This version of the form is not currently in use and is provided for reference only. Download this version of

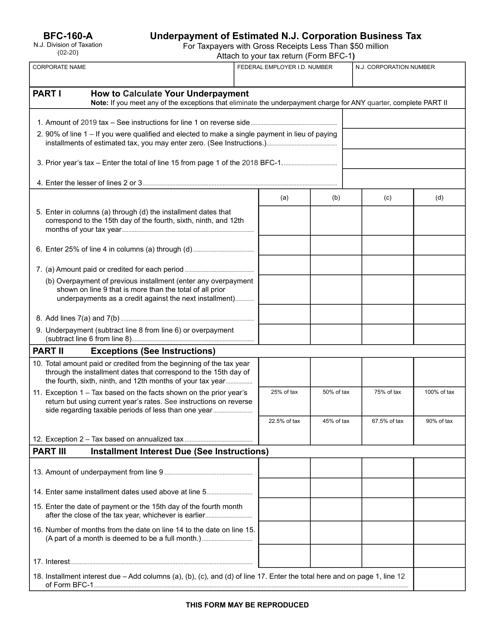

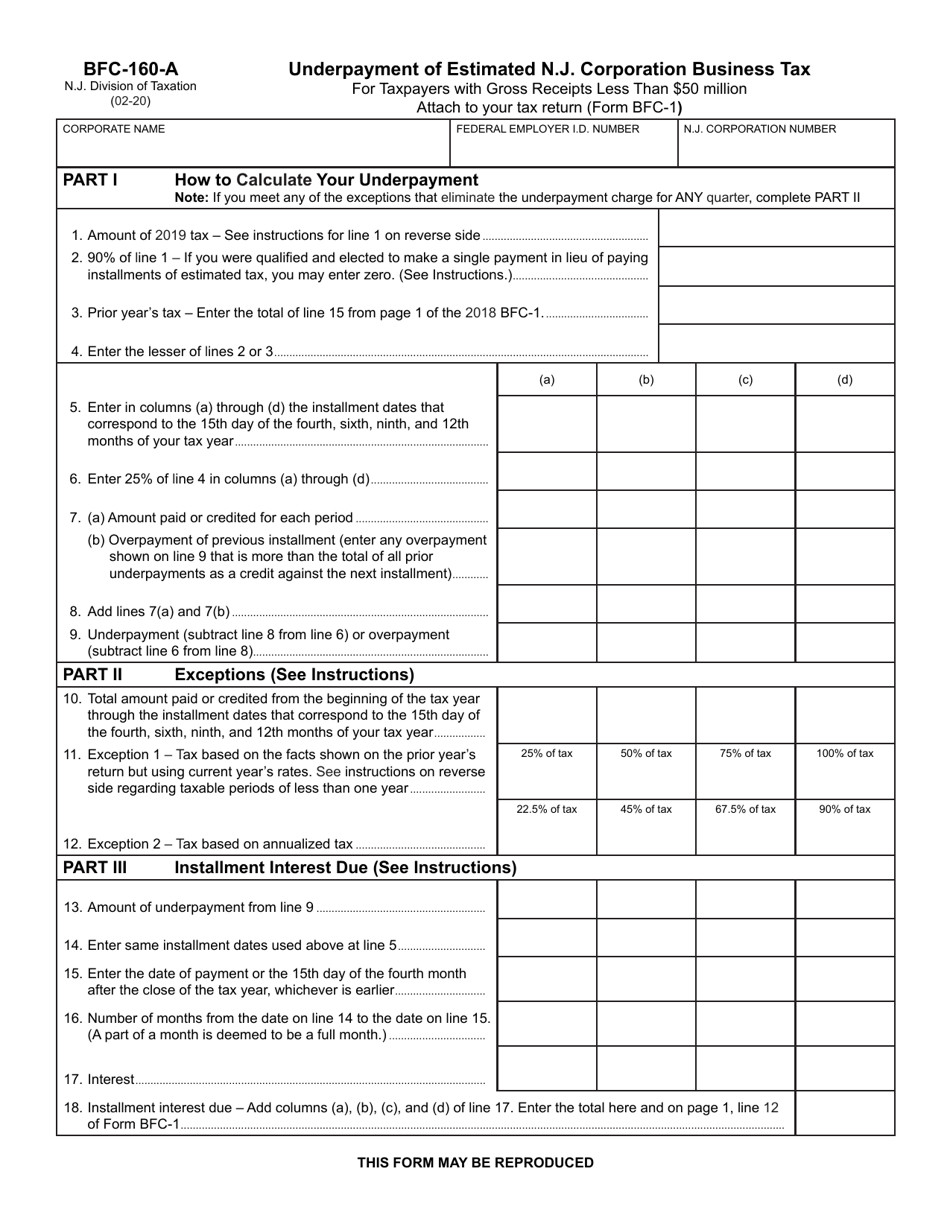

Form BFC-160-A

for the current year.

