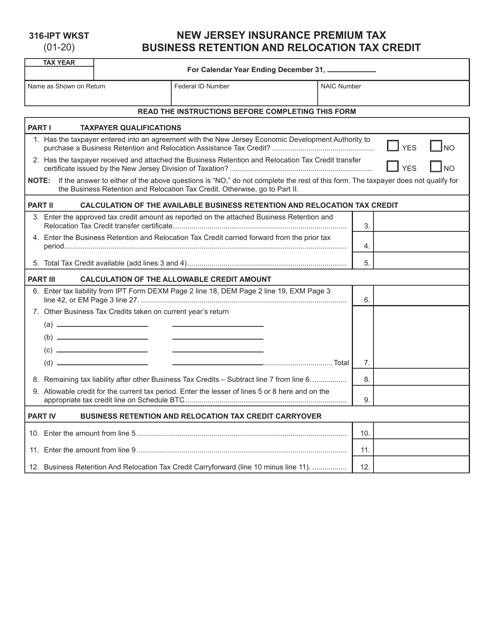

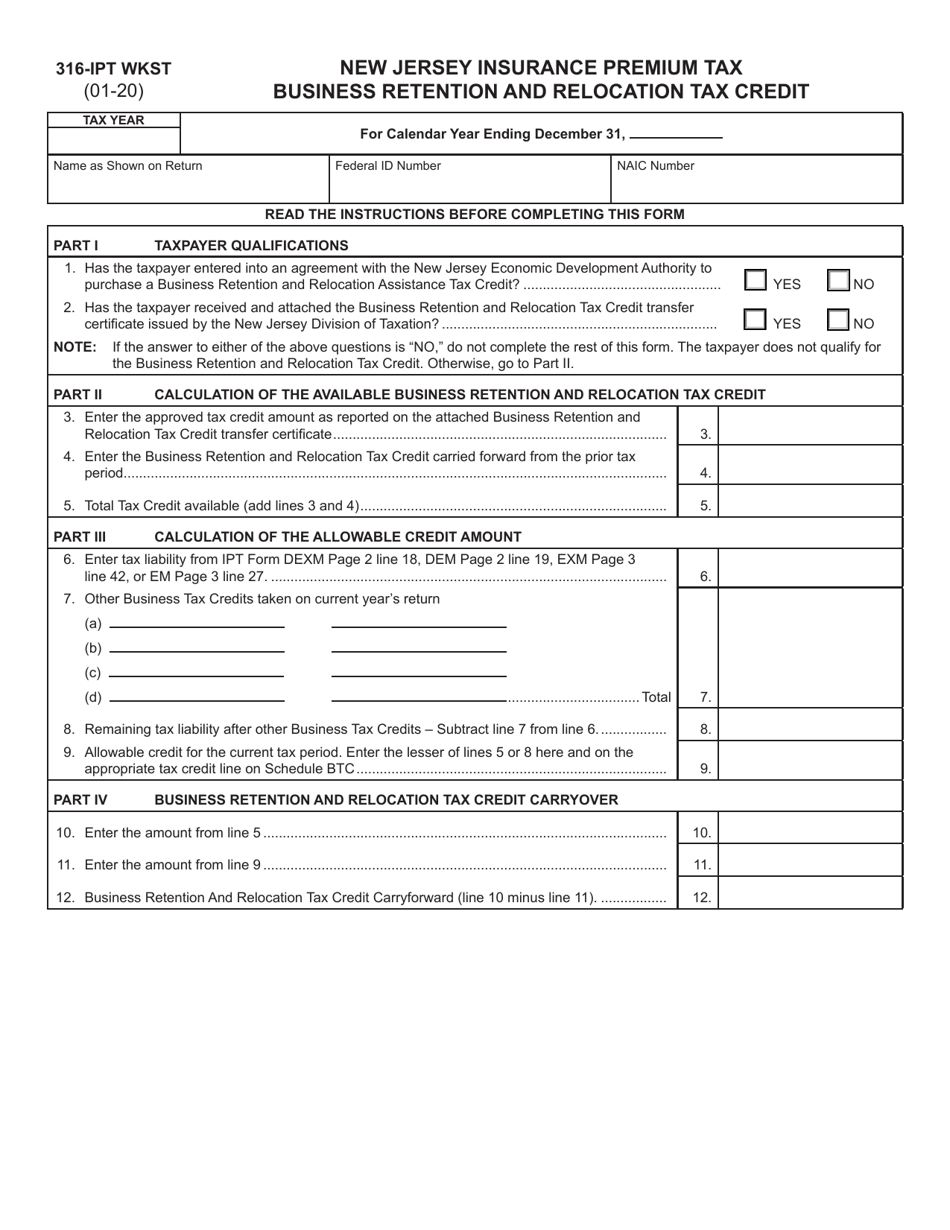

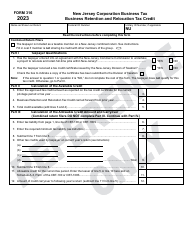

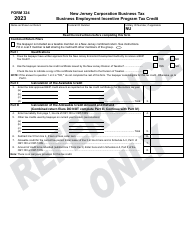

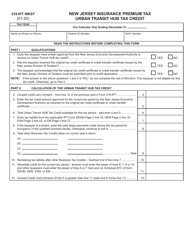

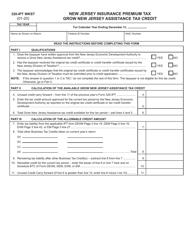

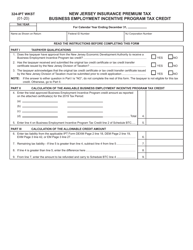

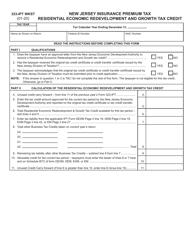

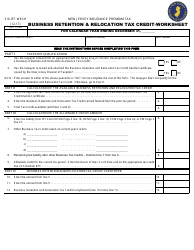

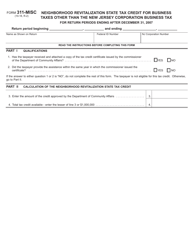

Form 316-IPR WKST Business Retention and Relocation Tax Credit - New Jersey

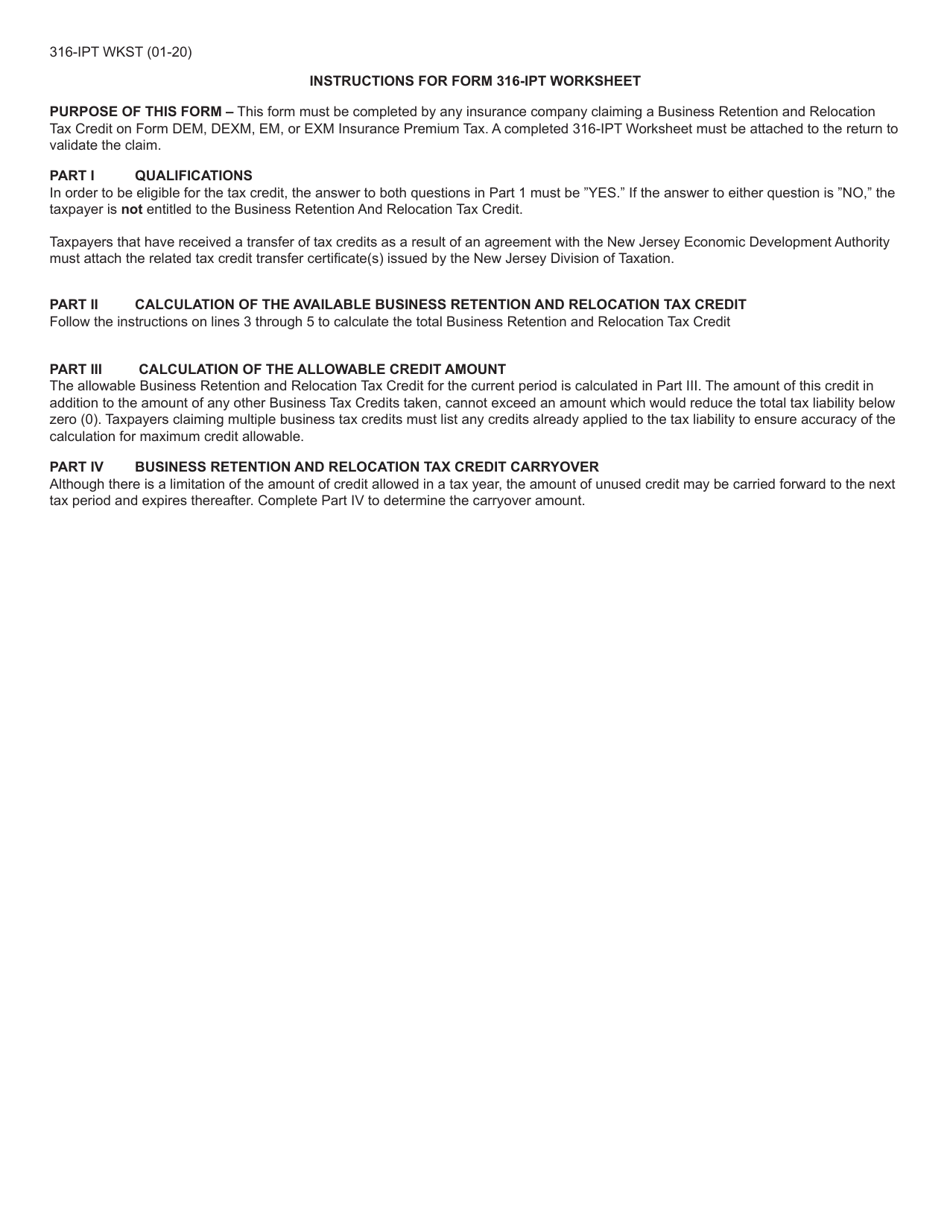

What Is Form 316-IPR WKST?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 316-IPR WKST?

A: Form 316-IPR WKST is a tax form used in New Jersey for the Business Retention and Relocation Tax Credit.

Q: What is the Business Retention and Relocation Tax Credit?

