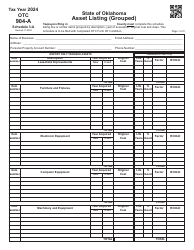

This version of the form is not currently in use and is provided for reference only. Download this version of

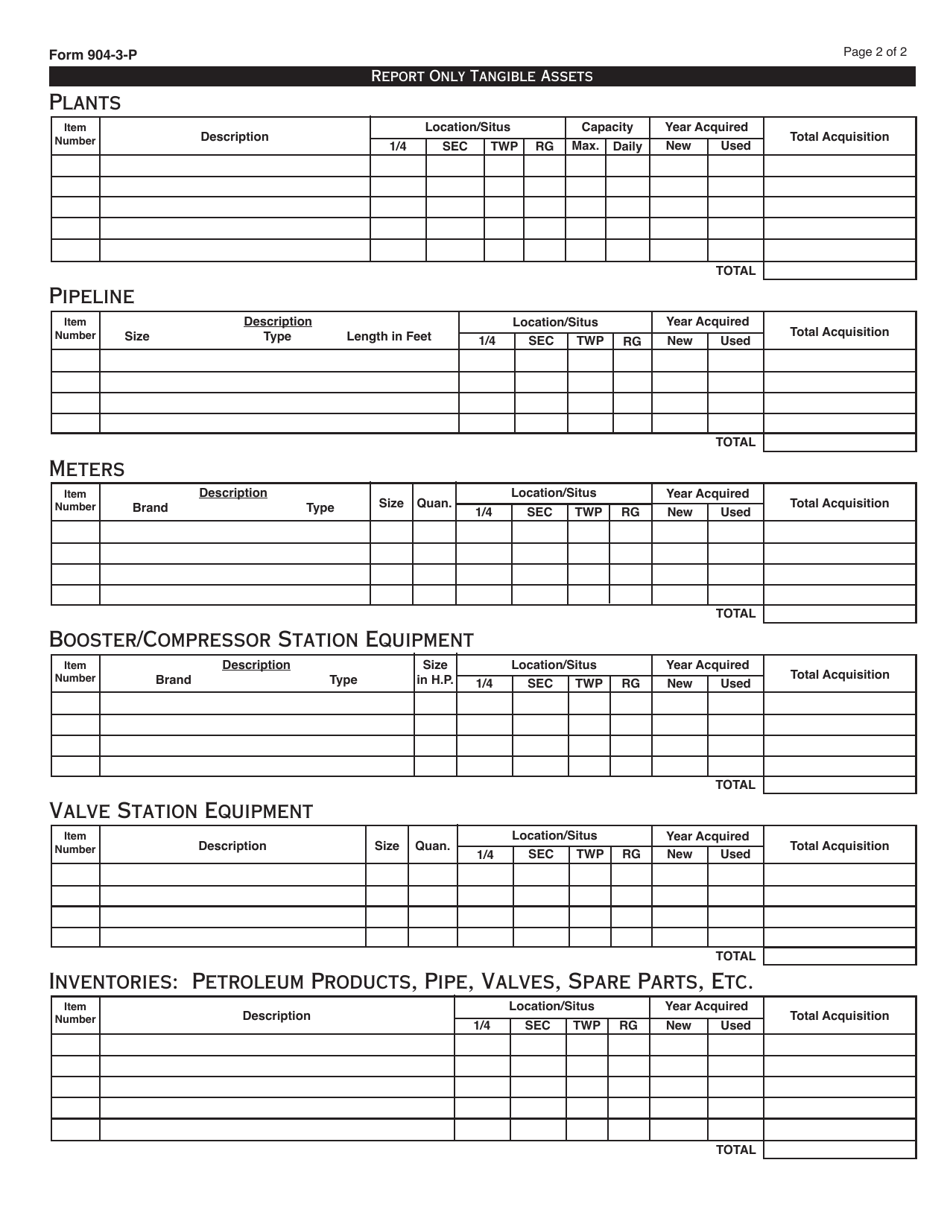

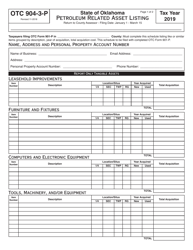

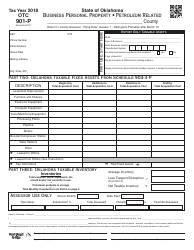

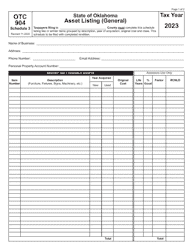

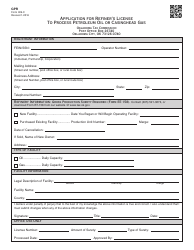

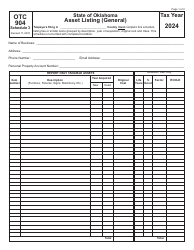

OTC Form 904-3-P

for the current year.

