This version of the form is not currently in use and is provided for reference only. Download this version of

Form 578

for the current year.

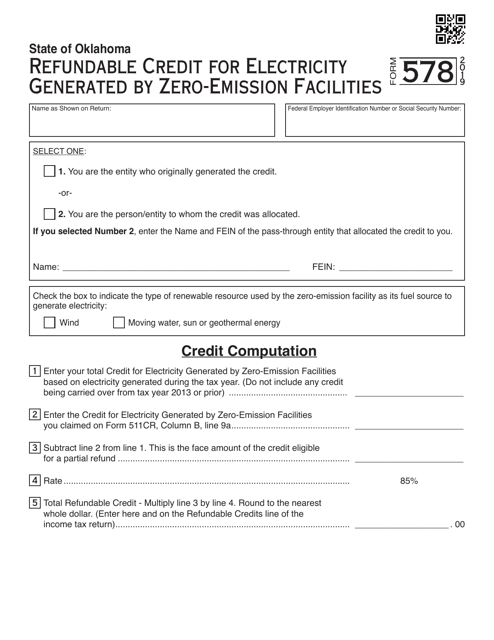

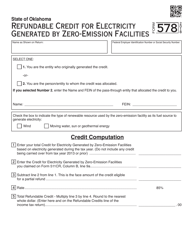

Form 578 Refundable Credit for Electricity Generated by Zero-Emission Facilities - Oklahoma

What Is Form 578?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 578?

A: Form 578 is a form used in Oklahoma to claim a refundable credit for electricity generated by zero-emission facilities.

Q: Who can claim the credit?

A: The credit can be claimed by individuals, corporations, partnerships, and other entities that generate electricity using zero-emission facilities in Oklahoma.

Q: What is a zero-emission facility?

A: A zero-emission facility is a facility that generates electricity using sources such as wind, solar, hydroelectric, geothermal, or biomass.

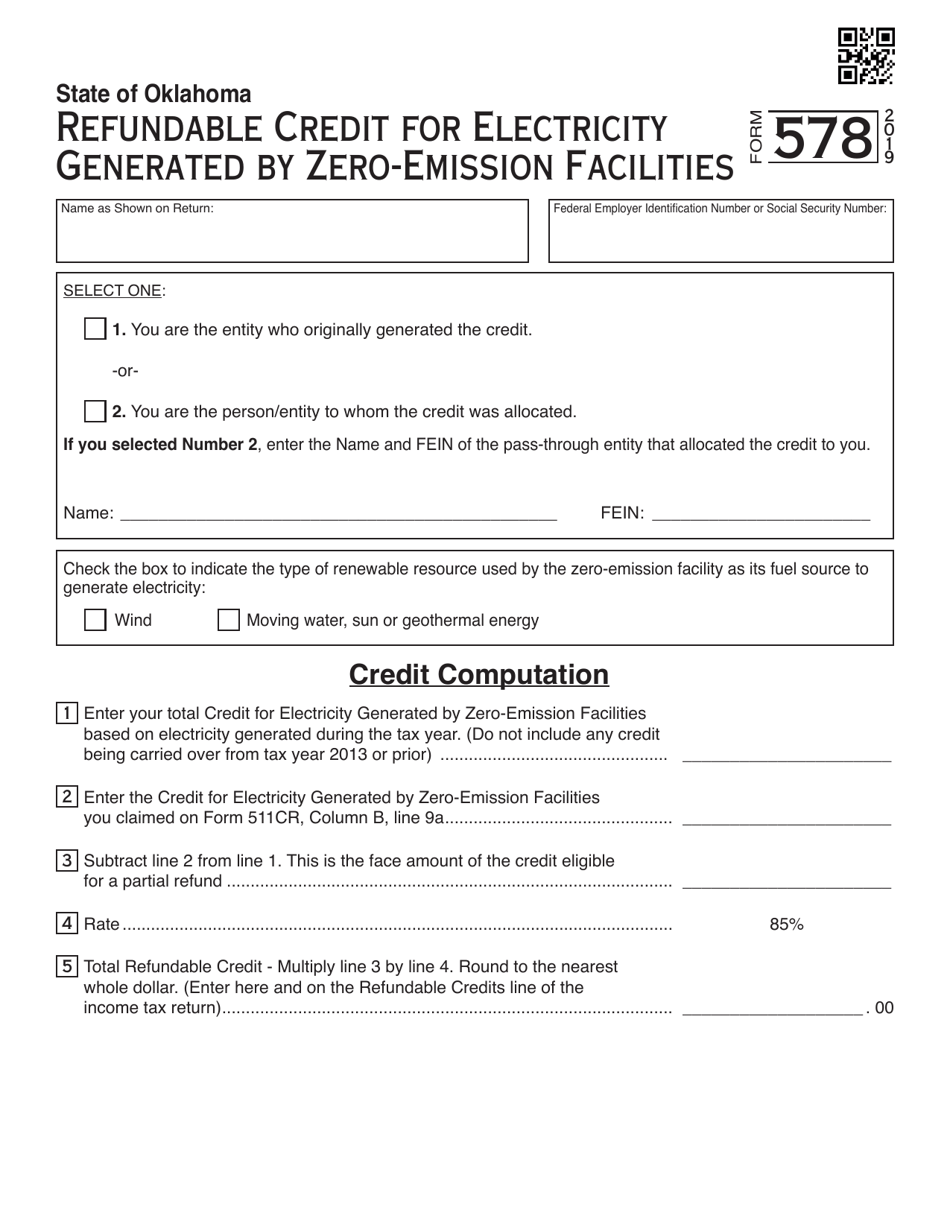

Q: How much is the credit?

A: The credit is 0.5 cents per kilowatt-hour of electricity generated by the zero-emission facility.

Q: How long can the credit be carried forward?

A: Any unused credit can be carried forward for up to five years.

Q: How do I claim the credit?

A: To claim the credit, you must file Form 578 with the Oklahoma Tax Commission.

Q: When is the deadline to file Form 578?

A: The deadline to file Form 578 is generally April 15th of the year following the calendar year in which the electricity was generated.

Q: Are there any additional requirements to claim the credit?

A: Yes, you must also provide supporting documentation, such as a certificate from the Oklahoma Corporation Commission, verifying the electricity generation from the zero-emission facility.

Q: Is the credit refundable?

A: Yes, the credit is refundable, meaning that if the amount of the credit exceeds your tax liability, you can receive a refund for the difference.

Q: Can the credit be transferred or sold?

A: No, the credit cannot be transferred or sold to another taxpayer.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 578 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.