This version of the form is not currently in use and is provided for reference only. Download this version of

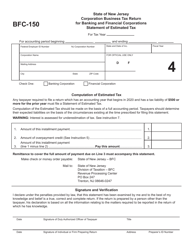

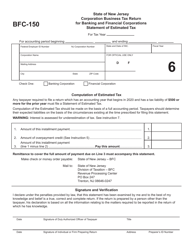

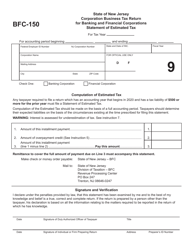

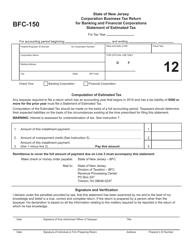

Form BFC-150

for the current year.

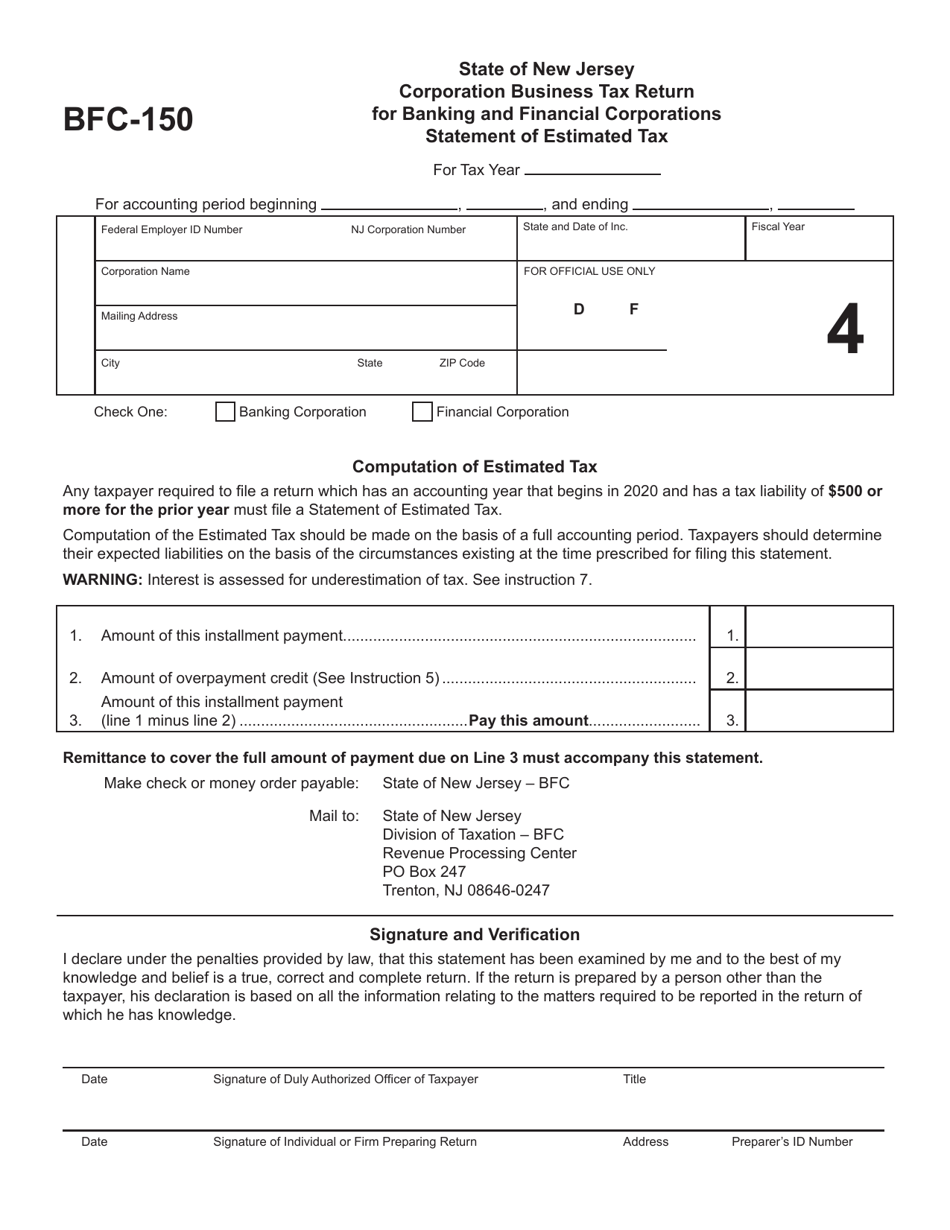

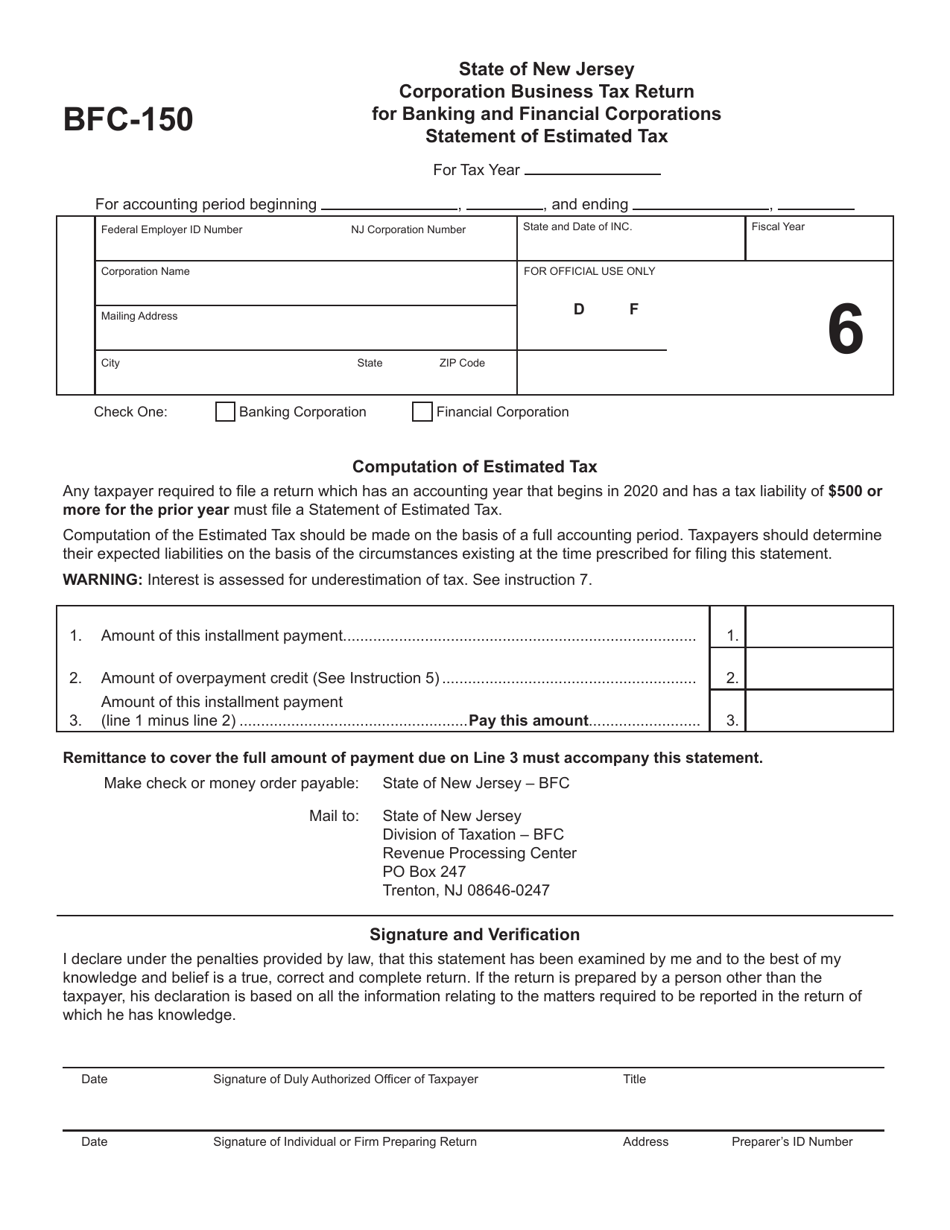

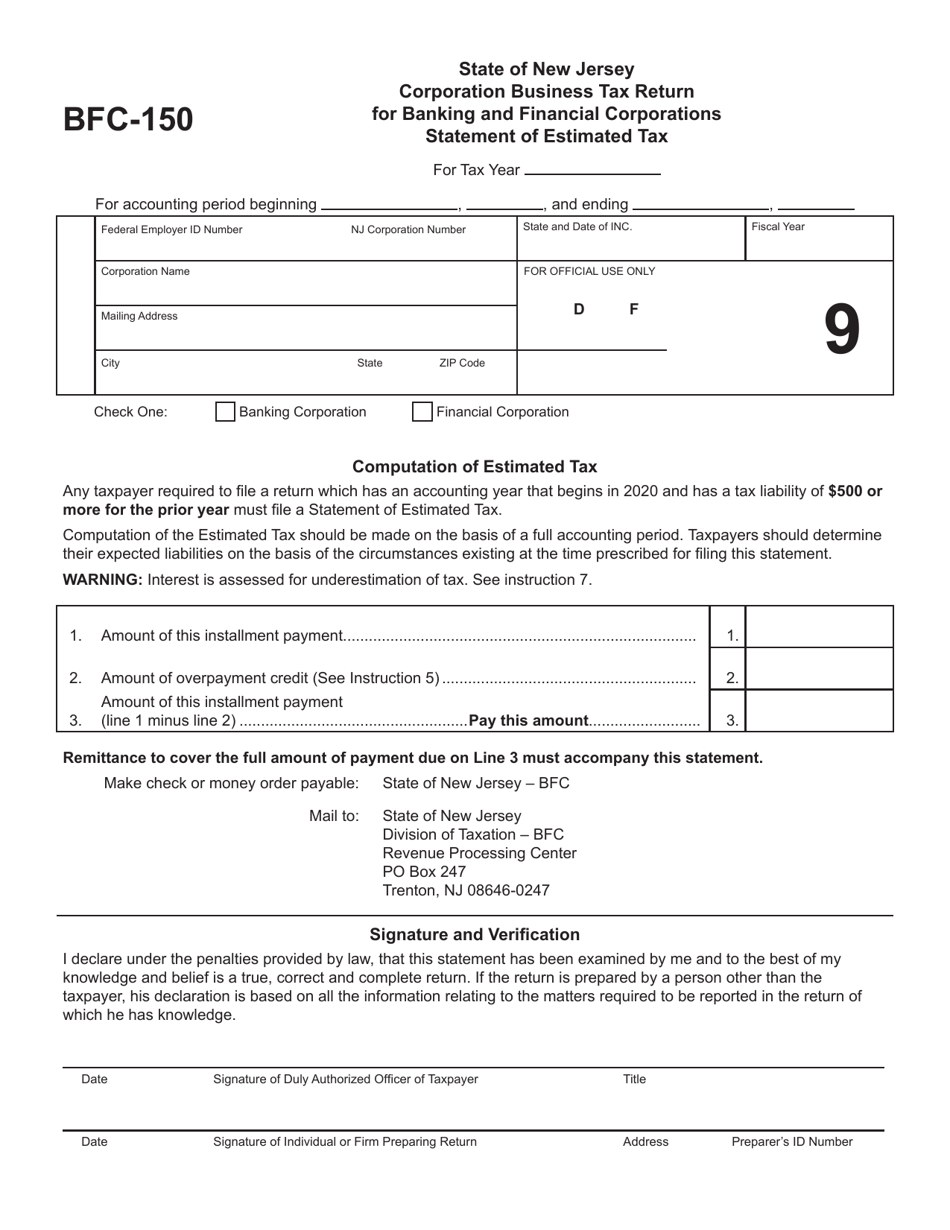