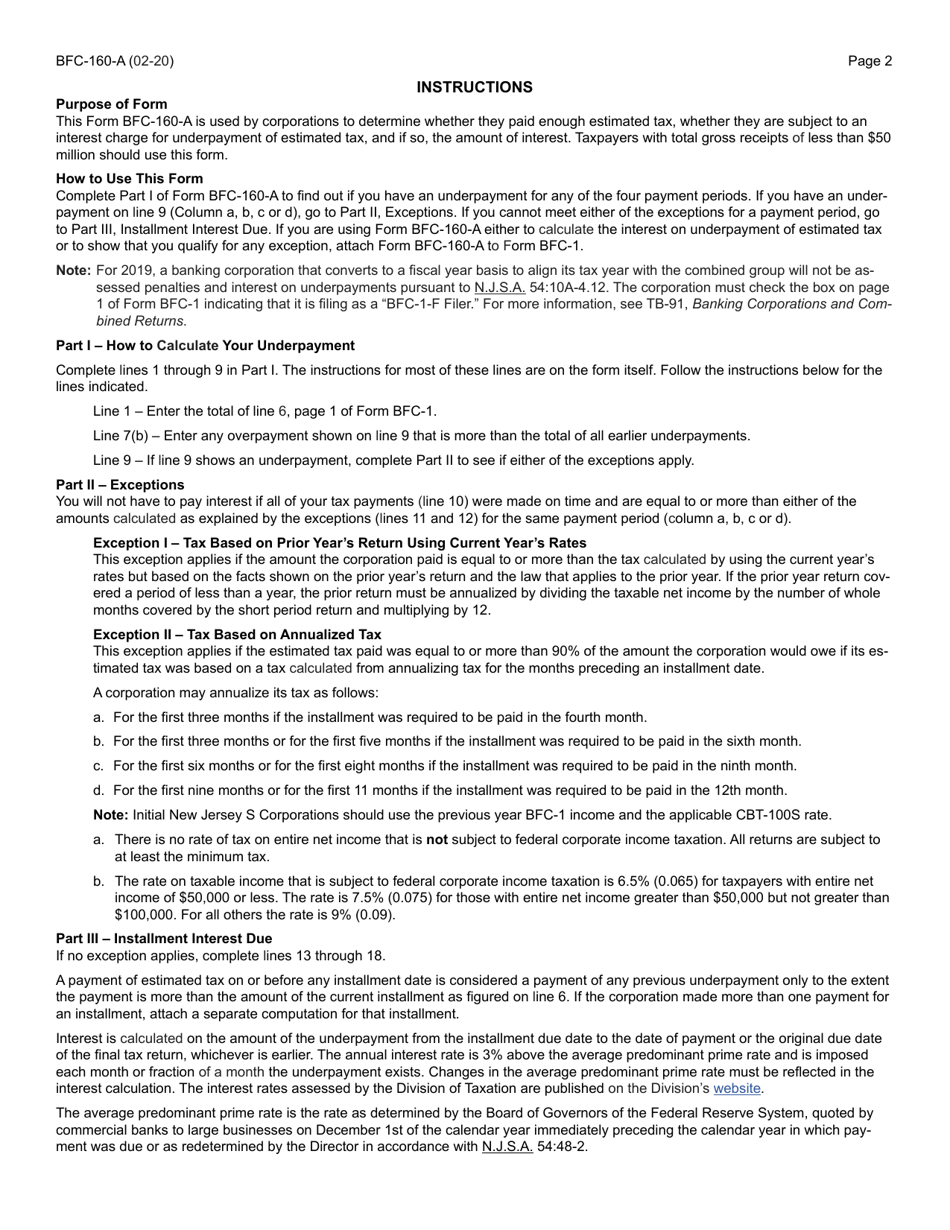

Form BFC-160-A Underpayment of Estimated N.j. Corporation Business Tax - New Jersey

What Is Form BFC-160-A?

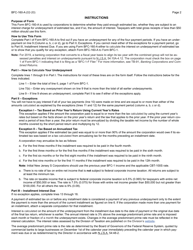

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BFC-160-A?

A: Form BFC-160-A is a form used to report underpayment of estimated N.J. Corporation Business Tax in New Jersey.

Q: Who should file Form BFC-160-A?

A: Corporations in New Jersey who have underpaid their estimated N.J. Corporation Business Tax need to file Form BFC-160-A.

Q: What is the purpose of Form BFC-160-A?

A: The purpose of Form BFC-160-A is to report and reconcile underpayment of estimated N.J. Corporation Business Tax.

Q: When is Form BFC-160-A due?

A: Form BFC-160-A is due on or before the original due date of the corporation's annual tax return.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BFC-160-A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.