This version of the form is not currently in use and is provided for reference only. Download this version of

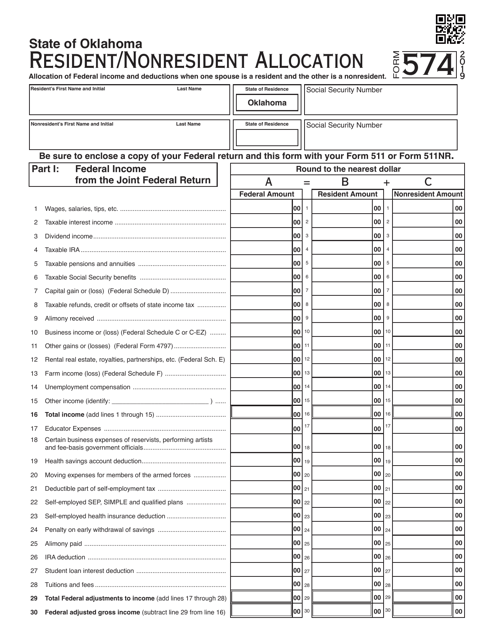

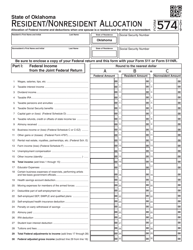

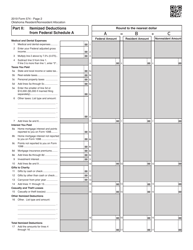

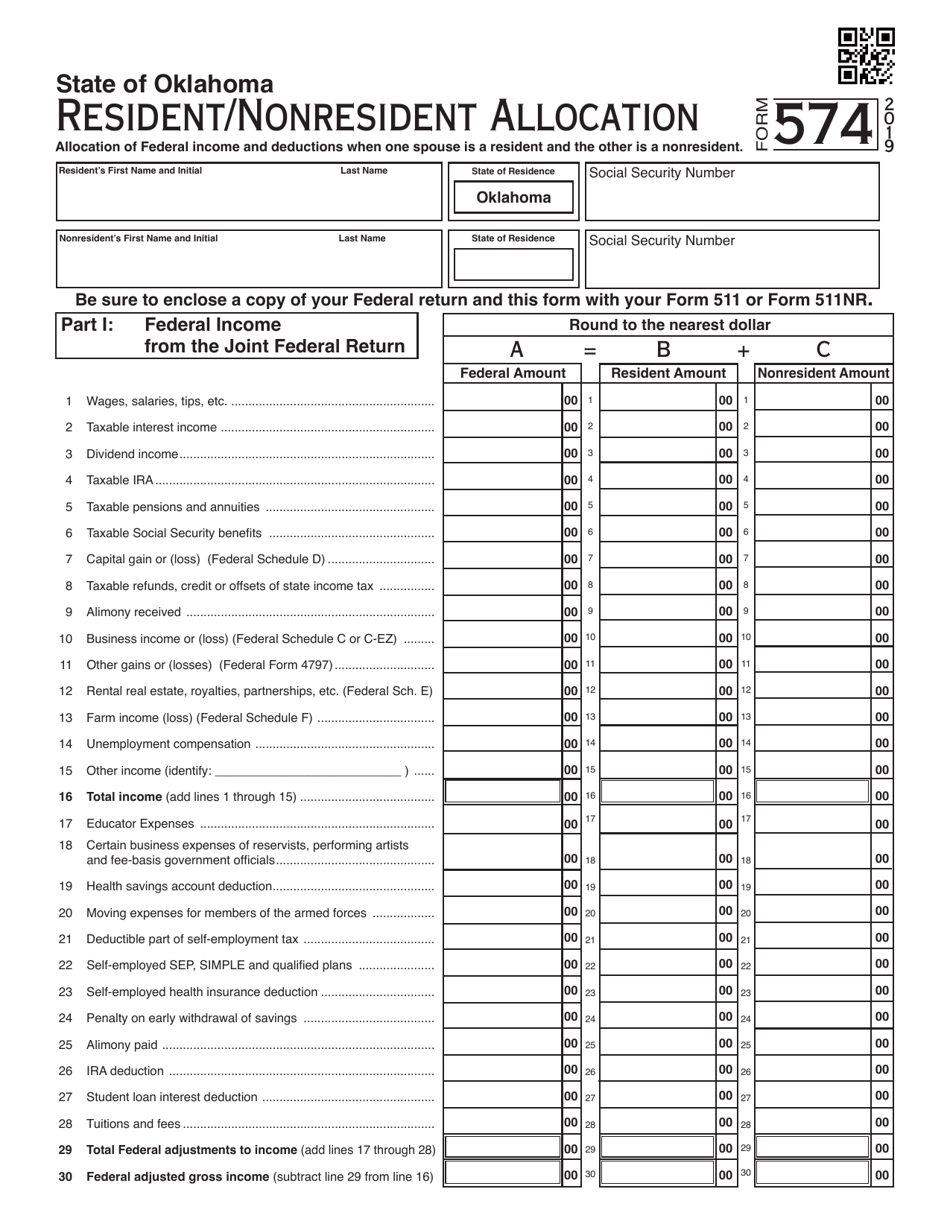

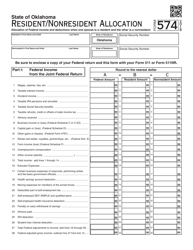

Form 574

for the current year.

