This version of the form is not currently in use and is provided for reference only. Download this version of

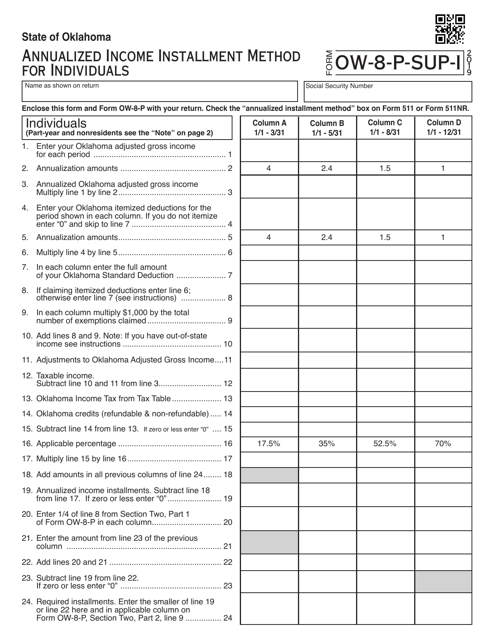

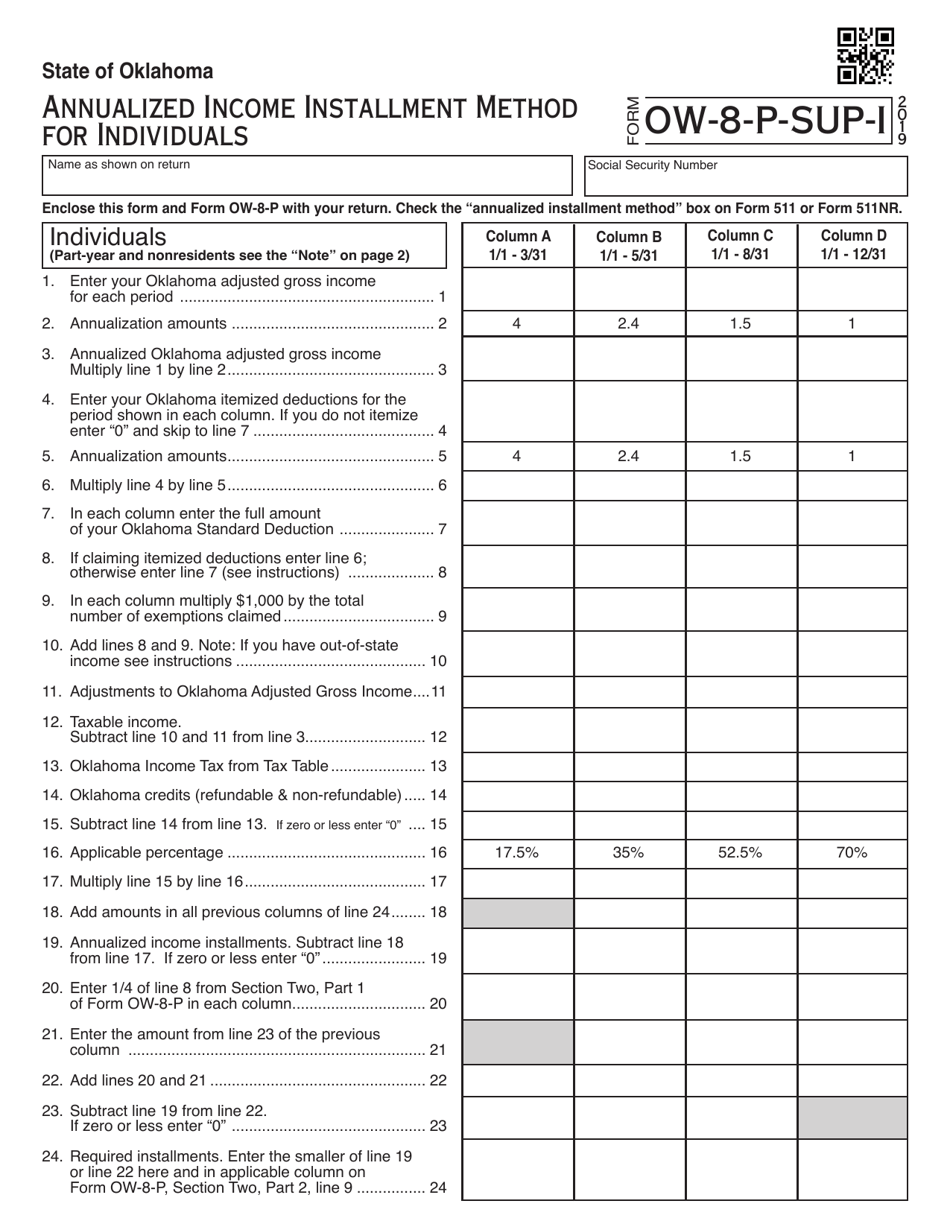

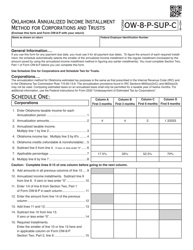

Form OW-8-P-SUP-I

for the current year.

