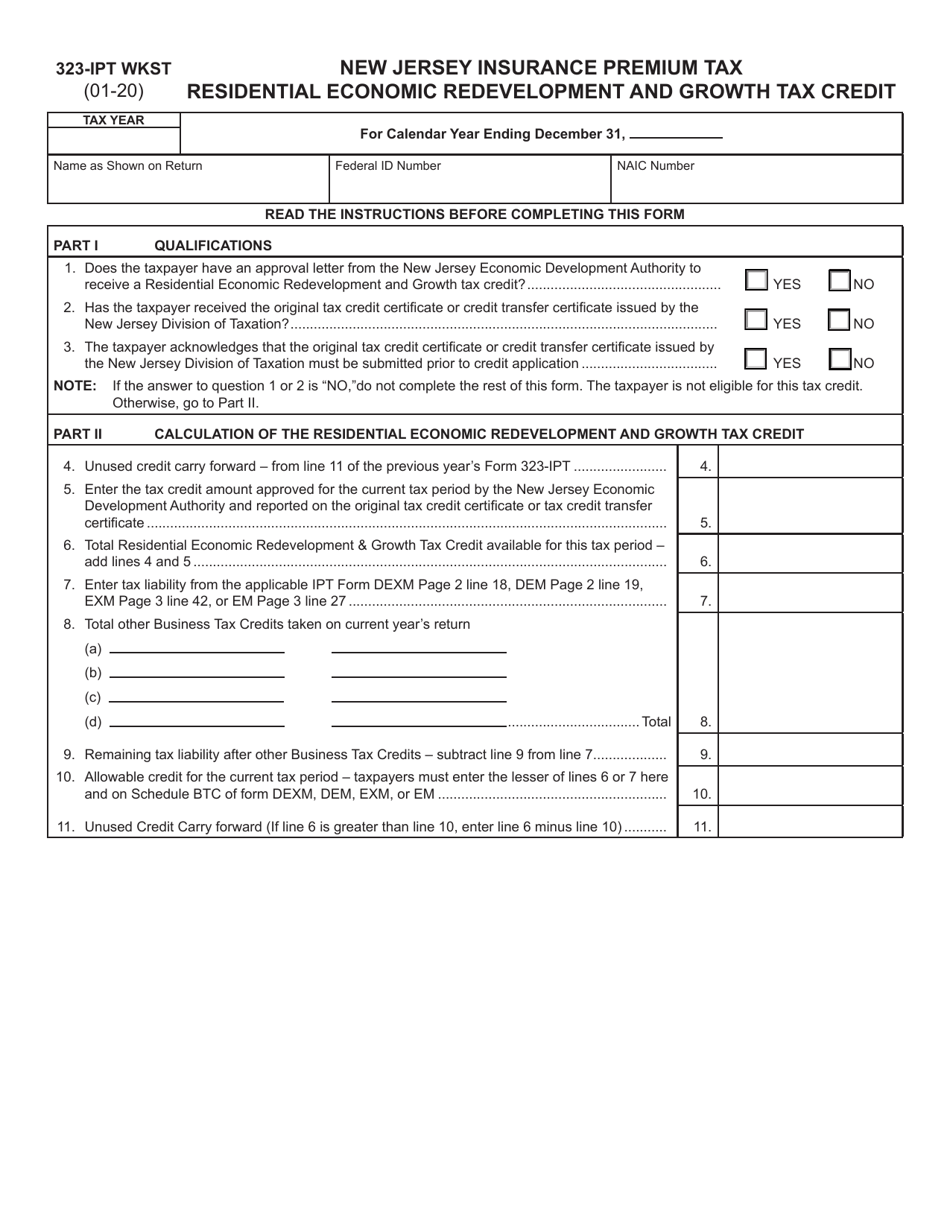

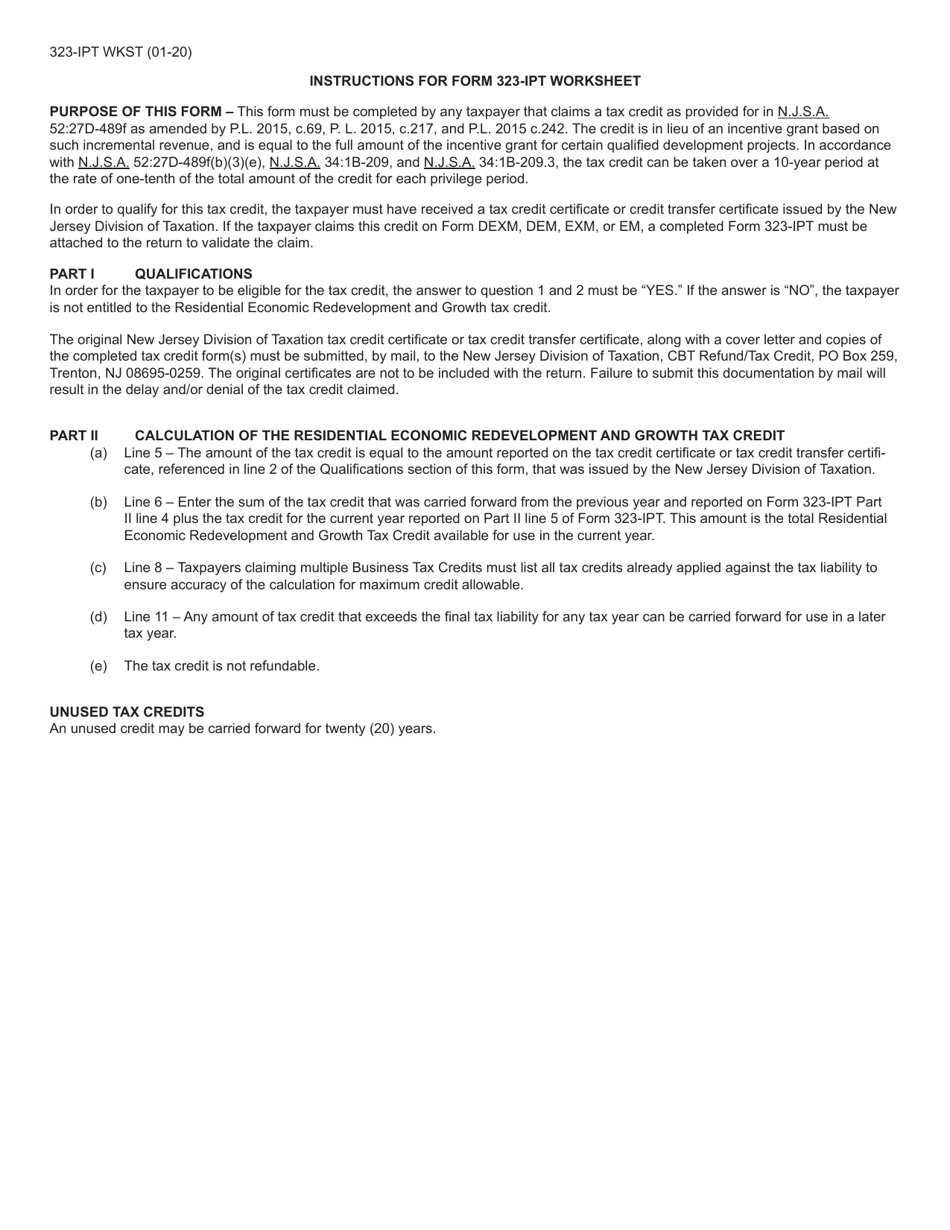

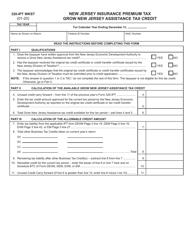

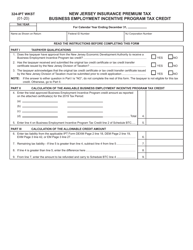

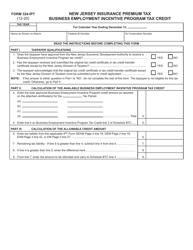

Form 323-IPT WKST Residential Economic Redevelopment and Growth Tax Credit - New Jersey

What Is Form 323-IPT WKST?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 323-IPT WKST?

A: Form 323-IPT WKST is a tax form used for claiming the Residential Economic Redevelopment and Growth Tax Credit in New Jersey.

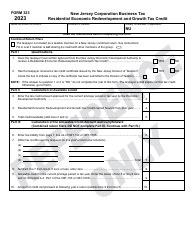

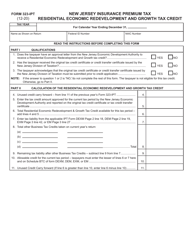

Q: What is the Residential Economic Redevelopment and Growth Tax Credit?

A: The Residential Economic Redevelopment and Growth Tax Credit is a tax credit designed to encourage residential development in targeted areas of New Jersey.

Q: Who is eligible for the Residential Economic Redevelopment and Growth Tax Credit?

A: Eligibility for the tax credit depends on meeting certain criteria, such as developing residential units in eligible areas and obtaining necessary certifications.

Q: How can I claim the Residential Economic Redevelopment and Growth Tax Credit?

A: You can claim the tax credit by completing Form 323-IPT WKST and submitting it to the New Jersey Division of Taxation along with any required documentation.

Q: Are there any deadlines for claiming the Residential Economic Redevelopment and Growth Tax Credit?

A: Specific deadlines for claiming the tax credit may vary, so it is important to check with the New Jersey Division of Taxation or consult a tax professional for the most up-to-date information.

Q: What are the benefits of the Residential Economic Redevelopment and Growth Tax Credit?

A: The tax credit can provide financial incentives for developers to invest in targeted areas and contribute to the economic growth and redevelopment of New Jersey.

Q: Are there any limitations or restrictions on the Residential Economic Redevelopment and Growth Tax Credit?

A: Yes, there are certain limitations and restrictions, such as caps on the total amount of tax credits available and specific requirements for the type of residential development.

Q: Can the Residential Economic Redevelopment and Growth Tax Credit be used in conjunction with other tax credits?

A: Yes, in some cases the tax credit can be combined with other tax credits or incentives offered by the state of New Jersey.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 323-IPT WKST by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.