Form 574 Resident / Nonresident Allocation - Oklahoma

What Is Form 574?

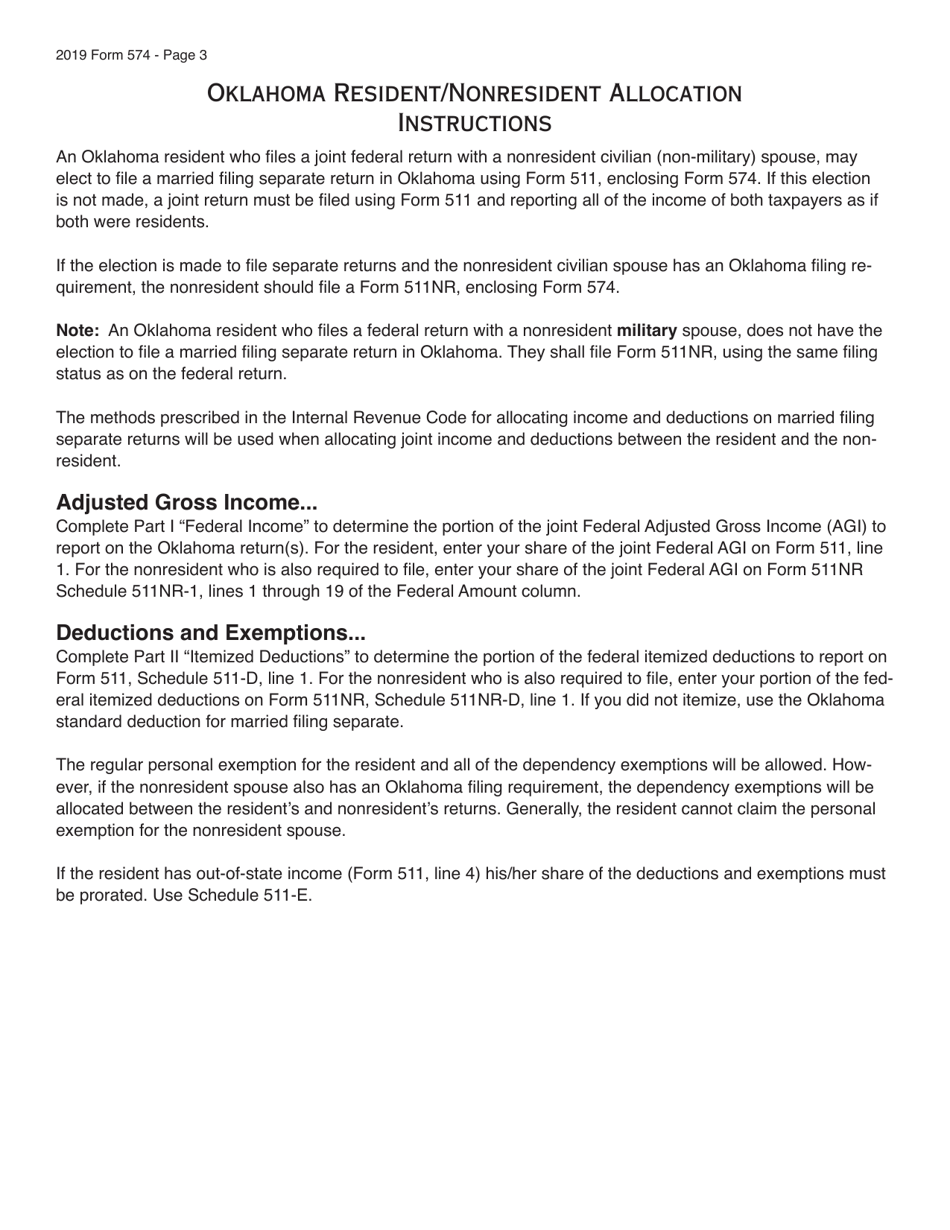

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 574?

A: Form 574 is the Resident/Nonresident Allocation form for Oklahoma.

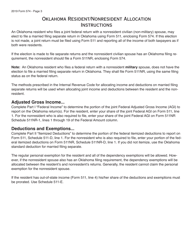

Q: Who needs to file Form 574?

A: Individuals who are residents of Oklahoma but have income from other states need to file Form 574 to allocate their income between Oklahoma and the other state(s).

