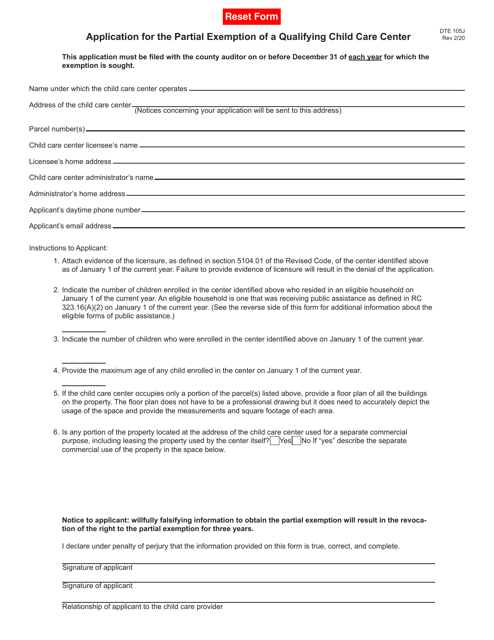

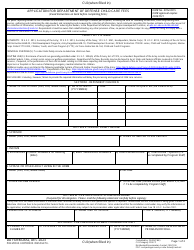

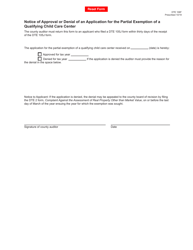

Form DTE105J Application for the Partial Exemption of a Qualifying Child Care Center - Ohio

What Is Form DTE105J?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE105J?

A: Form DTE105J is the application for the partial exemption of a qualifying child care center in Ohio.

Q: Who can use Form DTE105J?

A: Form DTE105J can be used by qualifying child care centers in Ohio to apply for a partial exemption.

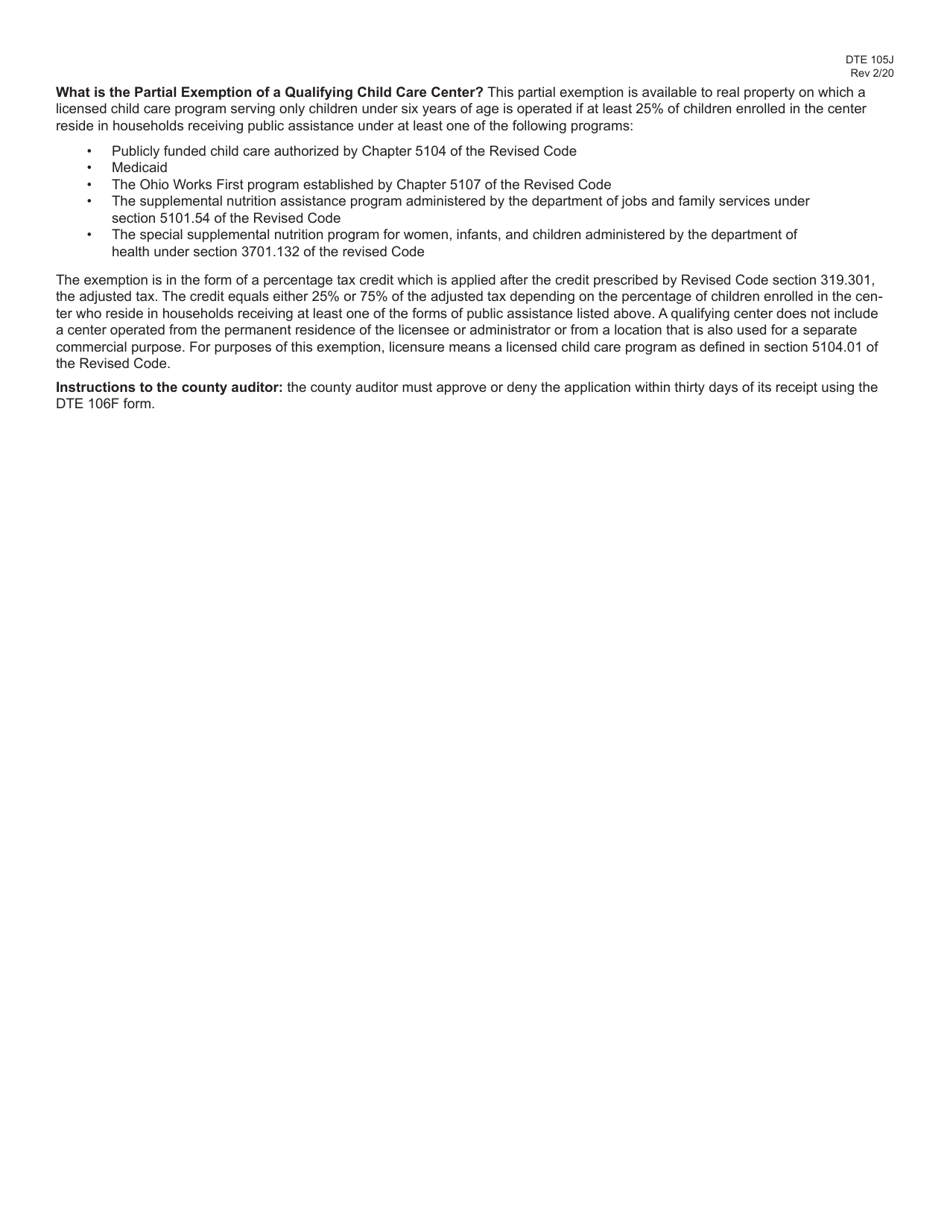

Q: What is the purpose of the partial exemption?

