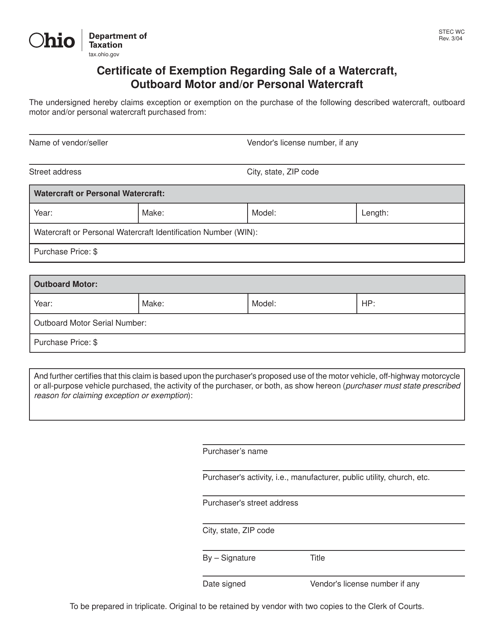

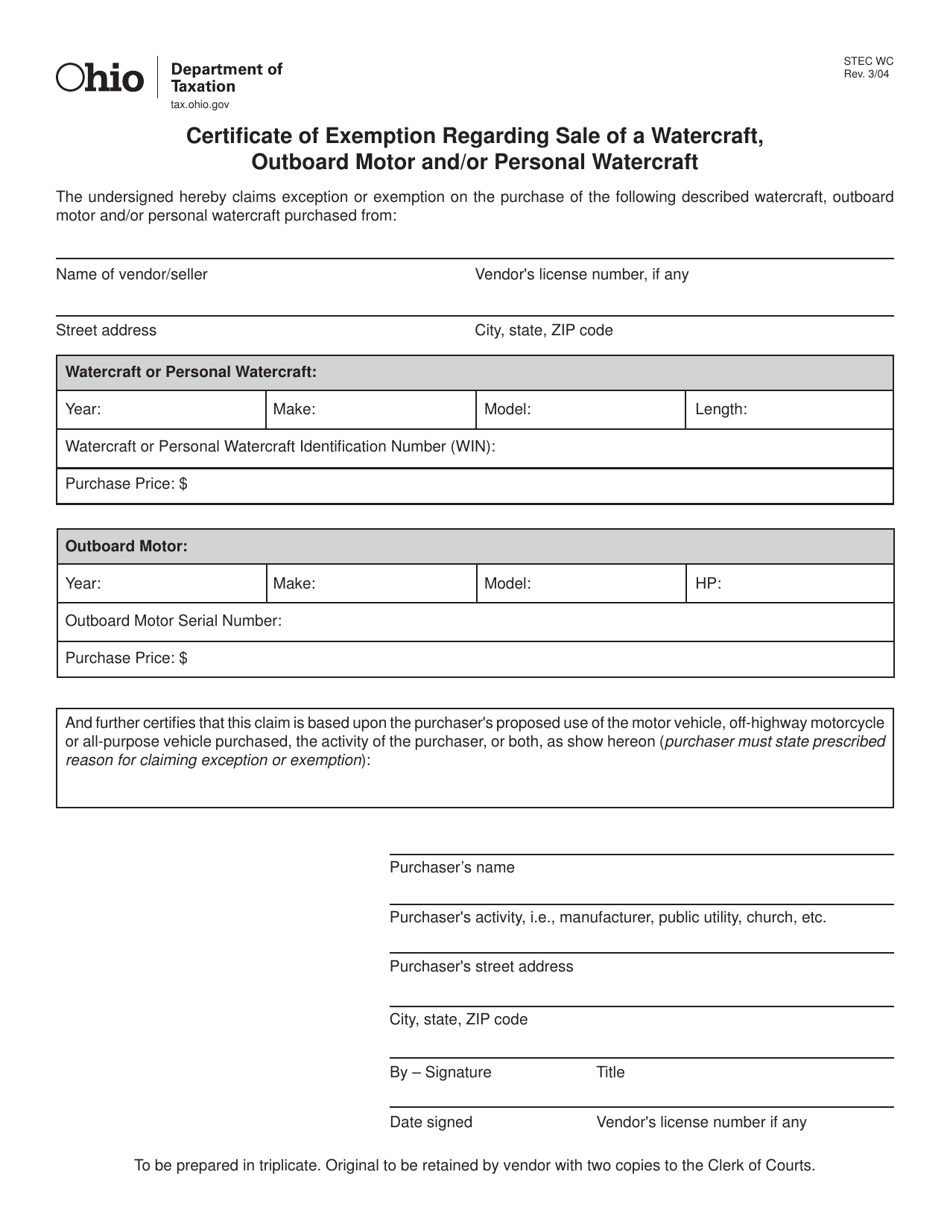

Form STEC WC Certifi Cate of Exemption Regarding Sale of a Watercraft, Outboard Motor and / or Personal Watercraft - Ohio

What Is Form STEC WC?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a STEC WC Certificate of Exemption?

A: A STEC WC Certificate of Exemption is a document related to the sale of a watercraft, outboard motor, and/or personal watercraft in Ohio.

Q: When is a STEC WC Certificate of Exemption required?

A: A STEC WC Certificate of Exemption is required when a watercraft, outboard motor, or personal watercraft is sold in Ohio.

Q: What does the STEC WC Certificate of Exemption exempt?

A: The STEC WC Certificate of Exemption exempts the buyer from paying Ohio sales tax on the purchase of a watercraft, outboard motor, or personal watercraft.

Q: Who is eligible to use the STEC WC Certificate of Exemption?

A: Any individual or entity who is purchasing a watercraft, outboard motor, or personal watercraft for a purpose that qualifies for exemption from Ohio sales tax.

Q: What information is required to complete the STEC WC Certificate of Exemption?

A: The STEC WC Certificate of Exemption requires information such as the buyer's name, address, and tax exemption reason, as well as details about the watercraft, outboard motor, or personal watercraft being purchased.

Q: Are there any limitations or conditions to using the STEC WC Certificate of Exemption?

A: Yes, there are limitations and conditions to using the STEC WC Certificate of Exemption. It is important to review the instructions on the certificate and ensure that you meet all the requirements.

Q: What should I do with the STEC WC Certificate of Exemption once it is completed?

A: Once completed, the STEC WC Certificate of Exemption should be provided to the seller of the watercraft, outboard motor, or personal watercraft. The seller may keep a copy for their records.

Q: What happens if I do not have a STEC WC Certificate of Exemption for my watercraft, outboard motor, or personal watercraft purchase?

A: If you do not have a STEC WC Certificate of Exemption for your purchase, you may be required to pay Ohio sales tax on the transaction.

Q: Is the STEC WC Certificate of Exemption transferable?

A: No, the STEC WC Certificate of Exemption is not transferable. It is specific to the buyer and the specific watercraft, outboard motor, or personal watercraft being purchased.

Form Details:

- Released on March 1, 2004;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STEC WC by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.