This version of the form is not currently in use and is provided for reference only. Download this version of

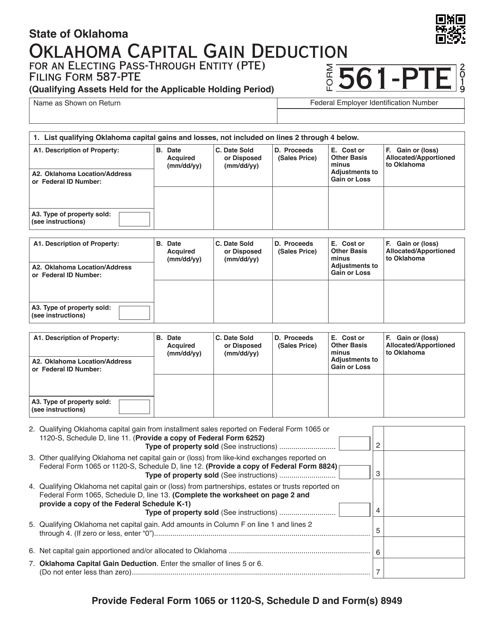

Form 561-PTE

for the current year.

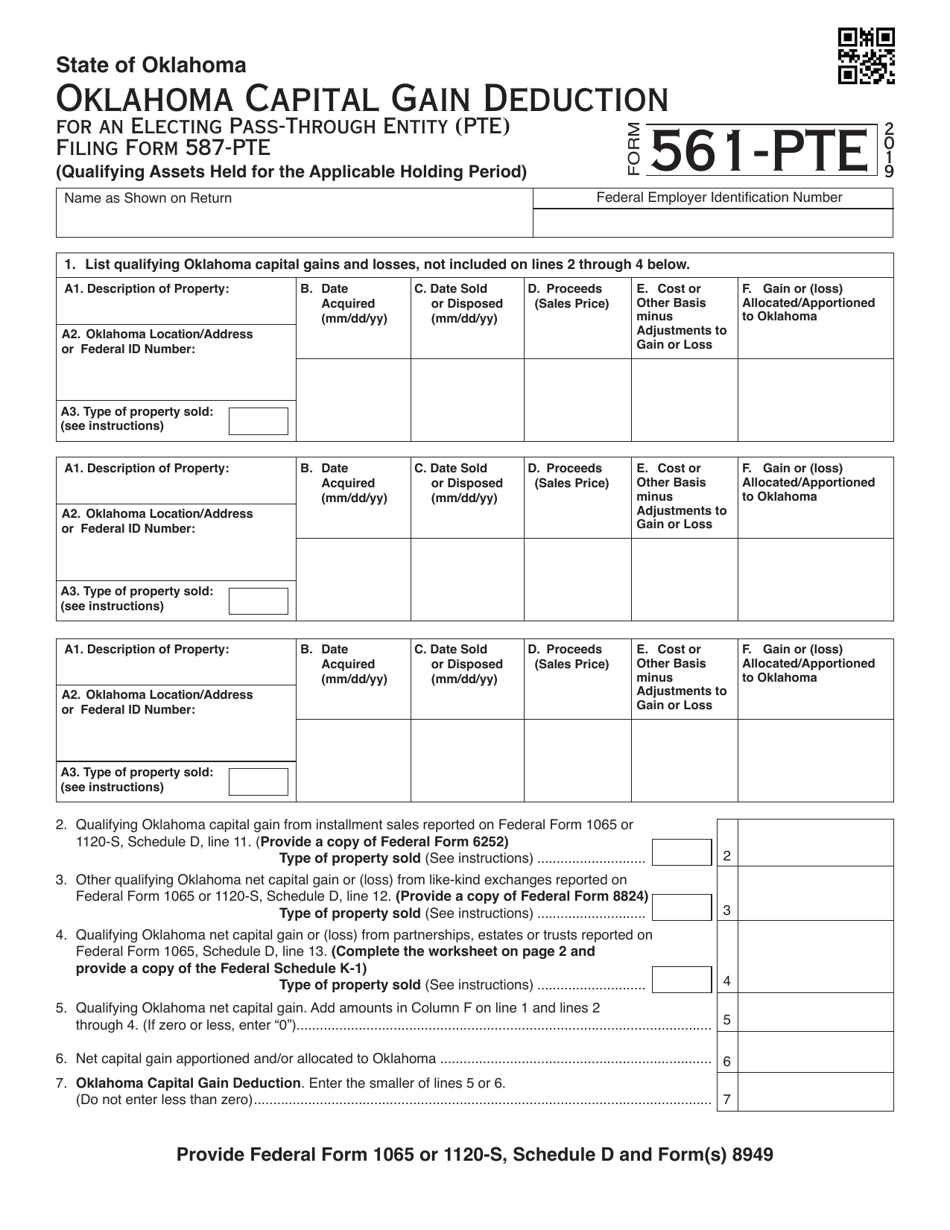

Form 561-PTE Oklahoma Capital Gain Deduction for an Electing Pass-Through Entity (Pte) Filing Form 587-pte - Oklahoma

What Is Form 561-PTE?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 561-PTE?

