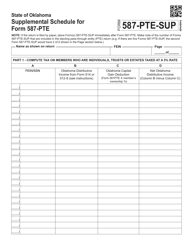

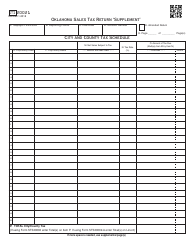

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 587-PTE

for the current year.

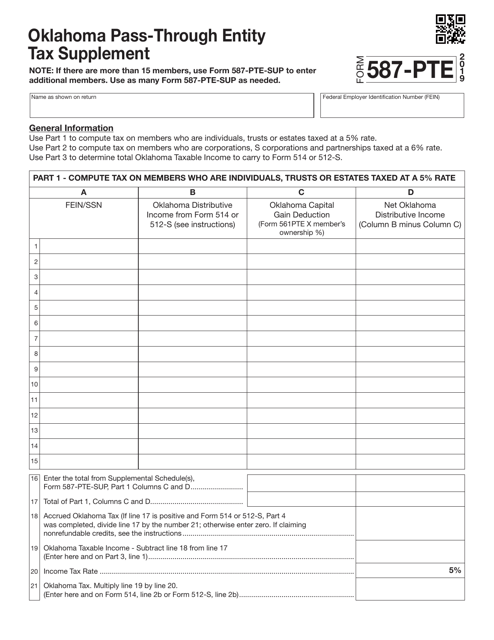

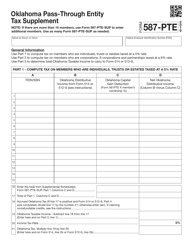

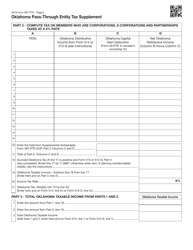

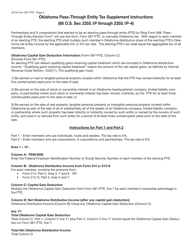

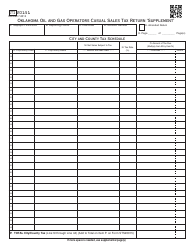

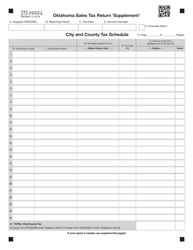

