This version of the form is not currently in use and is provided for reference only. Download this version of

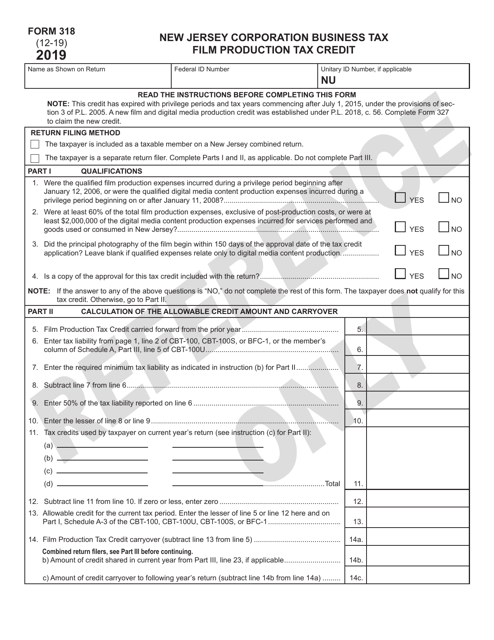

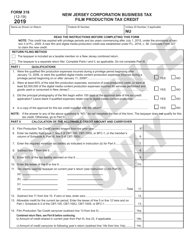

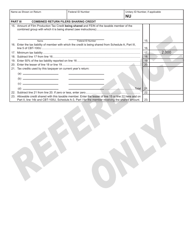

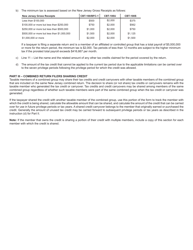

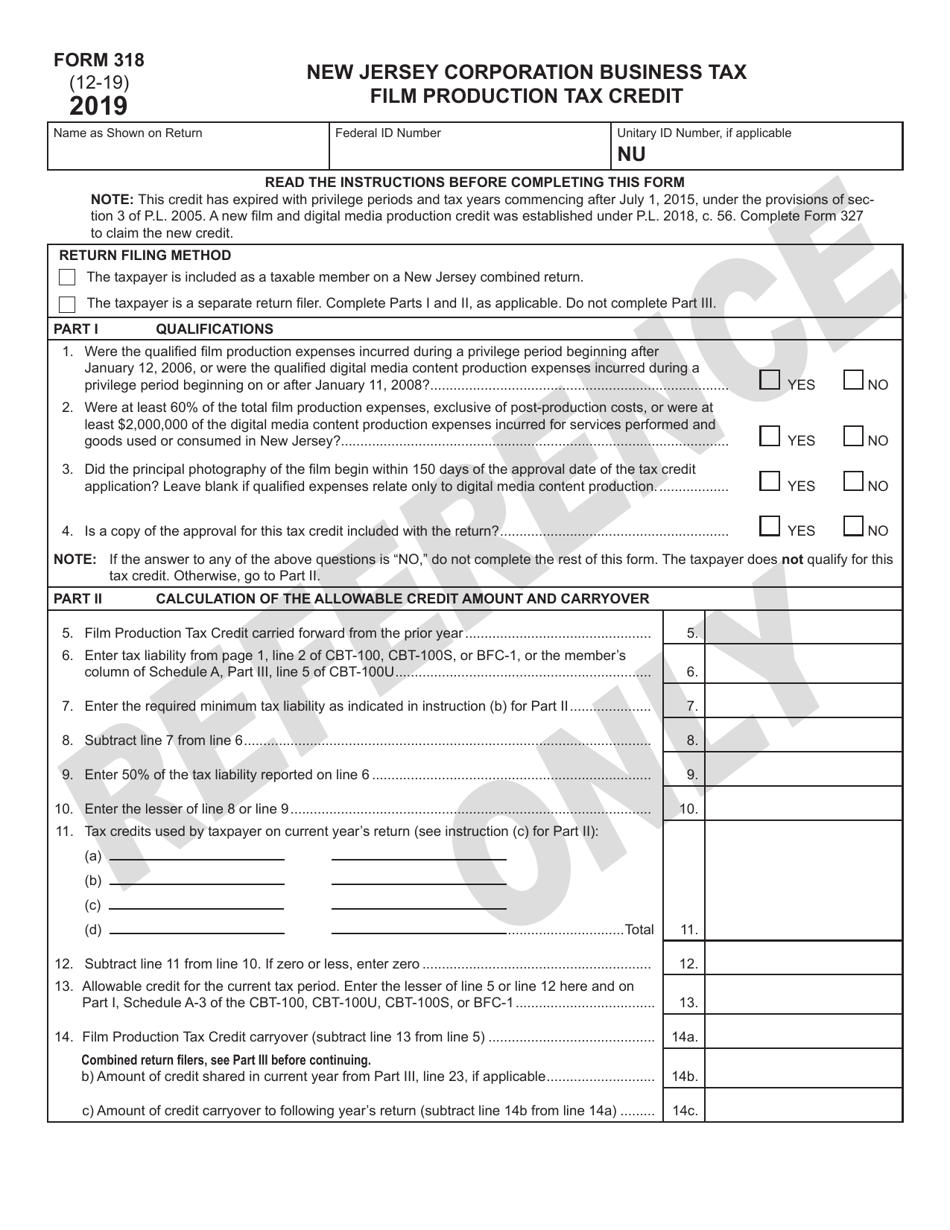

Form 318

for the current year.

