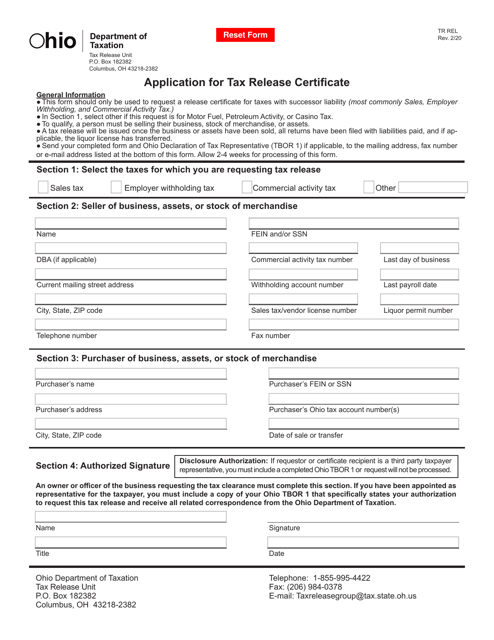

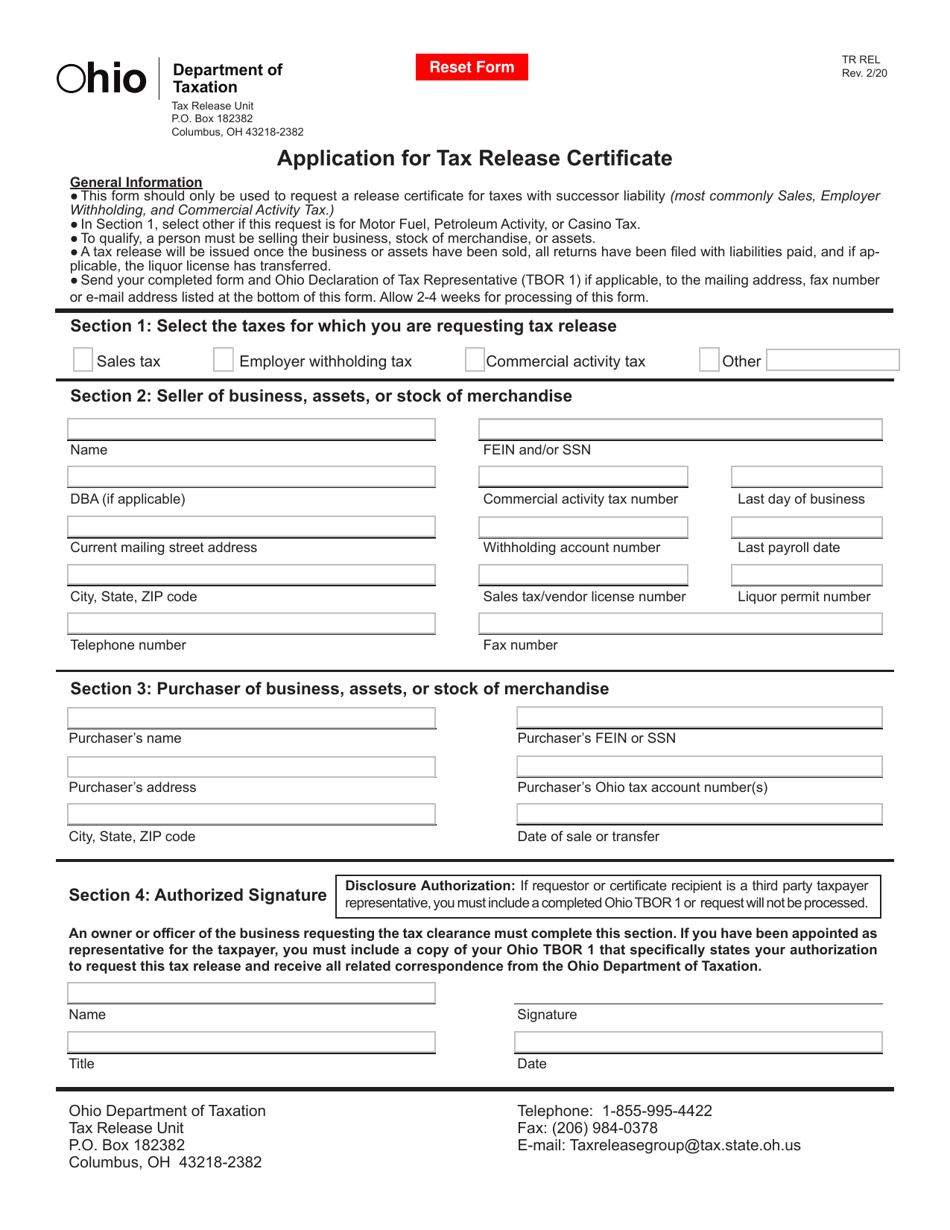

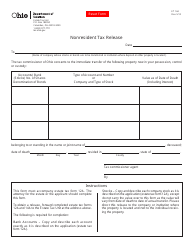

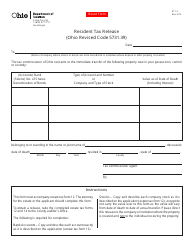

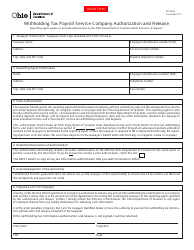

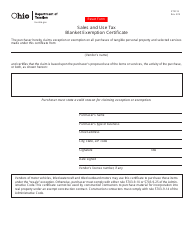

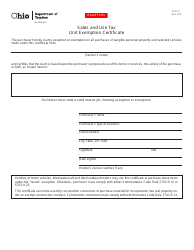

Form TR REL Application for Tax Release Certificate - Ohio

What Is Form TR REL?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TR REL?

A: Form TR REL is the Application for Tax Release Certificate.

Q: What is the purpose of Form TR REL?

A: The purpose of Form TR REL is to apply for a Tax Release Certificate in Ohio.

Q: Who needs to fill out Form TR REL?

A: Any individual or business entity seeking a Tax Release Certificate in Ohio needs to fill out Form TR REL.

Q: What information is required on Form TR REL?

A: Form TR REL requires information such as taxpayer identification number, contact information, and details of the tax debt being released.

Q: How long does it take to process Form TR REL?

A: The processing time for Form TR REL varies. It is recommended to contact the Ohio Department of Taxation for more information.

Q: Are there any other supporting documents required with Form TR REL?

A: Depending on the circumstances, additional supporting documents may be required. It is advised to check the instructions provided with Form TR REL or consult with the Ohio Department of Taxation.

Q: Can Form TR REL be used for tax releases in states other than Ohio?

A: No, Form TR REL is specifically used for tax releases in Ohio. Other states may have different forms and requirements.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TR REL by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.