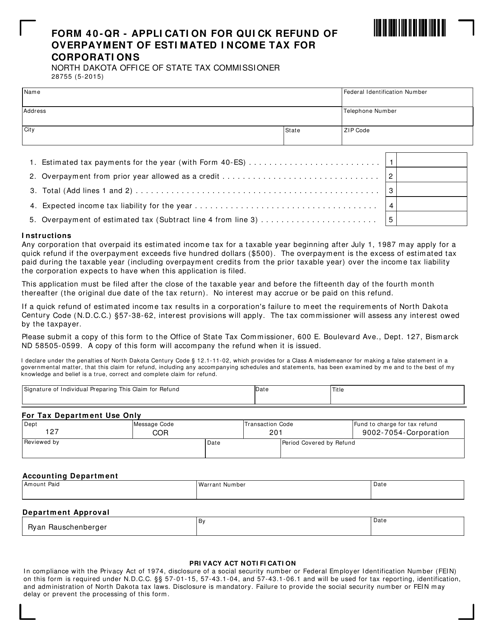

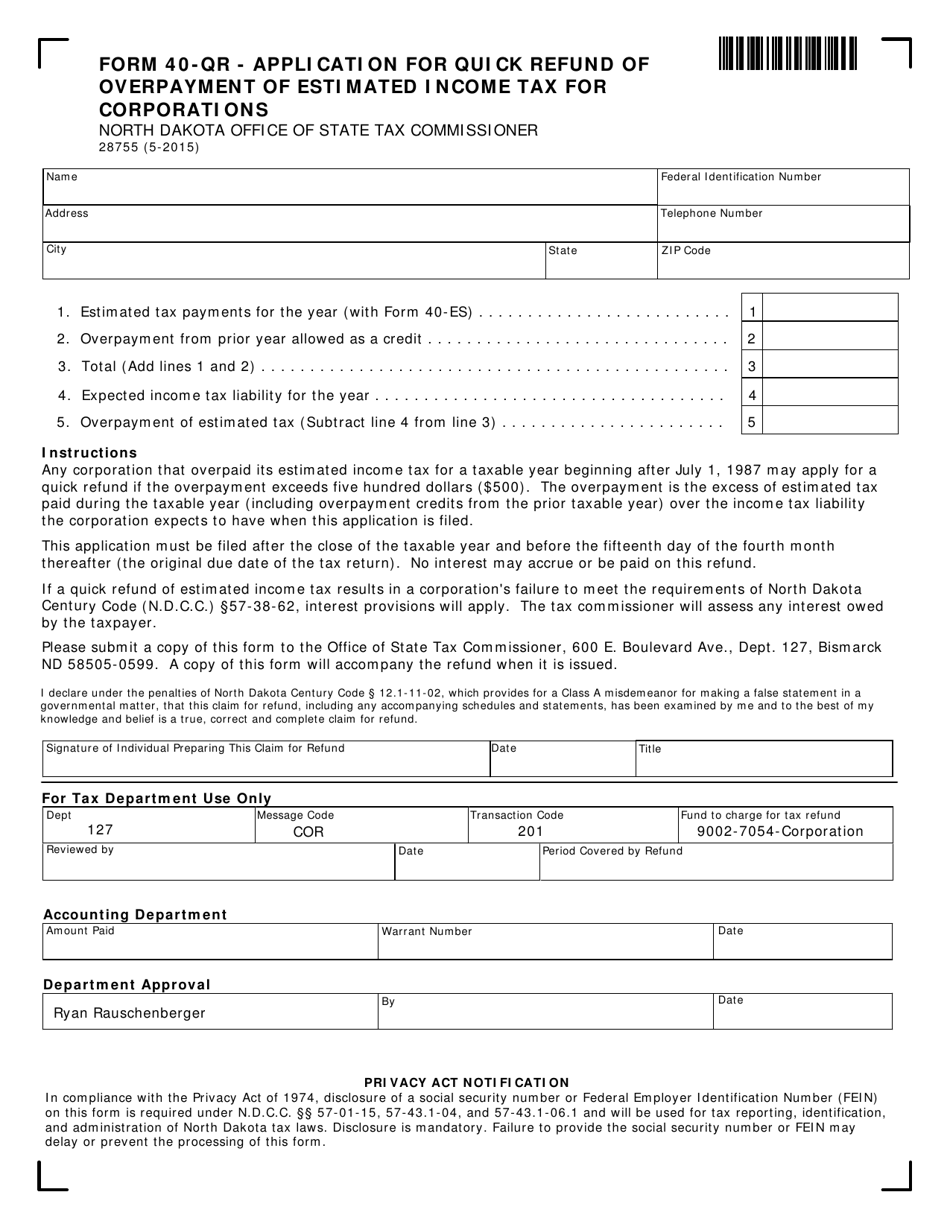

Form 40-QR (28755) Application for Quick Refund of Overpayment of Estimated Income Tax for Corporations - North Dakota

What Is Form 40-QR (28755)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40-QR?

A: Form 40-QR is an application for quick refund of overpayment of estimated income tax for corporations.

Q: Who can use Form 40-QR?

A: Corporations can use Form 40-QR to apply for a quick refund of an overpayment of estimated income tax.

Q: What is the purpose of Form 40-QR?

A: The purpose of Form 40-QR is to request a quick refund of overpayment of estimated income tax for corporations in North Dakota.

Q: How do I fill out Form 40-QR?

A: To fill out Form 40-QR, you will need to provide your corporation's information, details about the overpayment, and sign the form.

Q: How long does it take to receive a quick refund with Form 40-QR?

A: The processing time for a quick refund with Form 40-QR varies, but it is typically faster than regular refund processing.

Q: Can I e-file Form 40-QR?

A: No, Form 40-QR cannot be e-filed and must be submitted by mail.

Q: Is there a fee to file Form 40-QR?

A: No, there is no fee to file Form 40-QR.

Q: Are there any additional forms required to be filed with Form 40-QR?

A: No, only Form 40-QR needs to be filed for requesting a quick refund of overpayment of estimated income tax for corporations in North Dakota.

Form Details:

- Released on May 1, 2015;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-QR (28755) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.