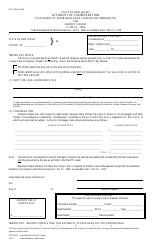

Form 318 Film Production Tax Credit - New Jersey

What Is Form 318?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

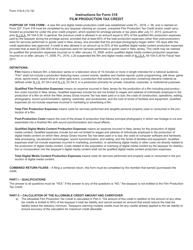

Q: What is Form 318?

A: Form 318 is the Film Production Tax Credit application form for the state of New Jersey.

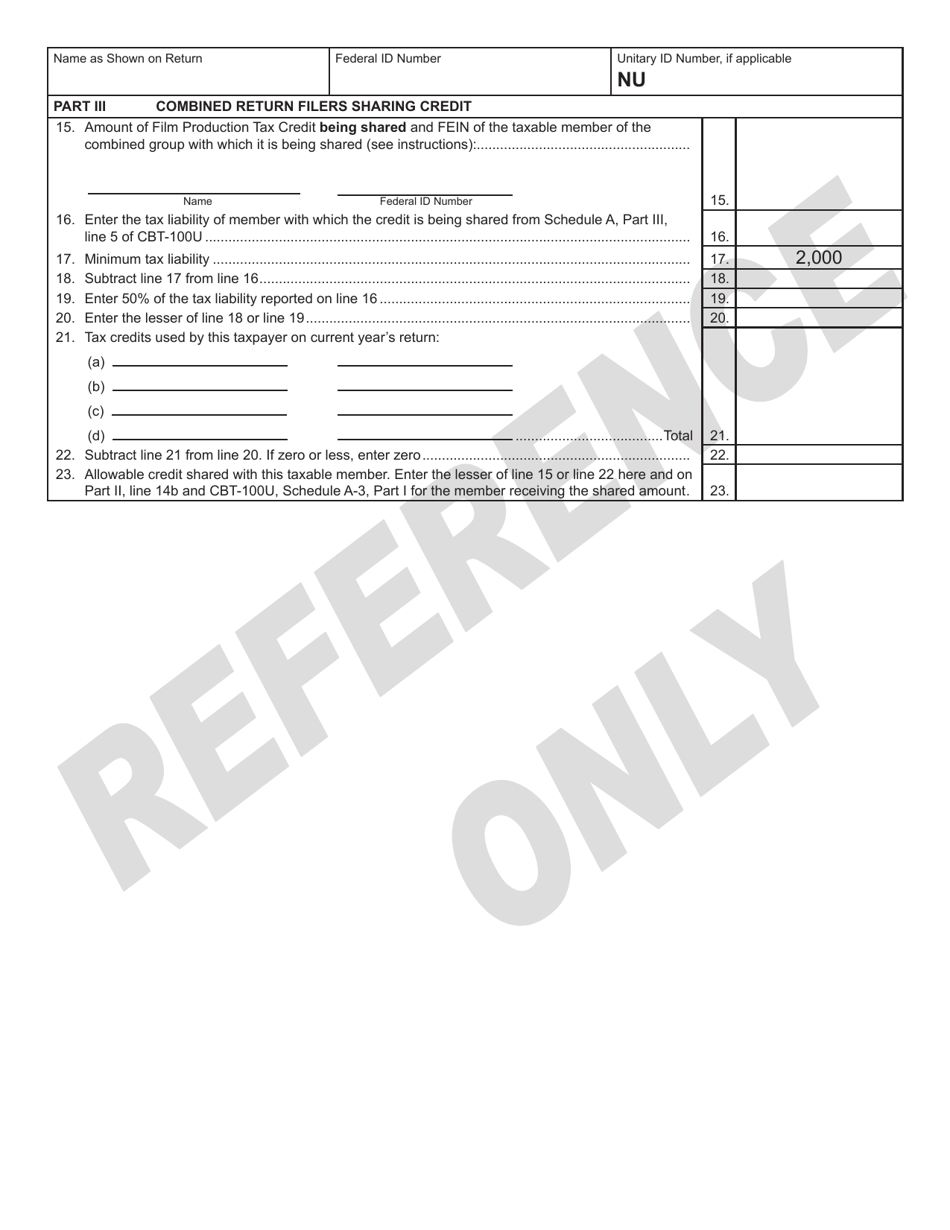

Q: What is the Film Production Tax Credit?

A: The Film Production Tax Credit is a financial incentive program offered by the state of New Jersey to encourage film and television production in the state.