Form 587-PTE Oklahoma Pass-Through Entity Tax Supplement - Oklahoma

What Is Form 587-PTE?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

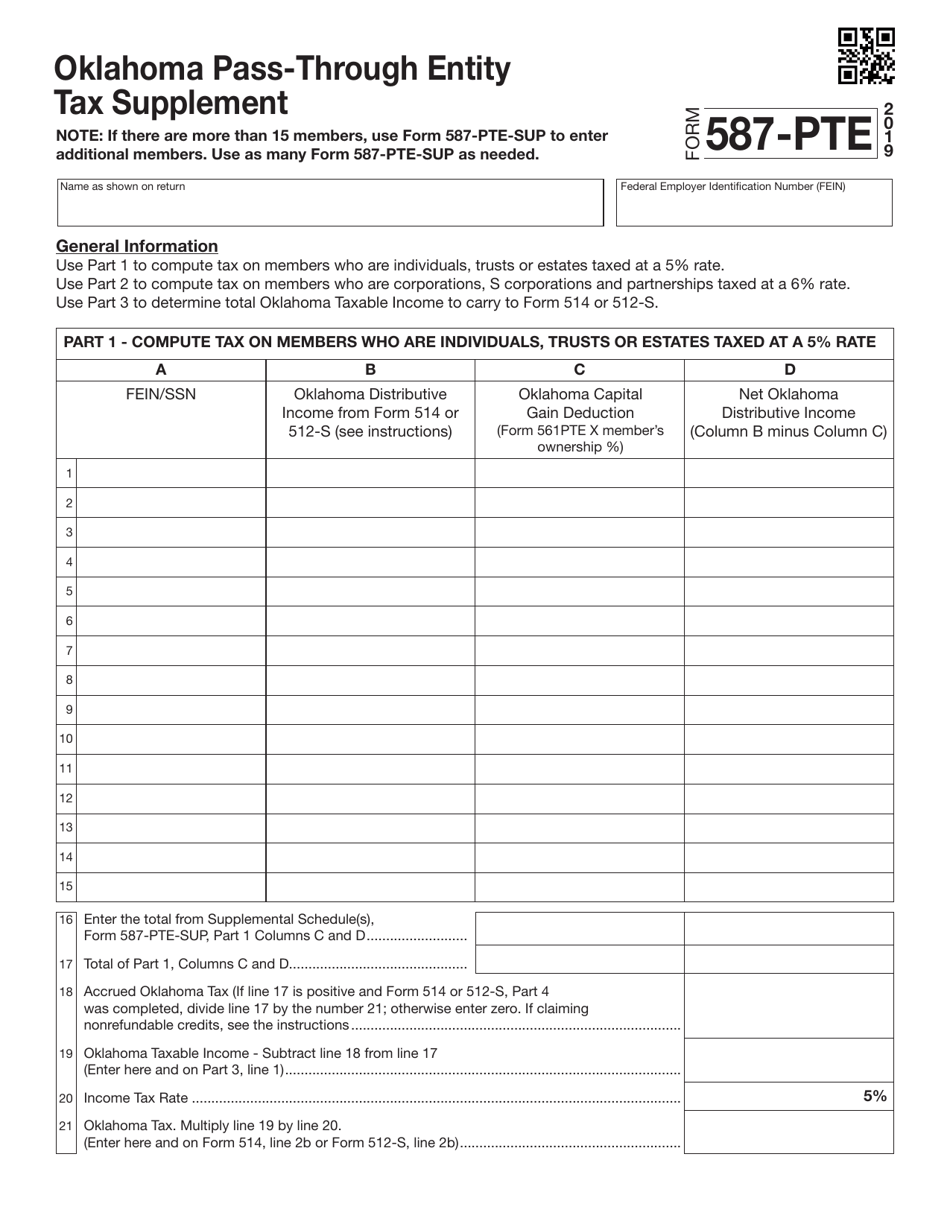

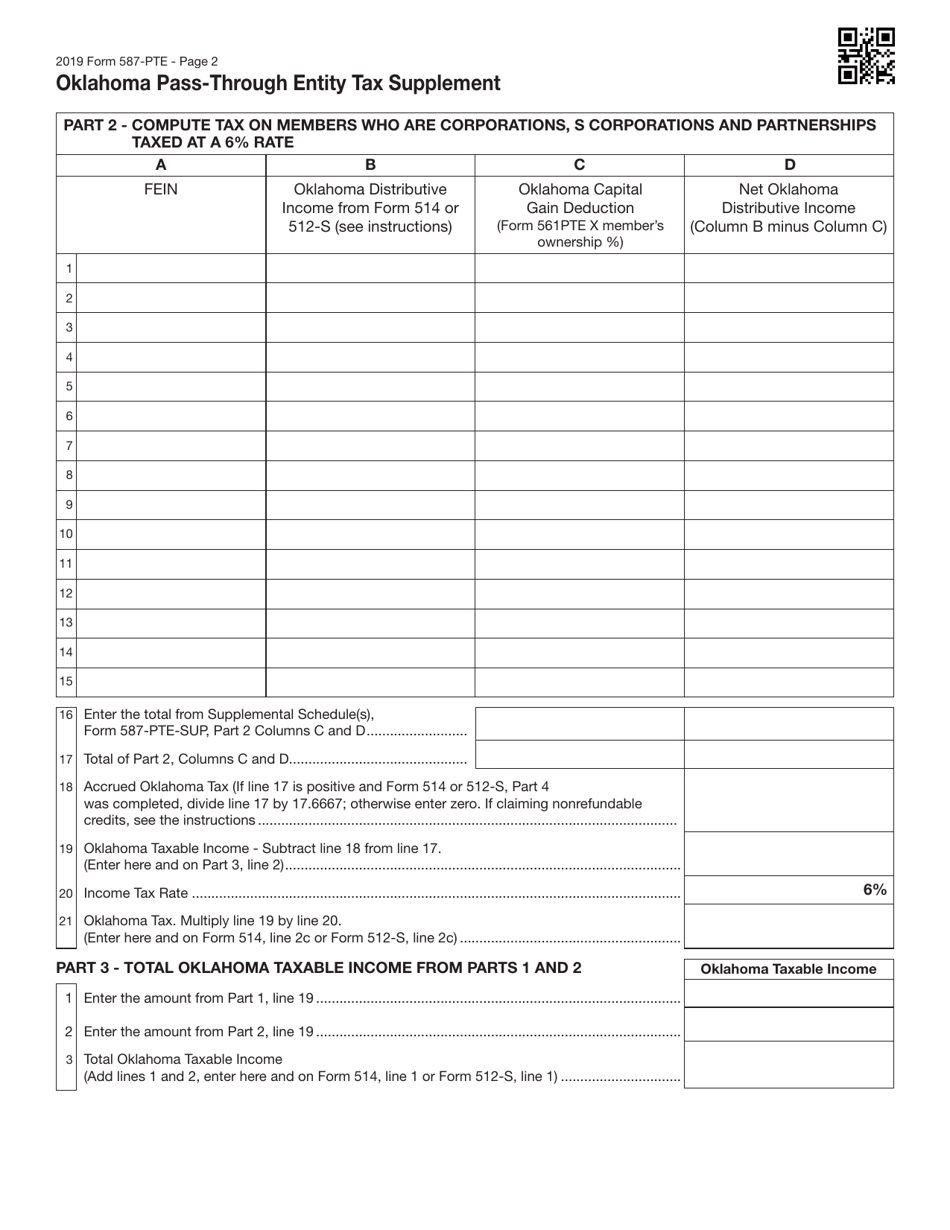

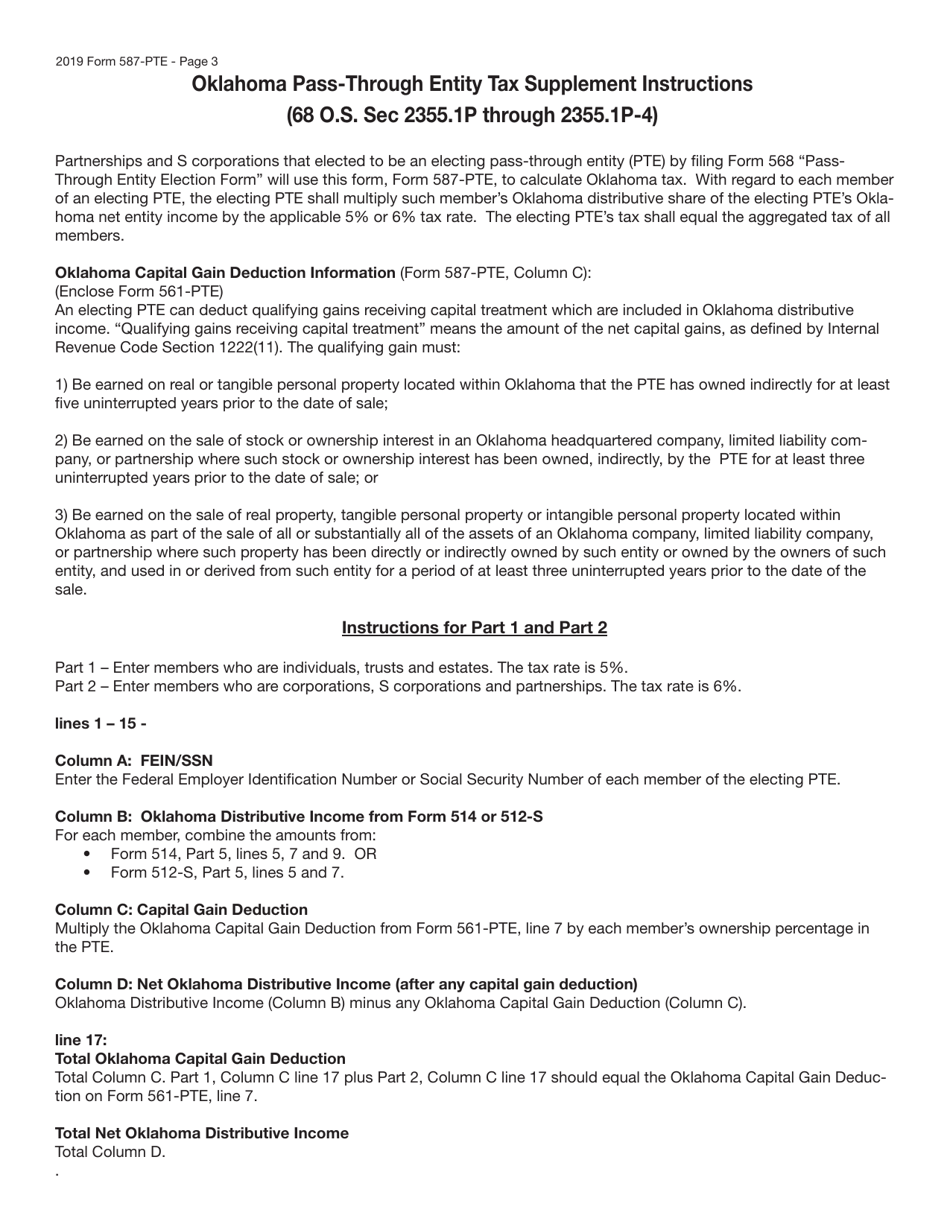

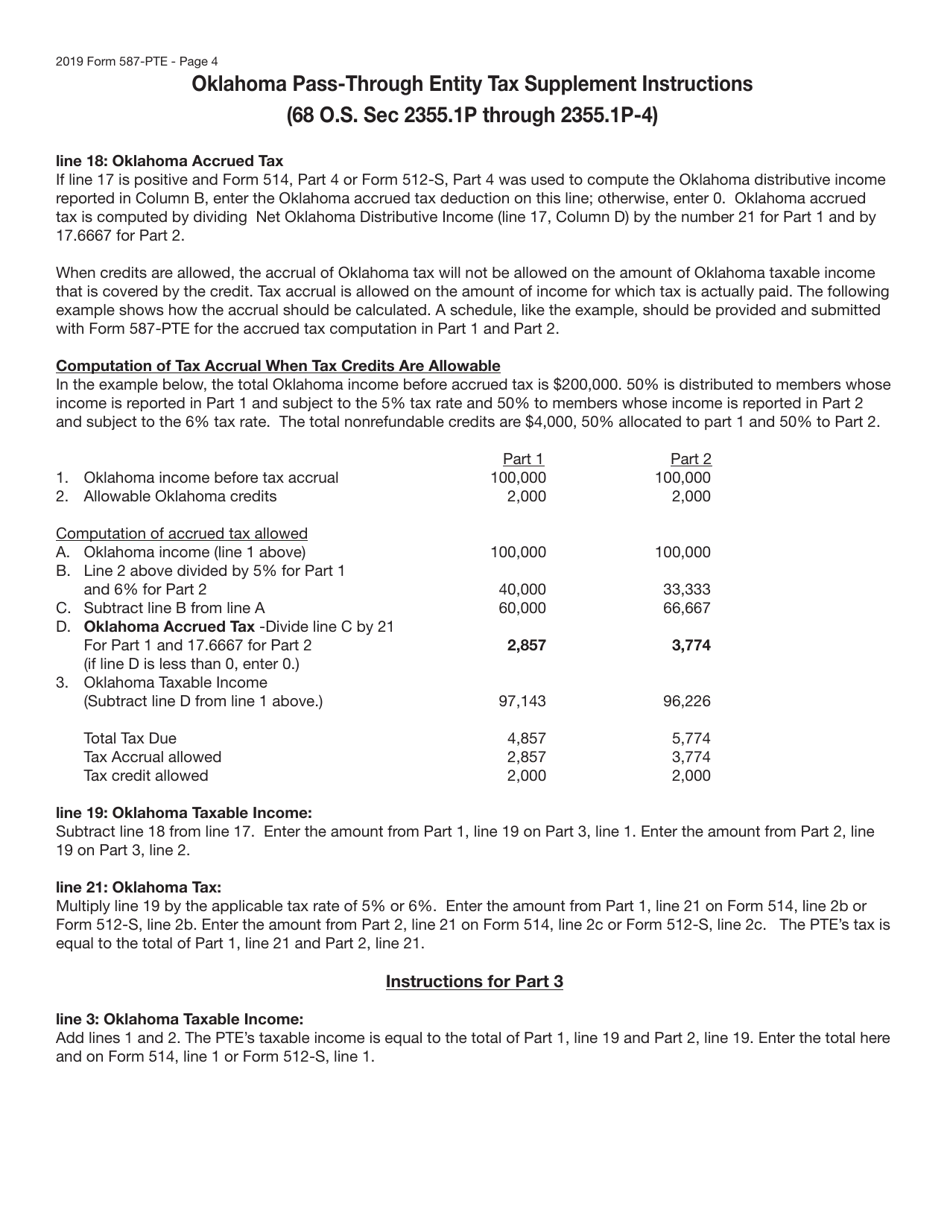

Q: What is Form 587-PTE?

A: Form 587-PTE is the Oklahoma Pass-Through Entity (PTE) Tax Supplement.

Q: Who needs to file Form 587-PTE?

A: Pass-Through Entities (PTEs) doing business in Oklahoma need to file Form 587-PTE.

Q: What is the purpose of Form 587-PTE?

A: Form 587-PTE is used to report information about the pass-through entity's taxable income, tax credits, and other information for Oklahoma tax purposes.

Q: What information is required to complete Form 587-PTE?

A: Form 587-PTE requires information such as the pass-through entity's federal tax information, Oklahoma apportionment factors, and any tax credits claimed.

Q: When is the deadline for filing Form 587-PTE?

A: Form 587-PTE is due on or before the 15th day of the 4th month following the close of the taxable year.

Q: Are there any filing fees associated with Form 587-PTE?

A: No, there are no filing fees for Form 587-PTE.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 587-PTE by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.