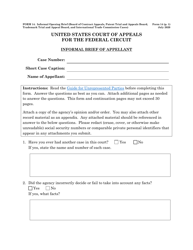

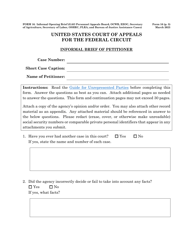

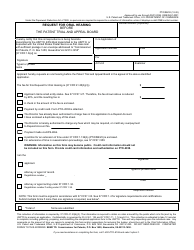

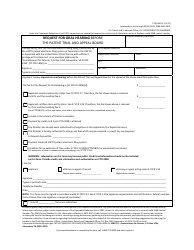

This version of the form is not currently in use and is provided for reference only. Download this version of

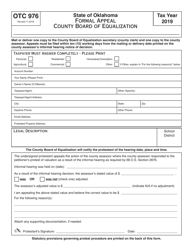

OTC Form 976

for the current year.

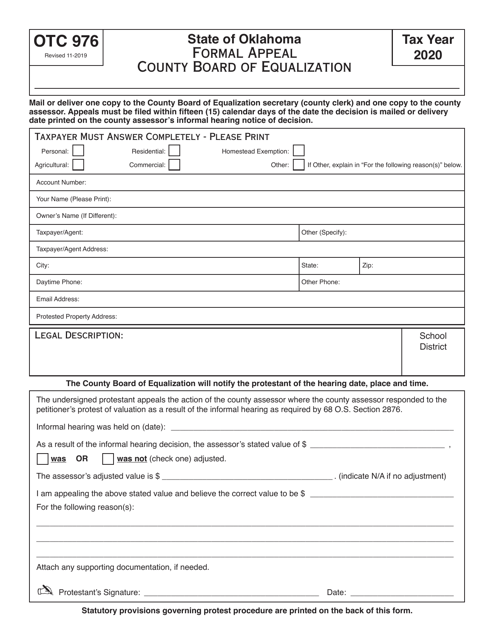

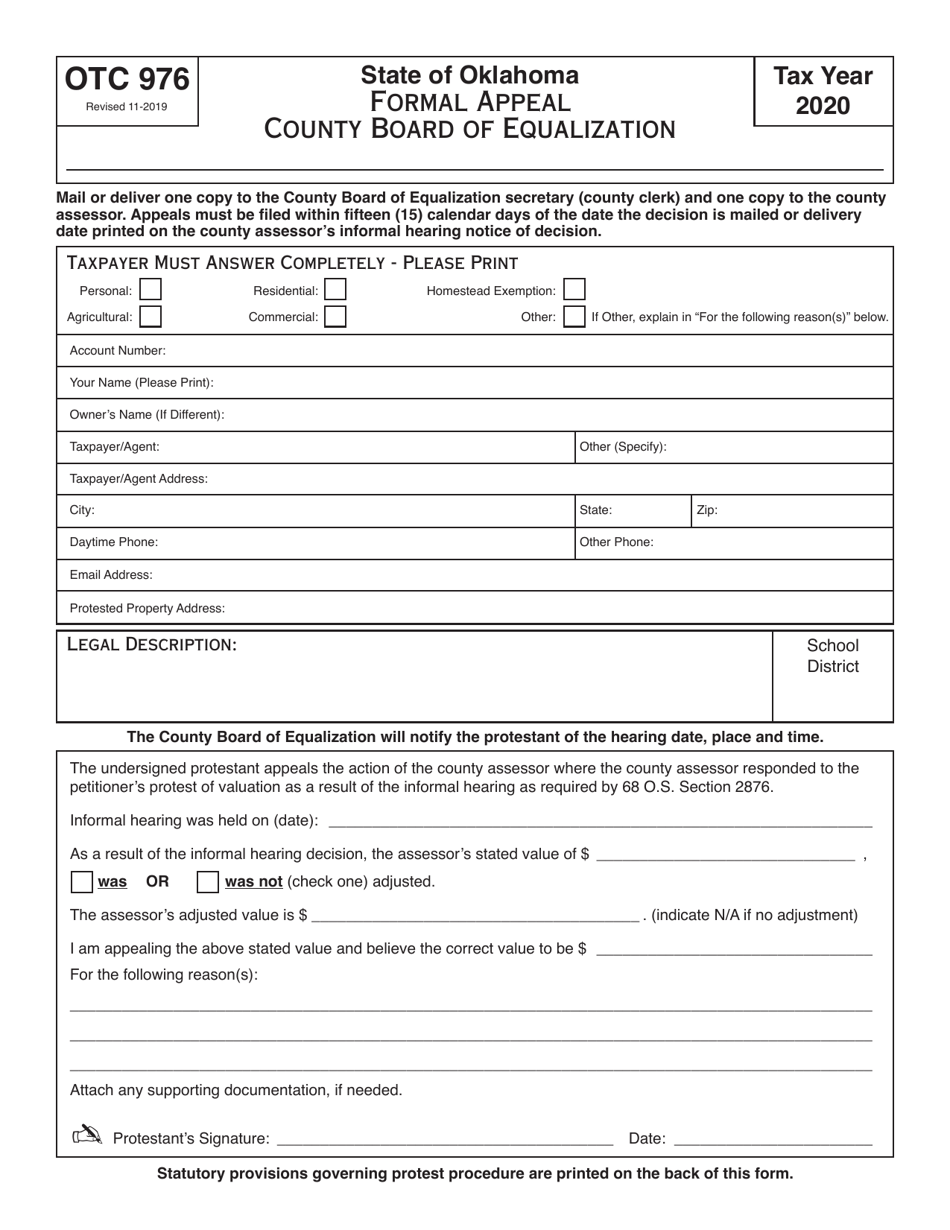

OTC Form 976 Formal Appeal - County Board of Equalization - Oklahoma

What Is OTC Form 976?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 976?

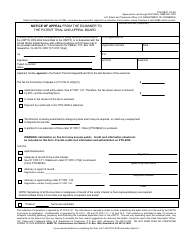

A: OTC Form 976 is a formal appeal form used to appeal property tax assessments to the County Board of Equalization in Oklahoma.

Q: Who can use OTC Form 976?

A: Any property owner in Oklahoma can use OTC Form 976 to appeal their property tax assessments.

Q: What is the County Board of Equalization?

A: The County Board of Equalization is a local government body that reviews property tax assessments and hears appeals from property owners.

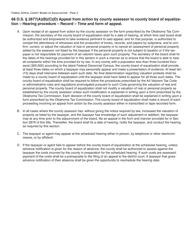

Q: How do I file an appeal using OTC Form 976?

A: To file an appeal using OTC Form 976, you must complete the form with your property information, provide supporting documentation, and submit it to the County Board of Equalization.

Q: What should I include as supporting documentation?

A: You should include any relevant documents that support your appeal, such as recent property appraisals or comparable sales data.

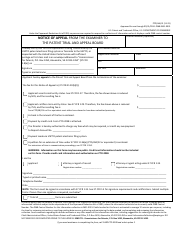

Q: Is there a deadline for filing an appeal?

A: Yes, there is a deadline for filing an appeal. The deadline is usually within 30 days of receiving your property tax assessment notice.

Q: What happens after I file an appeal?

A: After you file an appeal, the County Board of Equalization will review your case and make a decision on whether to adjust your property tax assessment.

Q: Can I appeal the decision of the County Board of Equalization?

A: Yes, if you are not satisfied with the decision of the County Board of Equalization, you can further appeal to the Oklahoma Tax Commission or the district court.

Q: Are there any fees associated with filing an appeal?

A: There may be fees associated with filing an appeal, such as a filing fee or appraisal fees. You should check with the County Board of Equalization for specific fee information.

Q: Can I get assistance with filing an appeal?

A: Yes, you can seek assistance from professionals such as tax consultants or real estate appraisers to help you with filing an appeal.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 976 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.