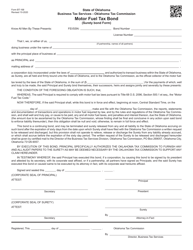

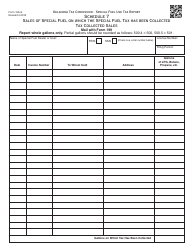

Form 105-14 Motor Fuel Bonded Importer Monthly Tax Calculation (For Filing Returns After July 1, 2018) - Oklahoma

What Is Form 105-14?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 105-14?

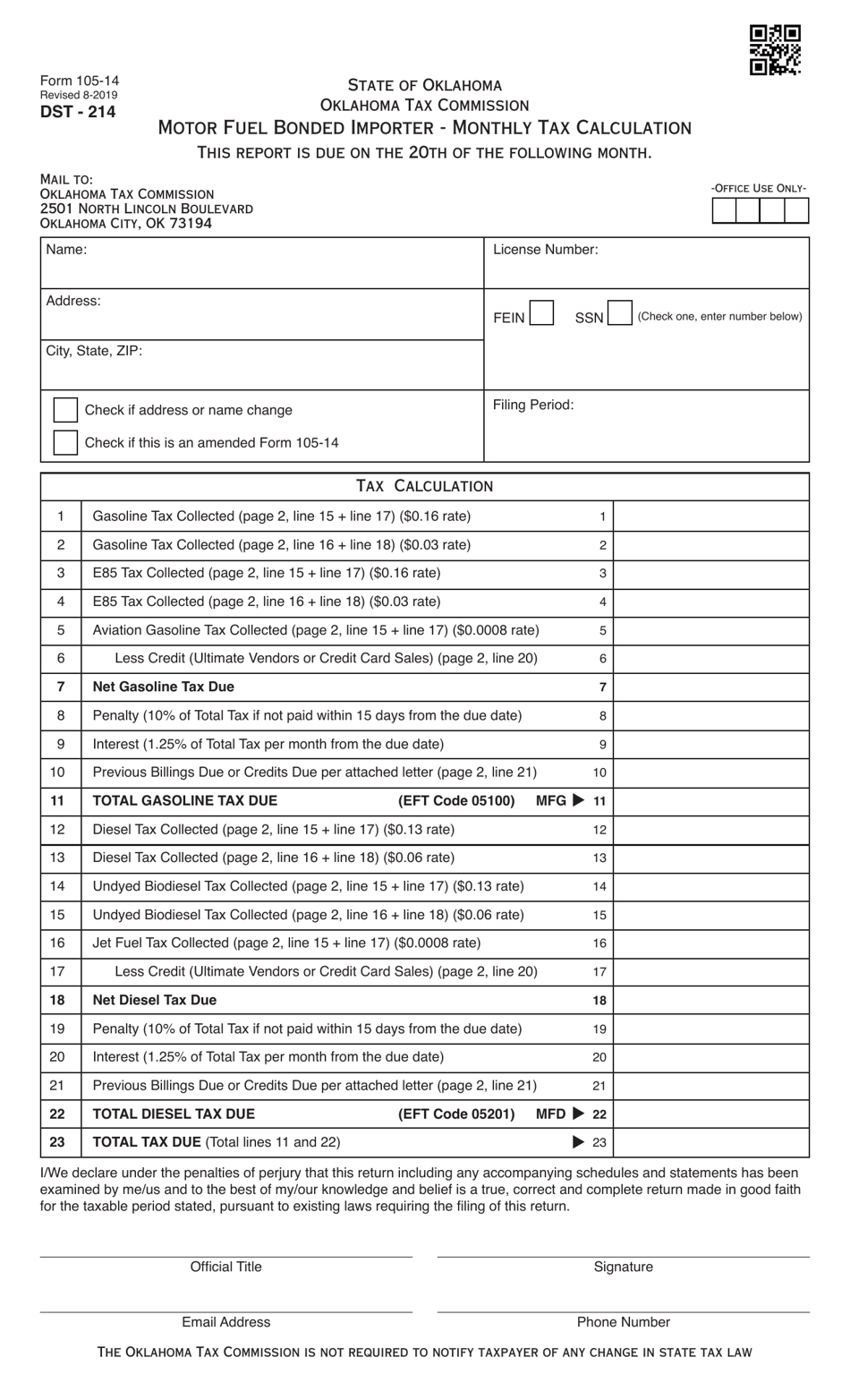

A: Form 105-14 is the Motor Fuel Bonded Importer Monthly Tax Calculation form used for filing returns after July 1, 2018 in Oklahoma.

Q: Who should use Form 105-14?

