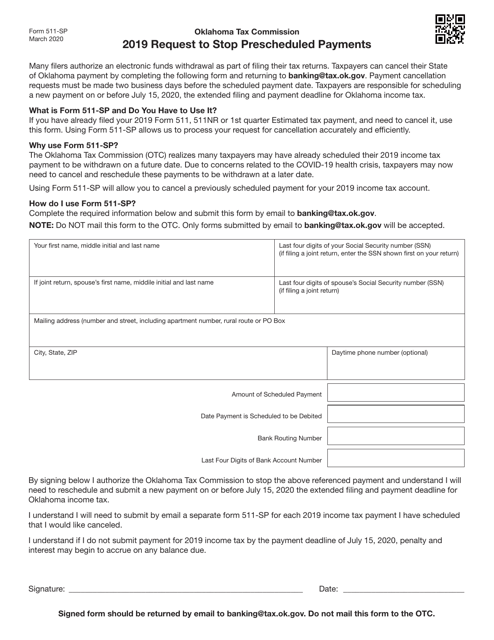

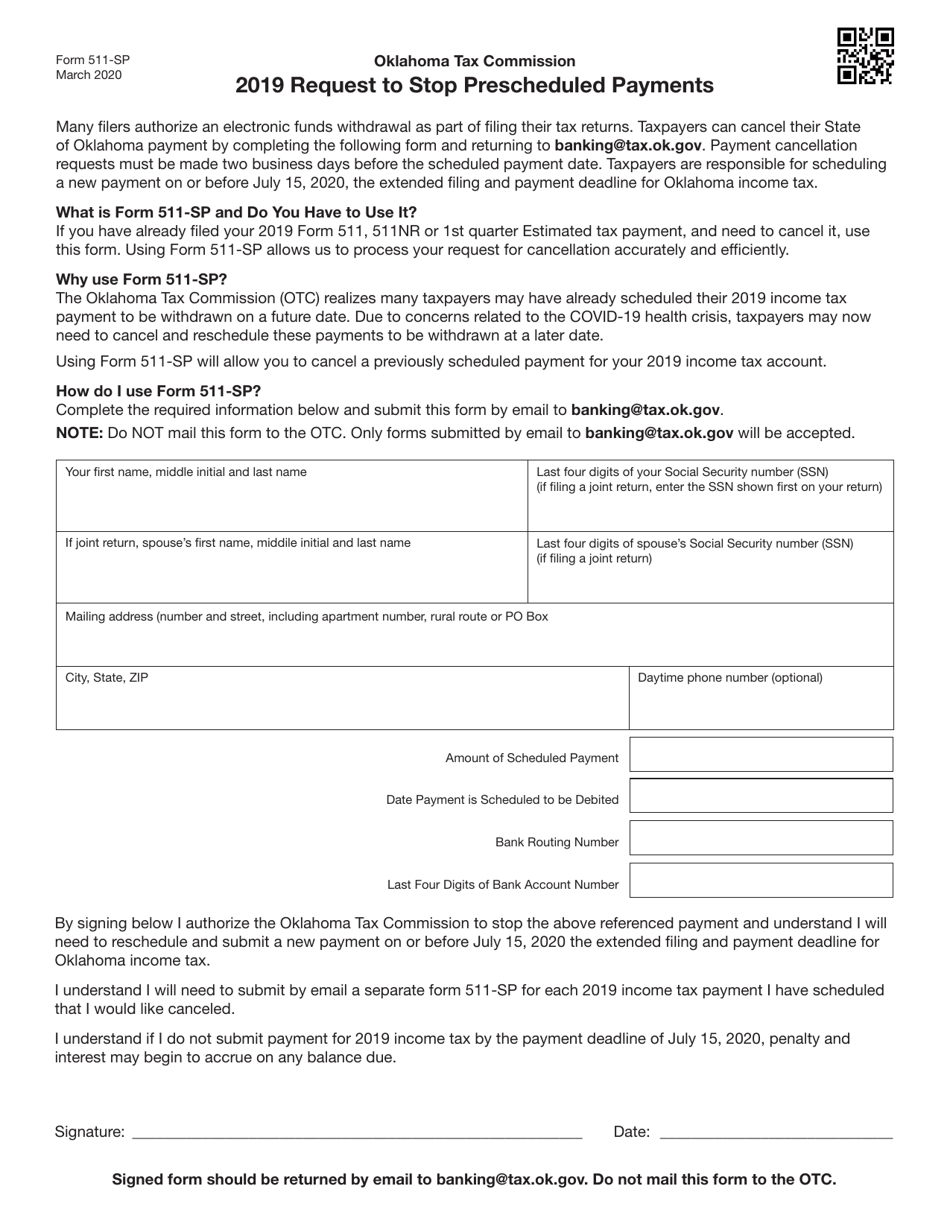

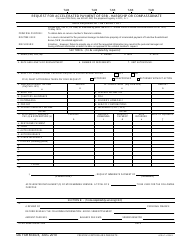

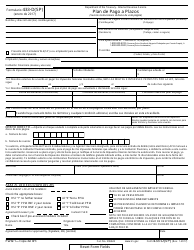

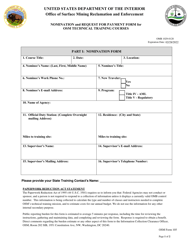

Form 511-SP Request to Stop Prescheduled Payments - Oklahoma

What Is Form 511-SP?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 511-SP?

A: Form 511-SP is a document used in Oklahoma to request the stop of prescheduled payments.

Q: What are prescheduled payments?

A: Prescheduled payments are recurring payments that are automatically deducted from your bank account.

Q: Why would I need to use Form 511-SP?

A: You would need to use Form 511-SP if you want to stop a prescheduled payment in Oklahoma.

Q: How do I fill out Form 511-SP?

A: To fill out Form 511-SP, you will need to provide your personal information, details about the prescheduled payment, and reasons for stopping the payment.

Q: Is there a fee for submitting Form 511-SP?

A: No, there is no fee for submitting Form 511-SP.

Q: How long does it take for a prescheduled payment to be stopped?

A: The time it takes to stop a prescheduled payment can vary, but it is generally processed within a few business days.

Q: What happens after I submit Form 511-SP?

A: Once you submit Form 511-SP, the Oklahoma Tax Commission will review your request and take appropriate action to stop the prescheduled payment.

Q: Can I cancel a prescheduled payment without using Form 511-SP?

A: It is recommended to use Form 511-SP to ensure that your request to stop a prescheduled payment is properly documented and processed.

Q: What if I have additional questions about Form 511-SP?

A: If you have additional questions about Form 511-SP, you can contact the Oklahoma Tax Commission for assistance.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 511-SP by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.