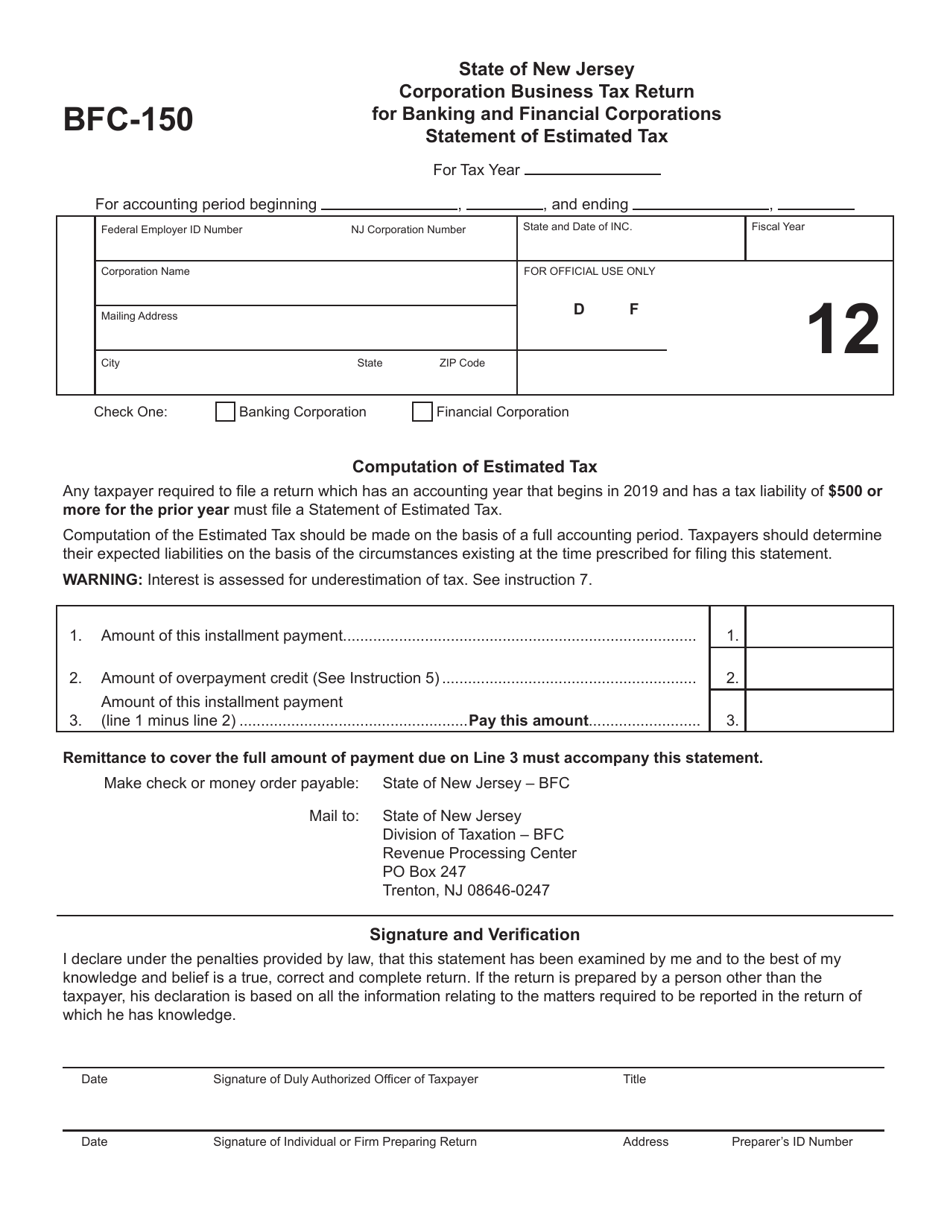

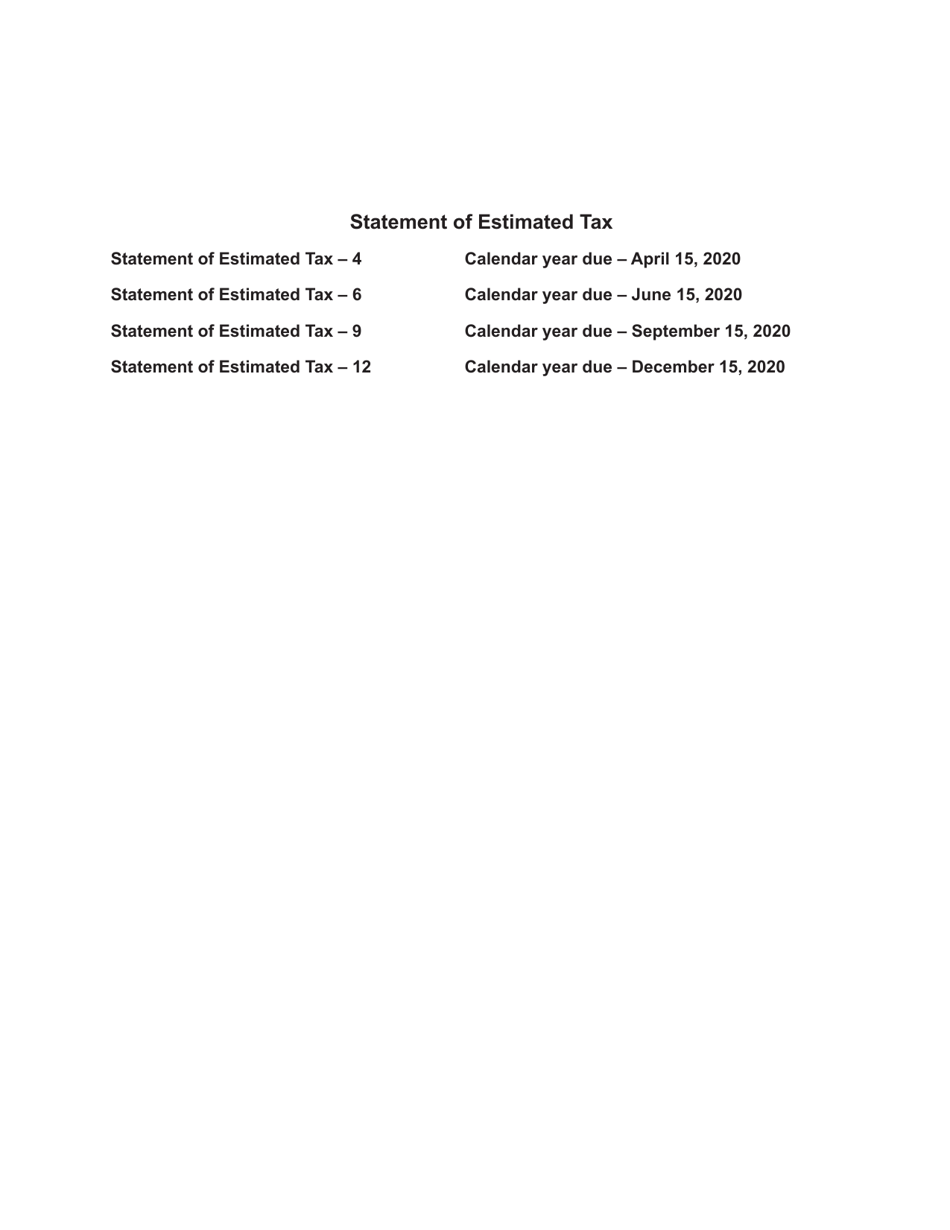

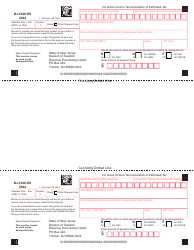

Form BFC-150 Statement of Estimated Tax - New Jersey