A: Form 561-PTE is a form used in Oklahoma to claim the Capital Gain Deduction for an Electing Pass-Through Entity (PTE).

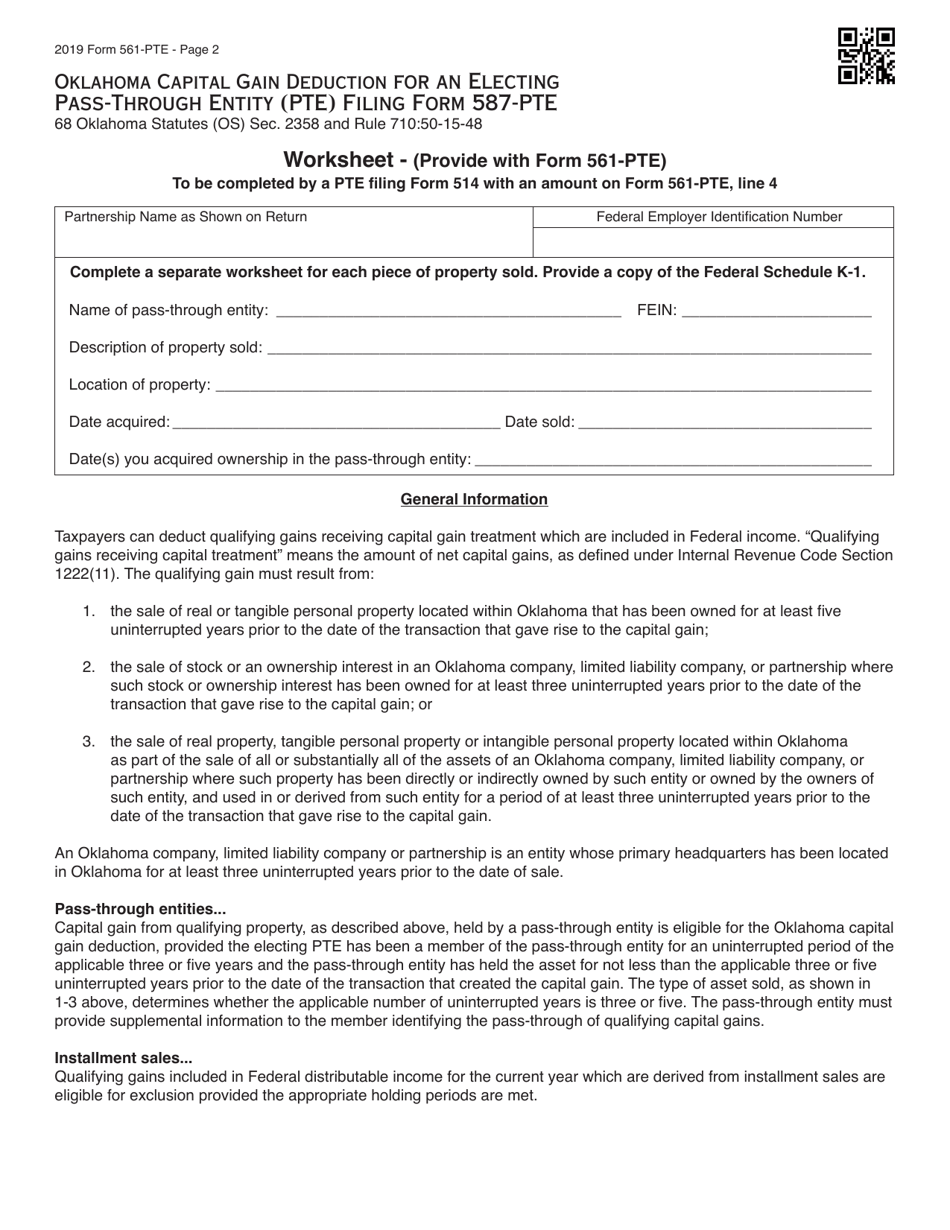

Q: What is an Electing Pass-Through Entity (PTE)?

A: An Electing Pass-Through Entity (PTE) is a business entity that elects to be treated as a pass-through entity for state tax purposes.

Q: What is the purpose of Form 561-PTE?

A: The purpose of Form 561-PTE is to claim the Capital Gain Deduction for an Electing Pass-Through Entity (PTE) in Oklahoma.

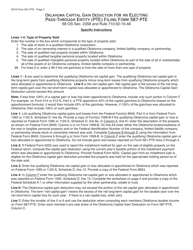

Q: What is the Capital Gain Deduction?

A: The Capital Gain Deduction is a tax deduction that allows eligible taxpayers to reduce their taxable income from capital gains.

Q: Is Form 561-PTE specific to Oklahoma?

A: Yes, Form 561-PTE is specific to Oklahoma and is used to claim the Capital Gain Deduction for an Electing Pass-Through Entity (PTE) in the state.

