This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule X

for the current year.

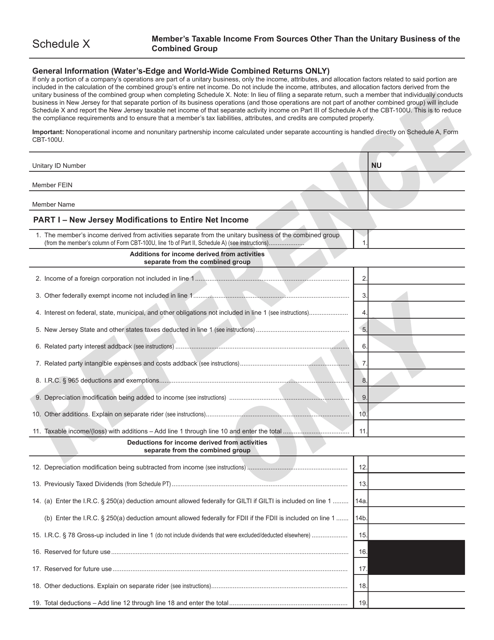

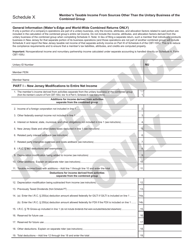

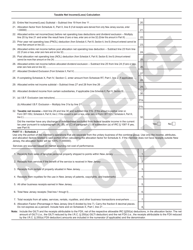

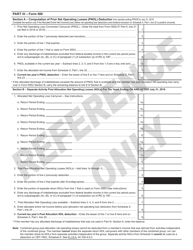

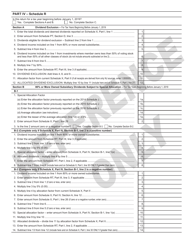

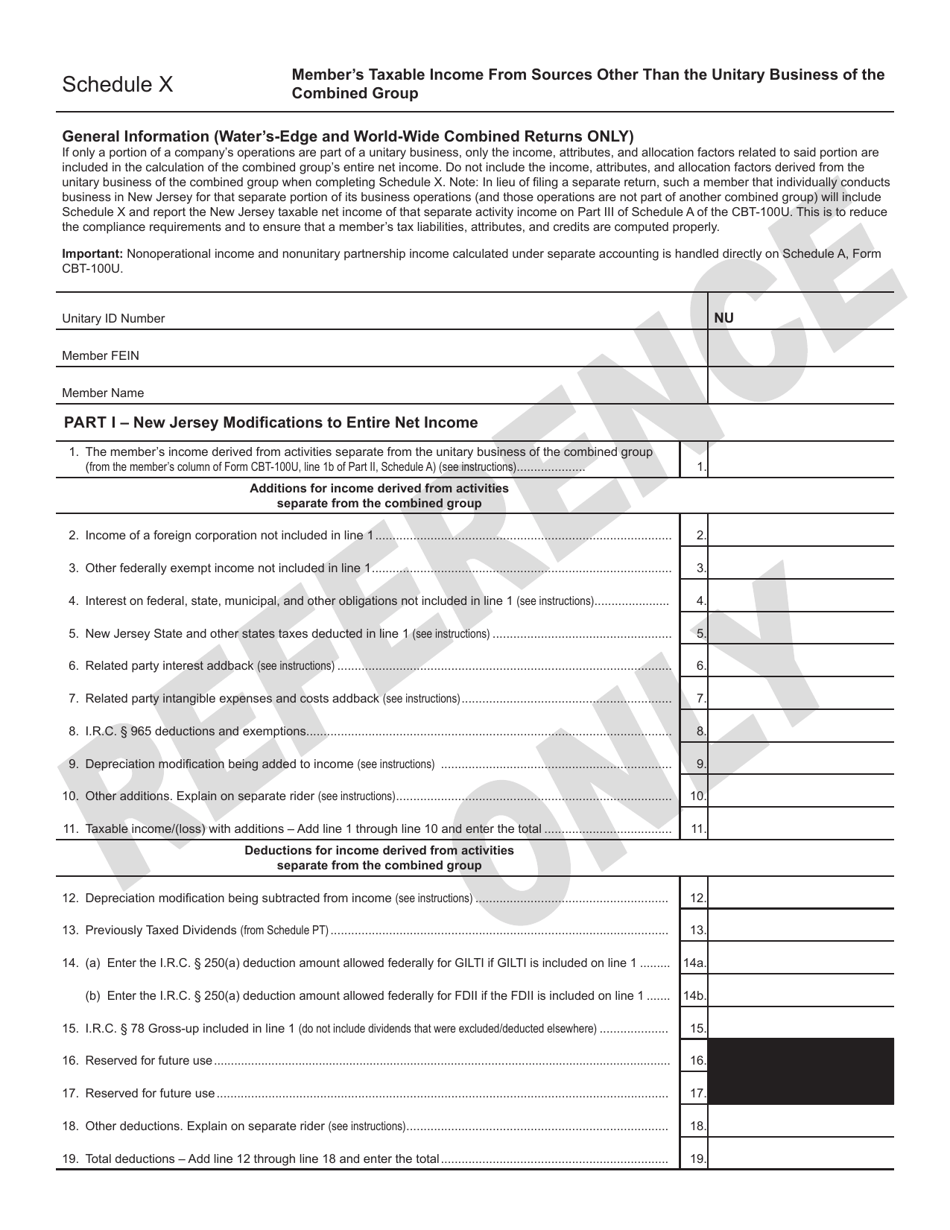

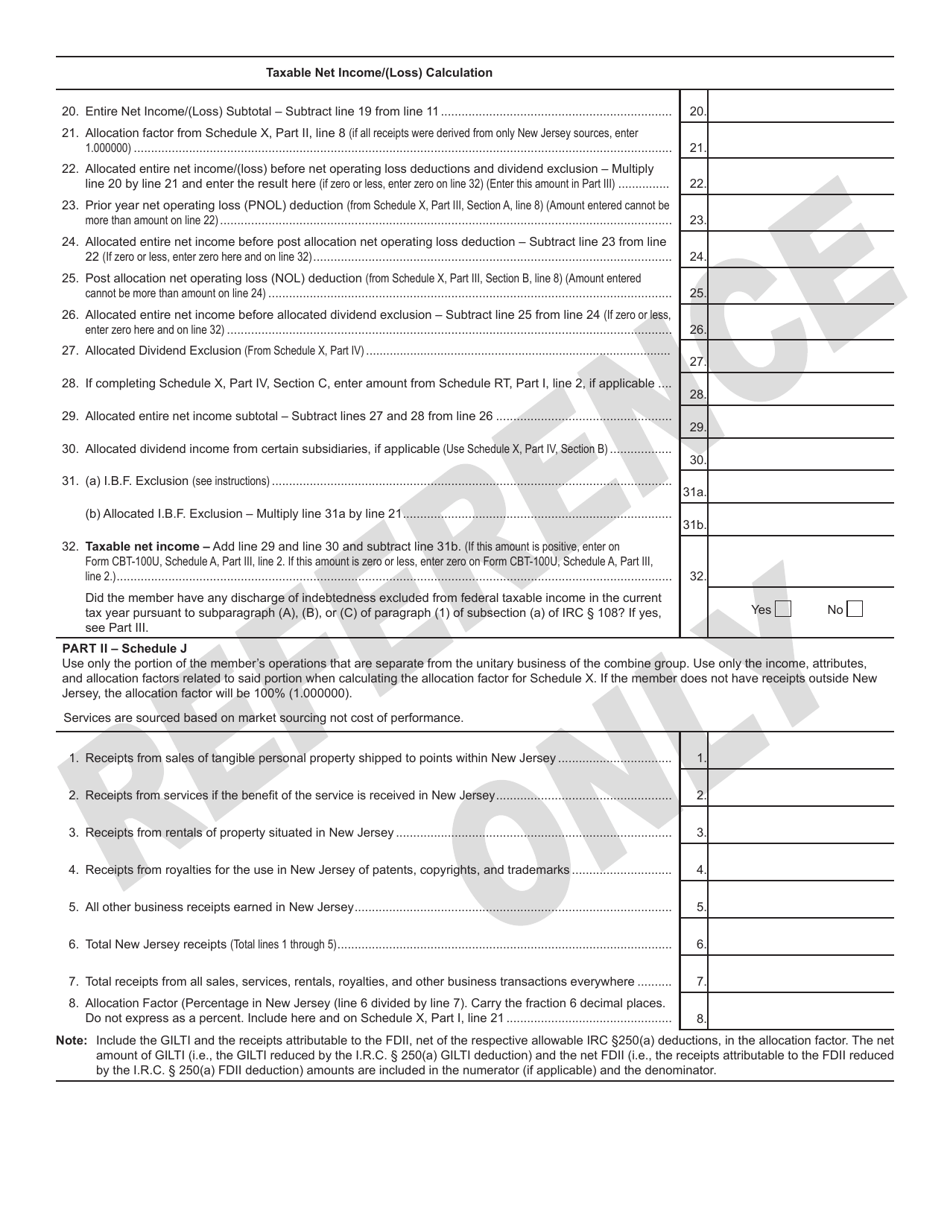