A: The partial exemption is meant to provide a tax reduction for qualifying child care centers in Ohio.

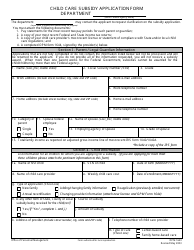

Q: How do I qualify for the partial exemption?

A: To qualify for the partial exemption, you must meet certain criteria set by the Ohio Department of Taxation.

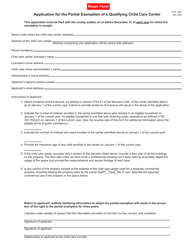

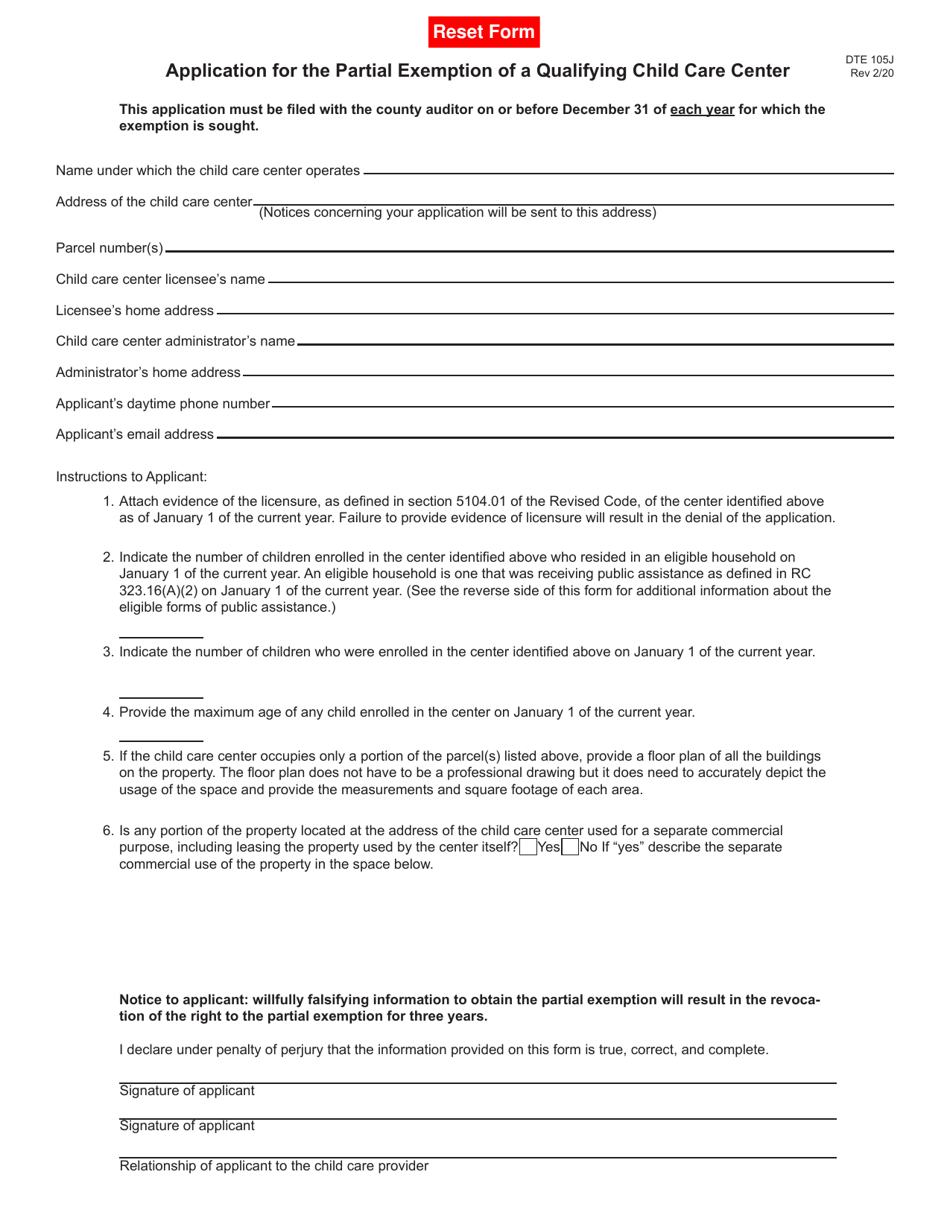

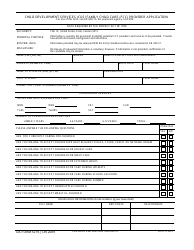

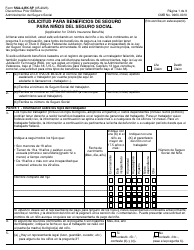

Q: What information do I need to fill out Form DTE105J?

A: You will need to provide information about your child care center, such as its location and operational details.

Q: What is the deadline to submit Form DTE105J?

A: The deadline for submitting Form DTE105J varies, so you should check with the Ohio Department of Taxation for the specific deadline.

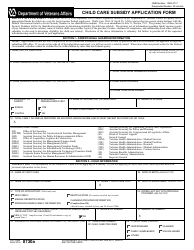

Q: What happens after I submit Form DTE105J?

A: After you submit Form DTE105J, the Ohio Department of Taxation will review your application and notify you of their decision.

Q: Can I appeal if my application for the partial exemption is denied?

A: Yes, you can appeal the decision if your application for the partial exemption is denied by the Ohio Department of Taxation.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE105J by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.