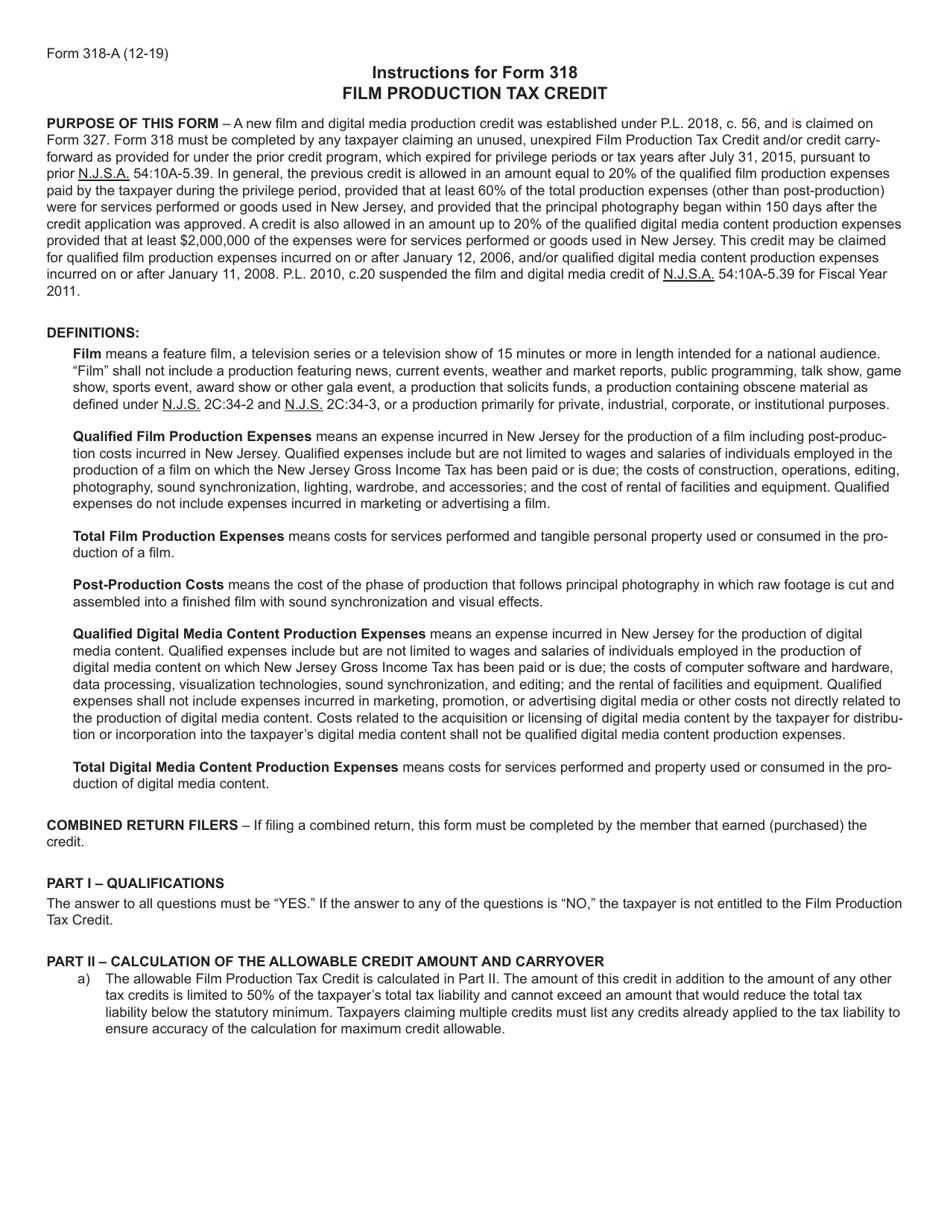

Q: Who is eligible to apply for the Film Production Tax Credit?

A: Eligible applicants for the Film Production Tax Credit include producers, directors, and production companies that meet the requirements set forth by the state of New Jersey.

Q: What expenses are eligible for the Film Production Tax Credit?

A: Eligible expenses for the Film Production Tax Credit include qualified production expenditures, such as payments to New Jersey residents, goods and services purchased in New Jersey, and other production-related costs.

Q: What is the application process for the Film Production Tax Credit?

A: The application process for the Film Production Tax Credit involves submitting Form 318, along with supporting documentation, to the New Jersey Motion Picture and Television Commission.

Q: What is the deadline to submit the Film Production Tax Credit application?

A: The deadline to submit the Film Production Tax Credit application is typically 30 days prior to the start of production.

Q: Can the Film Production Tax Credit be transferred or sold?

A: Yes, the Film Production Tax Credit can be transferred or sold to other taxpayers or entities, subject to certain limitations and restrictions.

Q: What is the maximum amount of tax credits that can be awarded?

A: The maximum amount of tax credits that can be awarded through the Film Production Tax Credit program is $75 million per fiscal year.

Q: What are the benefits of the Film Production Tax Credit?

A: The benefits of the Film Production Tax Credit include job creation, economic stimulus, and the promotion of New Jersey as a filming destination.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 318 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.