This version of the form is not currently in use and is provided for reference only. Download this version of

Form 773

for the current year.

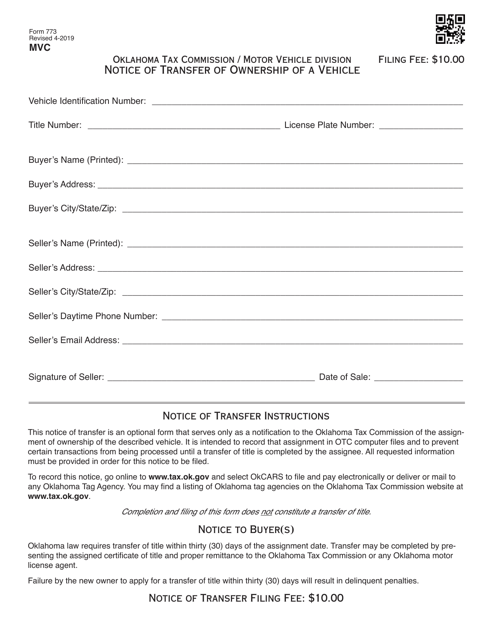

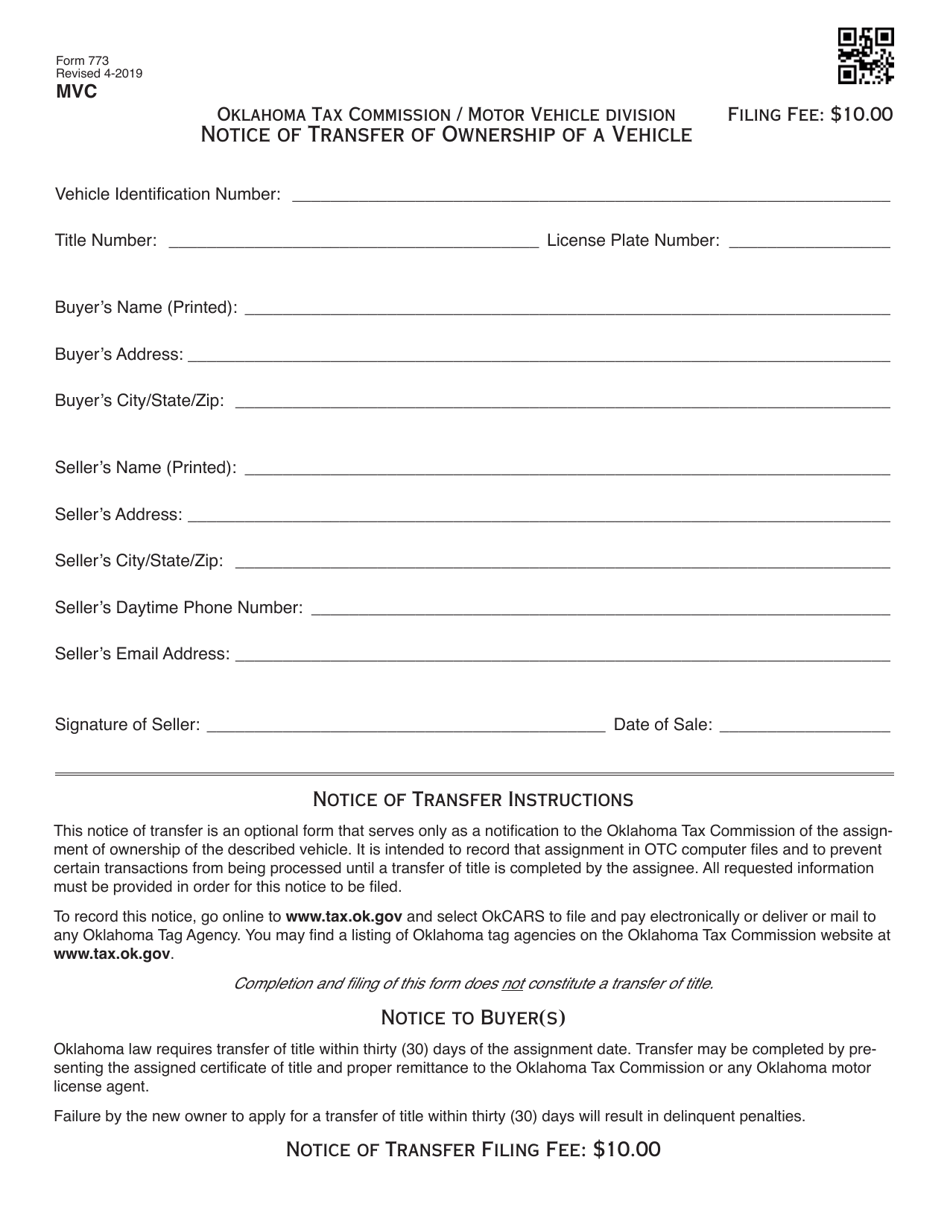

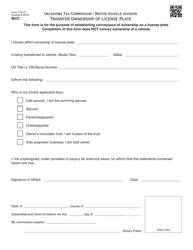

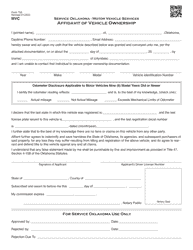

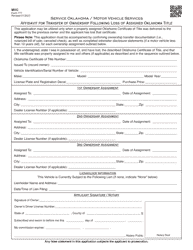

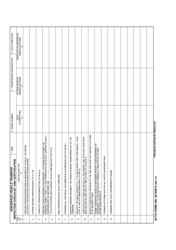

Form 773 Notice of Transfer of Ownership of a Vehicle - Oklahoma

What Is Form 773?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 773?

A: Form 773 is the Notice of Transfer of Ownership of a Vehicle in Oklahoma.

Q: Who needs to fill out Form 773?

A: Form 773 needs to be filled out by the seller of a vehicle in Oklahoma.

Q: What information is required on Form 773?

A: Form 773 requires information such as the seller's name and address, buyer's name and address, vehicle information, and sale date.

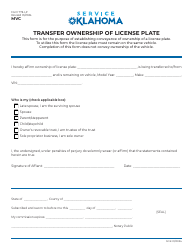

Q: Is Form 773 required for all vehicle sales in Oklahoma?

A: Yes, Form 773 is required for all vehicle sales in Oklahoma, even if the vehicle is given as a gift or sold for a nominal amount.

Q: What should I do with Form 773 after filling it out?

A: After filling out Form 773, the seller should deliver the form to the Oklahoma Tax Commission within 30 days of the sale.

Q: Are there any fees associated with submitting Form 773?

A: Yes, there is a $10 fee for submitting Form 773 to the Oklahoma Tax Commission.

Q: Can Form 773 be submitted electronically?

A: No, Form 773 cannot be submitted electronically and must be mailed to the Oklahoma Tax Commission.

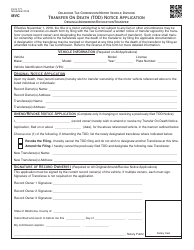

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 773 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.