What Is Form BFC-150?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BFC-150?

A: Form BFC-150 is the Statement of Estimated Tax for New Jersey.

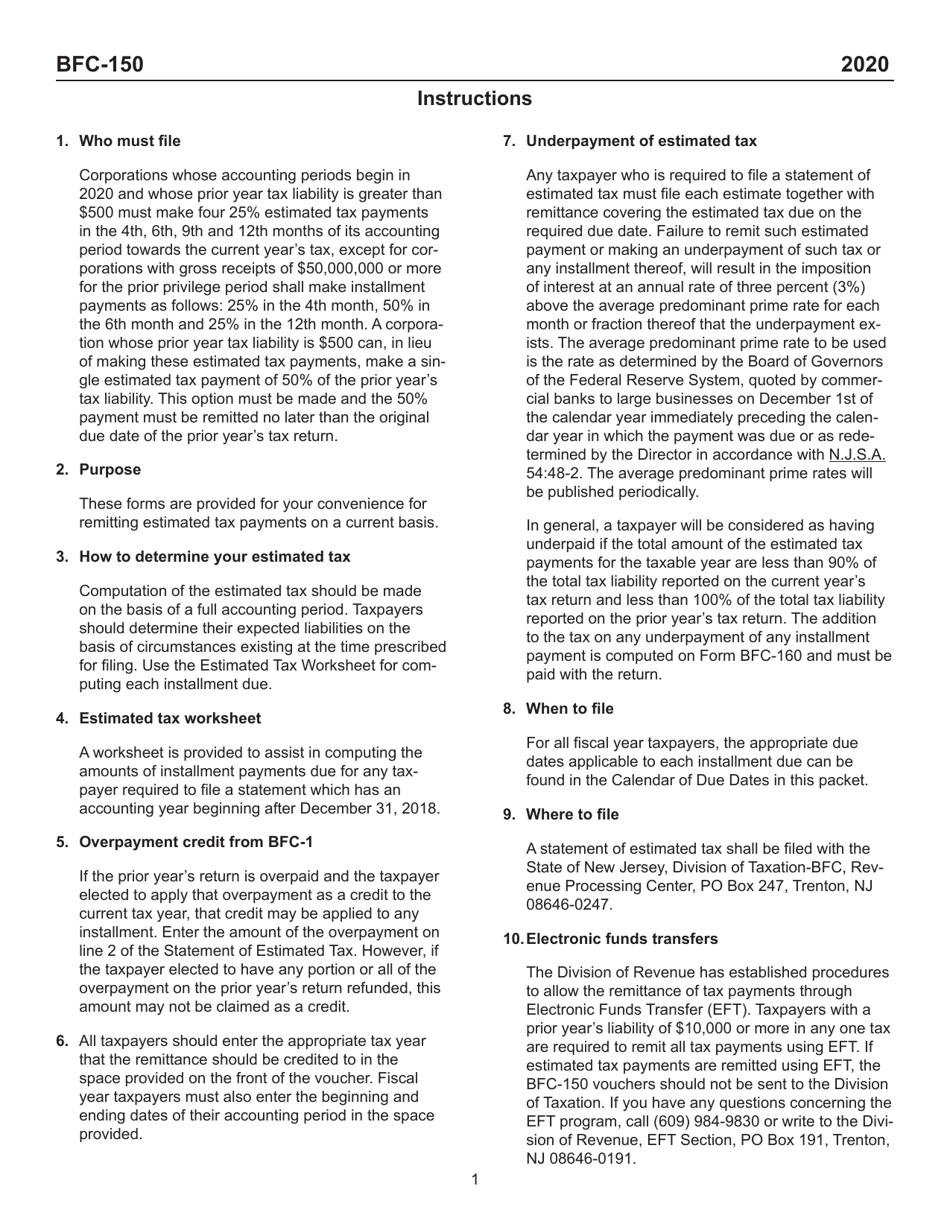

Q: Who needs to file Form BFC-150?

