This version of the form is not currently in use and is provided for reference only. Download this version of

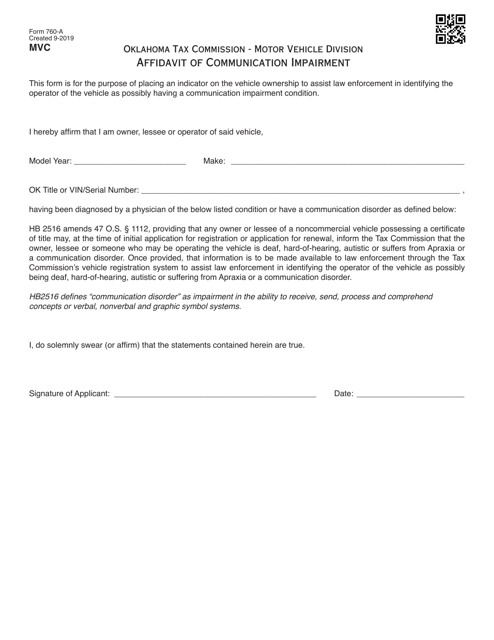

Form 760-A

for the current year.

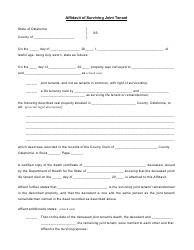

Form 760-A Affidavit of Communication Impairment - Oklahoma

What Is Form 760-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 760-A?

A: Form 760-A is the Affidavit of Communication Impairment.

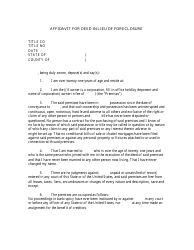

Q: What is the purpose of Form 760-A?

A: The purpose of Form 760-A is to provide documentation of a communication impairment that may affect a person's ability to interact with law enforcement officers during a traffic stop.

Q: Who needs to fill out Form 760-A?

A: Individuals with a communication impairment who wish to provide notification of their condition to law enforcement officers in Oklahoma should fill out the form.

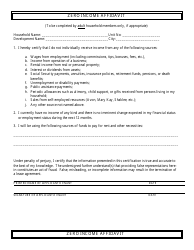

Q: Is there a fee to submit Form 760-A?

A: No, there is no fee to submit Form 760-A.

Q: What should I do with the completed Form 760-A?

A: The completed form should be kept in the individual's vehicle and presented to law enforcement officers when necessary.

Q: Does Form 760-A exempt me from traffic violations?

A: No, Form 760-A does not exempt individuals from traffic violations. It is simply a form of communication for individuals with impairments.

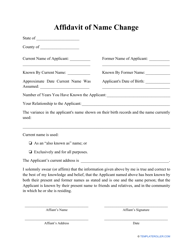

Q: Can I use Form 760-A in other states?

A: Form 760-A is specific to Oklahoma and may not be valid in other states. It is always best to check the requirements of the respective state.

Q: What if I have questions about completing Form 760-A?

A: If you have questions about completing Form 760-A, you can contact the Oklahoma Department of Public Safety for assistance.

Q: Are there any penalties for misusing Form 760-A?

A: Misusing or providing false information on Form 760-A may result in legal consequences. It is important to fill out the form accurately and truthfully.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 760-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.