This version of the form is not currently in use and is provided for reference only. Download this version of

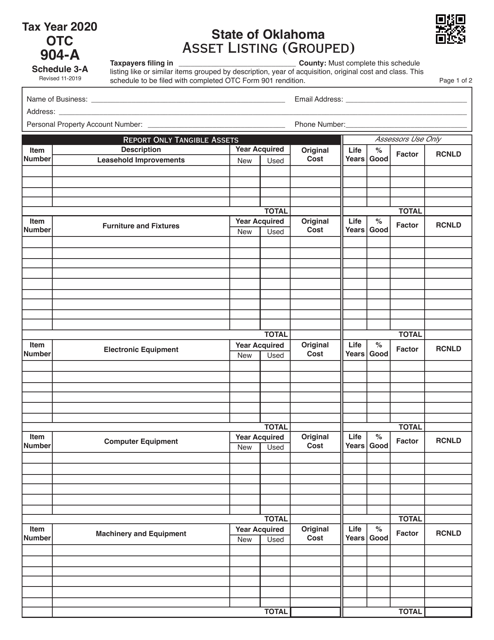

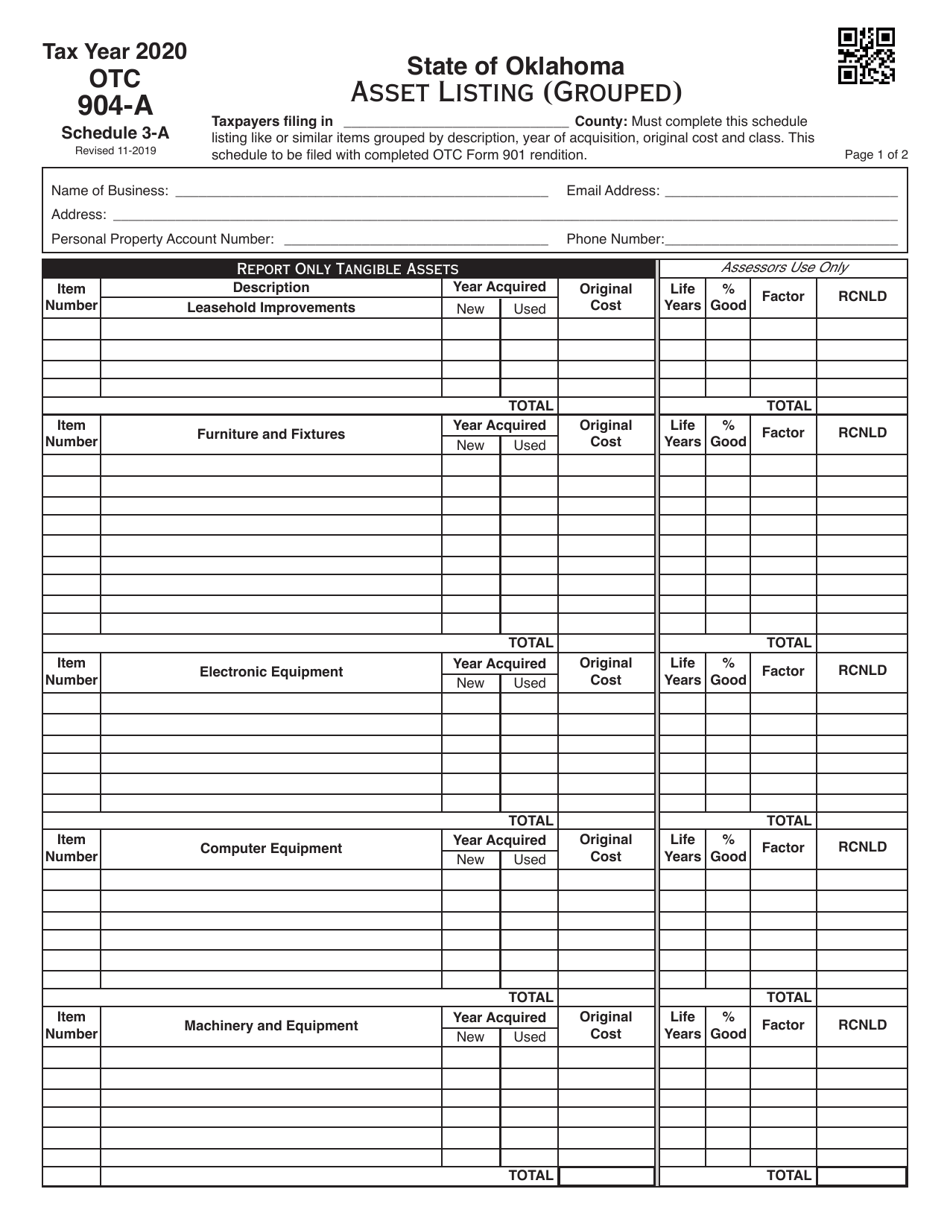

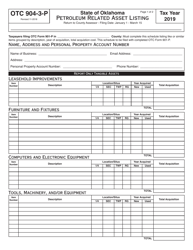

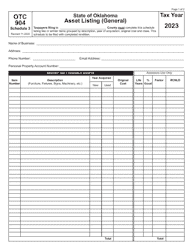

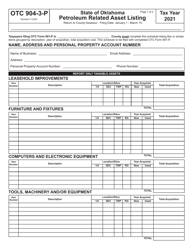

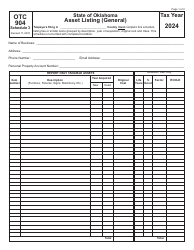

OTC Form 904-A Schedule 3-A

for the current year.

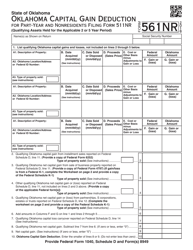

OTC Form 904-A Schedule 3-A Asset Listing (Grouped) - Oklahoma

What Is OTC Form 904-A Schedule 3-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form 904-A Schedule 3-A Asset Listing?

A: It is a form used in Oklahoma to list assets.

Q: Who needs to fill out OTC Form 904-A Schedule 3-A?

A: Individuals and businesses in Oklahoma who have assets to report.

Q: What is the purpose of OTC Form 904-A Schedule 3-A?

A: The form is used to provide an inventory of assets to the Oklahoma Tax Commission.

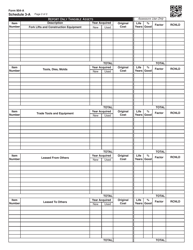

Q: What information is required on OTC Form 904-A Schedule 3-A?

A: The form asks for details about the assets, such as descriptions, costs, and dates of acquisition.

Q: Is there a deadline for submitting OTC Form 904-A Schedule 3-A?

A: Yes, the form must be filed by December 31st of each year.

Q: Are there any penalties for not filing OTC Form 904-A Schedule 3-A?

A: Yes, failure to file the form may result in penalties and fines imposed by the Oklahoma Tax Commission.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 904-A Schedule 3-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.