This version of the form is not currently in use and is provided for reference only. Download this version of

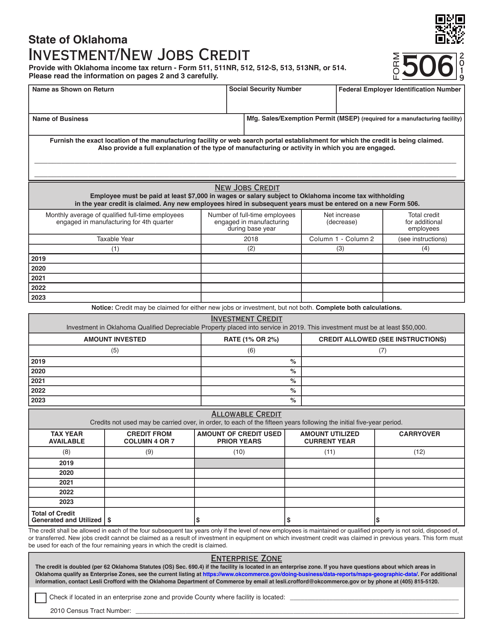

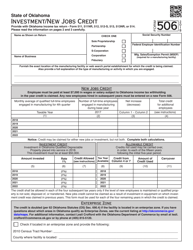

Form 506

for the current year.

