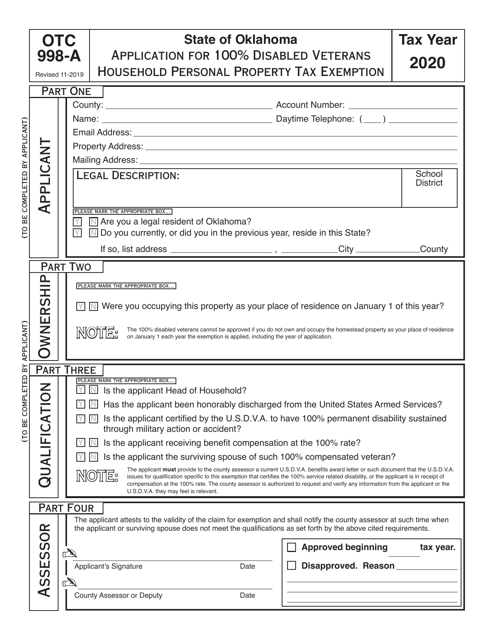

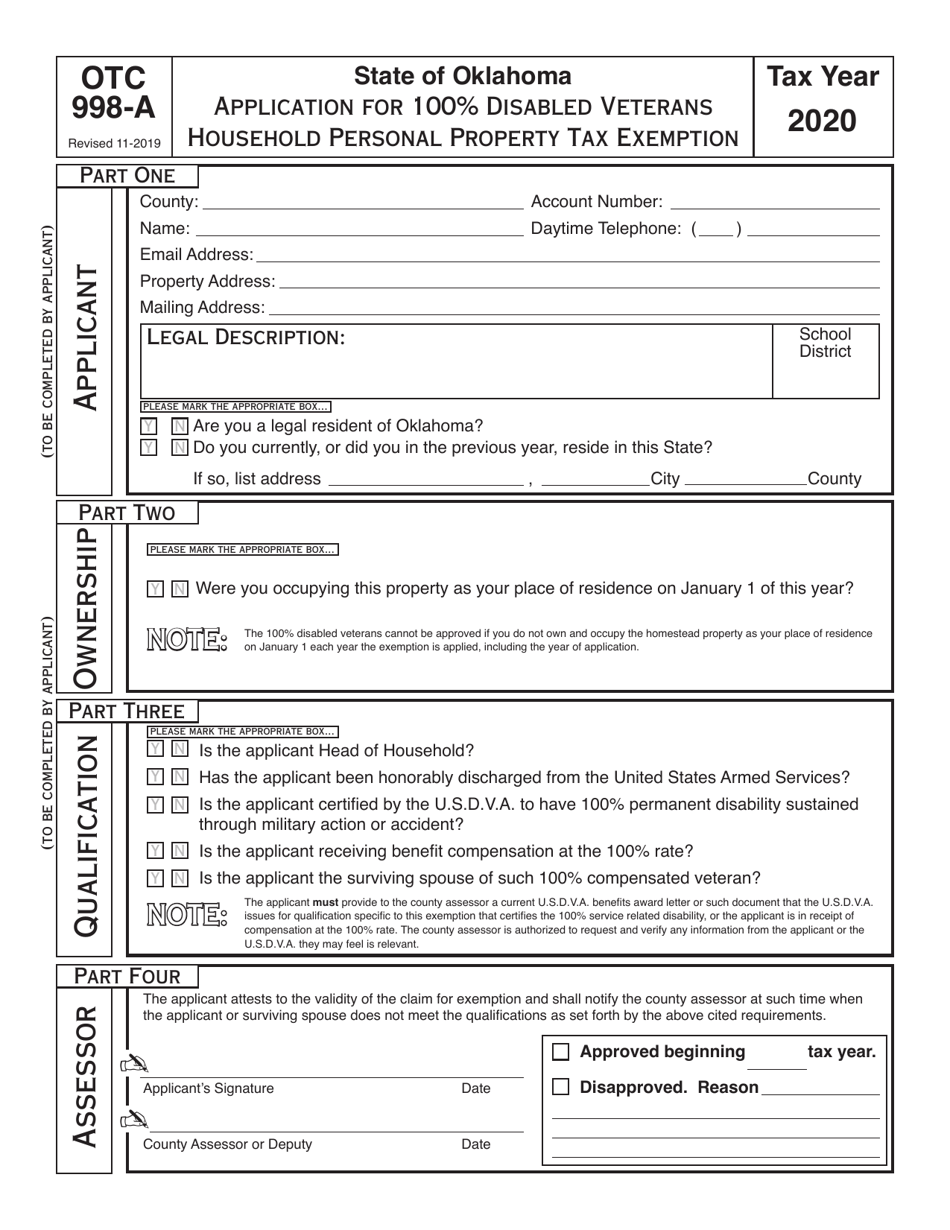

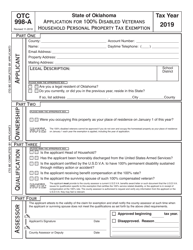

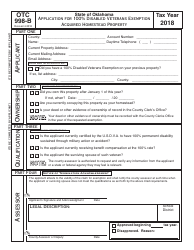

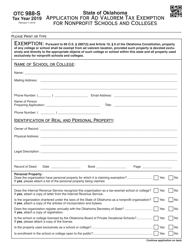

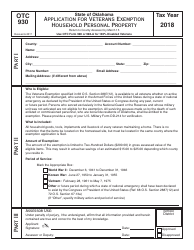

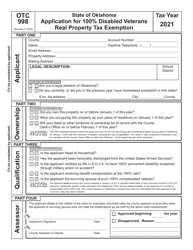

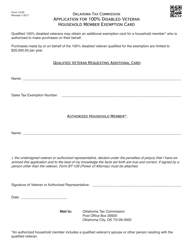

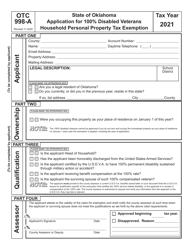

OTC Form 998-A Application for 100% Disabled Veterans Household Personal Property Tax Exemption - Oklahoma

What Is OTC Form 998-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 998-A?