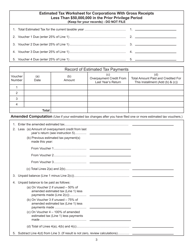

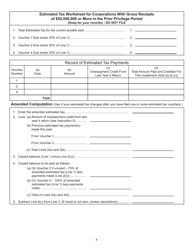

A: Individuals and businesses who expect to owe New Jersey income tax of $400 or more for the tax year.

Q: What is the purpose of Form BFC-150?

A: The purpose of this form is to report and pay estimated income tax for the current tax year.

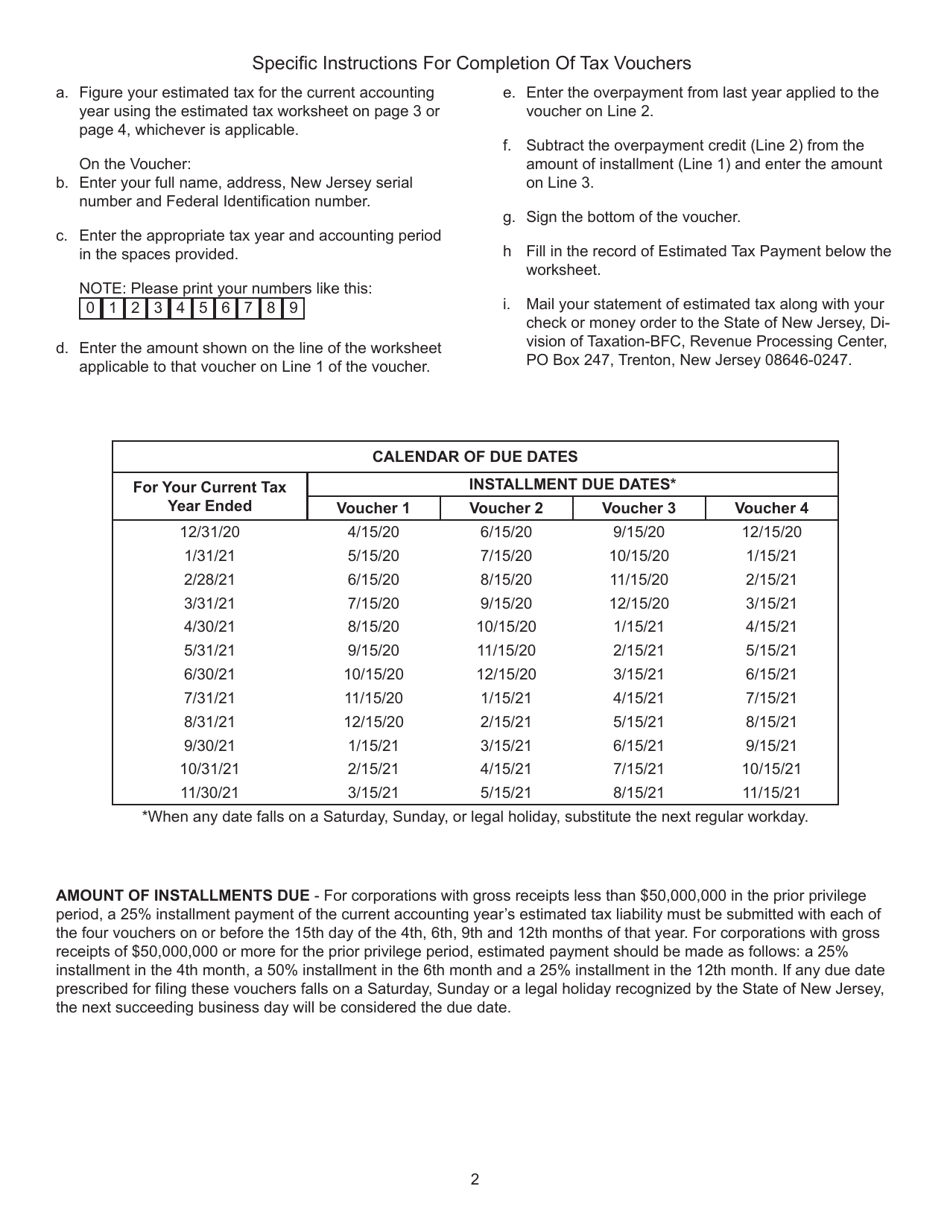

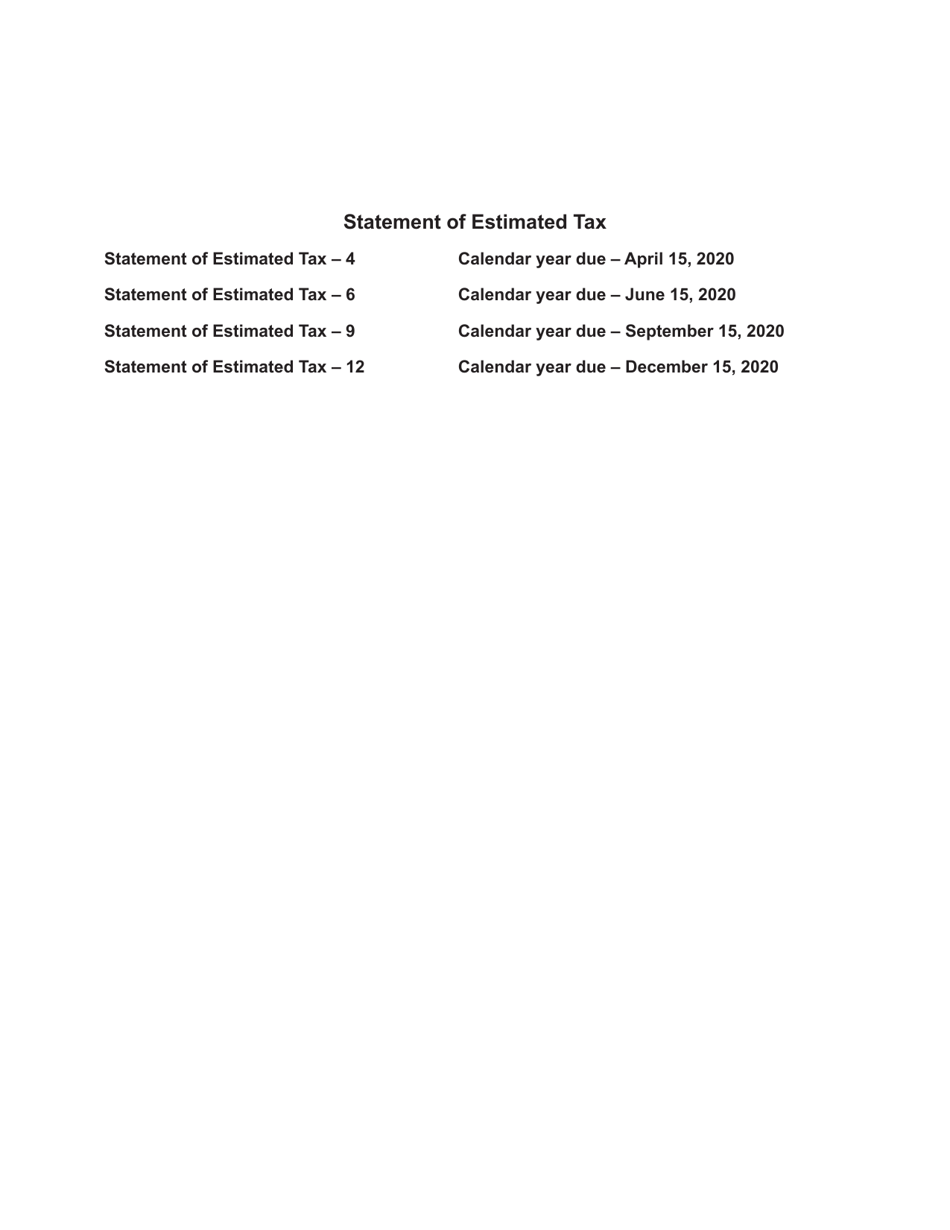

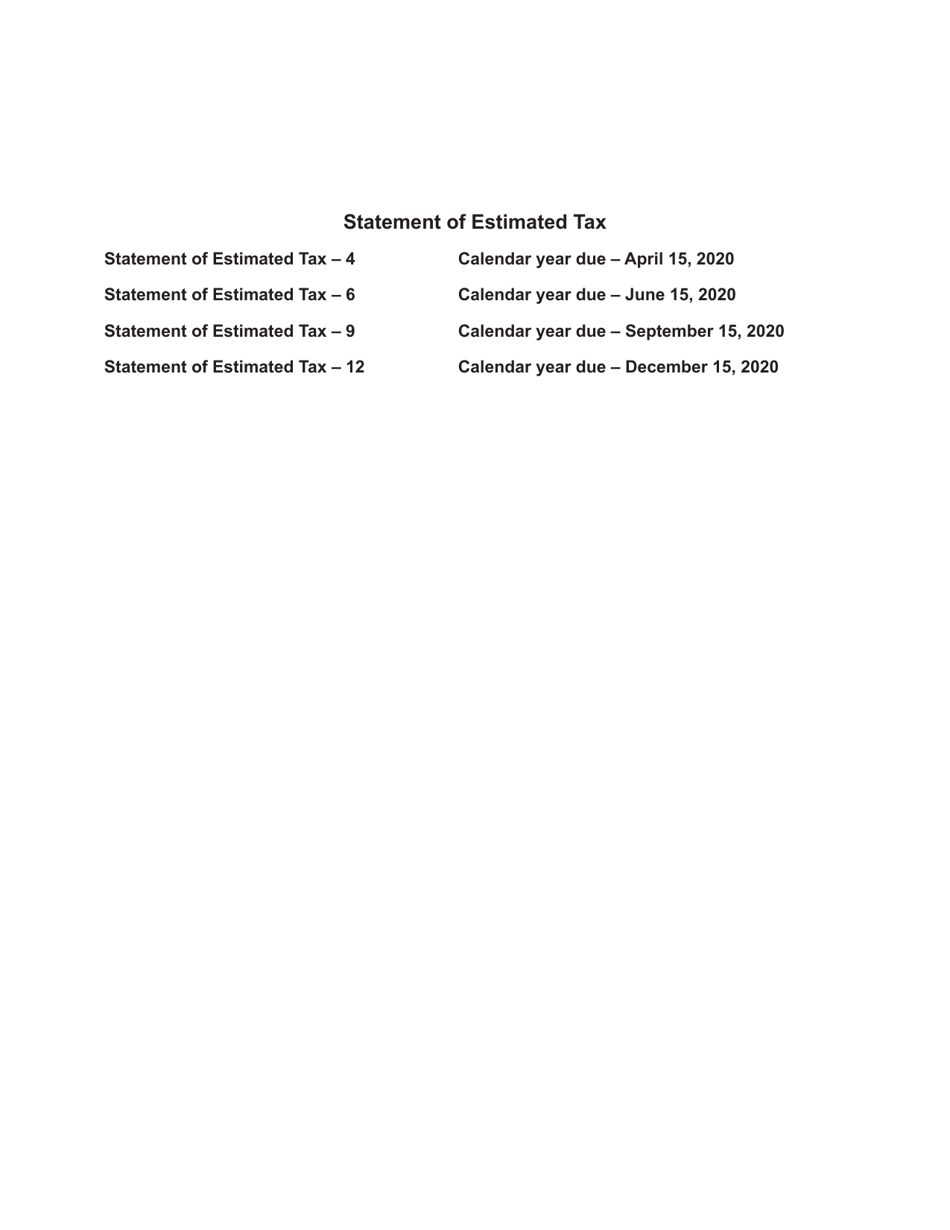

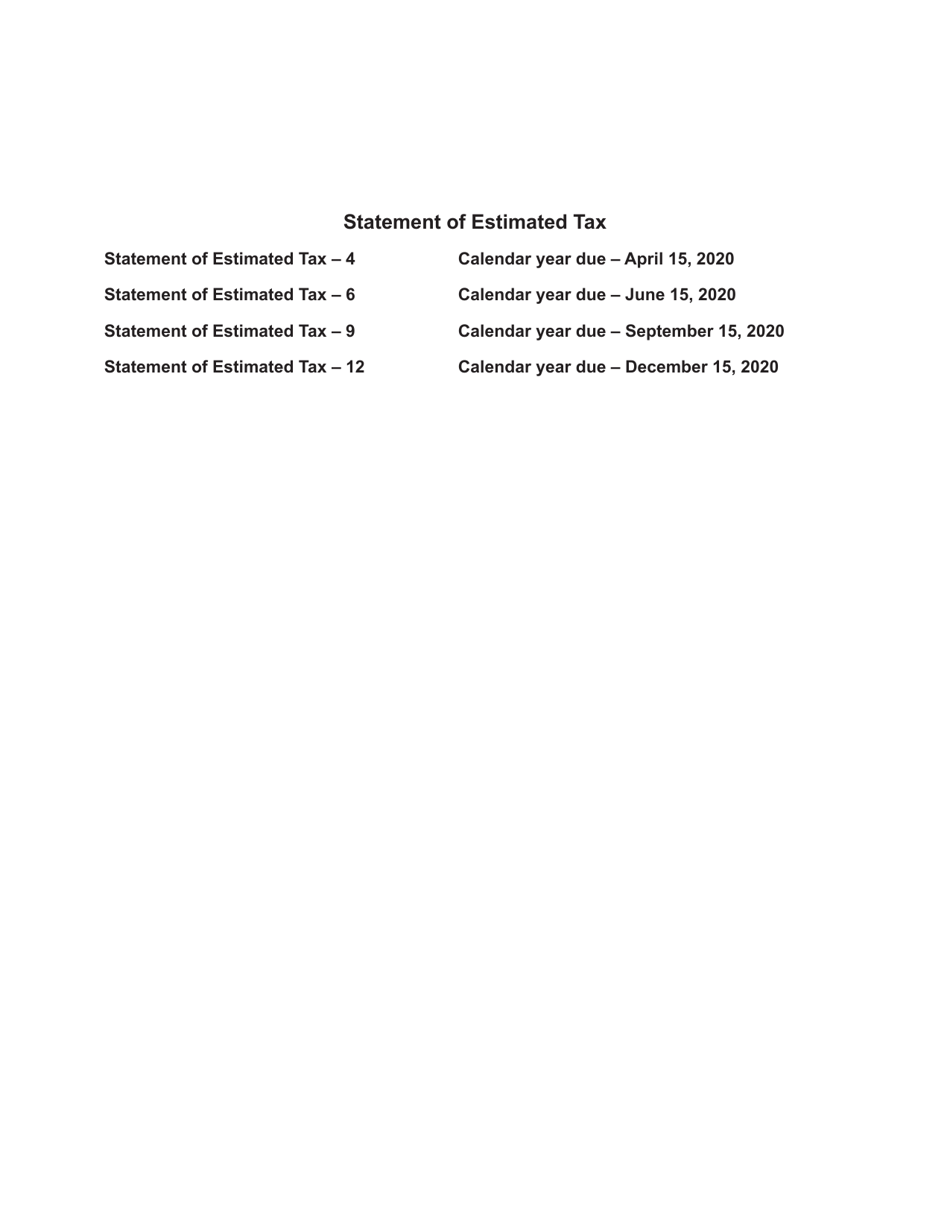

Q: When is Form BFC-150 due?

A: Form BFC-150 is generally due on or before April 15th of each year.

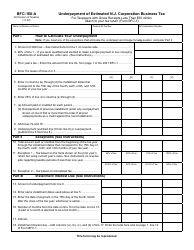

Q: Are there any penalties for not filing Form BFC-150?

A: Yes, there may be penalties for underpayment of estimated tax.

