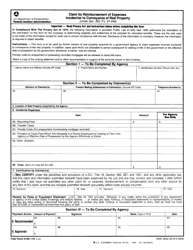

This version of the form is not currently in use and is provided for reference only. Download this version of

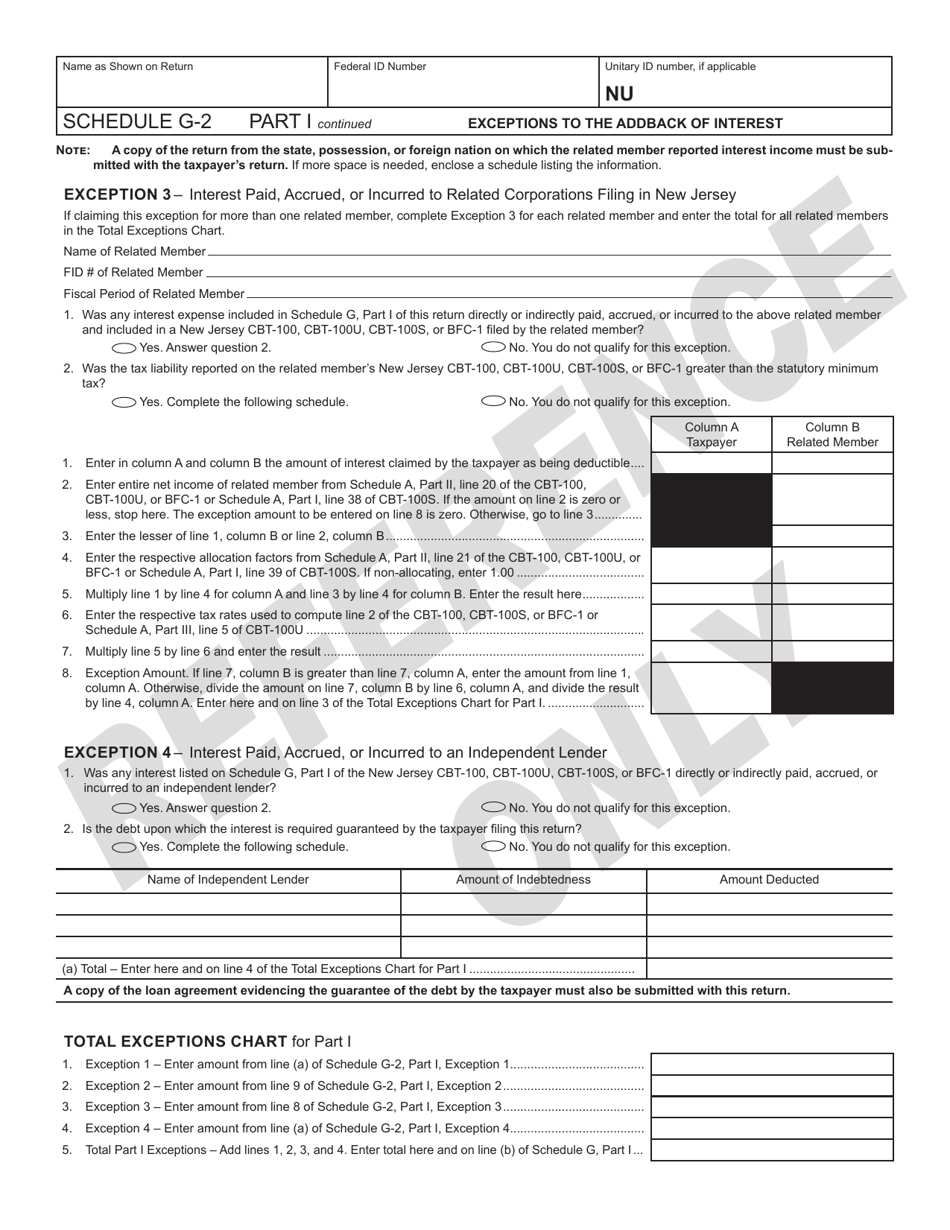

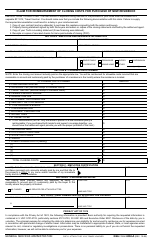

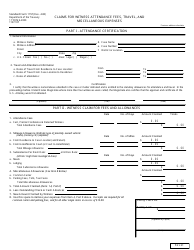

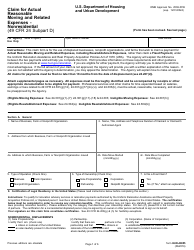

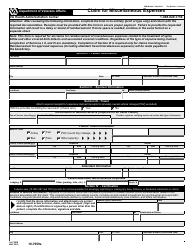

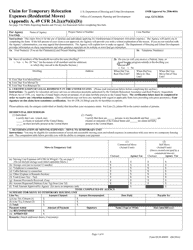

Schedule G-2

for the current year.