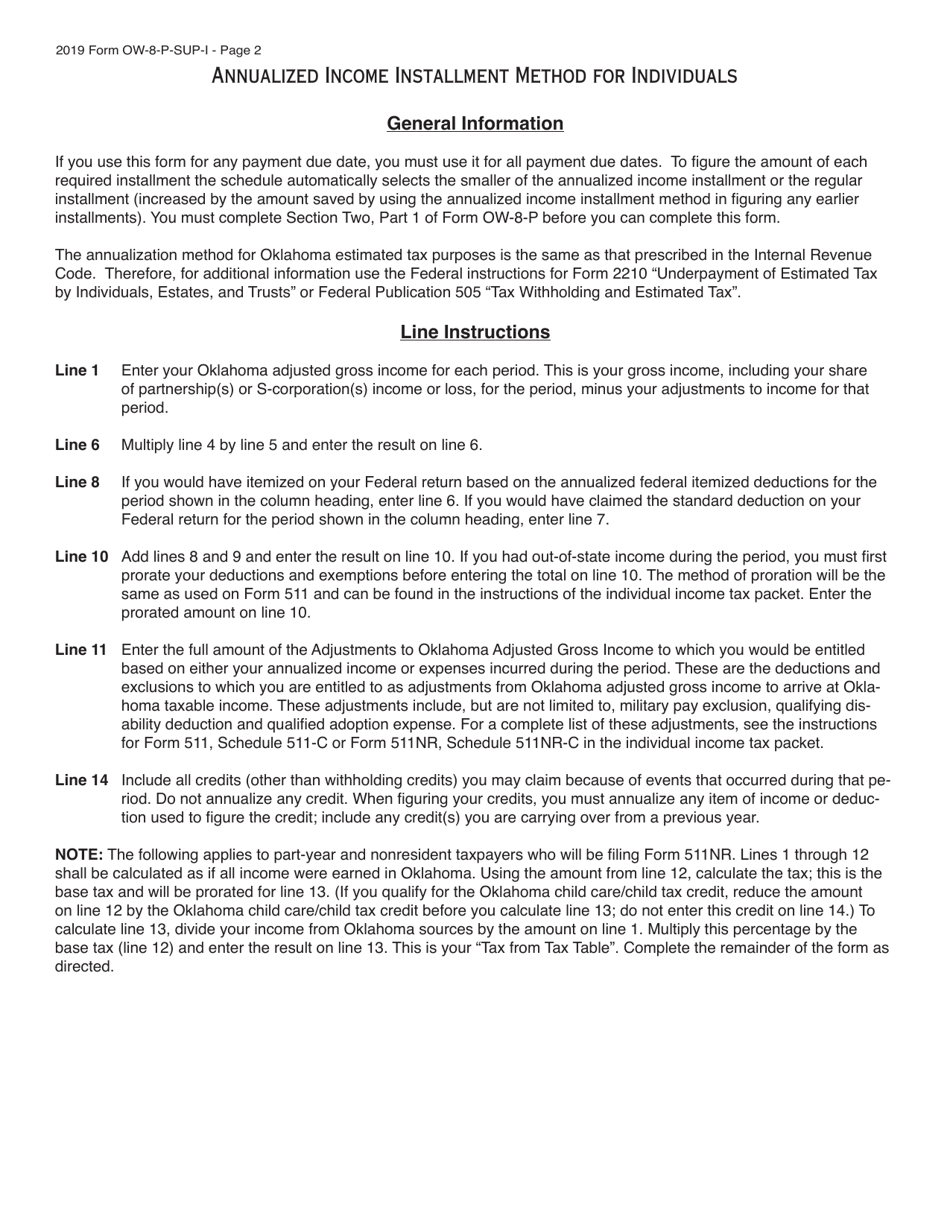

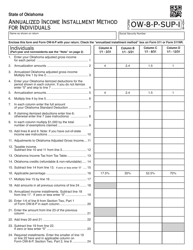

Form OW-8-P-SUP-I Annualized Income Installment Method for Individuals - Oklahoma

What Is Form OW-8-P-SUP-I?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OW-8-P-SUP-I?

A: Form OW-8-P-SUP-I is a tax form used in Oklahoma for individuals to calculate their annualized income installment method.

Q: Who needs to file Form OW-8-P-SUP-I?

A: Individuals in Oklahoma who want to calculate their income tax using the annualized income installment method need to file Form OW-8-P-SUP-I.

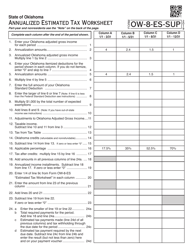

Q: What is the annualized income installment method?

A: The annualized income installment method is a way to calculate and pay your income tax throughout the year based on your estimated income and deductions.

Q: How do I fill out Form OW-8-P-SUP-I?

A: To fill out Form OW-8-P-SUP-I, you will need to gather information about your income, deductions, and tax payments made throughout the year. Follow the instructions provided on the form.

Q: When is Form OW-8-P-SUP-I due?

A: Form OW-8-P-SUP-I is typically due on or before the due date for filing your Oklahoma income tax return, which is usually April 15th.

Q: Is Form OW-8-P-SUP-I the only method to calculate income tax in Oklahoma?

A: No, Form OW-8-P-SUP-I is just one method to calculate income tax in Oklahoma. There are other methods available, such as the annualized income method and the seasonal income method.

Q: What if I have questions or need help filling out Form OW-8-P-SUP-I?

A: If you have questions or need help, it is recommended to consult with a tax professional or contact the Oklahoma Tax Commission for assistance.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-8-P-SUP-I by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.