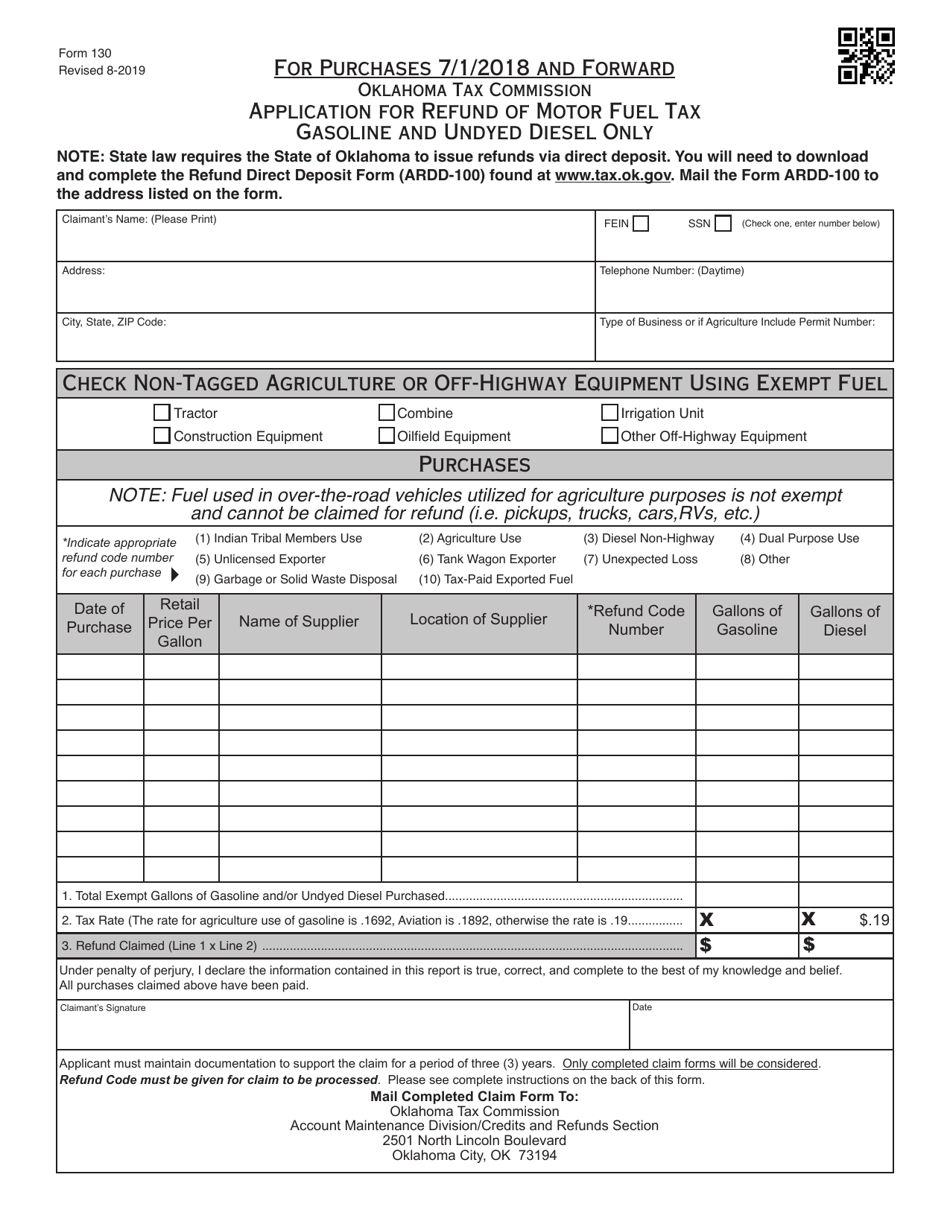

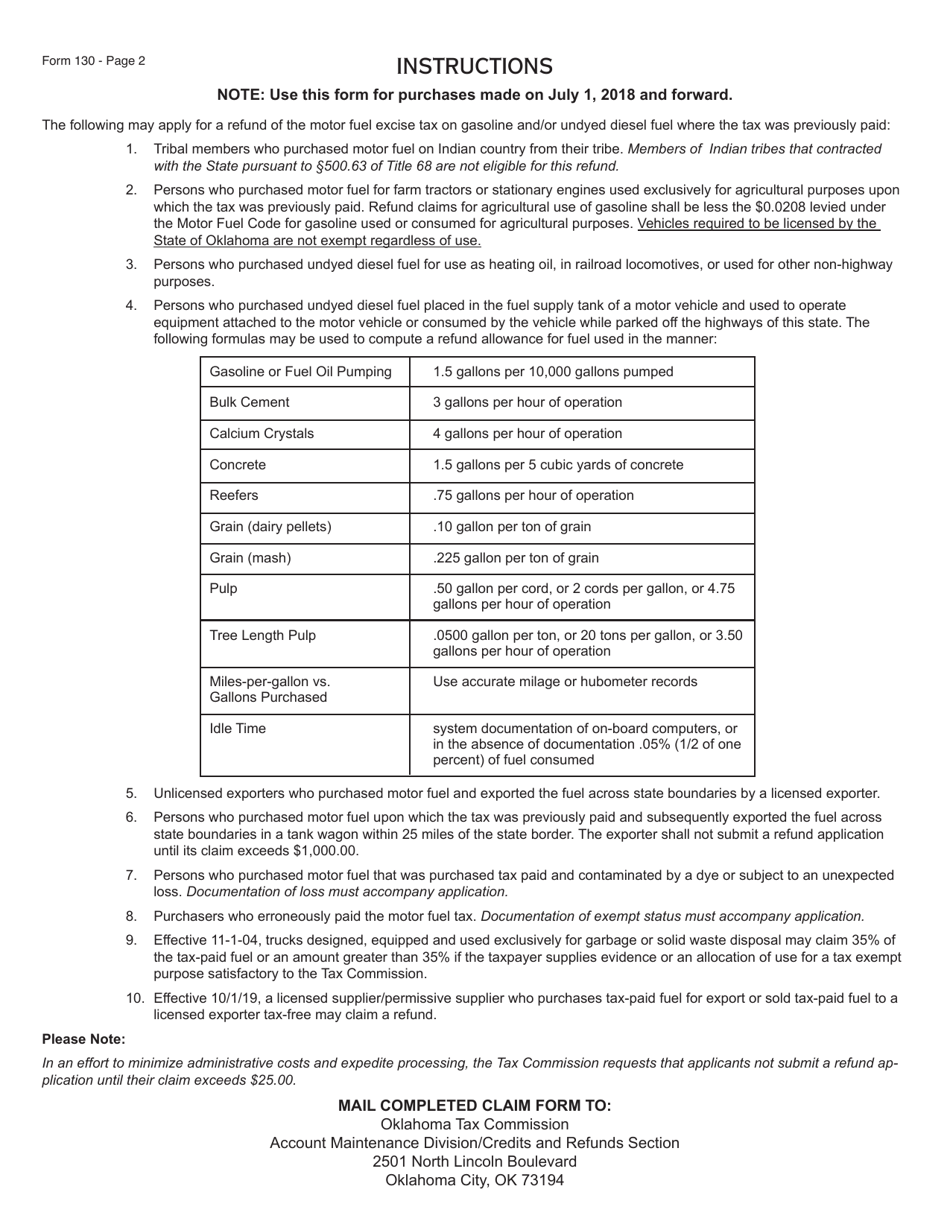

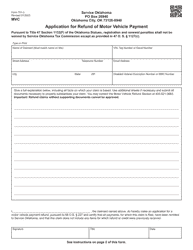

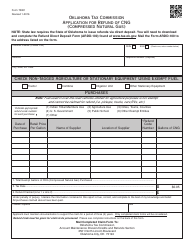

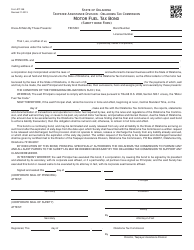

Form 130 Application for Refund of Motor Fuel Tax - Gasoline and Undyed Diesel Only (For Purchases July 1, 2018 and Forward) - Oklahoma

What Is Form 130?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 130?

A: Form 130 is the Application for Refund of Motor Fuel Tax for gasoline and undyed diesel.

Q: What is the purpose of form 130?

A: The purpose of form 130 is to apply for a refund of motor fuel tax on gasoline and undyed diesel purchased in Oklahoma.

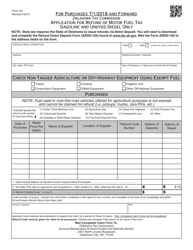

Q: Who is eligible to use form 130?

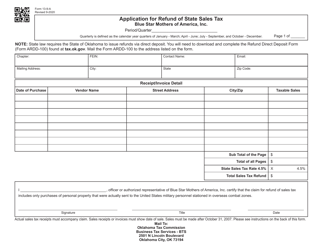

A: Anyone who has purchased gasoline or undyed diesel in Oklahoma after July 1, 2018, is eligible to use form 130 to apply for a refund.

Q: What purchases does form 130 apply to?

A: Form 130 applies to purchases of gasoline and undyed diesel made in Oklahoma after July 1, 2018.

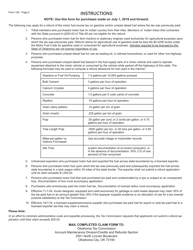

Q: When should I submit form 130?

A: Form 130 should be submitted within one year from the date of purchase.

Q: What documentation is required to accompany form 130?

A: Documentation such as fuel receipts and proof of payment is required to accompany form 130.

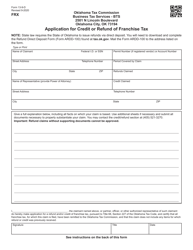

Q: How long does it take to receive a refund using form 130?

A: The processing time for a refund application using form 130 is typically 45 days.

Q: Can I file form 130 electronically?

A: Yes, the Oklahoma Tax Commission allows for electronic filing of form 130.

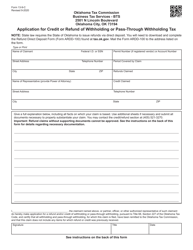

Q: What should I do if I have more questions about form 130?

A: If you have more questions about form 130, you can contact the Oklahoma Tax Commission for assistance.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 130 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.