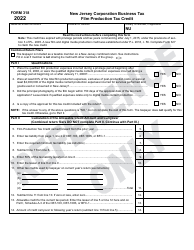

This version of the form is not currently in use and is provided for reference only. Download this version of

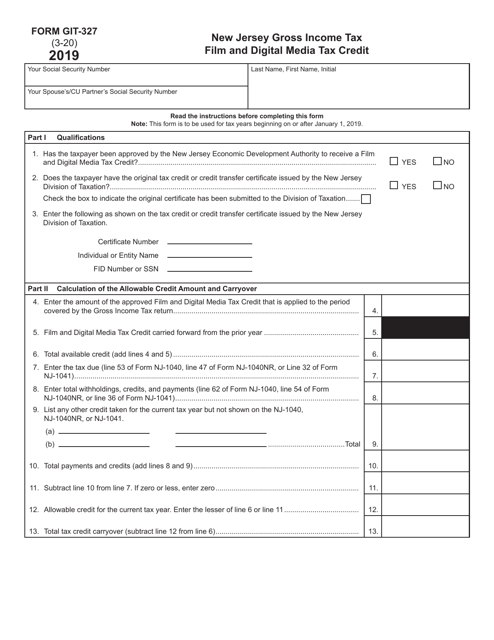

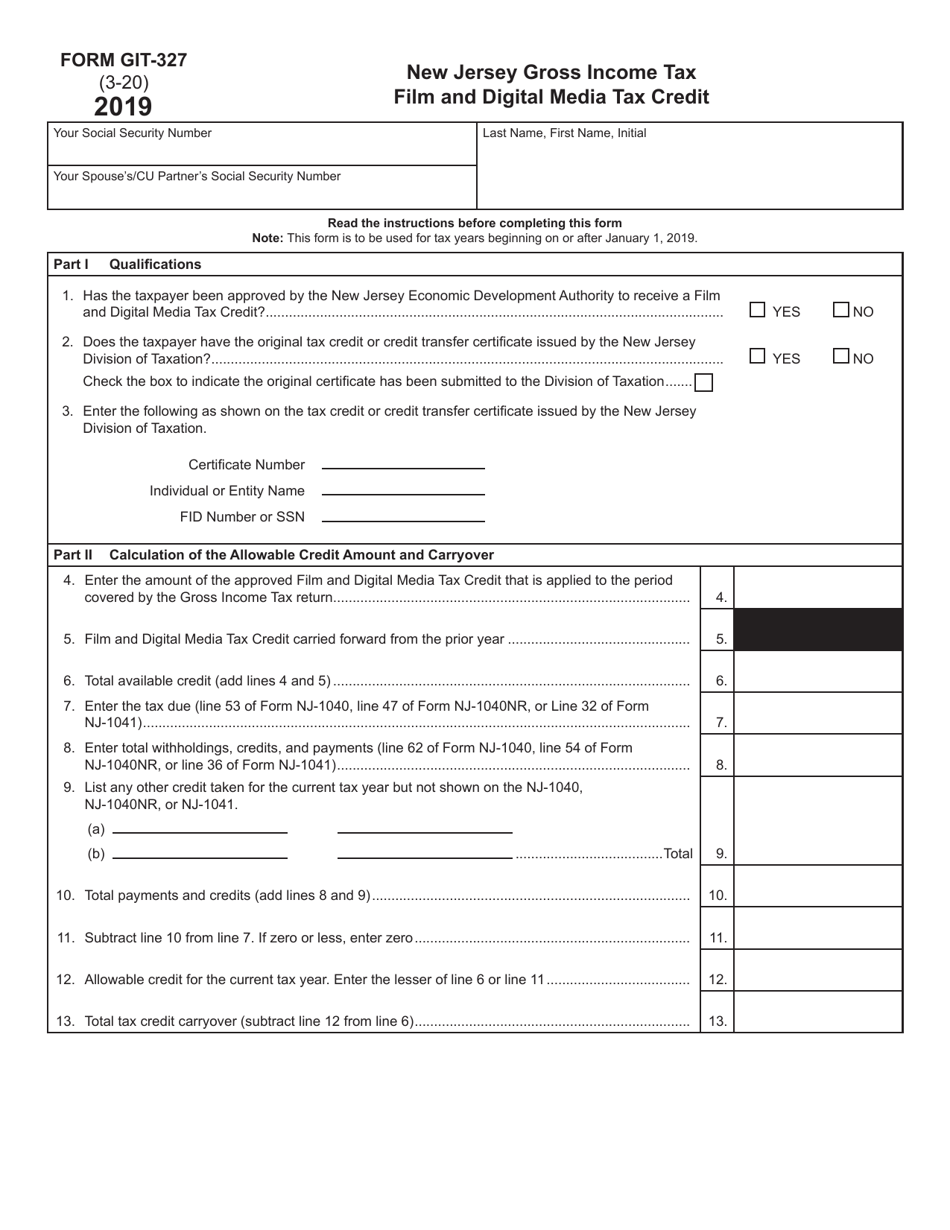

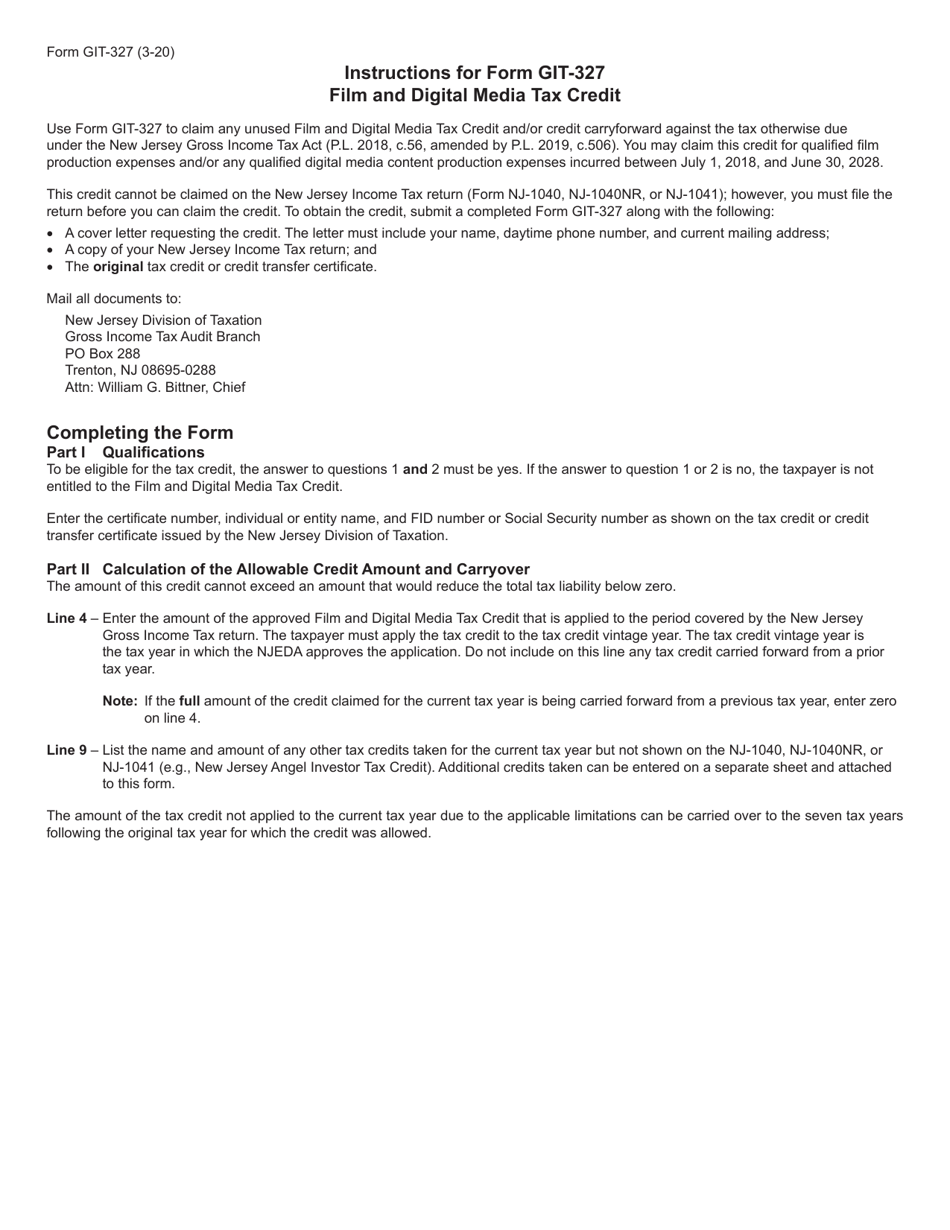

Form GIT-327

for the current year.

Form GIT-327 Film and Digital Media Tax Credit - New Jersey

What Is Form GIT-327?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

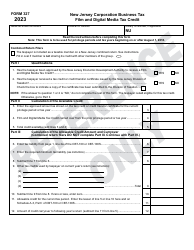

Q: What is the GIT-327 Film and Digital Media Tax Credit?

A: The GIT-327 Film and Digital Media Tax Credit is a tax incentive program offered by the state of New Jersey to encourage film and digital media production in the state.

Q: Who is eligible for the GIT-327 Film and Digital Media Tax Credit?

A: Film and digital media production companies that meet certain criteria are eligible to apply for the tax credit. These criteria include spending a certain amount on production-related expenses in New Jersey and meeting certain minimum thresholds for hiring New Jersey residents.

Q: What types of expenses are eligible for the tax credit?

A: Eligible production-related expenses include payments to New Jersey vendors, wages paid to New Jersey residents, and certain other production costs incurred in the state.

Q: How much is the tax credit?

A: The tax credit can range from 20% to 30% of eligible production expenses, depending on various factors such as the type of production and the location of filming.

Q: How can I apply for the GIT-327 Film and Digital Media Tax Credit?

A: To apply for the tax credit, production companies must submit an application to the New Jersey Economic Development Authority (NJEDA) and provide supporting documentation to demonstrate eligibility and the amount of eligible expenses.

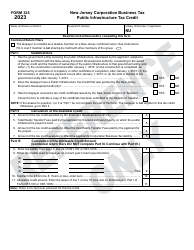

Q: Are there any restrictions or limitations on the tax credit?

A: Yes, there are certain restrictions and limitations on the tax credit. For example, there is a cap on the total amount of credits that can be awarded each fiscal year, and there are specific guidelines regarding eligible expenses and other requirements.

Q: What is the purpose of the tax credit?

A: The purpose of the GIT-327 Film and Digital Media Tax Credit is to attract and retain film and digital media production in New Jersey, stimulate economic growth, and create job opportunities in the state.

Q: Is the tax credit transferable or refundable?

A: Yes, the tax credit is transferable and refundable. This means that if a production company has excess tax credits that cannot be used, they may be able to sell or transfer them to another entity. In certain cases, the tax credit may also be refundable if the production company has no tax liability in New Jersey.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-327 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.