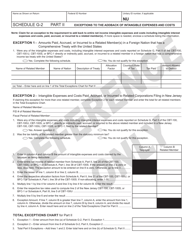

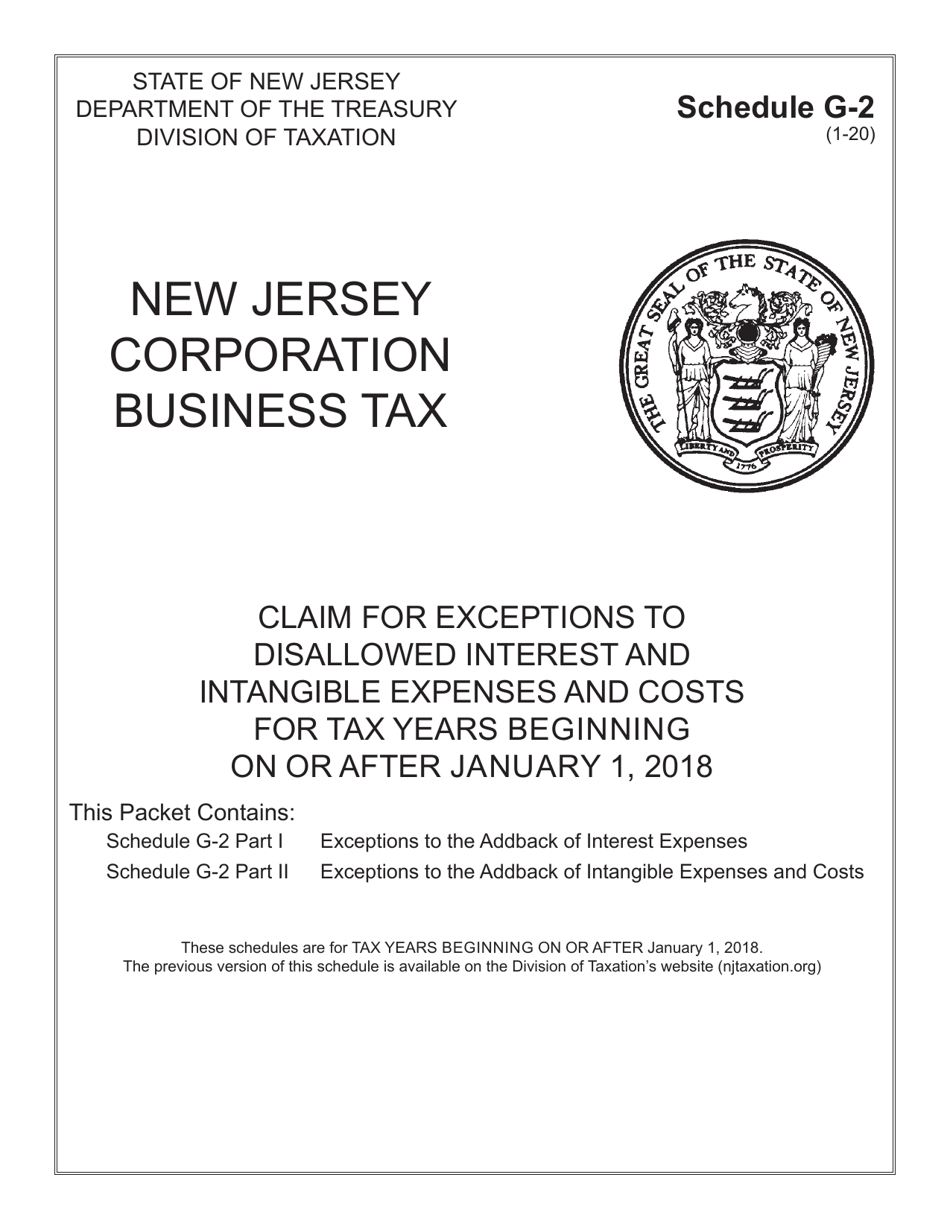

Schedule G-2 Claim for Exceptions to Disallowed Interest and Intangible Expenses and Costs - New Jersey

What Is Schedule G-2?