Q: Is Form 574 only for residents?

A: No, Form 574 is also used by nonresidents who have income from Oklahoma and need to allocate it between Oklahoma and their home state.

Q: What is the purpose of Form 574?

A: The purpose of Form 574 is to determine the correct allocation of income for individuals who have income from multiple states, ensuring that taxes are paid appropriately.

Q: Can I file Form 574 electronically?

A: Yes, Form 574 can be filed electronically through the Oklahoma Taxpayer Access Point (OkTAP) system.

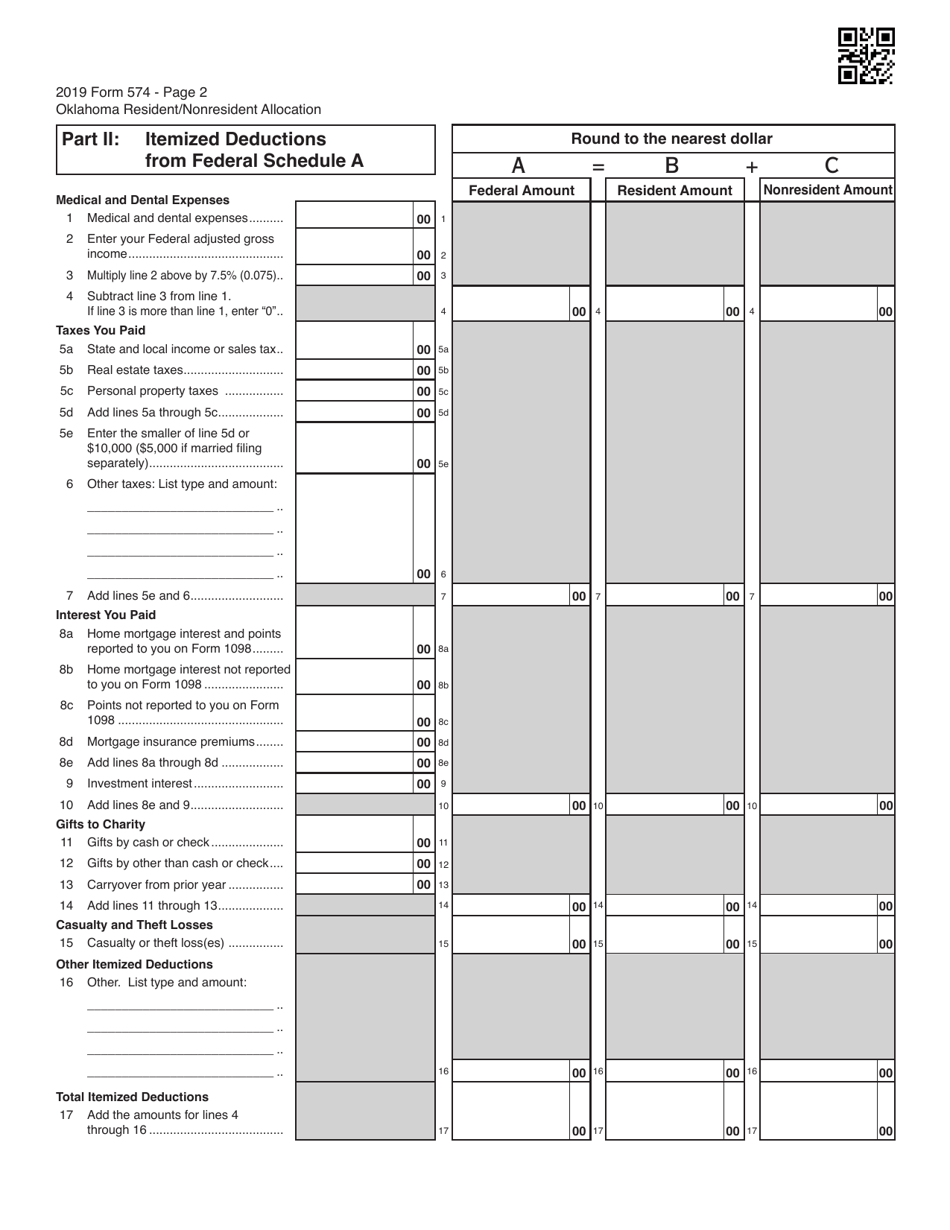

Q: What information is needed to complete Form 574?

A: To complete Form 574, you will need information about your total income, the income earned in Oklahoma, and the income earned in other states.

Q: When is the deadline to file Form 574?

A: The deadline to file Form 574 is the same as the deadline for filing your Oklahoma income tax return, which is typically April 15th.

Q: What happens if I don't file Form 574?

A: If you have income from both Oklahoma and another state and fail to file Form 574, your income may be incorrectly allocated, resulting in underpayment or overpayment of taxes.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 574 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.