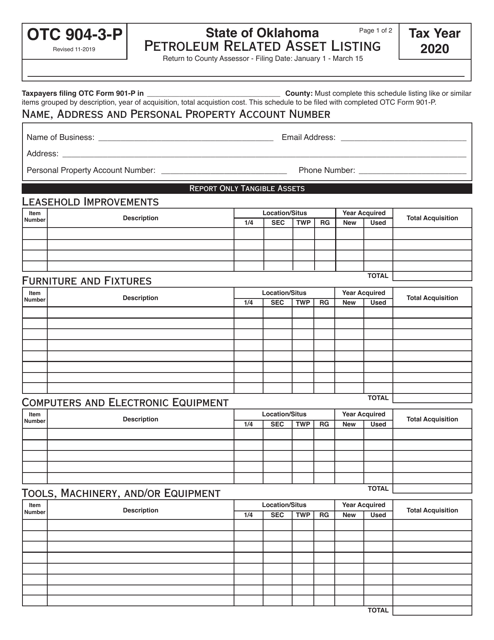

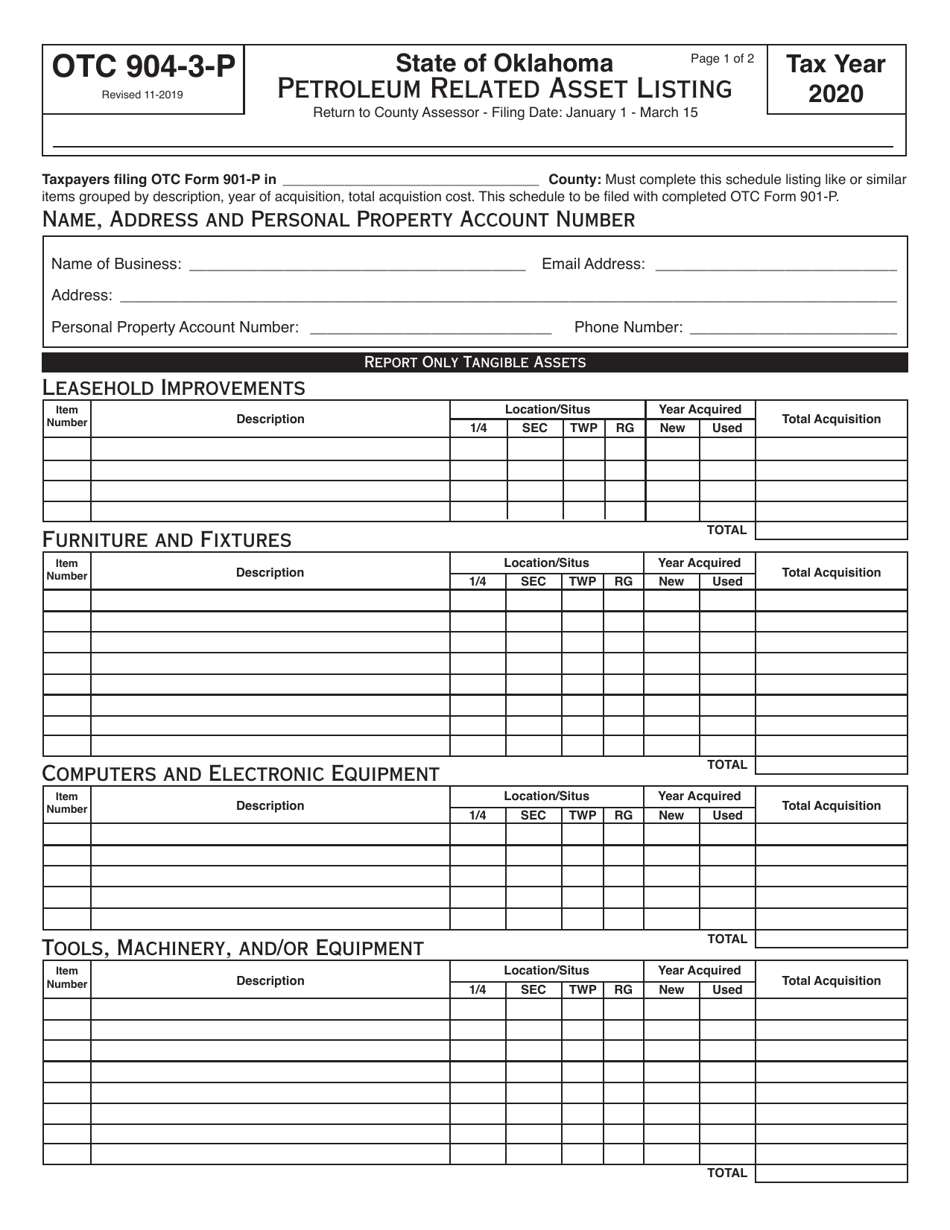

OTC Form 904-3-P Petroleum Related Asset Listing - Oklahoma

What Is OTC Form 904-3-P?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OTC Form 904-3-P?

A: OTC Form 904-3-P is a Petroleum Related Asset Listing form used in Oklahoma.

Q: Who uses OTC Form 904-3-P?

A: This form is used by individuals or companies with petroleum-related assets in Oklahoma.

Q: What is the purpose of OTC Form 904-3-P?

A: The purpose of this form is to report and provide information on petroleum-related assets.

Q: Do I need to file OTC Form 904-3-P?

A: If you have petroleum-related assets in Oklahoma, you are required to file this form.

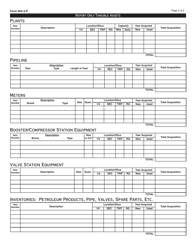

Q: What information do I need to provide on OTC Form 904-3-P?

A: You will need to provide details about your petroleum-related assets, such as location, ownership, and value.

Q: When is the deadline to file OTC Form 904-3-P?

A: The deadline for filing this form is typically April 15th of each year.

Q: Are there any penalties for not filing OTC Form 904-3-P?

A: Yes, there may be penalties for failure to file or for providing inaccurate information on this form.

Q: Is OTC Form 904-3-P for both individuals and businesses?

A: Yes, both individuals and businesses with petroleum-related assets in Oklahoma must file this form.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form 904-3-P by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.