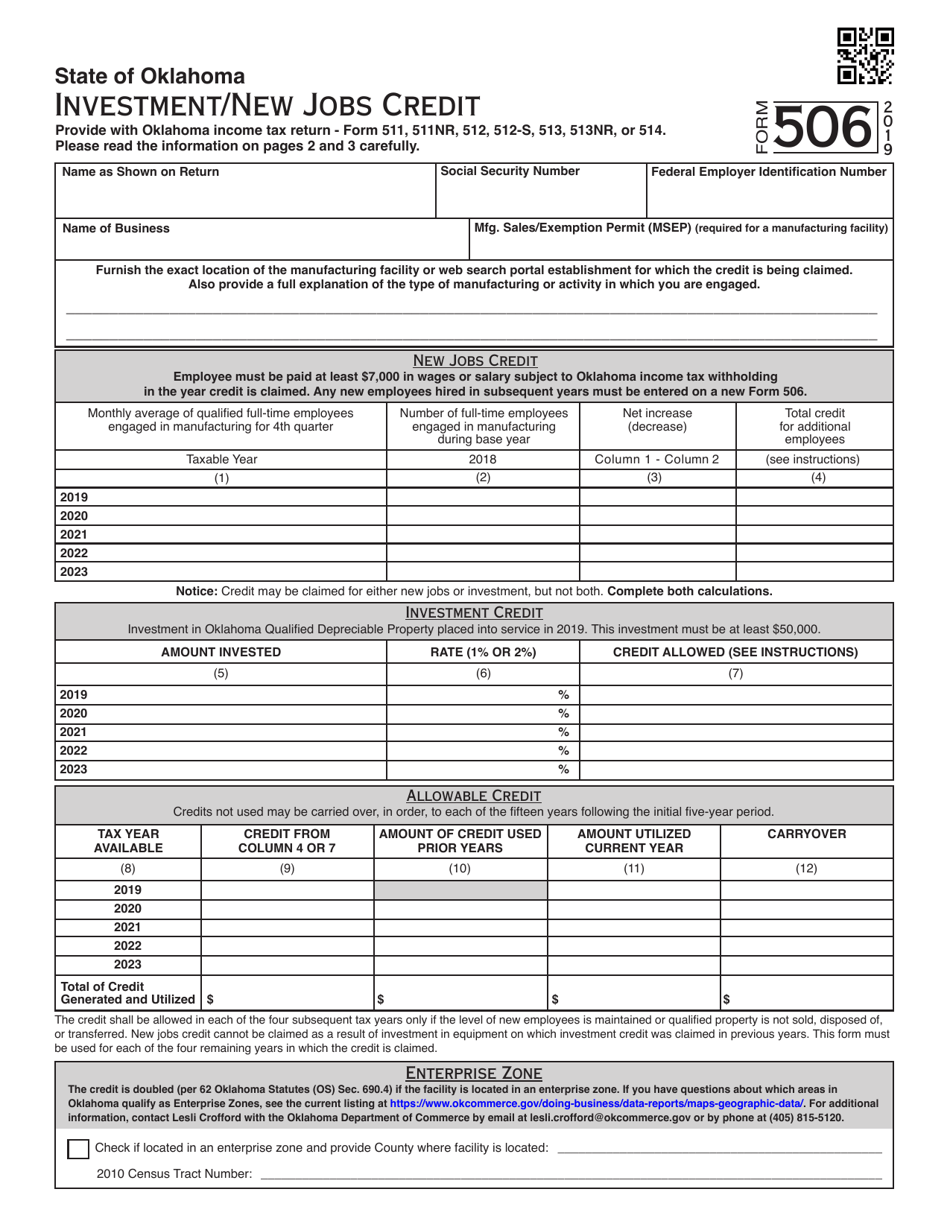

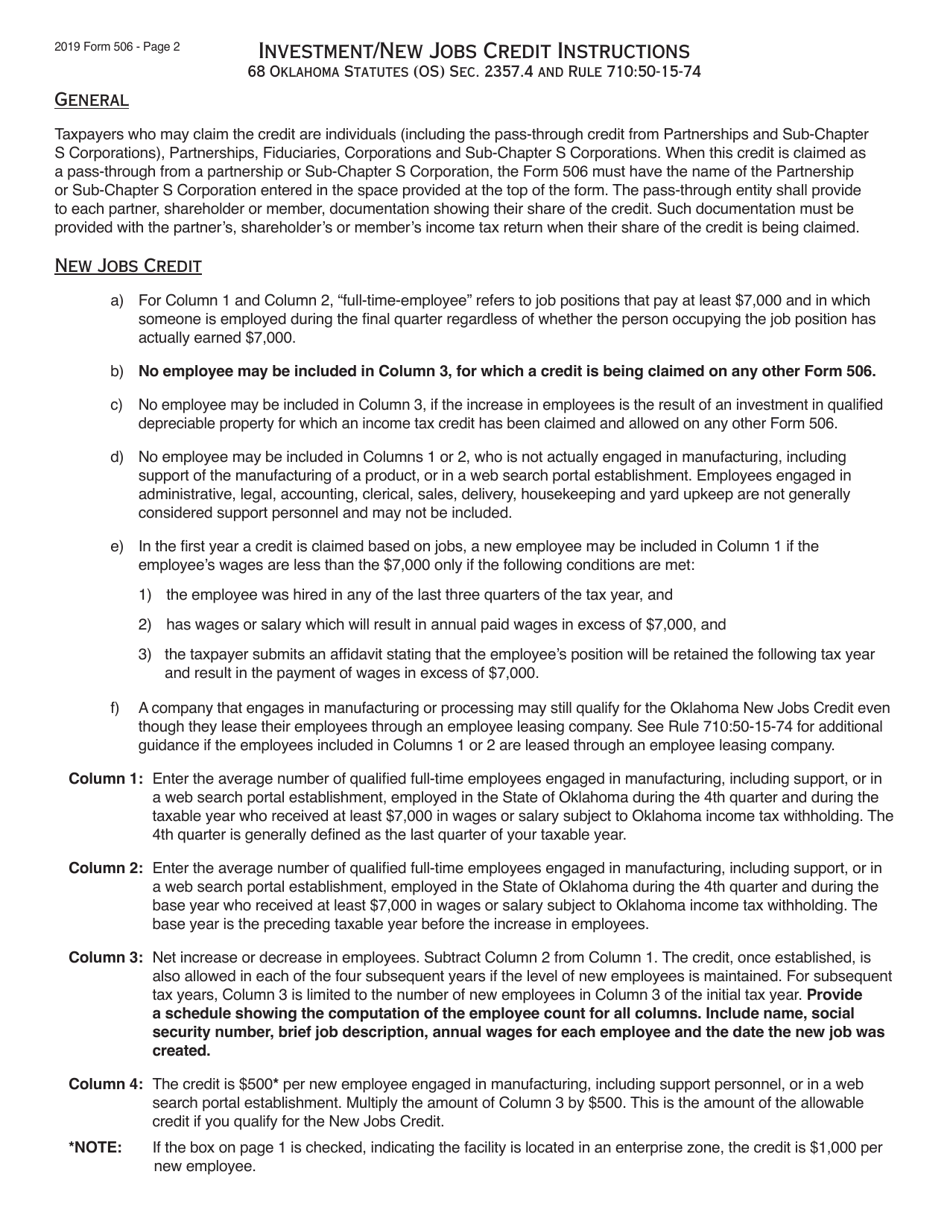

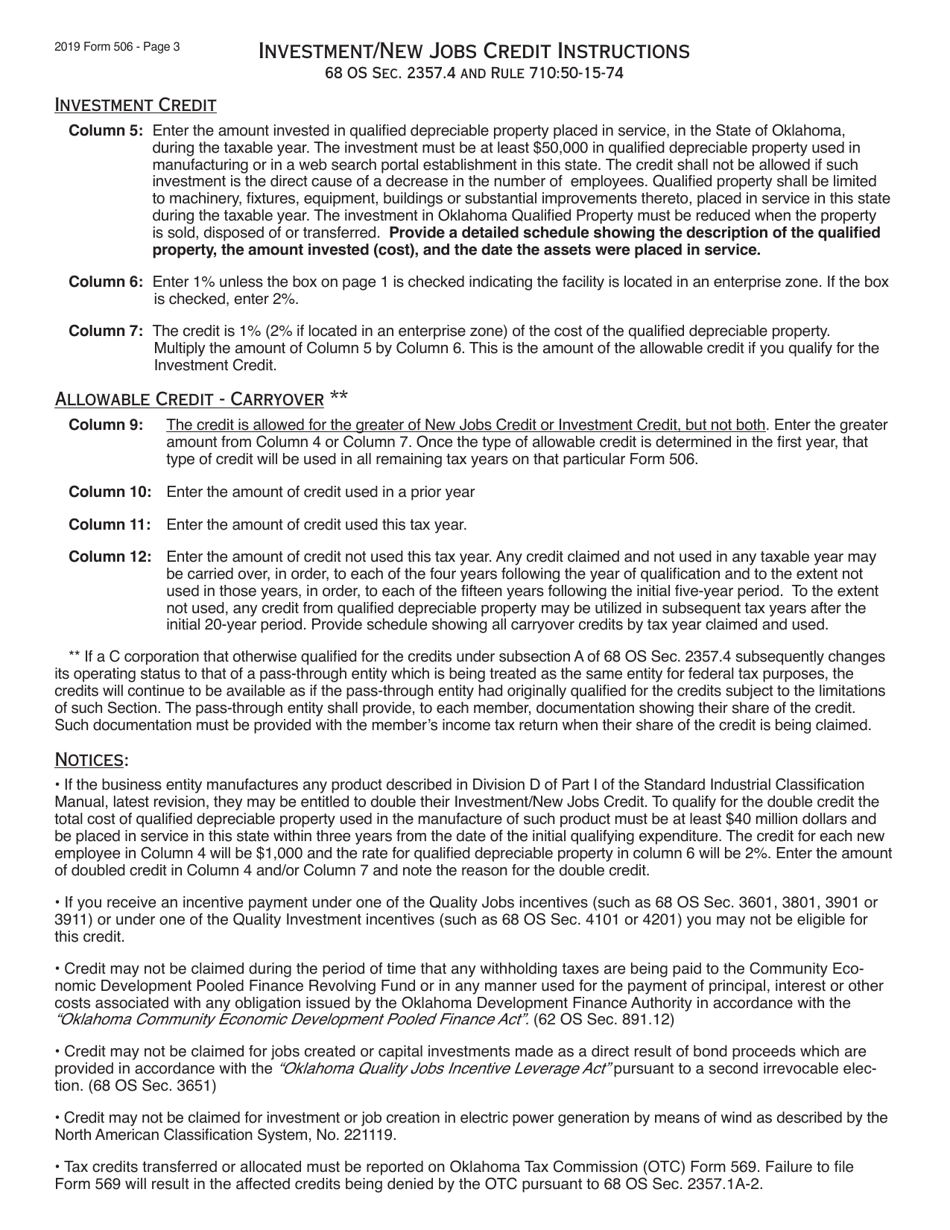

Form 506 Investment / New Jobs Credit - Oklahoma

What Is Form 506?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 506?

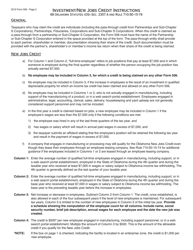

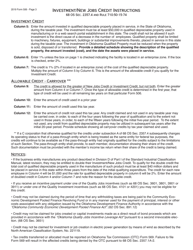

A: Form 506 is a tax form used to claim the Investment/New Jobs Credit in Oklahoma.

Q: What is the Investment/New Jobs Credit?

A: The Investment/New Jobs Credit is a tax credit offered by the Oklahoma Tax Commission to encourage businesses to create new jobs and make new investments in the state.

Q: Who is eligible for the Investment/New Jobs Credit?

A: Businesses that create new jobs or make new investments in Oklahoma may be eligible for the Investment/New Jobs Credit.

Q: What types of investments qualify for the Investment/New Jobs Credit?

A: Qualifying investments may include the purchase of new machinery, equipment, or real property.

Q: How much is the Investment/New Jobs Credit?

A: The amount of the credit depends on factors such as the number of new jobs created and the amount of the qualifying investment.

Q: How do I claim the Investment/New Jobs Credit?

A: To claim the credit, businesses must complete and file Form 506 with the Oklahoma Tax Commission.

Q: Are there any deadlines for claiming the Investment/New Jobs Credit?

A: Yes, businesses must file Form 506 within three years after the end of the tax year in which the investment or job creation occurred.

Q: Are there any restrictions or limitations on the Investment/New Jobs Credit?

A: Yes, there may be restrictions and limitations on the amount of the credit depending on the specific circumstances of the investment or job creation.

Q: Can the Investment/New Jobs Credit be carried forward or transferred?

A: Yes, unused credits can be carried forward for up to 14 years or transferred to another Oklahoma taxpayer.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 506 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.