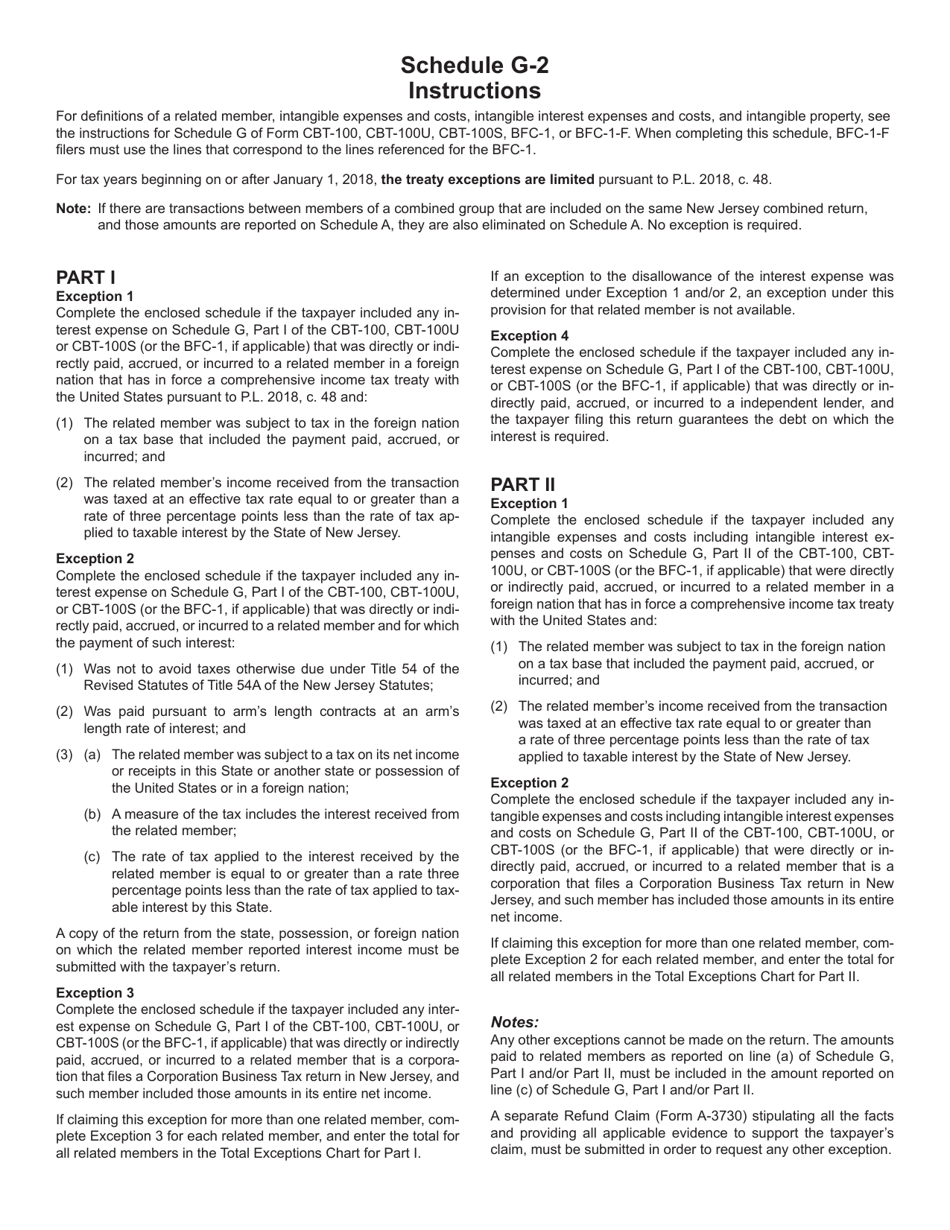

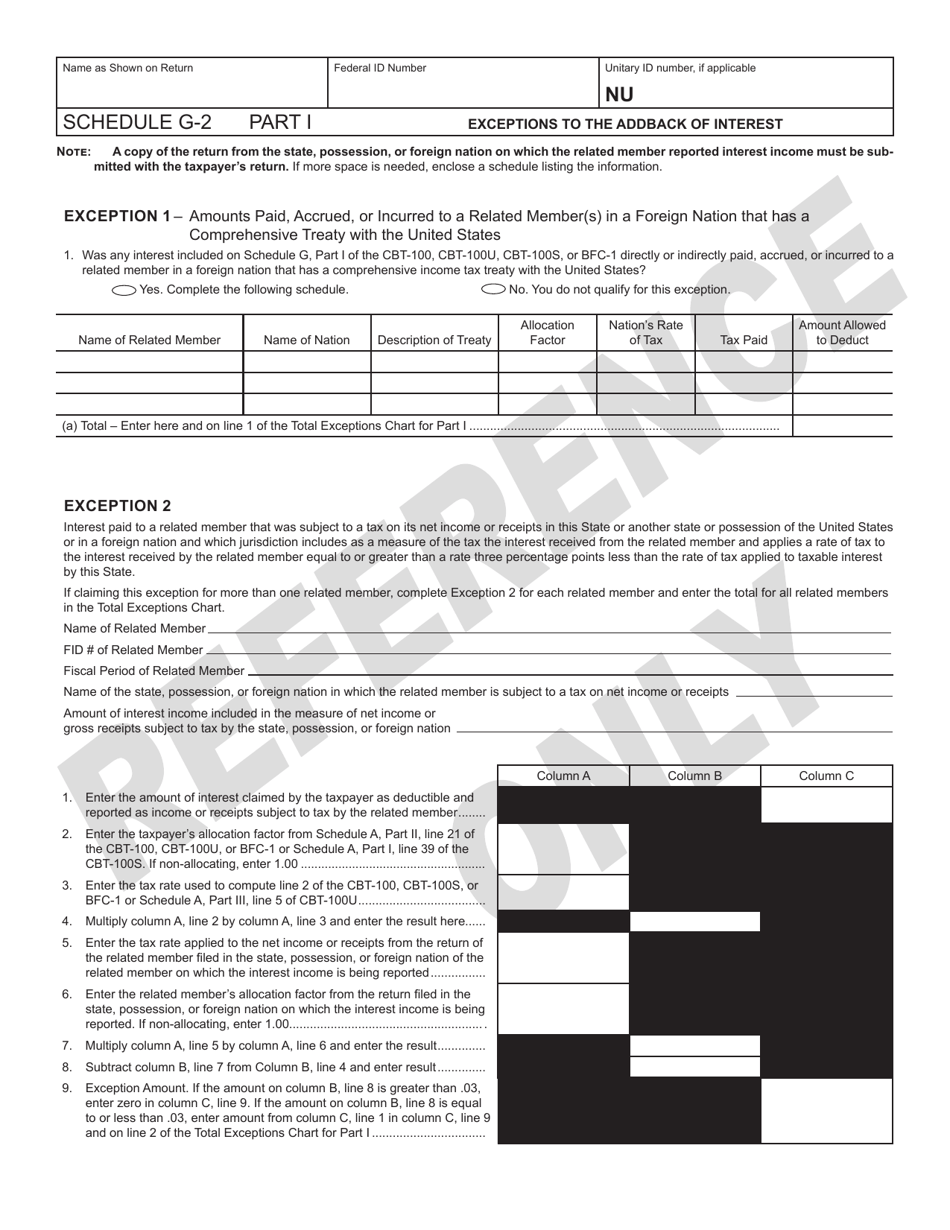

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

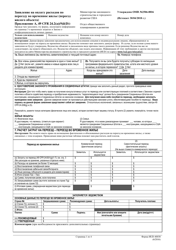

Q: What is Schedule G-2?

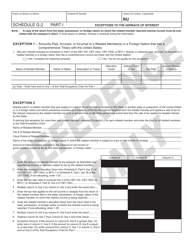

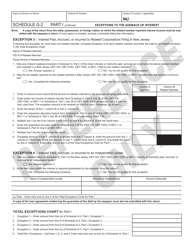

A: Schedule G-2 is a form used for claiming exceptions to disallowed interest and intangible expenses and costs in New Jersey.

Q: Who needs to file Schedule G-2?

A: Taxpayers who have disallowed interest and intangible expenses and costs in New Jersey need to file Schedule G-2.

Q: What are disallowed interest and intangible expenses and costs?

A: Disallowing interest and intangible expenses and costs means that those expenses are not deductible for New Jersey tax purposes.

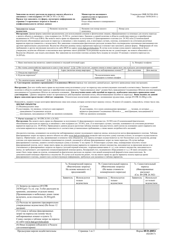

Q: What are exceptions to disallowed interest and intangible expenses and costs?

A: Exceptions are certain situations or circumstances where disallowed interest and intangible expenses and costs can be claimed as deductible in New Jersey.

Q: How do I claim exceptions to disallowed interest and intangible expenses and costs?

A: You can claim exceptions by completing and filing Schedule G-2 with your New Jersey tax return.

Q: Is there a deadline for filing Schedule G-2?

A: The deadline for filing Schedule G-2 is the same as the deadline for filing your New Jersey tax return.

Q: Can I claim exceptions to disallowed interest and intangible expenses and costs for previous tax years?

A: Yes, you can claim exceptions for previous tax years by filing an amended New Jersey tax return and including Schedule G-2.

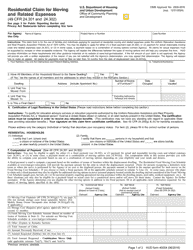

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule G-2 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.