A: OTC Form 998-A is the application form for the 100% Disabled Veterans Household Personal Property Tax Exemption in Oklahoma.

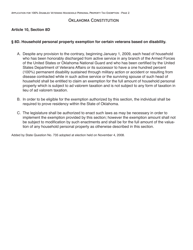

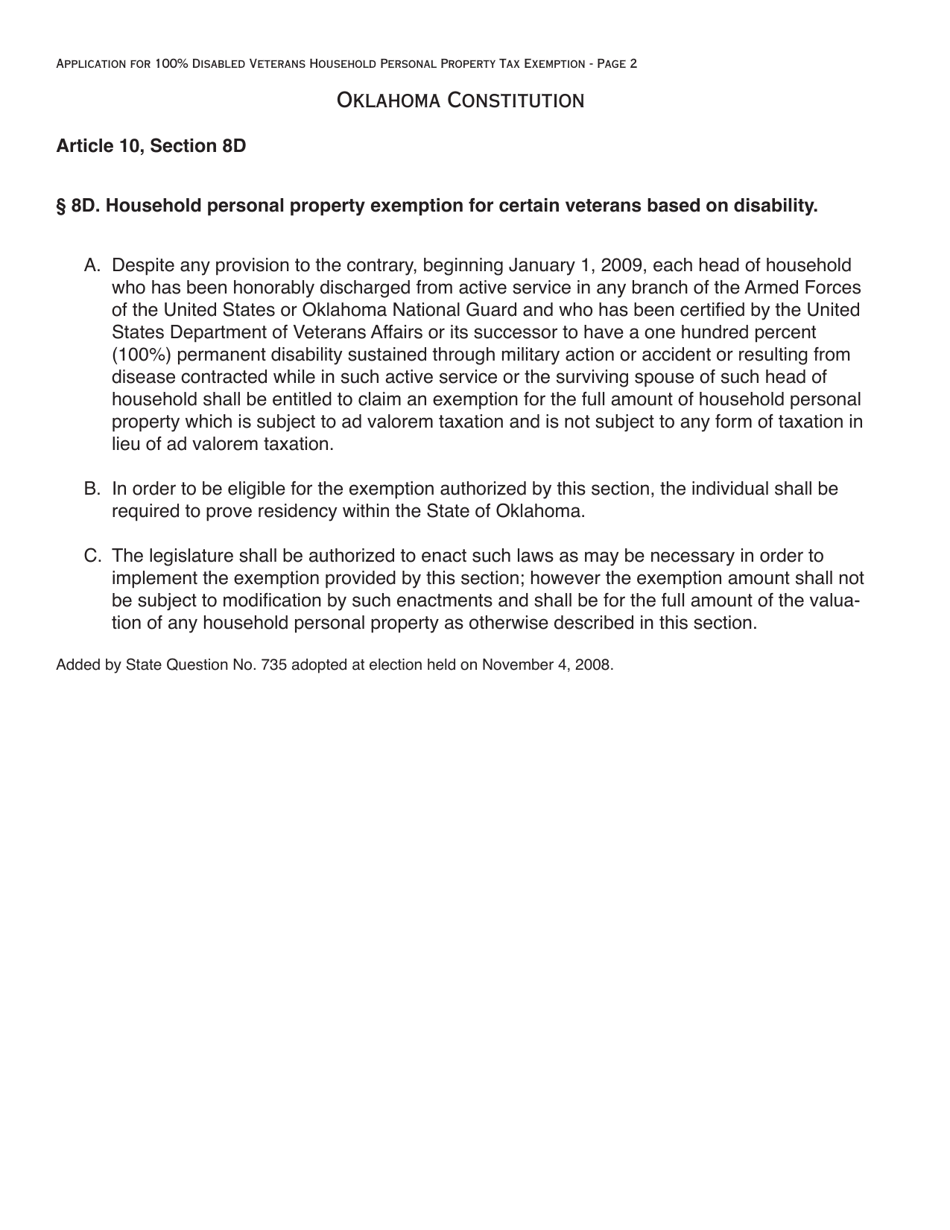

Q: Who is eligible to apply for the 100% Disabled Veterans Household Personal Property Tax Exemption?

A: Veterans who are 100% disabled and have been honorably discharged from the military are eligible to apply for this exemption.

Q: What does the 100% Disabled Veterans Household Personal Property Tax Exemption provide?

A: This exemption provides qualifying veterans with an exemption from paying personal property taxes on their household items.

Q: What is the purpose of OTC Form 998-A?

A: The purpose of OTC Form 998-A is to apply for the 100% Disabled Veterans Household Personal Property Tax Exemption in Oklahoma.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 998-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.