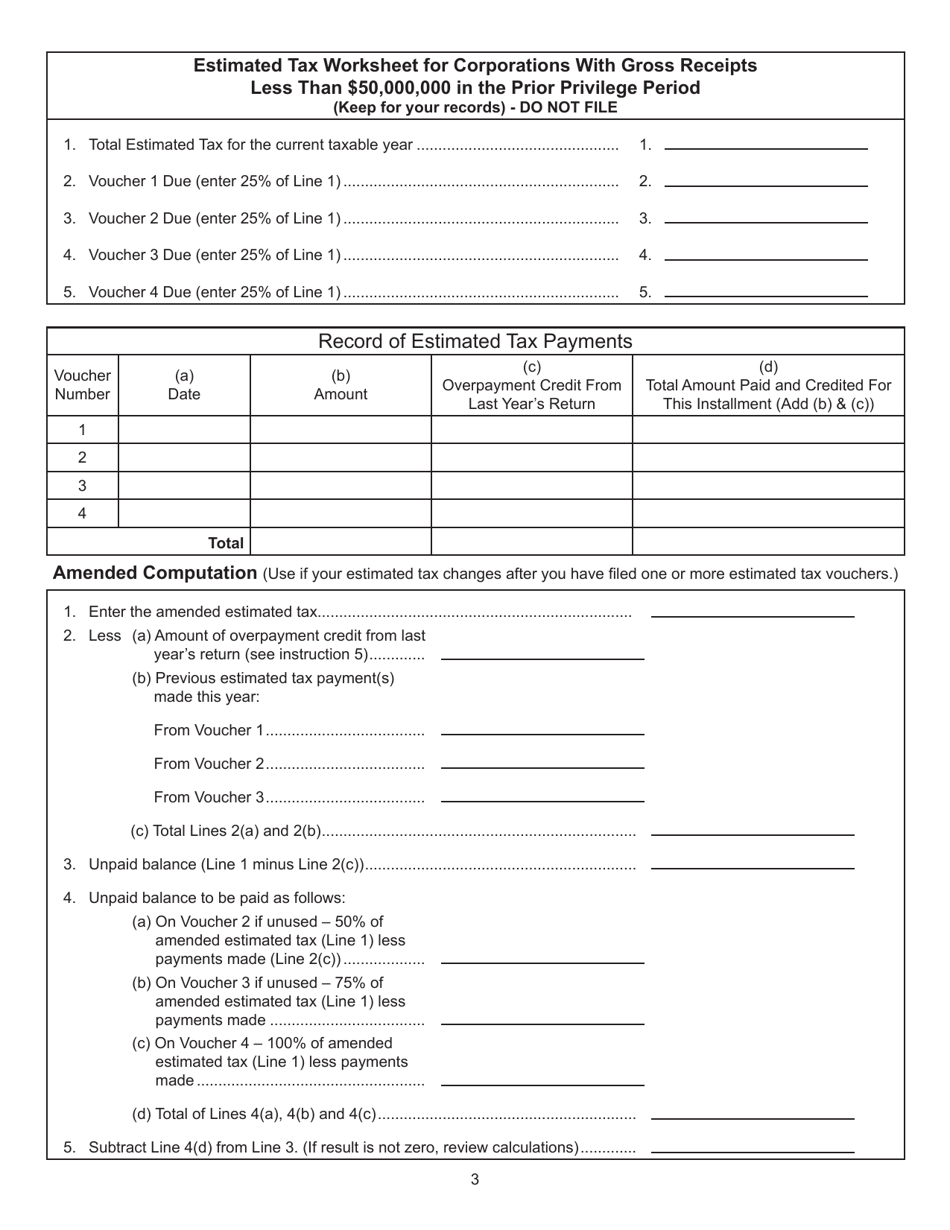

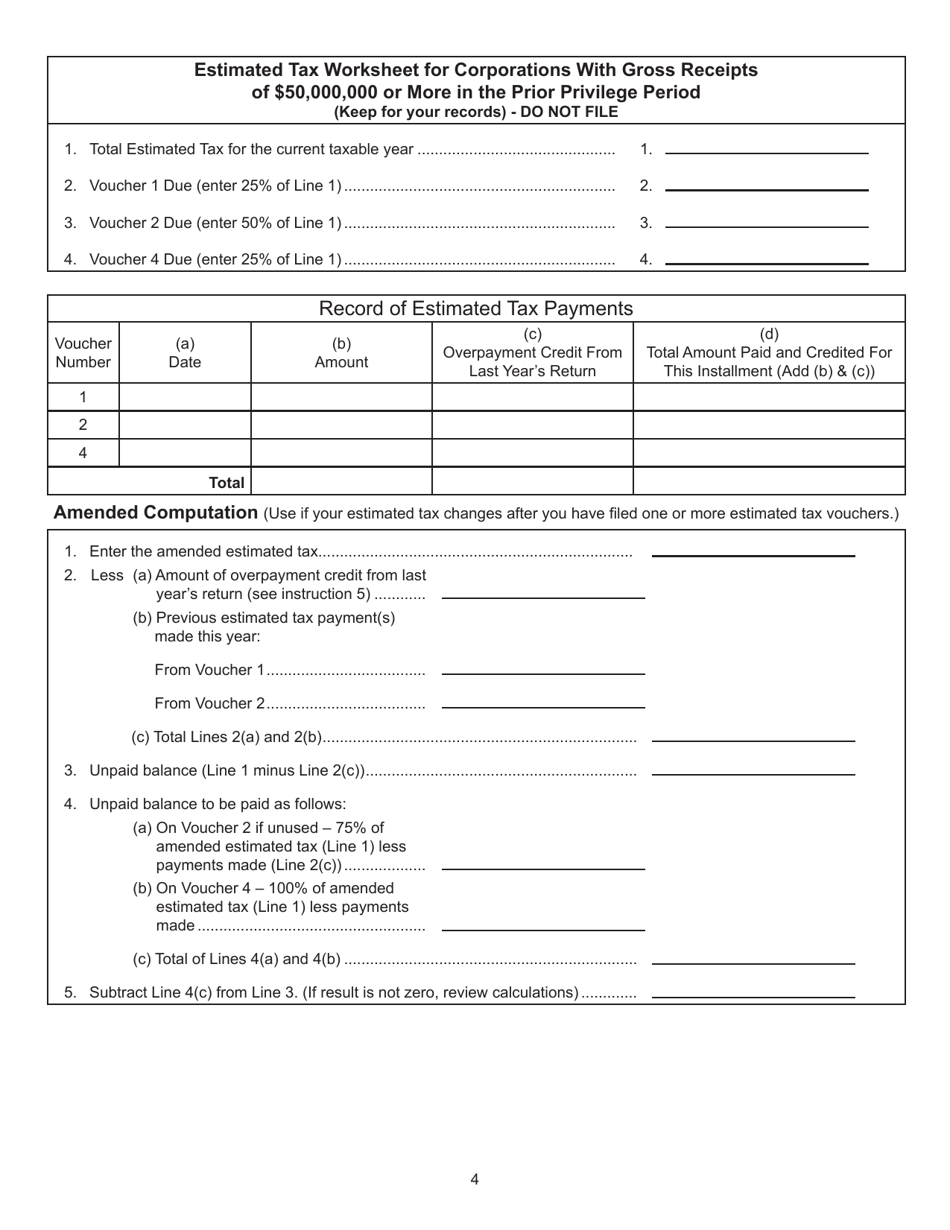

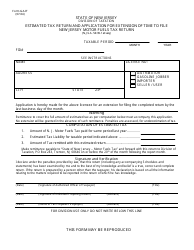

Q: Can I make changes to my estimated tax payments?

A: Yes, you can make changes to your estimated tax payments by filing an amended Form BFC-150.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BFC-150 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.