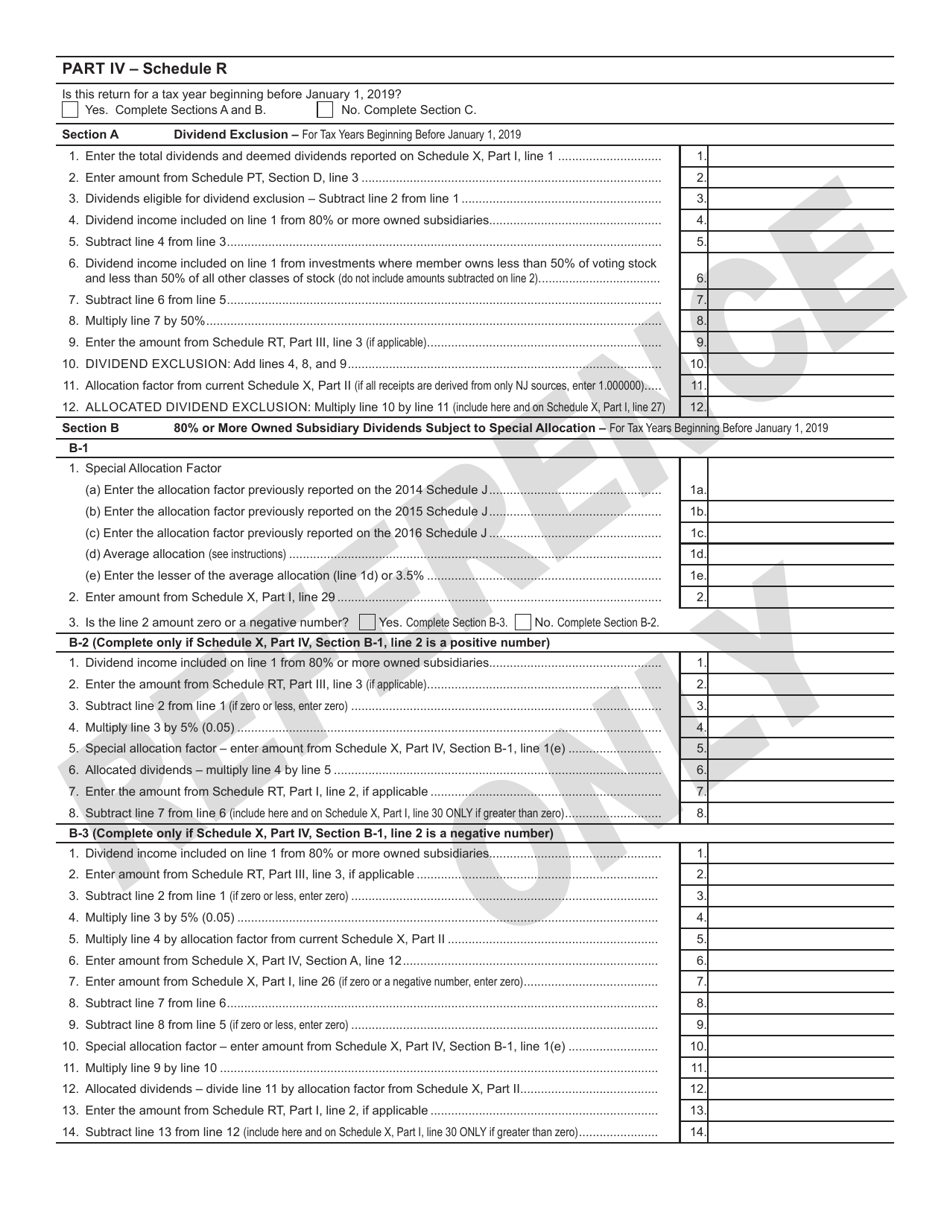

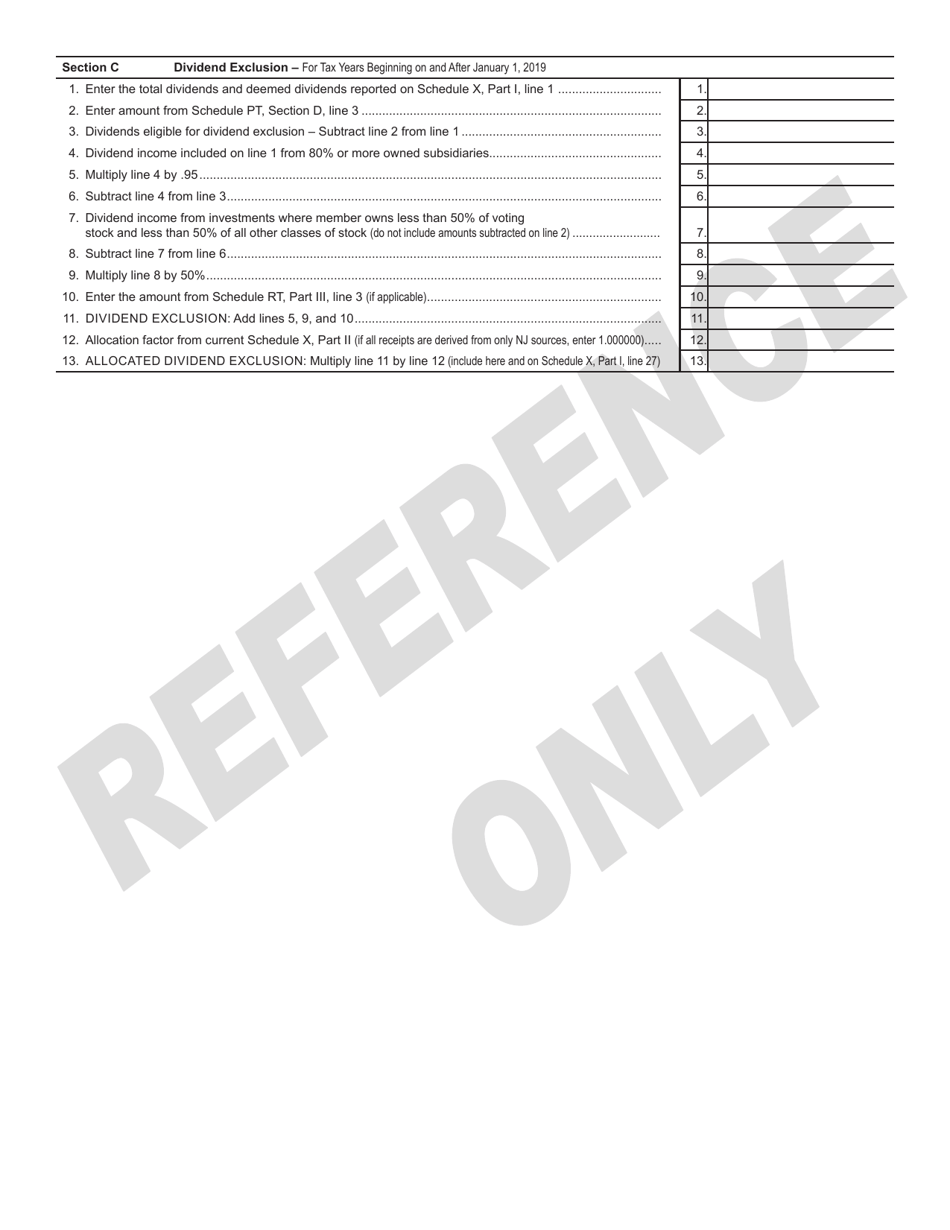

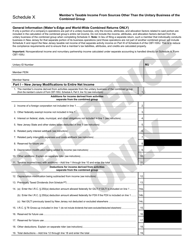

Schedule X Member's Taxable Income From Sources Other Than the Unitary Business of the Combined Group - New Jersey

What Is Schedule X?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule X?

A: Schedule X is a form used in New Jersey to report a member's taxable income from sources other than the unitary business of the combined group.

Q: Who needs to complete Schedule X?

A: Members of a combined group who have taxable income from sources other than the unitary business need to complete Schedule X.

Q: What types of income are reported on Schedule X?

A: Schedule X is used to report income from sources other than the unitary business, such as interest, dividends, royalties, and rental income.

Q: Is Schedule X required for all members of a combined group?

A: No, Schedule X is only required for members who have taxable income from sources other than the unitary business.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule X by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.