A: The Business Retention and Relocation Tax Credit is a tax incentive offered by the state of New Jersey to eligible businesses that plan to stay in or relocate to certain qualified areas.

Q: Who is eligible for the Business Retention and Relocation Tax Credit?

A: Eligible businesses include those that engage in qualified activities in designated areas and meet certain requirements outlined by the New Jersey Economic Development Authority.

Q: What are the qualified activities for the Business Retention and Relocation Tax Credit?

A: Qualified activities may include manufacturing, technology, research and development, and other targeted industries specified by the state.

Q: How much tax credit can businesses receive?

A: The amount of the tax credit can vary depending on several factors, such as the number of new or retained full-time jobs and the amount of capital investment made by the business.

Q: How can businesses apply for the tax credit?

A: Businesses can apply for the tax credit by completing and submitting Form 316-IPR WKST to the New Jersey Economic Development Authority.

Q: Is there a deadline for applying?

A: Yes, there is a deadline for applying for the Business Retention and Relocation Tax Credit. Businesses should check with the New Jersey Economic Development Authority for the current deadline.

Q: Are there any limitations or conditions for receiving the tax credit?

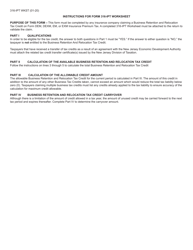

A: Yes, there are certain limitations and conditions that businesses must meet in order to qualify for and receive the tax credit. These are outlined in the instructions for Form 316-IPR WKST.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 316-IPR WKST by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.