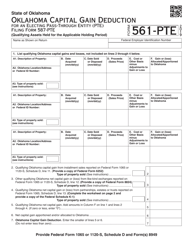

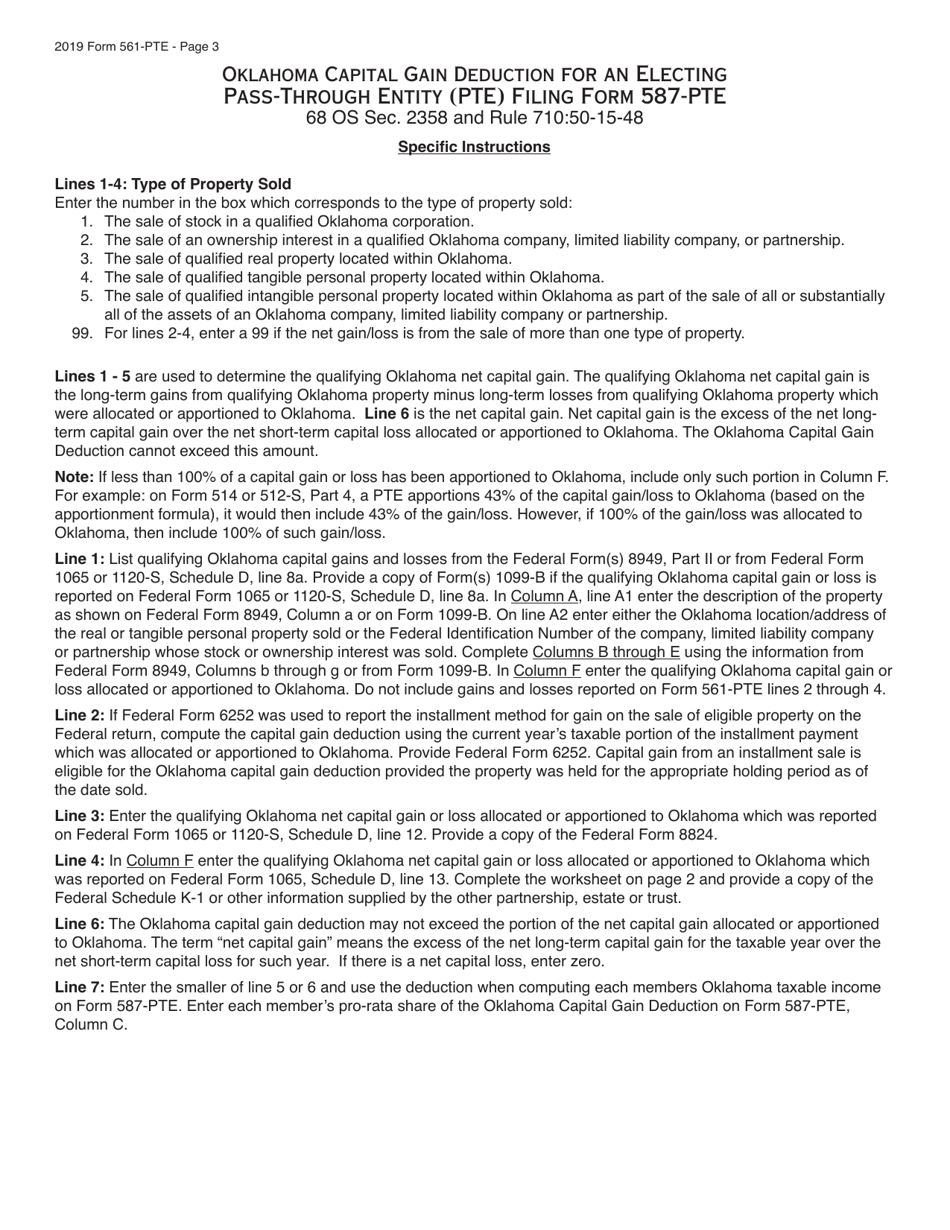

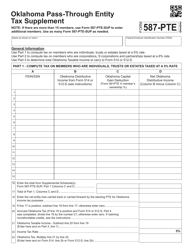

Q: What is Form 587-PTE?

A: Form 587-PTE is a form used in Oklahoma for Electing Pass-Through Entities (PTEs) to report business income and deductions.

Q: Do I need to file Form 587-PTE in addition to Form 561-PTE?

A: Yes, if you are claiming the Capital Gain Deduction for an Electing Pass-Through Entity (PTE) in Oklahoma, you will also need to file Form 587-PTE to report your business income and deductions.

Q: Is the Capital Gain Deduction available for all types of income?

A: No, the Capital Gain Deduction is specifically for capital gains, which are the profits made from the sale of investments or assets.

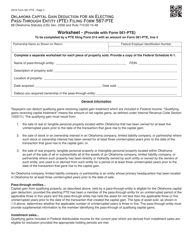

Q: Are there any eligibility requirements for claiming the Capital Gain Deduction?

A: Yes, there are eligibility requirements for claiming the Capital Gain Deduction, including holding the investment or asset for a certain period of time and meeting certain income thresholds.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 561-PTE by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.