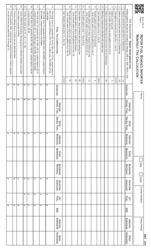

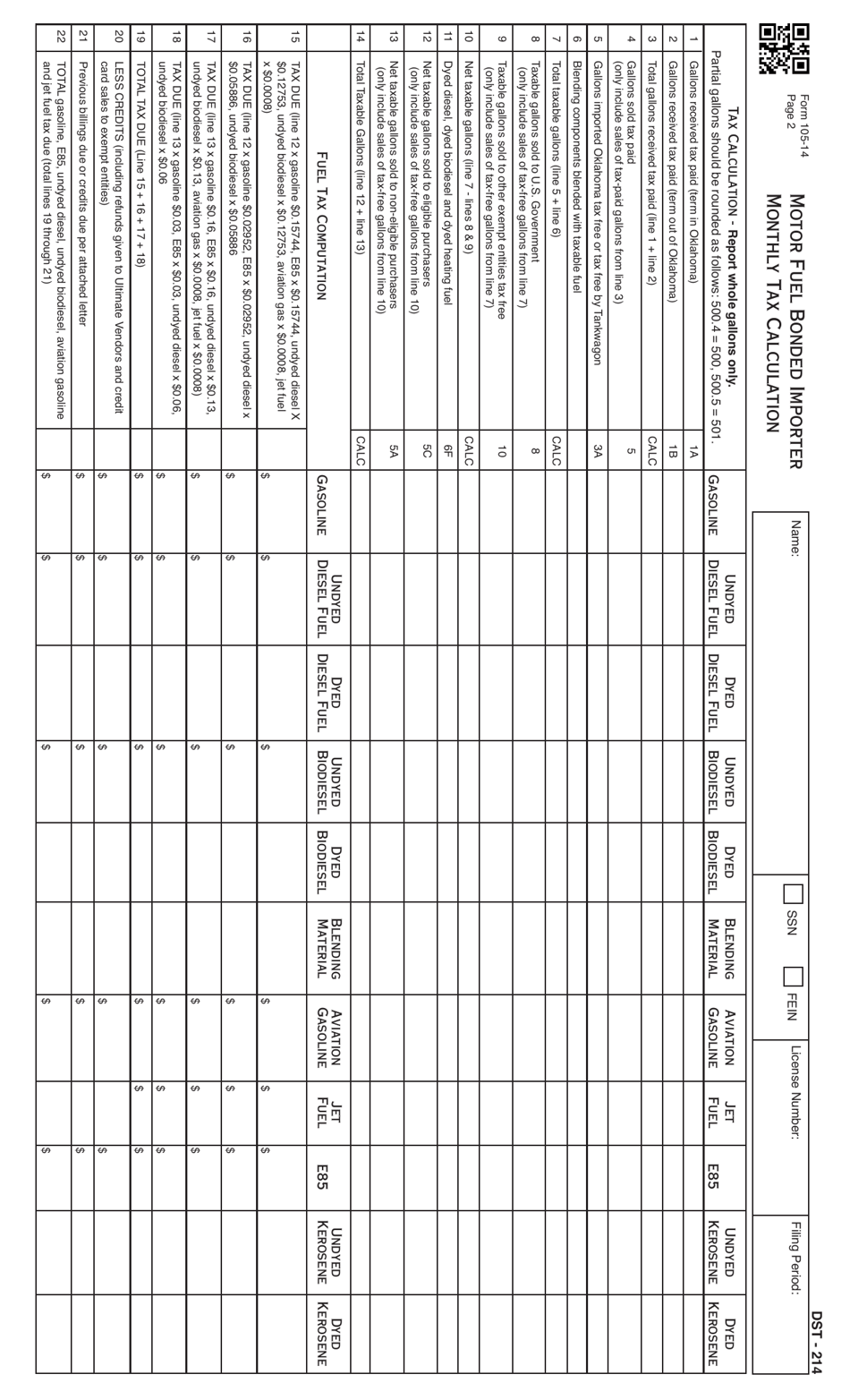

A: Bonded importers of motor fuel in Oklahoma should use Form 105-14 for monthly tax calculation.

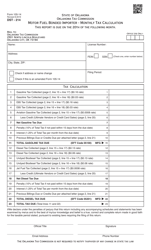

Q: What is the purpose of Form 105-14?

A: The purpose of Form 105-14 is to calculate and report the monthly tax liability for bonded importers of motor fuel in Oklahoma.

Q: When should Form 105-14 be filed?

A: Form 105-14 should be filed for monthly tax calculation after July 1, 2018 in Oklahoma.

Q: Is Form 105-14 specific to Oklahoma?

A: Yes, Form 105-14 is specific to Oklahoma and is used for motor fuel tax calculation in the state.

Q: Is there a deadline for filing Form 105-14?

A: Yes, there is a deadline for filing Form 105-14. Please refer to the instructions or contact the Oklahoma Tax Commission for specific deadlines.

Q: Are there any penalties for late filing of Form 105-14?

A: Yes, late filing of Form 105-14 may result in penalties. It is important to file the form on time to avoid any penalties.

Q: Can I file Form 105-14 electronically?

A: Yes, you may be able to file Form 105-14 electronically. Please check with the Oklahoma Tax Commission for available electronic filing options.

Q: What other forms may be required along with Form 105-14?

A: Depending on your situation, other forms such as Schedule R and Schedule T may be required along with Form 105-14. Check the instructions or contact the Oklahoma Tax Commission for more information.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 105-14 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.