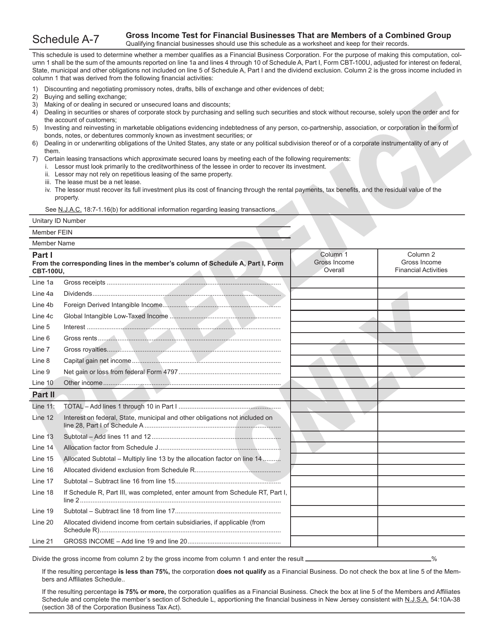

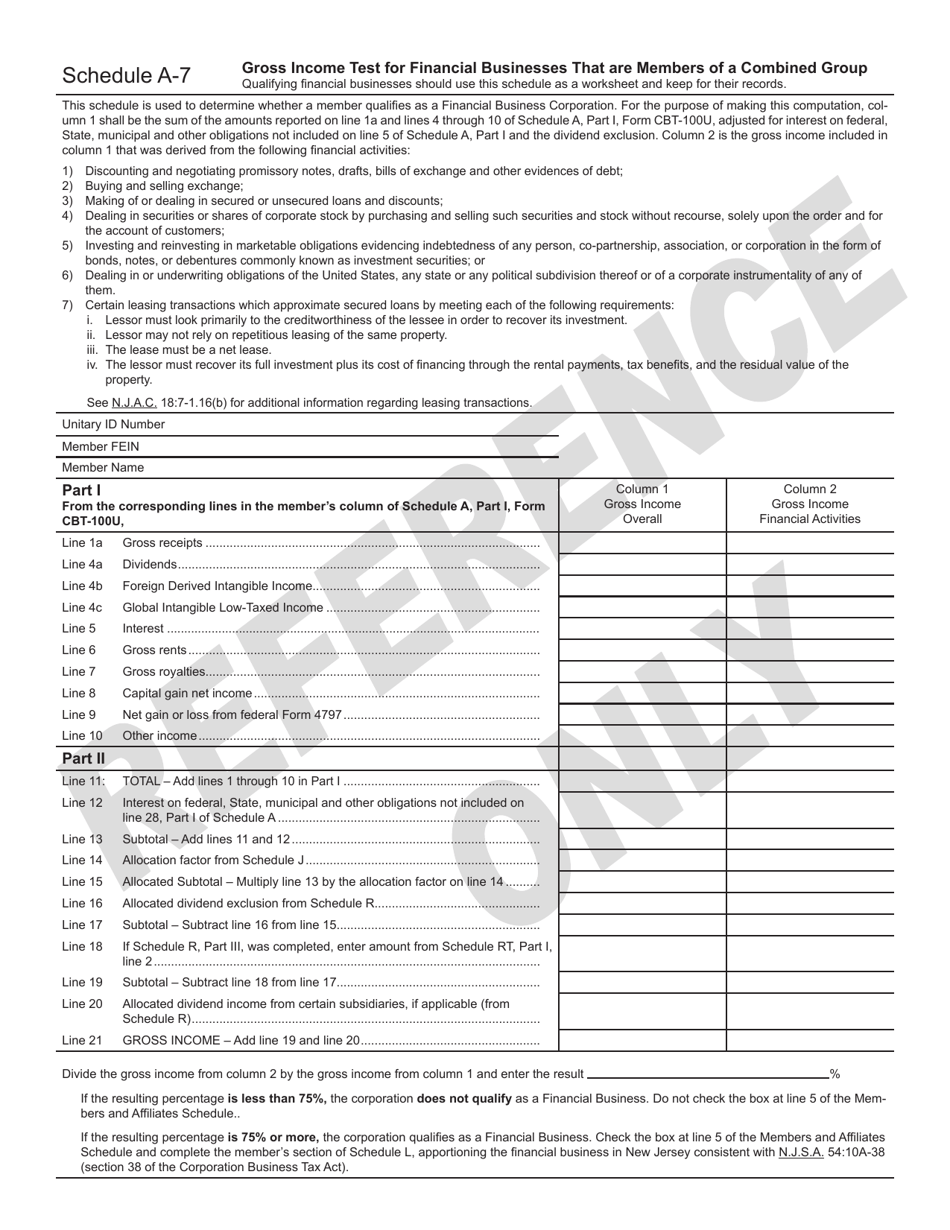

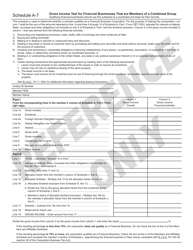

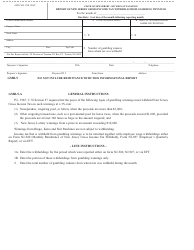

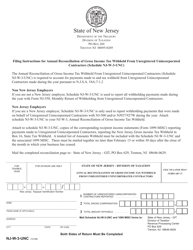

Schedule A-7 Gross Income Test for Financial Businesses That Are Members of a Combined Group - New Jersey

What Is Schedule A-7?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

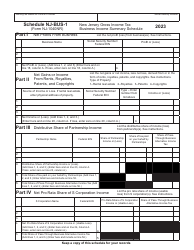

Q: What is Schedule A-7?

A: Schedule A-7 is a form used for the Gross Income Test for financial businesses that are members of a combined group in New Jersey.

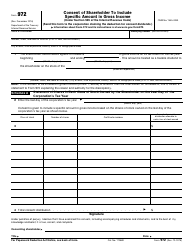

Q: What is the Gross Income Test?

A: The Gross Income Test is a requirement for financial businesses that are members of a combined group in New Jersey.

Q: Who needs to complete Schedule A-7?

A: Financial businesses that are members of a combined group in New Jersey need to complete Schedule A-7.

Q: What does Schedule A-7 assess?

A: Schedule A-7 assesses the gross income of financial businesses in a combined group.

Q: What is the purpose of Schedule A-7?

A: The purpose of Schedule A-7 is to determine the eligibility of financial businesses for certain tax benefits in New Jersey.

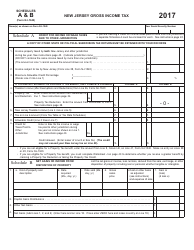

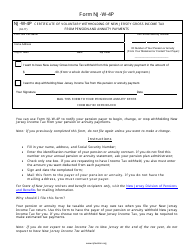

Q: Are there any specific requirements for completing Schedule A-7?

A: Yes, there are specific requirements and instructions provided with Schedule A-7 that must be followed.

Q: What happens if I don't complete Schedule A-7?

A: Failure to complete Schedule A-7 or providing inaccurate information may result in penalties or denial of tax benefits.

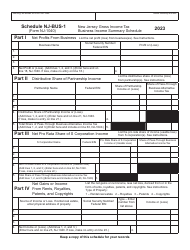

Q: Can I get assistance with completing Schedule A-7?

A: Yes, you can seek assistance from tax professionals or contact the New Jersey Division of Taxation for guidance.

Q: Is Schedule A-7 only applicable to financial businesses?

A: Yes, Schedule A-7 is specifically designed for financial businesses that are members of a combined group in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule A-7 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.